What is a Vendor Rebate?

Companies are constantly looking for ways to reduce costs, increase profitability, and maintain strong relationships with suppliers. One of the most powerful tools to achieve these objectives is vendor rebates. A vendor rebate is a financial incentive offered by suppliers to encourage businesses to purchase in higher volumes or meet specific purchasing criteria. While often seen as a strategic move to boost sales, vendor rebates can offer much more, enhancing supplier relationships, improving inventory management, and providing businesses with a competitive edge in the market. This blog dives deep into what vendor rebates are, how they work, their benefits, and how businesses can effectively implement them to maximize profitability.

Table of Contents:

- What are Vendor Rebates?

- Why Vendors Offer Rebates?

- Benefits of Vendor Rebates for Businesses

- Key Considerations Before Implementing Vendor Rebates

- How to Implement Vendor Rebates in Your Business?

- Vendor Rebates in Different Industries

- Common Pitfalls to Avoid

Jump to a section that interests you, or keep reading.

What are Vendor Rebates?

Vendor rebates are financial incentives provided by vendors, manufacturers, or occasionally distributors to their customers, typically retailers or distributors. These incentives are usually tied to specific purchasing goals, designed to encourage the customer to buy in larger quantities or meet set thresholds within a given period. Unlike discounts or coupons, vendor rebates offer a post-purchase reward based on the total volume or the value of purchases. The rebate is essentially a monetary reward or refund, provided to the customer after certain criteria have been fulfilled. This makes vendor rebates a tool not only for cost savings but also for strengthening long-term business relationships between the vendor and their customers.

How Vendor Rebates Work?

The core principle behind vendor rebates is straightforward: a customer purchases products from a vendor at full price, and after reaching a specified purchasing goal, they can claim a percentage of their total spend back from the vendor. This means that the customer benefits from the rebate only after they’ve met the agreed-upon purchasing thresholds. The rebate is not deducted at the time of purchase, unlike a discount. Instead, once the threshold is reached, the vendor issues the rebate, usually in the form of a refund, credit, or a check.

This system avoids the immediate effect of lowering the selling price and allows vendors to maintain their product pricing while incentivizing larger orders or long-term purchasing commitments. Vendor rebates are often linked to volume-based goals, but can also be contingent on other factors like frequency of orders, specific product purchases, or exclusive partnerships with a vendor. Thus, a customer can receive a rebate that makes the deal more advantageous without impacting the vendor’s listed price, giving the customer a better deal down the line once they’ve met their target.

Structures of Vendor Rebates

Vendor rebates can be structured in several ways, with two common structures being:

-

Percentage of Purchase Volume: This is one of the most straightforward structures, where the rebate is a percentage of the total purchase amount made over a certain period. For example, a vendor might offer a 5% rebate on all purchases exceeding $100,000 within a quarter. This type of structure incentivizes customers to buy in bulk or increase their total order volume to reach the rebate threshold, thus securing a better deal based on the total spend.

-

Purchase Thresholds: In this model, the rebate is linked to achieving a minimum level of purchases within a specified period. For instance, a manufacturer may offer a rebate for every order exceeding a set number of units or a specified dollar amount. The structure might look like: "If you purchase over 1,000 units of a product, you’ll receive a 3% rebate." In some cases, these thresholds may be tiered, meaning the more a customer buys, the larger the rebate percentage they can earn.

In both cases, the goal of the vendor rebate is to motivate customers to increase their purchasing volume or frequency, as they will receive financial incentives for meeting or exceeding predefined goals. This not only benefits the customer with cost savings but also supports the vendor in driving higher sales volumes, improving cash flow, and reinforcing long-term relationships with customers.

The flexibility in structuring vendor rebates allows vendors to tailor incentive programs to their business objectives, whether that's promoting specific products, targeting certain customer segments, or pushing for more consistent purchasing habits. The rebate can be tied to various criteria such as volume, frequency, or specific product purchases, allowing for a wide range of strategic applications across industries.

Why Vendors Offer Rebates?

