What is a Ship and Debit Program?

Manufacturers and distributors must find a balance between protecting profit margins and meeting customer pricing demands. One solution widely used across industries like technology, electrical supplies, and high-volume manufacturing is the Ship and Debit program.

These are structured rebate agreements that allow distributors to offer lower prices to customers, with manufacturers reimbursing the price difference after a sale. This arrangement helps manufacturers boost market share and inventory movement while giving distributors the flexibility to meet customer pricing needs without eroding profits.

A well-managed Ship and Debit program helps stabilize cash flow and drive increased sales volume, but success relies on precise tracking, consistent documentation, and strategic planning. In this guide, we’ll explore more about what Ship and Debit programs are, examine their benefits and challenges, and offer insights into maximizing the benefits of these programs.

Table of Contents:

- What is Ship and Debit?

- How Ship and Debit Agreements Work

- Ship and Debit Examples

- Benefits of Ship and Debit Programs

- Key Roles in Managing Ship and Debit Programs

- Common Challenges in Ship and Debit Programs

- Best Practices for Successful Ship and Debit Management

- Final Thoughts

Jump to a section that interests you, or keep reading.

What is Ship and Debit?

Ship and Debit is a rebate process in which distributors sell products at a lower price than the acquisition cost or expected margin to claim the difference from the supplier after the sale. This type of agreement allows distributors to maintain their pricing flexibility and customer satisfaction by meeting customer demands, handling bulk orders, moving unsold inventory, or building relationships with new clients without risking profit margins.

Commonly used in B2B sales, particularly in high-tech and electrical industries, Ship and Debit programs ensure that distributors receive financial support from manufacturers after the final transaction.

In these programs, a distributor initiates a request for a special price adjustment from the supplier before making a sale to an end customer. The supplier evaluates the request, and either approves or rejects it. If approved, an accrual offer is created, and sales orders are processed against this offer. After the sale, the distributor submits the claim to the supplier with supporting documents like invoices and sales reports to validate the transaction. The manufacturer reviews the claim to ensure the eligibility of products sold and the accuracy of information provided before authorizing the payment.

The rebate is issued after the sale has occurred, which allows manufacturers to manage cash flow more effectively. Payment methods include credit against future purchases, direct payments, or other arrangements. Some distributors pass on rebate benefits to customers by reducing the sales price or providing direct rebates. This setup helps strengthen distributor-supplier relationships and incentivizes distributors to prioritize specific products.

