Mastering Year-End B2B Rebate Accounting: Strategies & Tools for Success

Year-end accounting in B2B industries is a complex and time-sensitive process that requires meticulous attention to detail. This period demands an accurate reflection of a company’s financial health, yet the intricate nature of rebate agreements adds layers of difficulty to an already challenging task.

Businesses face several hurdles during year-end when it comes to rebate accounting. Complex agreements with varying eligibility criteria, rates, and payment terms make forecasting and accrual calculations difficult.

In this blog, we’ll explore the challenges businesses face with rebate accounting during year-end, the impact of inaccuracies like over-accruals and under-accruals, and practical steps to improve the process for more reliable financial reporting.

Table of Contents:

- The Importance of Accrued Rebates in Year-End Accounting

- What Happens When Rebate Accruals Are Wrong?

- How to Prepare for Year-End Rebate Accounting?

- Challenges in Managing B2B Rebates

- How B2B Rebate Management Software Simplify Year-End Accounting?

- 3 Tips for a Smooth and Accurate Year-End Rebate Accounting Process

Jump to a section that interests you, or keep reading.

The Importance of Accrued Rebates in Year-End Accounting

Accrued rebates are essential in ensuring financial statements give an accurate picture of a company’s performance. These accruals account for rebates that have been earned but not yet paid or received. For example, if a business qualifies for a quarterly rebate based on total purchases, but the payment isn’t made until year-end, the value of that rebate still needs to be recorded in the period it was earned. This allows financial statements to reflect real profits and losses rather than being skewed by the timing of payments.

Failing to manage rebate accruals properly can lead to misleading financial results. If rebates earned aren’t accounted for, profits will look lower than they actually are. On the other hand, delaying the recognition of rebates that need to be paid out can make profits seem higher temporarily. Both scenarios can misrepresent the company’s true financial health.

What Happens When Rebate Accruals Are Wrong?

When businesses overestimate the rebates they owe, it leads to over-accruals. This means they set aside more money than necessary to cover rebate payments, which makes their expenses seem higher than they are. As a result, profits for that period appear smaller. Later, when the excess accrual is reversed, profits in the next period appear artificially inflated. While this balances out over time, it creates inconsistency in financial reporting and raises concerns about the accuracy of the company’s accounting.

Here's an example:

A pharmaceutical company offers a rebate program for distributors. Based on estimated sales and expected rebate claims, the company accrues $10 million to cover rebates for the quarter. However, at the end of the quarter, actual rebate claims come in at only $7 million. This means the company over-accrued by $3 million.

Effects:

- During the quarter: The $10 million accrual increases the company's reported expenses, reducing its net profit. For example, if the company initially expected a profit of $20 million, the extra $3 million accrual reduces it to $17 million, making the financial performance seem weaker.

- In the next quarter: When the company reverses the excess $3 million accrual, it reports a lower expense, which artificially boosts profits for that period. For instance, if the company expected $20 million in profit for the next quarter, the reversal increases it to $23 million, making the results look unexpectedly strong.

While the total profit across both periods remains $40 million ($17 million + $23 million), the inconsistency in financial reporting might cause confusion for stakeholders, who may question the reliability of the company’s estimates and accounting practices.

Under-accruals, on the other hand, happen when rebate liabilities are underestimated. This can temporarily boost profits by recording fewer expenses than required. However, when the correct rebate amounts are eventually recognized, the company has to absorb the unexpected cost, reducing profits in a later period. These inaccuracies not only disrupt planning but also attract unwanted attention from auditors and regulators.

Here’s an example:

A consumer electronics company runs a rebate program promising customers $50 for every eligible product purchased during a holiday season. Based on estimated claims, the company accrues $5 million to cover the expected rebate liability for the quarter. However, due to higher-than-anticipated participation, the actual rebate claims amount to $8 million.

Effects:

- During the quarter: By under-accruing the liability, the company records $3 million less in expenses than needed, making its profit look higher than it should be. For instance, if the company expected $15 million in profit, the under-accrual artificially increases it to $18 million.

- In the next quarter: When the company realizes the rebate claims are $3 million higher than estimated, it has to record the additional expense. This reduces profits in the next period. If the expected profit for that quarter was $12 million, it drops to $9 million due to the unanticipated $3 million adjustment.