Vendors offer rebates primarily as a strategic marketing tool to navigate competitive environments and drive long-term business goals. In an industry where competition is fierce, vendor rebates allow businesses to incentivize purchasing behavior without sacrificing long-term pricing integrity. The rebate system helps vendors maintain their product pricing while still offering a form of incentive that encourages customer loyalty, repeat business, and larger orders. This flexibility is especially valuable in industries with tight margins, where traditional price cuts may not be a viable option.

One of the core reasons vendors offer rebates is to avoid permanent price cuts, which can permanently lower the perceived value of their products. Permanent discounts or price reductions can lead to customers expecting lower prices in the future, making it difficult for vendors to raise prices later. Vendor rebates, on the other hand, only activate after the purchase is made, meaning they provide a way to reward customers without permanently affecting the list price. This strategy ensures that the product remains perceived as valuable while offering customers a financial incentive to buy more or build stronger purchasing patterns over time.

Rebates also provide vendors with a flexible sales strategy that allows them to cater to specific business needs without devaluing their products. Whether a vendor wants to boost sales during slow periods, reward high-volume customers, or incentivize the purchase of specific products or product categories, rebates can be adjusted accordingly. For example, if a vendor aims to promote an underperforming SKU, they can offer a targeted rebate that encourages customers to purchase more of that particular product, without affecting the pricing of their bestsellers. This tailored approach allows vendors to optimize their sales tactics based on inventory needs, seasonal demand, or market shifts, all while protecting the overall brand and product value.