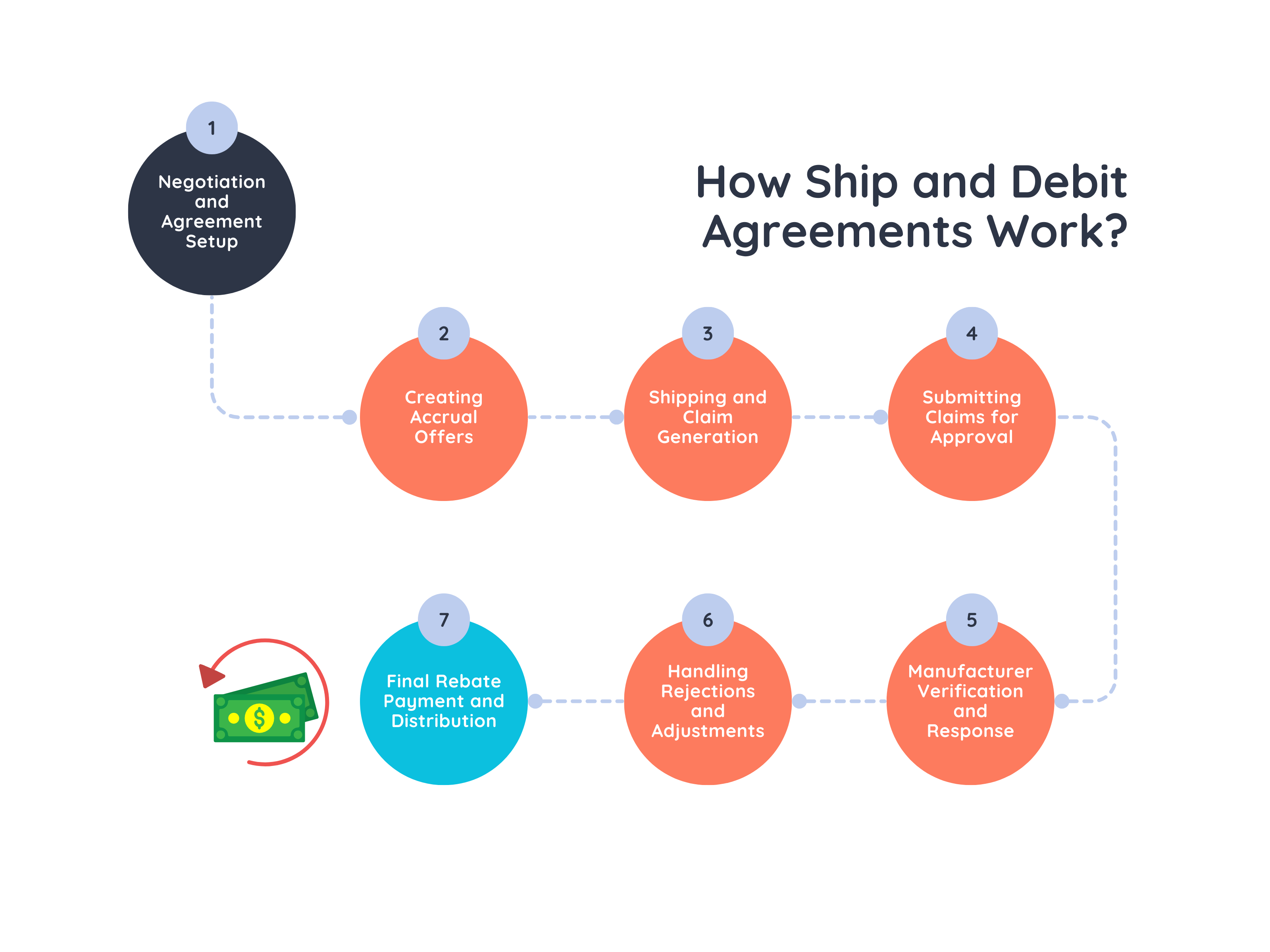

How Ship and Debit Agreements Work?

1. Negotiation and Agreement Setup

Manufacturers and distributors begin by negotiating the terms of the Ship and Debit program, including eligible products, rebate amounts, and the program's timeframe. Distributors propose a price adjustment for specific products, considering factors like bulk orders, competitive bids, or inventory management. Suppliers assess these proposals and decide whether to approve or amend them.

2. Creating Accrual Offers

Once the manufacturer approves the pricing request, an accrual offer is created. This offer serves as the basis for processing sales orders at the newly agreed rates. For internal requests where the supplier declines, distributors may choose to proceed and absorb the cost while maintaining their own financial records for internal tracking.

3. Shipping and Claim Generation

When products are sold and shipped, the distributor creates corresponding claim items logged in a ship and debit due list. This list includes data points like end customer invoices and shipment dates to match each transaction with the Ship and Debit agreement terms. The system calculates claim amounts using agreed rebate rates.

4. Submitting Claims for Approval

After the accruals are recorded, distributors compile claims into batches for submission to the manufacturer. The submission may occur through electronic means such as EDI or web-based templates. Suppliers review these batches and may approve, partially approve, or reject claims. Claims are updated with industry-standard dispute codes to indicate reasons for rejection.

5. Manufacturer Verification and Response

Manufacturers validate submitted claims to confirm that the sales meet the program’s criteria. This process includes reviewing documents like sales reports and invoices. Approved items in the batch lead to rebate payments, while rejected items are flagged for correction or further review.

