Tiered Pricing vs. Volume Pricing: The Complete Guide

Rebate programs are widely used in B2B selling to build customer loyalty and push for larger deals, but not all rebate models work the same way. Two of the most common structures are tiered rebate pricing and volume rebate pricing. While they might sound similar, each follows a different logic when it comes to how and when rebates apply. Choosing the right model isn't just about pricing, it's about how buyers behave, how deals are structured, and what kind of relationships you're trying to build with your customers. This blog breaks down both approaches and compares them side by side so you can decide which fits your product, customer base, and business goals.

Table of Contents:

- What Is Tiered Rebate Pricing?

- What Is Volume Rebate Pricing?

- Pros and Cons of Tiered Rebate Pricing

- Pros and Cons of Volume Rebate Pricing

- Tiered Rebate Pricing vs Volume Rebate Pricing

- Tiered Rebate Pricing vs Volume Rebate Pricing: TL;DR

Jump to a section that interests you, or keep reading.

What Is Tiered Rebate Pricing?

Tiered rebate pricing is a structured incentive model where buyers earn rebates based on the volume they purchase, but unlike volume pricing, the rebate applies only to the units within each tier—not the entire purchase.

Here’s how it works:

- A seller sets volume thresholds (tiers).

- As the buyer hits each tier, a new rebate rate kicks in for the units purchased within that tier.

- The more the buyer purchases, the greater the total rebate—but it scales in steps.

Example:

Let’s say a supplier offers this rebate structure:

- 0–100 units → 0% rebate

- 101–500 units → 2% rebate

- 501–1000 units → 5% rebate

- 1001+ units → 8% rebate

If a buyer orders 600 units:

- The first 100 units get no rebate

- The next 400 units (101–500) get 2%

- The remaining 100 units (501–600) get 5%

Only the units in each tier earn the corresponding rebate. The total rebate is a blend of rates, weighted by quantity across the tiers.

What Is Volume Rebate Pricing?

Volume rebate pricing is a pricing strategy where customers receive a rebate based on the total quantity of products or services they purchase within a specific period. The more a customer buys, the higher the rebate they can earn, which effectively lowers the overall cost per unit for larger purchases.

Unlike tiered rebate pricing, where rebates apply only after reaching set levels or thresholds, volume rebate pricing is about offering back-end incentives that apply retroactively to all purchases once a specific volume is reached. Essentially, customers receive a rebate on their entire order once they meet a pre-established quantity target.

How It Works?

Volume rebate pricing works by offering customers a rebate based on the cumulative total of their purchases. The rebate is applied to the entire volume purchased once a customer crosses the designated volume threshold.

For example, a supplier may offer a volume rebate pricing structure such as:

- A 5% rebate if the customer purchases 1,000 units of a product.

- If the customer then purchases 2,000 units, they may be eligible for a 10% rebate — applied retroactively to the full purchase, not just the additional units.

The idea behind this model is to incentivize customers to buy larger quantities to qualify for higher rebates, encouraging increased sales volume over time.