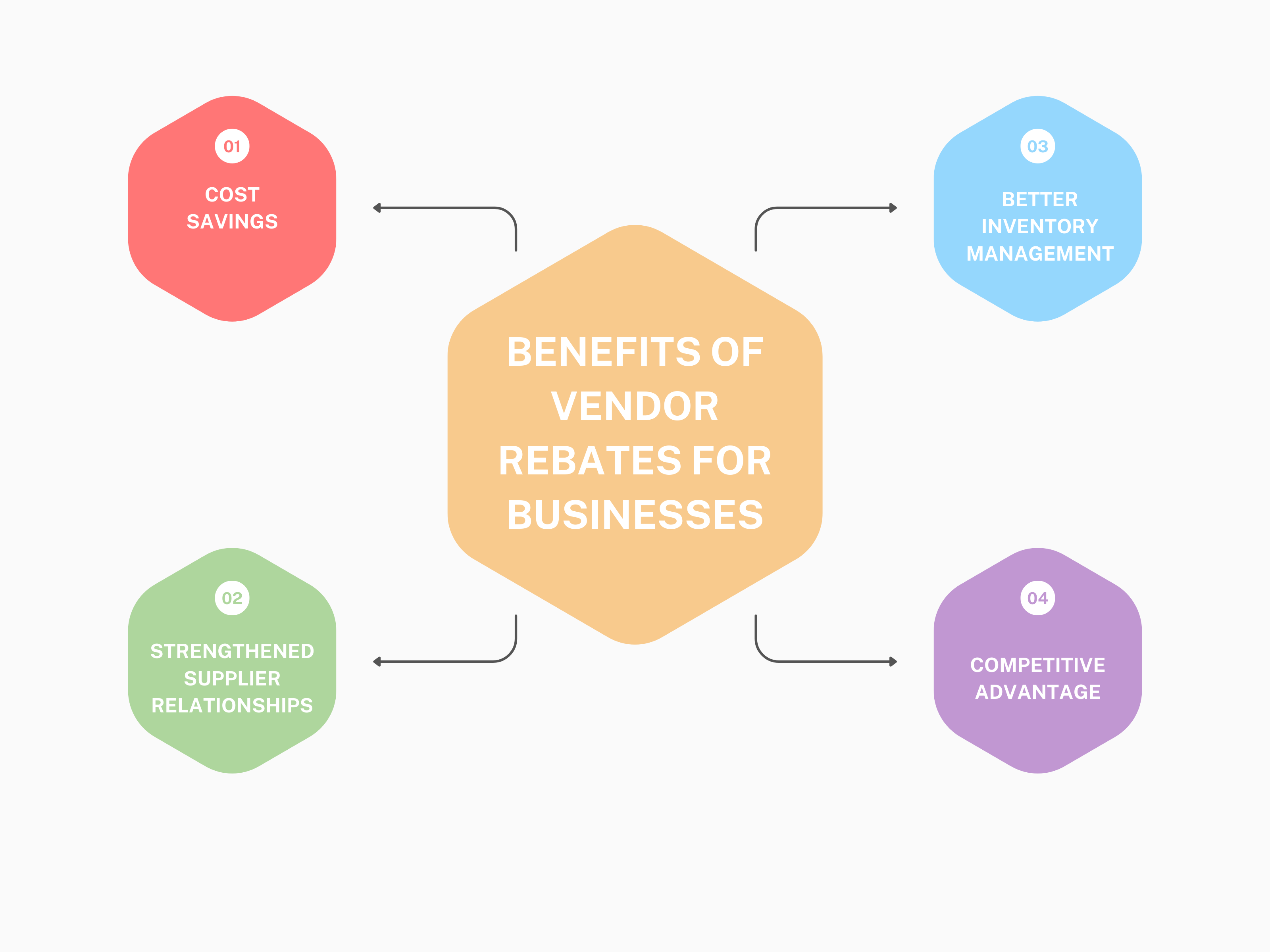

Benefits of Vendor Rebates for Businesses

Cost Savings

One of the primary benefits of vendor rebates is the reduced procurement costs they offer businesses. By taking advantage of vendor rebate programs, companies can receive a percentage of their total purchases back after meeting specific purchasing thresholds. This refund directly lowers the effective cost of products, leading to substantial savings on bulk orders or frequent purchases. These cost savings can accumulate over time, providing businesses with a more efficient way to manage their budgets while ensuring they are meeting demand.

The financial benefit of vendor rebates has a direct impact on profit margins. As businesses reduce their cost of goods sold, their margins naturally improve. This increased margin allows companies to reinvest savings into other critical business areas, such as marketing, technology upgrades, or expanding product offerings. The ability to save money on large purchases through rebates means that businesses can remain competitive in pricing while improving their profitability.

Strengthened Supplier Relationships

Vendor rebates also play a crucial role in strengthening supplier relationships. These programs create a framework where both the vendor and the business have aligned interests. The vendor benefits from increased order volumes, while the business enjoys financial rewards in the form of rebates. This mutual benefit fosters collaboration and trust, positioning both parties for long-term success.

By regularly engaging in rebate agreements, businesses demonstrate commitment to their suppliers, which can lead to building long-term trust. Strong relationships with vendors often result in better terms for future purchases, priority service, or more favorable payment schedules. Furthermore, businesses that have well-established rebate agreements are often seen as more reliable partners, which can grant them more favorable pricing and terms in future negotiations. This ongoing trust can also help businesses navigate supply chain disruptions more effectively, ensuring they have access to the products and services they need.

Better Inventory Management

Vendor rebates can also significantly improve inventory management. Businesses can use rebate programs as a tool for strategic purchasing. By aligning purchases with rebate thresholds, companies can optimize their order quantities, ensuring they buy in bulk or at the right times to maximize rebate returns. This strategy allows businesses to plan ahead, securing products at a lower cost while avoiding sudden price increases or stockouts.

Additionally, vendor rebates help reduce the risk of overstocking or stockouts. Since businesses have a clear incentive to reach specific purchase levels, they are more likely to manage their stock levels efficiently, reducing the need for excessive ordering that could lead to overstock or storage issues. Rebate-driven purchasing decisions promote smarter, more strategic ordering patterns that help maintain the right balance of inventory. This also minimizes the financial risk of holding excessive stock or running into shortages that could disrupt operations.