This sudden dip in profits disrupts financial planning and can raise red flags with auditors or regulators, as it suggests the company’s accrual process may lack accuracy or robustness.

Accurately handling rebate accruals requires a clear and consistent process. Businesses need reliable systems to forecast rebates, record them correctly, and provide clear documentation. This not only supports accurate financial reporting but also helps maintain trust with stakeholders and avoids costly errors.

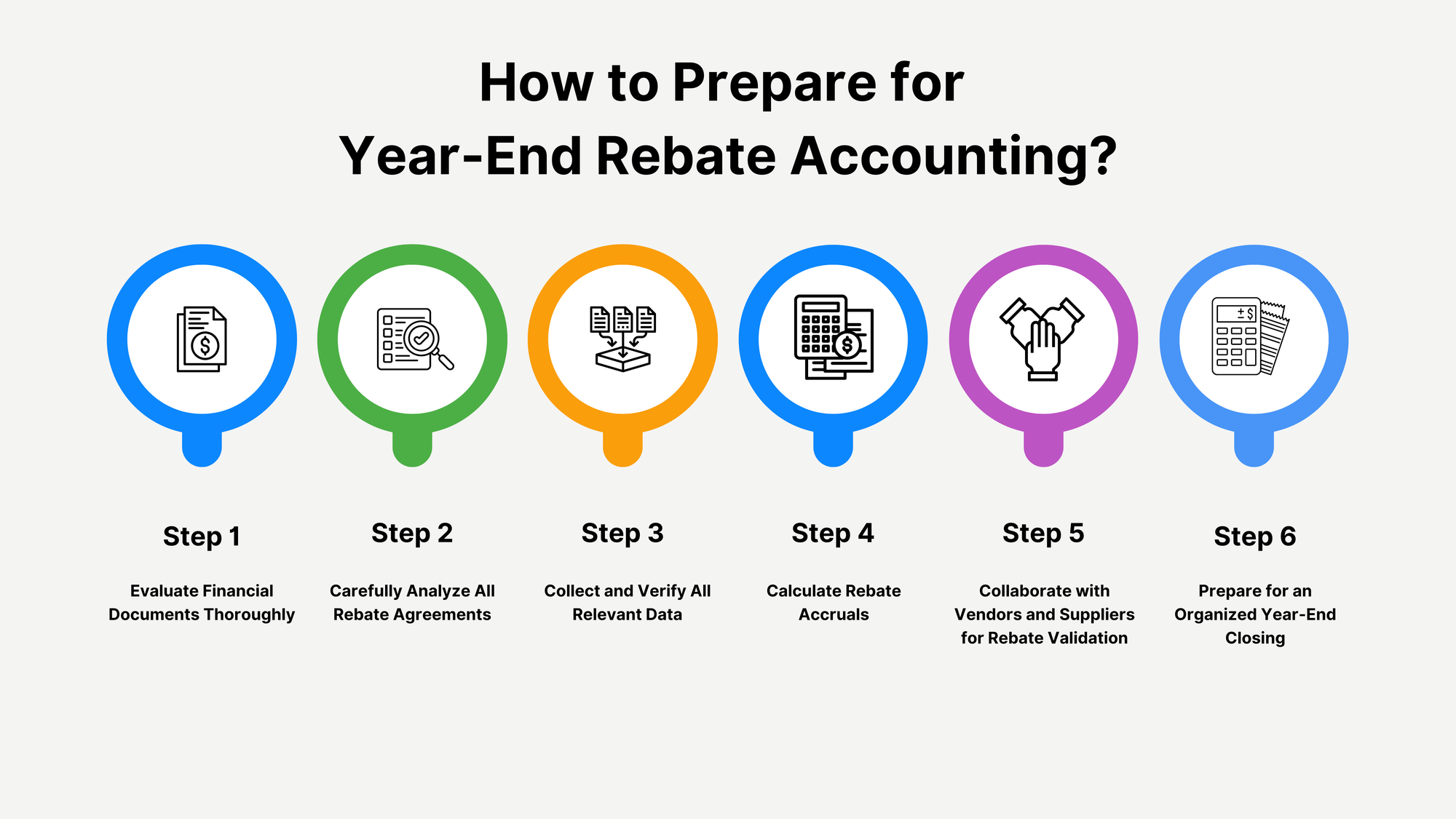

How to Prepare for Year-End Rebate Accounting?