6. Handling Rejections and Adjustments

For rejected or partially approved claims, the distributor can adjust and resubmit the claim. The distributor reviews dispute codes and makes necessary corrections to the claim data before resubmission. If a batch remains in Work in Progress (WIP) status due to rejections, updates are logged until no significant increase in approval is expected. The claim can then be closed, and the system adjusts the budget for rejected items.

7. Final Rebate Payment and Distribution

Approved claims result in rebates issued to the distributor. Payment methods include credit notes, wire transfers, or other pre-agreed formats. Some distributors pass these rebates to end customers by lowering sales prices or offering direct rebates. The system ensures accurate accounting for exchange rate gains or losses in multicurrency claims, thus balancing the general ledger accordingly.

Ship and Debit Examples

Basic Example: Fixed Rebate per Unit

Consider an OEM that sells computers to a distributor at $1,000 per unit. They agree on a rebate of $50 per unit sold.

Distributor buys 100 laptops at $1,000 each, totaling $100,000. The distributor then sells all 100 laptops. The distributor claims a rebate of $50 per unit for 100 units. So the total rebate will be:

Rebate per unit × Number of units = $50 × 100 = $5,000.

Net Cost = Total purchase cost - Total rebate = $100,000 - $5,000 = $95,000.

Complex Calculation Scenarios

In competitive sales scenarios, maintaining margins may require adjustments to standard pricing. For instance, a distributor purchasing an item at $2,000 with an agreed margin of 10% might need to sell the product for $1800 to meet market pressures.

To offset this reduction, a rebate claim is calculated as follows:

(Agreed Margin %×Sell Price)−Sell Price+Cost Price

Using the numbers provided:

(10%×1800)−1800+2000=$380

Thus, the distributor would claim $380 to meet the target margin. This way, the distributor receives the necessary rebate to preserve profitability despite competitive price adjustments.

Benefits of Ship and Debit Programs

Implementing Ship and Debit programs provides several key advantages for manufacturers and their distribution partners. Here’s why many tech and high-tech companies use these programs:

Increases Sales

Ship and Debit rebates motivate distributors to sell more of a manufacturer’s products by offering financial incentives based on sales volume. This focus on driving higher sales benefits both distributors and manufacturers by increasing total sales volume and revenue.

Improves Market Share

By encouraging distributors to prioritize certain product lines, Ship and Debit programs help manufacturers capture more of the market. As distributors work to meet specific sales targets, the manufacturer’s presence and competitiveness within the industry grows.

Improves Cash Flow

Instead of providing discounts upfront, rebates are only issued once revenue has been realized, which keeps capital available throughout the sales cycle.

Increases Distributor Loyalty

Providing structured rebates helps distributors maintain profit margins without sacrificing competitive pricing, which strengthens the relationship with the manufacturer.

Reduces Inventory Levels

By tying rebates to active sales, manufacturers encourage distributors to move products faster, which helps reduce inventory levels. This lowers distributors’ carrying costs, improves their cash flow, and reduces the risk of excess or obsolete stock.

Key Roles in Managing Ship and Debit Programs

Admins

Admins set up and configure tools essential for Ship and Debit program management. They integrate systems (e.g., ERP and rebate management software), create approval workflows, configure layouts, and customize automated processes. They also manage user access.

Rebate Program Managers

Rebate Program Managers design and oversee Ship and Debit programs. They define eligibility criteria, set rebate calculation parameters, and collaborate with sales and finance to ensure rebate structures align with business goals. Managers monitor program performance, enroll partners, and adapt structures to support various business relationships.

Ship and Debit Claims Analysts

Claims Analysts validate and audit submitted claims. They review claims for accuracy, adjust amounts if needed, and communicate outcomes to partners. They also audit claims against proof-of-sale documents to resolve issues and prevent financial losses.