Competitive Advantage

Finally, vendor rebates provide businesses with a competitive advantage in the marketplace. By securing rebates, businesses can lower their overall procurement costs, which in turn allows them to offer more competitive pricing to their customers. This pricing flexibility enables companies to pass savings along to consumers, whether through discounts, promotions, or better prices on popular items. In industries like retail, electronics, or manufacturing, where margins are often tight, vendor rebates can be a significant differentiator.

Moreover, the ability to adjust pricing based on rebates contributes to an improved market position. Businesses that leverage rebates can quickly adapt to market changes, outmaneuvering competitors who lack such flexibility. This capability is especially valuable in price-sensitive markets where customers are constantly looking for the best deals. By offering better pricing and promotions, businesses can attract more customers, increase sales volume, and solidify their position in a competitive market.

Key Considerations Before Implementing Vendor Rebates

Complexity of Agreements

Before implementing vendor rebates, businesses must be aware of the complexity of rebate agreements. These agreements often involve detailed terms that specify conditions for earning rebates, such as purchase thresholds, volumes, or specific products that qualify. Due to the multifaceted nature of these agreements, it is crucial to negotiate and document terms clearly from the outset. Clear negotiation ensures that both the vendor and the customer are on the same page regarding rebate percentages, deadlines, and the criteria required to qualify for the rebates. Without clear documentation, there’s a risk of misunderstanding or disputes later on, which can undermine the effectiveness of the rebate program.

Ensuring that all terms and conditions are well-defined also helps prevent issues related to the interpretation of the agreement, particularly in cases where businesses need to meet multiple thresholds or conditions to earn the rebate. Properly structured agreements with well-outlined expectations can provide both parties with a solid foundation for a mutually beneficial relationship, increasing the chances of long-term success with rebate programs.

Tracking and Management

Accurate purchase tracking is essential to the success of a vendor rebate program. Businesses need to be able to track eligible purchases in real-time to ensure that they are meeting the necessary criteria for rebate claims. Without a robust tracking system, it becomes difficult to determine whether a business has qualified for a rebate, and errors can lead to missed opportunities or disputes.

Effective tracking also involves capturing data on both the total volume of purchases and specific details such as product codes, quantities, and dates of purchase. This data must be carefully managed to ensure that all qualifying purchases are accounted for, and nothing is overlooked. Many businesses choose to integrate reliable software tools to streamline this tracking process. These systems can help centralize purchase records, automate data entry, and track rebate eligibility automatically, making the process far less error-prone and time-consuming.

In addition to tracking, businesses need to pay close attention to timely claiming of rebates. Each vendor rebate program comes with specific timelines for submitting rebate claims, often with deadlines for when the rebate must be requested. Failing to submit a claim on time could result in losing out on the rebate entirely, negating the financial benefits it was meant to provide. Establishing a clear internal process for rebate claims ensures that no opportunity is missed and that businesses maximize the financial rewards available from the program.

