Trade Promotion vs. Deduction Management: Which Protects Your Revenue More?

When suppliers work with major retailers, a significant amount of energy goes into planning trade promotions. Pricing programs, coordinated marketing efforts, and structured agreements are all designed to support customer demand and sales momentum. These initiatives shape how products move through the channel and help suppliers strengthen their market position.

But while promotions influence the commercial side of the business, an equally important question sits on the financial side:

How much of that revenue is actually collected?

This is where deduction management becomes critical. Issues such as shortages, pricing mismatches, documentation gaps, and compliance disputes can interrupt the order-to-cash cycle and place pressure on working capital. When left unresolved, they create backlogs, slow down reporting, and reduce true profitability.

Promotions may help drive sales, but deduction management determines whether those sales convert into cash.

Table of Contents:

- The Role of Trade Promotion

- The Role of Deduction Management

- Why Deduction Management Has a Stronger Immediate Financial Effect?

- Trade Promotion vs. Deduction Management: A Practical Comparison

- How Automation Strengthens Deduction Control?

- Why Many Organizations Address Deduction Management First?

- A Balanced Strategy

Jump to a section that interests you, or keep reading.

The Role of Trade Promotion

Trade promotion involves coordinating planned pricing actions or programs with retail partners. These activities require clear communication between teams, reliable data, and accurate downstream execution. When handled correctly, they support account strategy and help retailers meet demand.

However, any promotional agreement eventually flows into billing, settlement, and reconciliation. If the information exchanged during promotions is incomplete or unclear, disputes may surface later in the cycle.

The Role of Deduction Management

Deductions arise for a variety of reasons:

- Shortages

- Pricing discrepancies

- Compliance-related issues

- Timing or documentation gaps

- Disputes connected to shipping or invoicing

Each deduction interrupts accounts receivable until it is researched, validated, and resolved. When handled manually, this work demands significant time and can create a large backlog. Your operations, finance, and customer teams all feel the burden when deductions accumulate.

Why Deduction Management Has a Stronger Immediate Financial Effect?