Pros and Cons of Tiered Rebate Pricing

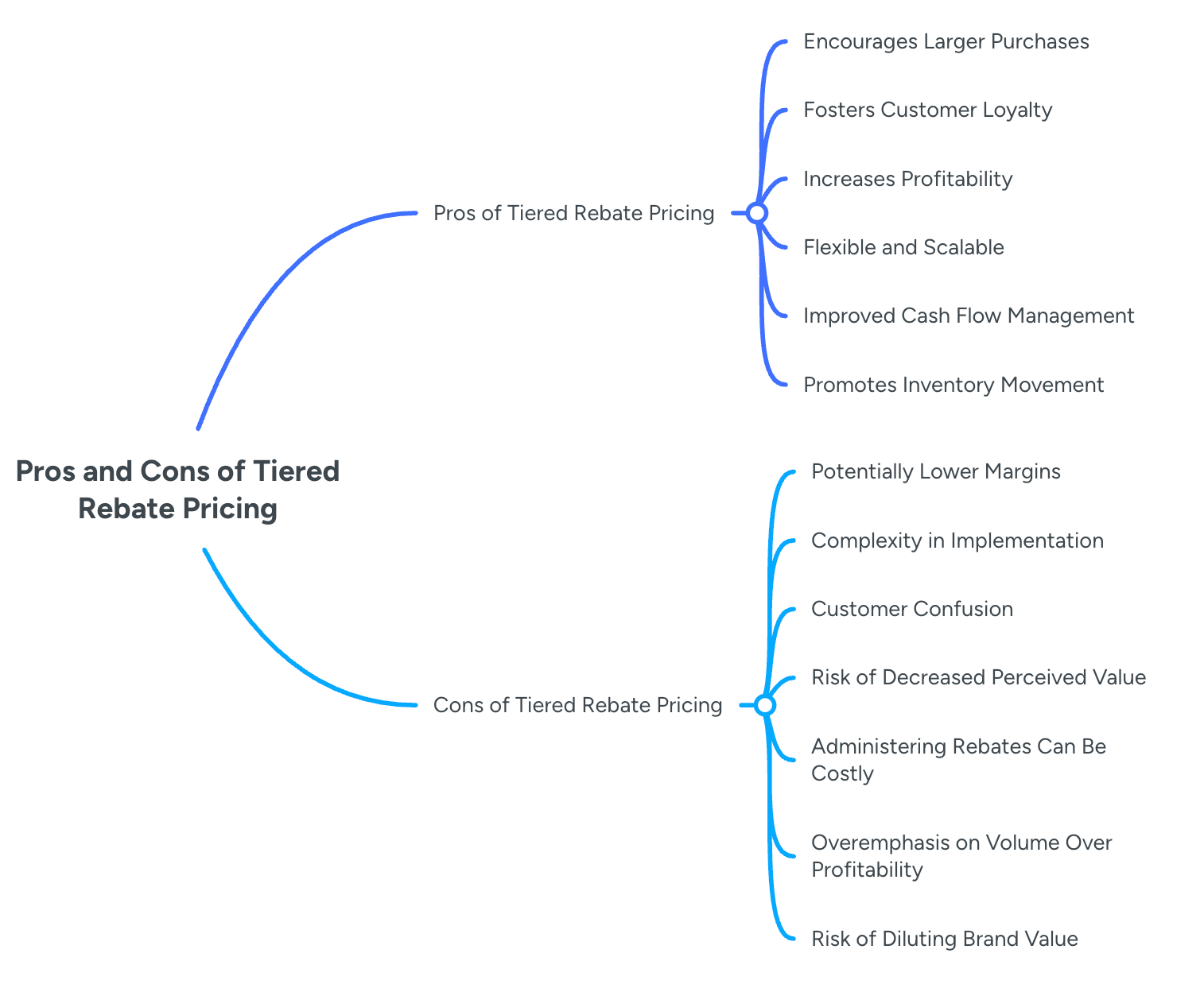

Pros of Tiered Rebate Pricing

- Encourages Larger Purchases

Tiered rebate pricing incentivizes customers to buy more in order to qualify for better discounts. As customers approach a higher rebate threshold, they are often motivated to purchase more to receive a better deal, which boosts sales volume and overall revenue for businesses. This is particularly beneficial for businesses looking to increase the average order value or shift large volumes of inventory.

- Fosters Customer Loyalty

By offering rebates based on purchase volume, businesses can create long-term relationships with customers. The idea of receiving a rebate for future purchases encourages repeat business, as customers are incentivized to return to reach the next tier or continue enjoying discounts. This can significantly improve customer retention rates, as buyers are often more likely to stay with a business offering tangible, ongoing benefits.

- Increases Profitability

While the business offers discounts to customers who meet certain thresholds, the rebate model can still help maintain profitability. This is because the higher purchase volumes often make up for the discount given, and businesses can continue to profit from the increased sales. Additionally, tiered rebate pricing allows businesses to segment customers, offering rebates to those who can generate higher volumes of purchases, thus maximizing profits from valuable clients.