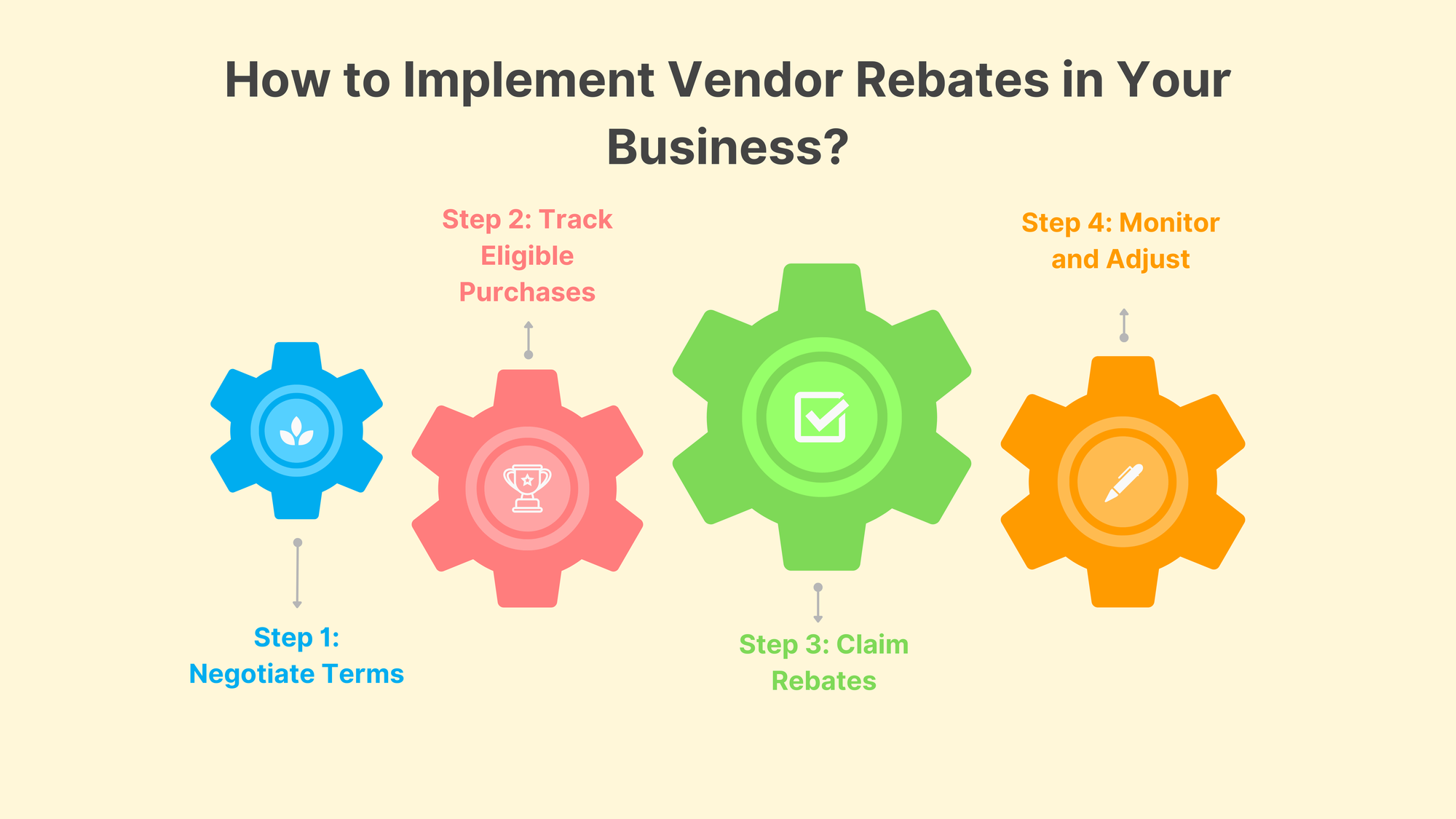

How to Implement Vendor Rebates in Your Business?

Step 1: Negotiate Terms

The first step in implementing vendor rebates is to negotiate the terms of the agreement. This involves setting clear rebate thresholds, determining rebate percentages, and agreeing on the conditions that must be met for the rebate to apply. Vendors typically set specific purchasing goals, such as volume or spend, that need to be reached before the rebate is triggered. Negotiating these terms involves determining what works best for your business while ensuring that the agreement is achievable and beneficial for both parties.

When setting thresholds, it’s crucial to balance your purchasing capabilities with the potential savings. For example, if a vendor offers a 5% rebate on purchases over a certain volume, you need to ensure that reaching that volume is realistic for your business without overextending your budget or stock levels. Additionally, defining the criteria for qualifying purchases is vital—this might include specific product categories, a certain dollar amount of purchases, or a time frame in which purchases must be made. Clearly outlining all conditions ensures there is no ambiguity later on and that the rebate system runs smoothly.

Step 2: Track Eligible Purchases

Once the terms are negotiated, the next step is to track eligible purchases as they occur. Businesses must implement a system for ongoing monitoring of purchases to ensure they meet the agreed criteria. This can be done manually or through automated systems that track purchasing volume, product categories, and order values in real-time.