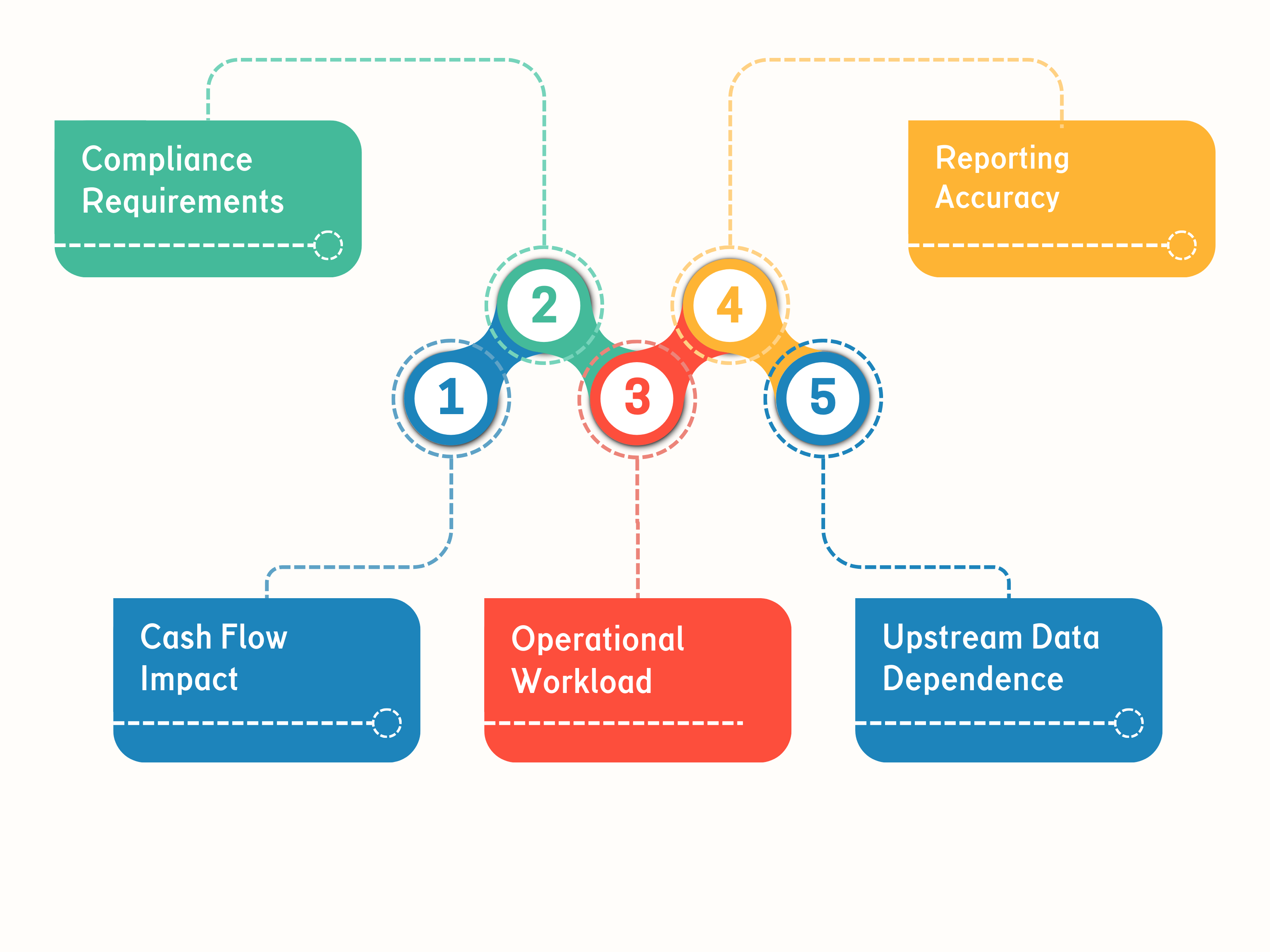

Several operational realities make deduction management central to financial health:

1. Cash Flow Impact

Every open deduction delays payment. If disputes remain unresolved, overall receivables become unpredictable.

2. Compliance Requirements

Retailer and industry standards are strict. Any missing or inaccurate detail—from documentation to shipment data—can trigger a deduction.

3. Operational Workload

Manual research consumes time. Identifying the cause, gathering documents, and preparing a response lengthens the cycle and strains teams.

4. Reporting Accuracy

If deductions are not settled promptly, revenue and forecasting become less reliable, affecting business decisions and planning.

5. Upstream Data Dependence

Clean contract terms, reliable pricing data, and consistent internal processes reduce the number of deductions and shorten resolution times.

Trade Promotion vs. Deduction Management: A Practical Comparison

Promotions shape the commercial strategy. Deductions determine how much revenue the business retains.

Here’s how the two areas naturally differ when viewed through operational and financial outcomes:

| Area | Trade Promotion | Deduction Management |

|---|---|---|

| Primary Purpose | Support demand and customer programs | Protect revenue and speed collection |

| Timing of Impact | During planning and promotional cycles | Immediately upon invoicing or dispute |

| Workload | Cross-functional coordination | Detailed case work and validation |

| Financial Exposure | Depends on market outcomes | Directly affects cash flow and revenue accuracy |

| Dependence on Data | Needed for planning | Essential for dispute resolution |

Both matter—but deductions carry direct consequences that appear quickly and affect the entire O2C chain.

How Automation Strengthens Deduction Control?