- Flexible and Scalable

One of the key advantages of tiered rebate pricing is its adaptability. Businesses can set multiple rebate levels that align with different customer needs or purchasing patterns. This flexibility means companies can target various customer segments with rebates that are most relevant to them, whether for small buyers or large-volume customers. As business needs or market conditions change, tiered rebates can be adjusted to maintain competitiveness and profitability.

- Improved Cash Flow Management

With tiered rebates, customers may be encouraged to buy more upfront, which can improve cash flow in the short term. This is especially beneficial for businesses that sell products with high upfront costs or those looking to smooth out cash flow fluctuations. By offering rebates in exchange for bulk purchases, businesses can better predict sales cycles and manage their finances.

- Promotes Inventory Movement

Tiered rebate pricing is effective at helping businesses move large quantities of inventory. As customers are driven by the rebate incentive to purchase more, excess stock or slow-moving products can be sold more efficiently. This can help businesses reduce storage costs, free up warehouse space, and maintain healthier inventory turnover rates.

Cons of Tiered Rebate Pricing

- Potentially Lower Margins

While tiered rebate pricing can increase sales, it also comes with the risk of eroding profit margins. Offering rebates to customers who meet certain purchase thresholds means that businesses are sacrificing some profit in exchange for higher sales volume. This is particularly true when the rebates are too aggressive or the tiers are set too low, leading to lower-than-expected profit margins on each sale.

- Complexity in Implementation

Managing a tiered rebate system can become complex, especially when dealing with multiple rebate levels or various customer segments. Companies need to ensure they have the proper infrastructure in place to track customer purchases and accurately apply rebates. This can require significant administrative effort, especially for businesses with large customer bases or frequent pricing changes.

- Customer Confusion

If tiered rebate pricing is not communicated clearly, customers may become confused or frustrated by the terms of the offer. For example, customers might not understand how much more they need to purchase to qualify for a rebate or feel that the rebate thresholds are unreasonably high. This can lead to customer dissatisfaction and result in lost sales opportunities. Businesses must ensure that the tier structure is simple, transparent, and easy for customers to understand.

- Risk of Decreased Perceived Value

If the rebates are too frequent or too large, customers may start to expect these discounts as the norm, leading to a decrease in the perceived value of the product or service. This can reduce the customer’s willingness to pay full price for products without the rebate, affecting the long-term pricing strategy. Additionally, if businesses rely too heavily on rebates to drive sales, they may risk devaluing their products or services in the eyes of customers.

- Administering Rebates Can Be Costly

Offering tiered rebates often requires a significant amount of administrative work, especially when tracking multiple levels of rebates across many customers. The process of calculating, issuing, and monitoring rebates can be time-consuming and costly. For businesses with limited resources, this can become a drain on staff time and finances, making the rebate program less efficient.

- Overemphasis on Volume Over Profitability

One drawback of tiered rebate pricing is that it can incentivize customers to buy larger quantities simply for the sake of receiving a rebate, even if it’s not the most profitable move for the business. In some cases, customers may prioritize meeting rebate thresholds over purchasing products that offer the highest margins. This can lead to a misalignment between customer purchasing behavior and the business’s profitability goals.

- Risk of Diluting Brand Value

A frequent concern with rebate models is that offering discounts too often may cause customers to associate the brand with lower value. Over-relying on tiered rebates to drive sales may affect brand perception, especially for premium products or services. Customers may begin to question the true value of the product if it’s frequently available at a discounted price.