Year-end rebate accounting can be complex, but following a structured approach will help simplify the process. Here are six essential steps for thorough preparation:

Step 1: Evaluate Financial Documents Thoroughly

Start by reviewing key financial documents such as balance sheets, income statements, and cash flow statements. This provides a comprehensive overview of your company’s financial standing by helping you identify areas for improvement, such as optimizing cash flow or cutting unnecessary expenses. A thorough review also ensures your financial position reflects reality before year-end adjustments.

Step 2: Carefully Analyze All Rebate Agreements

Carefully review the terms of all rebate agreements with suppliers and customers. Pay close attention to rates, eligibility criteria, and payment terms. This analysis helps you forecast future rebate liabilities and potential earnings. Understanding the details of each agreement ensures nothing is overlooked and provides clarity on where rebates have been earned and where additional opportunities might exist.

Step 3: Collect and Verify All Relevant Data

Gather all relevant data, including sales, purchases, and inventory records. Ensure this information is both complete and accurate. Small discrepancies, even down to a decimal point, can result in substantial financial errors. Organized and reliable data is the foundation of correct rebate calculations, so verify its accuracy before moving forward.

Step 4: Calculate Rebate Accruals

Using the collected data, calculate rebate accruals for the period. This involves estimating the rebates owed or earned based on transactions throughout the year. Precise calculations are important, as they directly impact profit and loss statements. Misjudging rebate amounts can distort financial results, leading to challenges with auditors and stakeholders.

Step 5: Collaborate with Vendors and Suppliers for Rebate Validation

Engage with vendors and suppliers to confirm rebate agreements and verify the accuracy of rebate-related data. Open communication reduces the risk of disputes and ensures everyone is aligned on payment amounts and terms. This not only simplifies the accounting process but also strengthens relationships to build trust and cooperation for the year ahead.

Step 6: Prepare for an Organized Year-End Closing

Finally, ensure that all rebate payments are accurately recorded in financial statements before year-end. This involves reconciling rebate accruals with actual payments and addressing any discrepancies promptly. Proper planning reduces last-minute issues, ensures compliance with reporting standards, and sets the stage for a smooth transition into the next fiscal year.

Challenges in Managing B2B Rebates

Managing B2B rebates is a multifaceted process that poses significant challenges for businesses, especially when complex rebate agreements and stringent accounting standards come into play. These obstacles can disrupt financial accuracy and operational efficiency if not addressed systematically.

Complex Rebate Agreements and Variable Considerations under IFRS 15

IFRS 15 introduces strict guidelines for revenue recognition that require businesses to account for variable considerations like rebates with precision. Rebate agreements often include multiple tiers, conditions, and performance criteria, which makes them difficult to interpret and implement. For instance, some contracts contain hundreds of individual deals, each with distinct rules and rebate triggers. Accurately estimating rebate amounts is essential to avoid revenue reversals in later periods, but this can be daunting given the need to predict outcomes based on uncertain future events. Missteps in this area can lead to financial inaccuracies and audit scrutiny.

The Contingent Nature of Rebates and Their Impact on Revenue Recognition

Rebates are inherently contingent, as they depend on specific actions or outcomes, such as meeting sales thresholds or achieving particular purchasing volumes. This contingent nature complicates revenue recognition, as businesses must account for the likelihood of meeting rebate conditions while avoiding over- or underestimations. Failure to manage these contingencies correctly can distort financial results. For example, premature recognition of rebates can inflate profits, while delayed recognition will understate revenue, both of which mislead stakeholders and complicate long-term planning.

Manual Processes, Data Silos, and Inconsistent Communication

Rebate management often relies on manual workflows and spreadsheets, which are prone to human error and inefficiency. Manually tracking rebate agreements, calculating accruals, and reconciling payments consume significant time and resources. Moreover, siloed data, where sales, procurement, and finance teams operate independently, hinders collaboration and creates gaps in rebate tracking. Inconsistent communication between internal teams and external partners further exacerbates these inefficiencies, leading to missed rebate claims, disputes over payment terms, and inaccuracies in financial reporting.

Addressing these challenges requires a structured approach, robust systems, and better coordination across teams. Without these measures, the complexities of B2B rebate management can lead to financial misstatements, strained vendor relationships, and operational inefficiencies.