Effective tracking ensures that all purchases made during the rebate period are captured accurately. By regularly monitoring your purchasing activity, you can verify that you’re on track to meet the rebate thresholds and take timely action if adjustments are needed. For example, if you’re approaching the required volume for a rebate, it may make sense to strategically purchase more to trigger the rebate. Tracking also helps businesses avoid missing out on rebates by catching eligible purchases that may otherwise go unaccounted for.

Step 3: Claim Rebates

Once the qualifying purchases have been made and tracked, the next step is to claim the rebates. Setting up a well-organized process for submitting rebate claims is essential. This process should include defining the documentation required, such as proof of purchase, purchase volume reports, and any other relevant data the vendor may require to process the claim.

Having a clear internal procedure for rebate claims ensures that the process is efficient and timely. Businesses should establish deadlines for submitting claims and ensure that they meet the vendor’s stipulated timelines. Any delays in submitting rebate claims can result in the loss of rebates, so it’s critical to have a system in place that tracks deadlines and automates reminders to ensure timely submissions. Additionally, businesses should maintain a record of past claims for reference and audit purposes.

Step 4: Monitor and Adjust

To maximize the benefits of vendor rebates, businesses need to monitor and adjust their rebate agreements regularly. This involves reviewing the performance of the rebate program to ensure that the terms are still aligned with your business goals. Businesses should assess whether the rebate thresholds and percentages are achieving the desired financial results, or if adjustments need to be made to optimize the program further.

Regular monitoring also allows businesses to adapt to changes in purchasing behavior, market conditions, or supplier relationships. For instance, if a particular product category is underperforming, a vendor may be willing to offer a higher rebate percentage to boost sales. By continuously reviewing and adjusting the agreements, businesses can ensure that they are maximizing their savings and strengthening supplier relationships. Additionally, this step provides the opportunity to renegotiate terms if needed, based on performance data or changes in business needs.

Vendor Rebates in Different Industries

Retail

In the retail sector, vendor rebates are often used to reduce overall product costs, manage inventory more efficiently, and improve profit margins. For example, a grocery chain may negotiate a 5% rebate with a supplier on bulk purchases of high-demand items. This rebate is typically triggered when the retailer purchases a specified volume of products, such as cases of canned goods or other staples.

The benefits of this arrangement are significant for retailers. First, the reduced costs from the rebate directly contribute to lower product prices, allowing retailers to offer more competitive prices to consumers. This can also help control inventory by encouraging bulk purchases, ensuring that retailers have enough stock to meet demand while avoiding shortages. Additionally, the rebate improves profit margins as the savings from the rebate can be reinvested into other areas of the business or passed on to customers through discounts, leading to increased sales volumes.

Manufacturing

For manufacturers, vendor rebates play a crucial role in reducing the costs of raw materials or parts, which in turn enables more competitive pricing for finished goods. For example, an automotive manufacturer might receive a rebate on purchases of steel or specialized automotive parts once certain volume thresholds are met, say a 3% rebate on purchases over a certain amount of parts.

The primary benefits for manufacturers include lower material costs, which directly impact the bottom line. By securing discounts on components through rebates, manufacturers can produce finished goods at a lower cost, giving them a competitive edge when pricing their products in the marketplace. This advantage allows them to maintain or increase market share, especially in industries where product pricing is highly competitive. Furthermore, consistent rebate programs foster stronger supplier relationships, as manufacturers and suppliers collaborate to reach mutually beneficial purchasing goals.

Electronics

The electronics industry is highly price-sensitive, where procurement costs must be carefully managed to maintain profitability. For example, an electronics retailer might negotiate a 2% rebate with a supplier for products like smartphones or televisions when their purchases exceed a certain volume threshold. This allows the retailer to reduce the effective purchase cost of high-ticket items, which can be pivotal in a competitive, margin-tight industry.