Finance Teams

Finance teams track payouts and manage program budgets. They review calculated rebates, process payments, and integrate approved payouts into financial systems. They adjust budgets based on claims outcomes to maintain accurate and compliant financial records.

Partner Users

Partner Users (e.g., distributors or dealers) maintain and submit claims to ensure compliance with rebate requirements. They track claim status and payouts to align their operations with program terms and maximize rebate earnings.

Common Challenges in Ship and Debit Programs

Administrative Complexity

Ship and Debit programs require meticulous management of agreements, sales tracking, and thorough documentation. Distributors must maintain detailed records of each transaction, including the quantities sold, prices, and customer information.

Accurately capturing this data is important for processing claims, but it is labor-intensive and error-prone without robust systems.

Disputes and Claim Rejections

One of the significant challenges in Ship and Debit programs is dealing with disputes over claims. Manufacturers may reject submitted claims due to discrepancies such as incomplete documentation, inaccurate sales data, or failure to meet eligibility criteria outlined in the agreement. This can cause delays in receiving rebates and requires distributors to review, correct, and resubmit claims. The need for clear communication and transparent documentation is critical to resolving these issues and minimizing the impact on cash flow.

Competitive Pressures

Manufacturers face intense competition from similar rebate programs offered by other industry players. To attract and retain distributors, manufacturers must ensure their Ship and Debit agreements are attractive enough for the distributors while balancing profitability.

The challenge lies in creating rebate structures that are competitive enough to incentivize distributors without eroding margins.

Resource Demands

Implementing and managing Ship and Debit programs comes with huge resource requirements. The process involves time-intensive setup, ongoing tracking, claim verification, and dispute resolution, all of which demand skilled personnel and technology solutions.

Without dedicated resources and automation, the cost of managing these programs can outweigh the benefits. Manufacturers must weigh these demands against the expected return on investment to ensure the program remains profitable.

Best Practices for Successful Ship and Debit Management

Define Clear Policies and Procedures

Successful Ship and Debit management begins with setting clear policies and procedures. These guidelines should outline the terms of the program, including rebate amounts, eligible products, and the timeframe for claiming rebates. Well-defined rules will reduce ambiguity and ensure all parties understand their conditions and timelines for claim submissions.

Use Technology for Automation

Using technology is important for simplifying the complex processes involved in Ship and Debit programs. Software solutions automate the tracking of sales, validation of claims, and documentation management, significantly reducing manual workload.

Automation tools offer features such as integrated claim submission portals, real-time tracking, and automated approval workflows. This way, using these tools will help reduce administrative burdens, improve data capture, and minimize errors to ensure that claims are processed more smoothly.

Regularly Review and Adjust the Program

A Ship and Debit program should not remain static. Regular reviews and adjustments are necessary to ensure continued alignment with market conditions and business needs. Periodic assessments help identify inefficiencies, such as delays in claim submissions or processing and allow for recalibrations in program parameters for improved profitability.

Build Transparency and Collaboration

Clear communication between manufacturers, distributors, and end customers ensures that all parties have a mutual understanding of the program’s rules and progress. Using online platforms helps stakeholders access real-time information on claim statuses, supporting documents, and payout details. Transparency minimizes disputes, allows for faster resolution of issues, and strengthens trust between partners.

Final Thoughts

The complexity of managing Ship and Debit programs, such as tracking sales data, validating claims, and ensuring timely rebate payouts, requires precision and efficiency. Without the right systems, you risk errors, revenue leakage, and administrative bottlenecks that will diminish the benefits of Ship and Debit agreements.

A dedicated rebate management platform like Speedy Labs will automate key tasks and provide real-time visibility into program performance. With features that support data integration, claim validation, and detailed audit trails, rebate management platforms reduce the administrative burden. These tools also offer distributors and manufacturers the transparency they need to resolve claims efficiently and optimize cash flow, all while maintaining compliance with program terms.

Schedule a demo with our team to see how our platform can help you optimize rebate tracking and improve profitability.