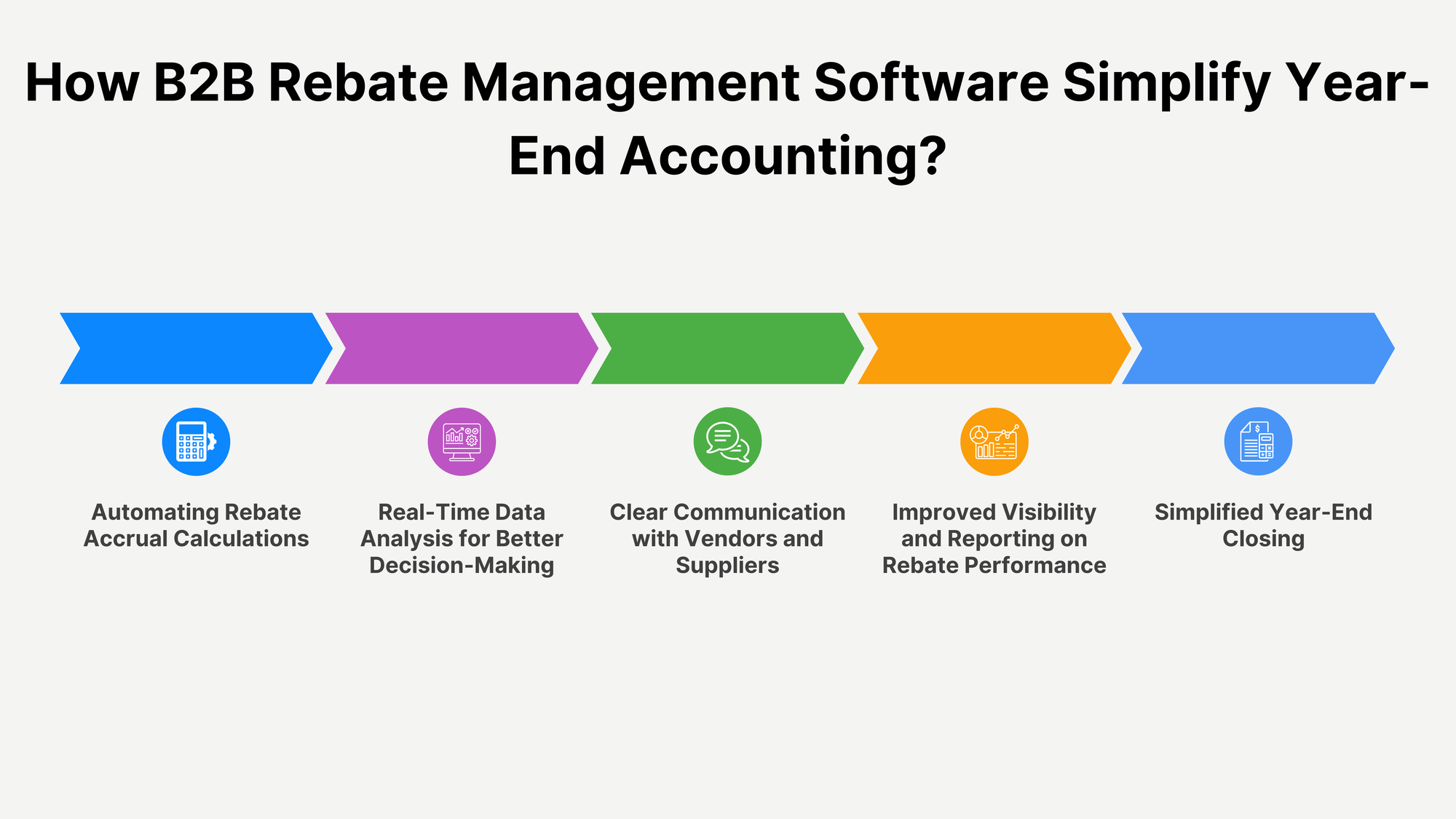

How B2B Rebate Management Software Simplify Year-End Accounting?

B2B rebate management software addresses the complexities of rebate accounting, particularly during year-end. It replaces manual, error-prone methods with automated, precise systems that improve accuracy and efficiency. Here's how it simplifies the process:

Automating Rebate Accrual Calculations

Manually calculating rebate accruals is both time-intensive and prone to mistakes, especially with complex agreements. Rebate management software automates these calculations, ensuring consistent accuracy while significantly reducing the time required. By eliminating manual entry errors, businesses can produce reliable accrual figures to improve confidence in financial reports and simplify compliance with accounting standards.