The main benefits for electronics companies include lower procurement costs, enabling them to maintain competitive pricing without sacrificing margins. These rebates can also provide retailers with the flexibility to offer better consumer pricing, making their products more attractive to price-conscious buyers. Furthermore, by negotiating rebates, retailers can increase their margins on high-volume products, driving more profit per unit sold. This, in turn, helps them to remain competitive while maintaining a healthy bottom line in a challenging marketplace.

Common Pitfalls to Avoid

Overcomplicating Rebate Structures

One common pitfall businesses face when implementing vendor rebates is overcomplicating the rebate structures. While rebates offer valuable incentives, overly complex terms and conditions can create confusion for both the vendor and the business. When rebate structures involve numerous thresholds, fluctuating percentages, or convoluted criteria, it can be difficult to manage, track, and optimize. This complexity can lead to misinterpretations or errors in the rebate process, reducing the overall effectiveness of the program.

To avoid this, businesses should aim for clarity and simplicity when negotiating rebate terms. Clear, easily understandable conditions allow both parties to track progress and ensure that the rebate targets are met without unnecessary confusion. Simpler structures also make it easier for businesses to plan their purchasing strategies and for vendors to assess rebate eligibility, ultimately ensuring that both sides benefit from the agreement.

Poor Tracking and Missed Rebate Opportunities

Another significant issue is poor tracking of purchases and missed rebate opportunities. Without a robust tracking system in place, it’s easy for businesses to overlook qualifying purchases, fail to meet thresholds, or miss the deadlines for submitting rebate claims. This results in lost potential savings, undermining the financial benefit that vendor rebates can offer.

To address this, businesses should implement a reliable tracking system that monitors eligible purchases in real-time. This ensures that all purchases are accounted for and that businesses can act proactively when approaching rebate thresholds. Automated systems can provide alerts or reminders for approaching deadlines, helping businesses stay on top of their rebate claims. Maintaining precise records also ensures that the rebate process runs smoothly and minimizes the risk of missing out on savings.

Failure to Align Rebate Programs with Actual Business Goals

Failure to align rebate programs with actual business goals is another pitfall that can hinder the success of a vendor rebate program. Vendor rebates should support the overarching objectives of the business, whether that’s reducing procurement costs, improving profit margins, or strengthening supplier relationships. If the rebate program doesn’t align with the business’s priorities, it can become an inefficient use of resources, offering benefits that don’t contribute to the company’s long-term strategy.

To avoid this, businesses must ensure that the rebate terms and targets they negotiate are directly tied to their key objectives. For instance, if a company’s goal is to clear out excess inventory, the rebate program could be structured to encourage bulk purchasing of slow-moving products. On the other hand, if the focus is on improving profit margins, rebates might be tied to higher volume purchases of high-margin items. By aligning the rebate program with business goals, companies can maximize the strategic value of these incentives.

Neglecting Regular Review and Renegotiation of Terms

Finally, neglecting regular review and renegotiation of rebate terms is a common mistake. Vendor rebate agreements should not be set-and-forget; instead, they require ongoing evaluation to ensure that they remain relevant and effective. Market conditions, purchasing behaviors, and vendor relationships evolve over time, and a rebate program that worked well a year ago may no longer provide the same benefits today.

Regularly reviewing the terms of the rebate agreement allows businesses to optimize the program and adjust targets, percentages, or conditions as necessary. It also provides an opportunity to renegotiate terms with vendors if the business’s purchasing needs change or if better conditions can be negotiated based on performance. Failure to revisit and adjust rebate terms regularly can lead to missed opportunities for enhanced savings, more favorable terms, or improved supplier relations.

Conclusion

Vendor rebates are not just about saving money—they are a strategic tool that can unlock significant benefits for businesses across industries. From cost savings and improved supplier relationships to better inventory management and a competitive pricing edge, the advantages of implementing a well-structured rebate program are clear. However, like any business strategy, it requires careful planning, clear agreements, diligent tracking, and regular review. By avoiding common pitfalls and aligning rebate programs with overarching business goals, companies can ensure that their vendor rebates deliver long-term value. When managed properly, vendor rebates become not just a financial incentive, but a key driver of business growth and success.