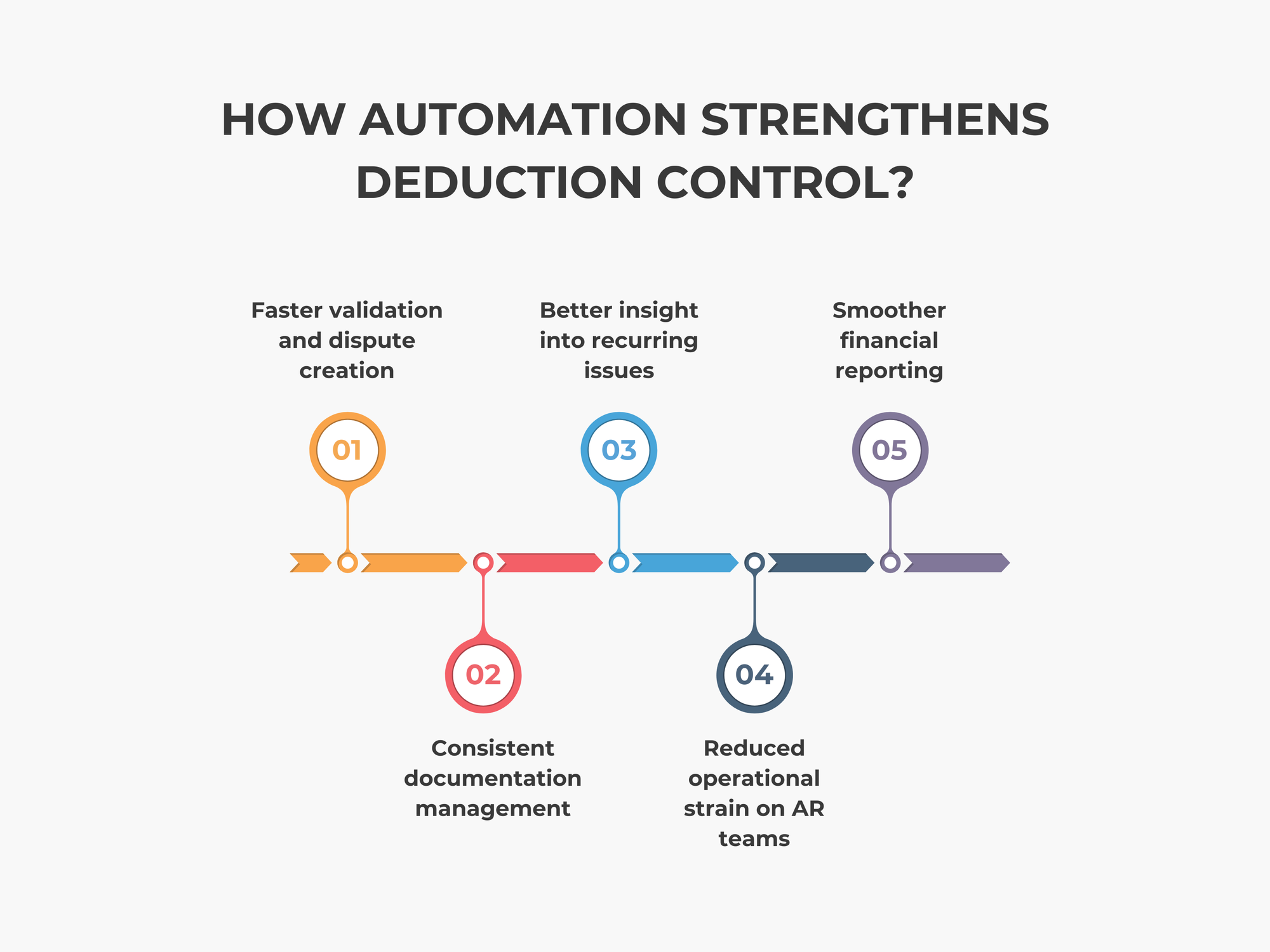

Automation plays an important role in modern financial operations. Across O2C and rebate processes, automated tools reduce manual work, increase accuracy, and help teams manage large volumes of cases with consistent rules.

When applied to deductions, automation supports:

- Faster validation and dispute creation

- Consistent documentation management

- Better insight into recurring issues

- Reduced operational strain on AR teams

- Smoother financial reporting

The result is fewer backlogs, improved accuracy, and better control over cash collection.

Why Many Organizations Address Deduction Management First?

Even strong commercial programs cannot compensate for unresolved deductions. When shortages, pricing differences, and compliance issues remain open:

- Cash is delayed

- Costs rise

- Reporting becomes unclear

- Forecasts lose reliability

For many suppliers, stabilizing deduction processes becomes the first step toward strengthening the entire revenue cycle. With controls in place, promotional activity is easier to assess and support.

A Balanced Strategy

Promotions help retailers meet demand, while deduction management ensures accurate settlement. A healthy supplier-retailer relationship requires both.

Clear documentation, structured processes, integrated data, and automated systems support consistency across the entire chain—from contract terms to final payment.

The organizations that perform best are those that treat deduction management as a foundational part of their commercial operations, not a back-end task.

Conclusion

Trade promotions influence how products move through the market, but deduction management determines how much revenue is ultimately realized. By strengthening deduction processes—through clarity, clean data, and automation—suppliers gain a reliable financial foundation that supports future promotional strategy as well.