Real-Time Data Analysis for Better Decision-Making

Access to real-time data is important for tracking rebate performance throughout the year. Rebate software helps businesses to monitor transactions, identify trends, and forecast outcomes with precision. This helps finance teams to make informed adjustments to rebate programs based on current insights rather than relying on outdated or incomplete data. Real-time analysis also supports faster responses to business needs, thus reducing the time spent sifting through legacy data during year-end.

Clear Communication with Vendors and Suppliers

Miscommunication with vendors and suppliers can lead to disputes, delays, or missed opportunities. Rebate management software simplifies communication by automatically sharing key rebate details, such as rates, eligibility, and performance criteria. Some systems, like those with supplier portals, even provide third parties with direct access to rebate information for transparency. This improves collaboration and strengthens relationships while reducing the risk of disputes.

Improved Visibility and Reporting on Rebate Performance

Visibility into rebate performance is important for tracking accruals, payments, and overall program outcomes. Rebate software offers comprehensive reporting capabilities for businesses to generate detailed reports on rebate-related metrics. With clear insights into accruals and payments, companies can assess performance, identify opportunities to improve margins, and support better strategic planning. The enhanced reporting also provides stakeholders with the confidence that financial operations are well-managed.

Simplified Year-End Closing

Year-end closing is often fraught with challenges, from reconciling rebate accruals to ensuring all payments are correctly recorded. B2B rebate management software automates much of this process, reconciling accruals against actual payments to ensure accuracy. By providing a clear, organized view of all rebate activity, the software makes it easier to close the year with confidence and prepare for the next fiscal period without unnecessary stress or delays.

3 Tips for a Smooth and Accurate Year-End Rebate Accounting Process

Achieving accuracy and efficiency in year-end rebate accounting requires a thoughtful approach supported by well-structured systems and reliable processes. Here are three key practices to help ensure success:

1. Build Confidence in Rebate Accrual Processes Through Structured Systems

Rebate accruals are critical in reflecting true financial performance, so the process must be robust and consistent. Establishing structured systems for rebate accounting ensures that calculations are accurate, predictable, and backed by clear documentation. Rules-based approaches to estimating accruals help eliminate guesswork and minimize risks of over- or under-accruals. Systems that centralize and organize rebate agreements, transaction data, and claims processing create transparency and provide a strong foundation for audit trails, making it easier to justify decisions and maintain stakeholder trust.

2. Ensure Compliance with IFRS 15 by Standardizing Variable Consideration Documentation

IFRS 15 introduces stringent requirements for accounting variable considerations like rebates. Businesses must document rebate agreements and conditions in a way that meets compliance standards while reducing the risk of revenue reversals. Standardized documentation is critical as it provides clarity on rebate terms, helps assess probabilities for achieving conditions, and ensures consistency across contracts. Properly accounting for rebates, even when their outcomes are uncertain, avoids compliance risks and enhances financial statement accuracy. This standardization is particularly important for rebate agreements with complex or contingent terms.

3. Integrate Rebate Data into Broader Financial Reporting with the Right Tools

Year-end success depends on the integration of rebate data into overall financial reporting. Manual systems often fall short, leading to inconsistencies or missing information. Tools designed for rebate management help companies combine rebate accruals, payments, and performance metrics with broader financial data for a unified and comprehensive view. By using these tools, businesses can align rebate accounting with other financial processes and provide stakeholders with a complete and accurate picture of financial health. Integration also supports better forecasting and planning for future fiscal periods.

Conclusion

Accurate rebate accounting is essential for maintaining financial transparency and ensuring profitability. Rebates play a pivotal role in the financial performance of many businesses, particularly those in industries heavily reliant on supplier or customer agreements. Properly accounting for rebates allows companies to present an accurate picture of their profits and losses, avoid misleading stakeholders, and meet regulatory standards such as IFRS 15.

As year-end processes often reveal gaps in traditional rebate management methods, businesses should consider modern solutions to address these challenges. Rebate management software like Speedy Labs simplifies complex calculations, improves data accuracy, and simplifies communication with vendors and suppliers.

Schedule a demo with our team to see how Speedy Labs can transform how rebates are managed to tackle year-end processes efficiently and build a solid foundation for long-term success.