Pros and Cons of Volume Rebate Pricing

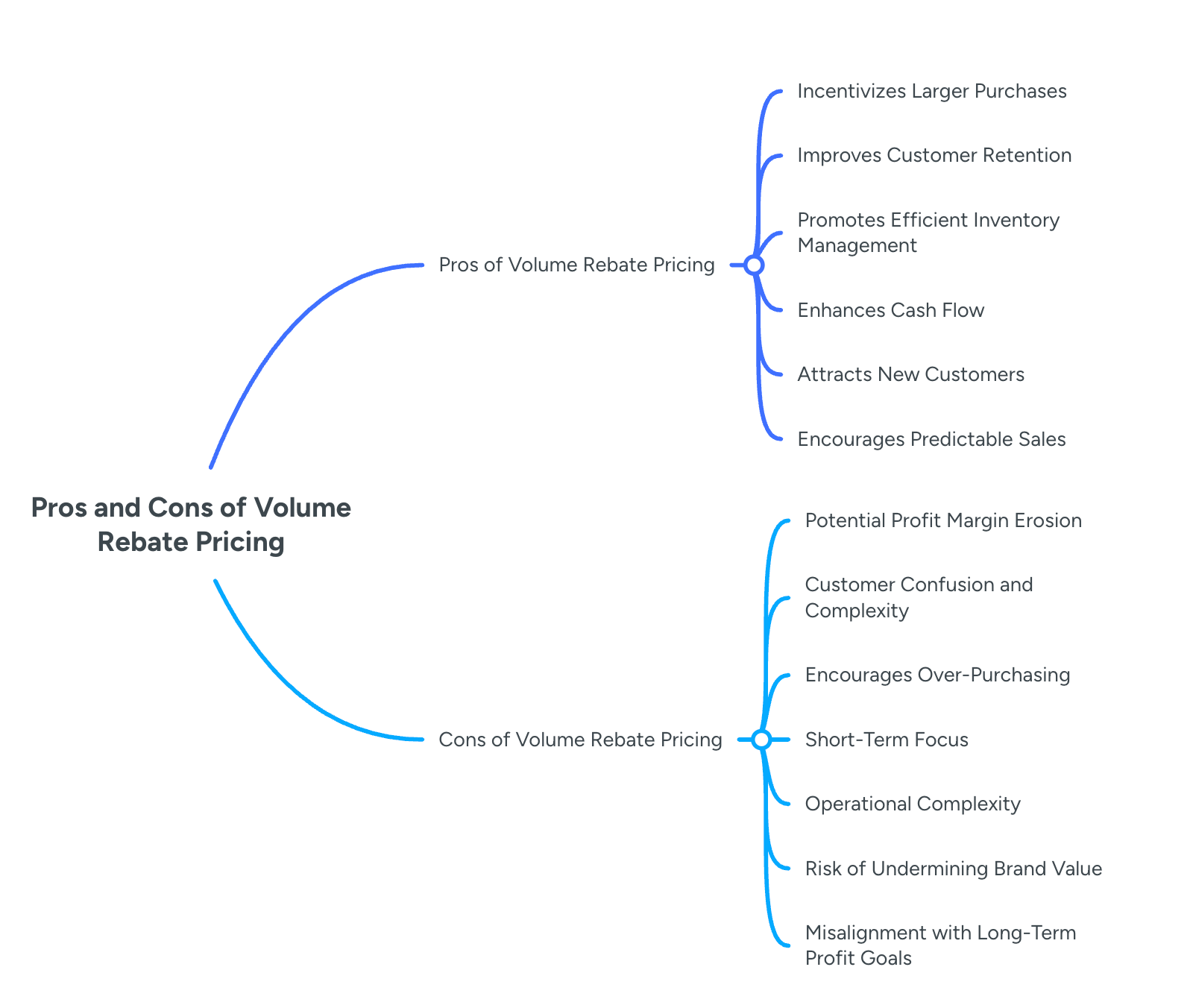

Pros of Volume Rebate Pricing

- Incentivizes Larger Purchases

One of the primary benefits of volume rebate pricing is its ability to encourage customers to make larger purchases. By offering rebates that increase with the amount purchased, businesses can motivate customers to buy more in order to qualify for the rebate. This can lead to a higher average order value, increased sales volume, and greater overall revenue for the business. Customers are more likely to purchase in bulk when they see the financial benefit of doing so.

- Improves Customer Retention

Volume rebate pricing can enhance customer loyalty. Customers who are consistently rewarded for their purchasing behavior may feel more inclined to return to the business for future purchases. The potential to receive a rebate or discount on future orders can create a sense of ongoing value, prompting repeat business. This helps businesses maintain a stable customer base over time, as customers are more likely to stay with a company offering financial incentives based on volume.

- Promotes Efficient Inventory Management

Offering volume rebates is an effective way for businesses to move large quantities of inventory. When customers are motivated to buy more, it can help clear out slow-moving or excess stock, which is particularly valuable for businesses with perishable goods or time-sensitive products. This can also reduce storage costs and improve inventory turnover, making the business more agile and responsive to market demands.

- Enhances Cash Flow

By encouraging larger purchases, volume rebate pricing can help improve short-term cash flow. Customers often make bulk purchases upfront to reach rebate thresholds, which results in immediate cash inflows for the business. This is particularly beneficial for businesses that need to maintain liquidity or manage cash flow during peak seasons or while preparing for future growth.

- Attracts New Customers

Volume rebate pricing can serve as an attractive proposition for new customers, especially in industries where buyers are already accustomed to purchasing in bulk or making larger orders. By offering a rebate as an incentive for volume purchasing, businesses can attract customers who may have been hesitant to commit to larger purchases without a clear financial benefit. This pricing model makes the business competitive and can be a key differentiator in crowded markets.

- Encourages Predictable Sales

Volume rebate pricing creates predictability in sales. Businesses can estimate how much volume will be sold based on the rebate thresholds and structure their production and inventory accordingly. The predictable nature of the volume-driven rebate system can also aid in forecasting future revenue and planning marketing campaigns effectively.

Cons of Volume Rebate Pricing

- Potential Profit Margin Erosion

The most significant drawback of volume rebate pricing is the risk of eroding profit margins. While offering rebates incentivizes customers to buy more, the business must absorb the cost of the rebate. If the rebate amounts are too generous or the thresholds are set too low, businesses may find themselves selling products at a lower margin than anticipated, which can negatively impact overall profitability. Careful balancing is required to ensure that rebates do not outweigh the increased sales volume.

- Customer Confusion and Complexity

Volume rebate programs can become complex and difficult for customers to understand, especially when the rebate structure is multi-tiered or has multiple conditions. Customers may not fully grasp how much they need to spend to qualify for a rebate or might overlook the program entirely. If the rebate terms are not clearly communicated, businesses may face confusion, which can undermine the effectiveness of the program. A complicated rebate structure may also lead to customer frustration and discourage participation in the offer.

- Encourages Over-Purchasing

While the goal of volume rebate pricing is to increase sales, it can sometimes lead to customers purchasing more than they actually need. This over-purchasing may occur simply to qualify for a higher rebate, leading to excess inventory or wastage. For businesses that sell perishable goods, this can result in product spoilage or added storage costs. Customers may not always make purchases that align with the business’s most profitable offerings, which can distort the sales model and waste resources.

- Short-Term Focus

Volume rebate pricing often emphasizes immediate sales volume rather than long-term customer value. Customers may only be motivated to make larger purchases in the short term to access the rebate, but once they have taken advantage of the offer, they may reduce their future purchases or stop buying altogether. This can create a temporary boost in sales, but it may not translate into long-term growth or customer loyalty. Businesses that rely too heavily on rebates might struggle to retain customers without offering ongoing incentives.

- Operational Complexity

Managing a volume rebate pricing system can introduce operational complexity. Businesses must track purchases, calculate rebates, and ensure that customers meet the required thresholds. For companies with a large customer base or frequent sales, this administrative burden can become significant. Without the right tools or infrastructure in place, businesses may struggle to keep track of rebate claims, which could result in errors or delays in processing, leading to dissatisfaction among customers.

- Risk of Undermining Brand Value

If volume rebates are too frequent or too large, customers may begin to expect discounts as the norm. This can diminish the perceived value of the product or service. For businesses that offer premium products, customers might feel that the product is not worth its original price if they are consistently receiving discounts or rebates. Over time, this may lead to reduced brand equity, as customers may perceive the brand as lower in value due to the frequent availability of discounts.

- Misalignment with Long-Term Profit Goals

Volume rebate pricing can incentivize behavior that doesn’t align with long-term business goals. For example, customers may focus solely on reaching rebate thresholds, purchasing more than they need, and potentially purchasing less profitable items. This can create a disconnect between the pricing strategy and the overall profitability of the business. Businesses must carefully monitor which products are being purchased and ensure that the rebate program is aligned with their broader business objectives, not just short-term sales volume.

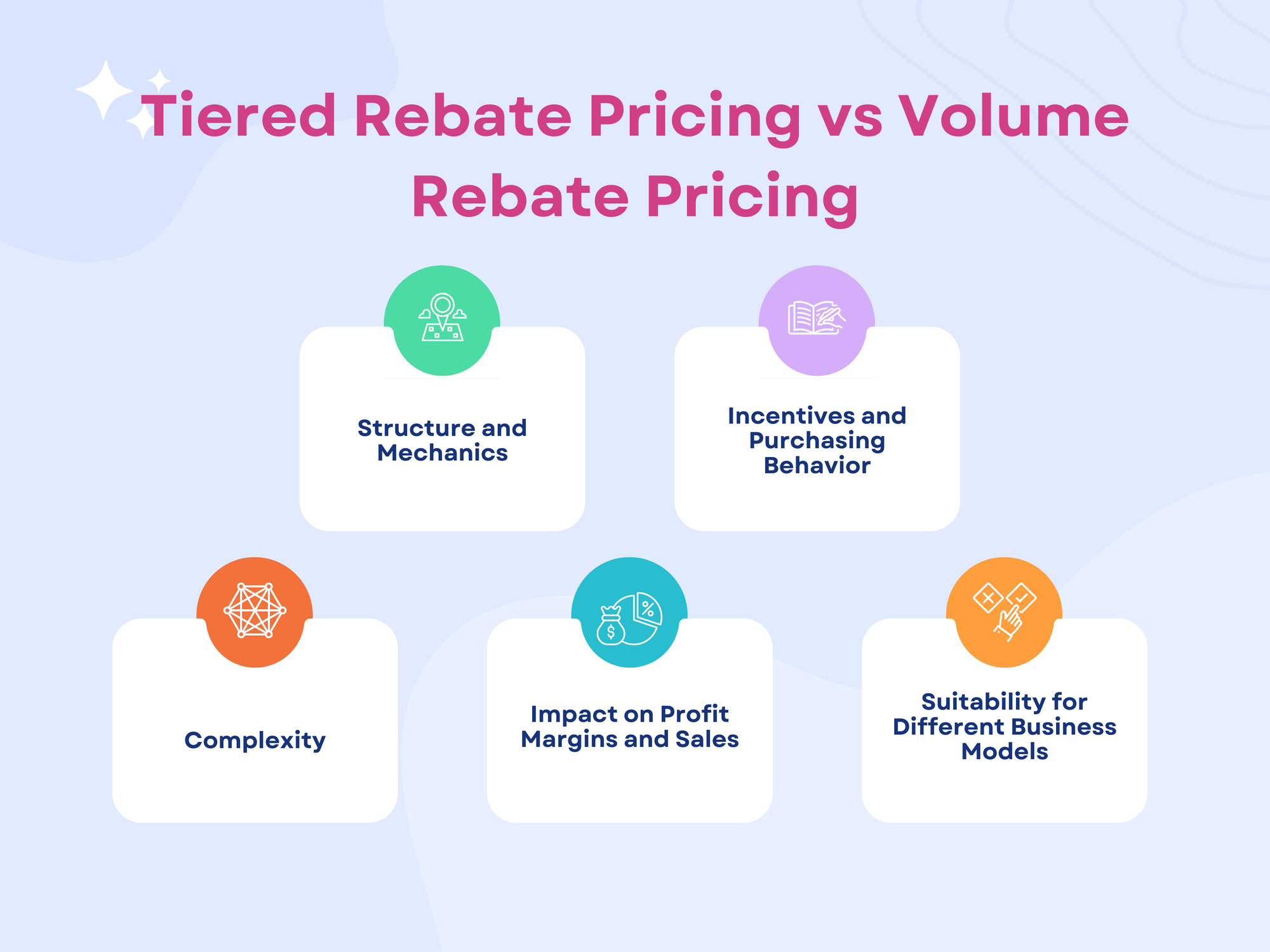

Tiered Rebate Pricing vs Volume Rebate Pricing

1. Structure and Mechanics

Tiered Rebate Pricing: Tiered rebate pricing involves multiple rebate levels or "tiers," where customers earn progressively larger rebates as their purchase volume increases. Each tier corresponds to a specific purchase amount or quantity, and once a customer reaches a threshold within a tier, they qualify for the rebate associated with that level. For example, a customer might receive:

- A 5% rebate for purchases up to $5,000

- A 10% rebate for purchases between $5,001 and $10,000

- A 15% rebate for purchases over $10,000

This structure provides clear steps where customers are incentivized to reach higher tiers in order to qualify for greater rebates. It creates a clear distinction between different levels of purchasing behavior, rewarding customers progressively for higher purchases.

Volume Rebate Pricing: Volume rebate pricing, on the other hand, is based solely on the total quantity or value of goods purchased, offering rebates when certain purchase thresholds are met. The key difference is that the rebate applies to the entire purchase once a customer reaches the qualifying volume. There are no distinct tiers with different rebate levels as in tiered rebate pricing. For example:

- A customer buying 500 units of a product may receive a 10% rebate on the entire purchase

- A customer buying 1,000 units may receive a 15% rebate on the entire purchase

The rebate is applied uniformly across the entire purchase once the volume threshold is met. This structure is straightforward, and the rebate is often seen as an immediate reward for purchasing a set amount.

2. Incentives and Purchasing Behavior

Tiered Rebate Pricing: The incentive in tiered rebate pricing encourages customers to not only make larger purchases but also to exceed specific thresholds to unlock more substantial rebates. This model encourages customers to aim for higher spending in incremental steps. As customers approach the next tier, they may feel motivated to increase their purchase slightly to gain access to a larger rebate.

For example, a customer who is purchasing $4,800 worth of goods might be encouraged to spend just $200 more to reach the next tier, qualifying for a larger rebate. This model works well for businesses that want to push customers to make incremental increases in their purchase behavior.

Volume Rebate Pricing: In contrast, volume rebate pricing often leads customers to make large bulk purchases at once to meet a specific volume threshold, after which they are rewarded with the rebate. The main incentive here is the total quantity purchased, with less emphasis on reaching higher incremental tiers. It’s ideal for businesses looking to encourage large, one-time purchases, such as when customers need to buy significant quantities to get a good deal. This model tends to attract bulk buyers who need to stock up on inventory or plan for the long term.

For example, a customer purchasing 500 units of a product may feel that it’s worth buying in bulk to take advantage of the rebate, while customers who don’t require that large amount would refrain from purchasing.

3. Complexity

Tiered Rebate Pricing: Tiered rebate pricing tends to be more complex than volume rebate pricing. Because it involves multiple rebate levels, customers need to understand how much they need to spend or how many units they need to buy to reach each threshold. The structure requires more communication to ensure customers know the exact requirements for each tier and the corresponding rebate. This can sometimes lead to confusion, especially if the tier boundaries are too close or the rebate amounts vary significantly between tiers.

For businesses, tracking and calculating the rebate amounts for each tier can also add an extra layer of complexity to the administrative process. Detailed record-keeping is necessary to ensure that the rebates are applied accurately, especially if customers have multiple purchases spanning different rebate thresholds.

Volume Rebate Pricing: Volume rebate pricing, on the other hand, is relatively simple and straightforward. There is only one threshold, and once it is met, the rebate applies to the entire order. For example, a customer buying 1,000 units receives a 15% rebate on the total order. This simplicity makes the model easier for customers to understand and businesses to implement and manage. There’s less room for confusion about rebate thresholds, and the rebate structure can be easily communicated.

However, while the structure is simple, businesses still need to monitor customer purchases to ensure the correct rebate is applied based on the total volume purchased.

4. Impact on Profit Margins and Sales

Tiered Rebate Pricing: The tiered rebate structure has the potential to offer higher rebates to customers who make significant purchases. While this can lead to larger order sizes, it also runs the risk of reducing profit margins if customers are frequently reaching higher tiers. However, businesses can set tiers strategically to ensure that the rebate structure doesn’t erode their margins too much. For instance, setting a higher threshold for the top-tier rebates can help balance the increased sales volume with profitability.

Because tiered rebate pricing creates a gradual increase in rebate percentages, it can also provide businesses with a better chance to maintain a sustainable margin while driving incremental sales. Businesses may find that this model fosters a more consistent growth in sales, as customers are driven to reach the next tier.

Volume Rebate Pricing: Volume rebate pricing can be a more straightforward approach for businesses that want to encourage bulk buying. However, the simplicity of the model can sometimes lead to an over-reliance on large orders, which may erode profit margins if the rebates offered are too generous or if customers are buying significantly larger volumes than expected.

The rebate is typically applied to the entire order, meaning that if a customer makes a very large purchase, the rebate could have a considerable impact on profitability. While volume rebate pricing can encourage immediate sales and improved cash flow, it may not necessarily foster long-term customer loyalty if customers focus only on reaching the rebate threshold without considering repeat purchases.

5. Suitability for Different Business Models

Tiered Rebate Pricing: Tiered rebate pricing works best for businesses that sell products with varying price points or that want to encourage incremental growth in sales. It is particularly useful in B2B sectors or in industries where customers tend to make repeat purchases over time. This model is effective for businesses that want to create a structured, tiered incentive system where customers feel motivated to keep buying more to reach the next rebate level.

Volume Rebate Pricing: Volume rebate pricing is more appropriate for businesses that sell bulk products or offer services that require large, one-time purchases. It is commonly used in industries like wholesale, manufacturing, or for SaaS licensing, where customers are encouraged to purchase in bulk or sign up for long-term contracts. This model is effective for businesses that want to generate large, one-time orders or contracts, making it ideal for industries where customers need to stock up on supplies or commit to large purchases at once.

Tiered Rebate Pricing vs Volume Rebate Pricing: TL;DR

| Aspect | Tiered Rebate Pricing | Volume Rebate Pricing |

|---|---|---|

| Structure | Multiple rebate levels or "tiers" based on purchase thresholds. | One rebate applied to the entire purchase once a volume threshold is reached. |

| Rebate Application | Rebates are progressively higher as customers reach higher tiers. | Rebate applies to the full order once the required volume is met. |

| Incentives | Encourages customers to aim for higher incremental purchases to qualify for bigger rebates. | Encourages large, one-time bulk purchases to meet volume thresholds. |

| Complexity | More complex due to multiple rebate levels and tracking requirements. | Simple to understand and apply—one threshold, one rebate. |

| Profit Margin Impact | Rebates can be structured to balance growth and margins, but higher rebates may still affect profitability. | Can impact margins more significantly if large purchases are common. |

| Customer Behavior | Motivates customers to make repeat purchases to reach higher tiers. | Promotes bulk buying or long-term commitments (e.g., multi-year contracts). |

| Admin Complexity | Requires tracking of customer purchases across different tiers. | Less administrative effort—only needs to track total volume per customer. |

| Best For | B2B industries, repeat customers, and products with varying price points. | Bulk product sales, wholesale, SaaS contracts, and large one-time orders. |

| Rebate Calculation Example |

- 5% for $1,000 - $5,000 - 10% for $5,001 - $10,000 - 15% for $10,001+ |

10% rebate on a $10,000 order when 500 units are purchased. |

Conclusion

Tiered rebate pricing and volume rebate pricing each serve a purpose, but they drive different behaviors and create different incentives. Tiered pricing rewards steady progression and long-term engagement, while volume pricing focuses on high-volume commitments in a single go. There’s no one-size-fits-all choice. What matters is how each model aligns with your sales strategy, pricing flexibility, and the type of buyer relationships you're aiming to build. Whether you’re optimizing for growth, margin, or retention, understanding the trade-offs helps you structure deals that make sense for both sides.