The Complete Guide to Retail Rebate Management

Retail rebate programs have become a critical lever for influencing shopper behavior, improving category performance, and deepening supplier collaboration. Unlike trade-focused incentives, customer rebates are structured to drive end-user purchases through cashbacks, seasonal offers, and volume-based rewards. Yet managing these programs across multiple product lines, sales regions, and retail partners introduces operational challenges few teams are equipped to handle. Disconnected systems, inconsistent terms, and limited visibility often lead to missed payouts, underused incentives, or compliance issues.

This guide breaks down every stage of retail rebate management—from structuring offers to auditing outcomes with a focus on consumer-facing rebates.

Table of Contents:

- What is a Retail Rebate?

- Why Retail Rebates Exist?

- Types of Retail Rebates

- The Retail Rebate Management Lifecycle

- Common Challenges in Retail Rebate Management

- Best Practices for Retail Rebate Management

- Role of Technology in Retail Rebate Management

Jump to a section that interests you, or keep reading.

What is a Retail Rebate?

In retail, a customer rebate is a post-sale financial incentive given by a supplier or manufacturer to the retailer, based on pre-agreed conditions. Unlike point-of-sale discounts, rebates are applied after the transaction, typically calculated over a period based on cumulative performance. These are not upfront price reductions but retrospective rewards tied to behaviors like total volume purchased, sales growth, or promotional support.

Retail rebates fall under B2B agreements between brands and retailers, often negotiated annually or quarterly. These rebates directly affect net margin, influencing not just purchase decisions but also category planning, shelf allocation, and sales strategies.

The key difference between rebates, discounts, and promotions lies in timing, structure, and purpose:

- Discounts are immediate price reductions applied at the time of purchase.

- Promotions are often short-term consumer-facing incentives aimed at boosting sell-through (e.g., buy-one-get-one offers).

- Rebates, in contrast, are performance-based payouts triggered only when agreed thresholds are met, such as units purchased, revenue generated, or percentage growth.

Retail rebates typically span a variety of types including volume-based tiers, fixed annual agreements, or goal-based structures (e.g., growth YOY). They are formalized through rebate agreements and require robust tracking across sales systems, procurement records, and financial reporting to be administered correctly.

Why Retail Rebates Exist?

Retailers use rebate agreements not only to support margin but also to incentivize specific business outcomes. The primary function is to encourage volume purchases by providing a retrospective reward for hitting order thresholds, which supports better purchasing economies of scale without altering shelf prices.

Rebates also drive product uptake. Suppliers use them to push new SKUs, seasonal lines, or strategic categories into retail channels. By tying rebate payments to the stocking or movement of particular products, they align retailer behavior with the supplier’s go-to-market goals.

Another reason for their use is to strengthen long-term supplier-retailer relationships. Rebates are often framed around annual agreements, creating shared planning cycles and deepening commercial ties. This arrangement encourages retailers to prioritize those suppliers when making merchandising decisions or allocating promotional space.

Finally, rebates are a tool for enhancing brand competitiveness within the retailer's environment. In crowded categories, suppliers use targeted rebates to win favorable shelf placement, secure advertising support, or influence assortment choices. Rather than cutting base pricing, they offer margin improvement opportunities based on performance, preserving brand equity while remaining attractive to the retailer.

Types of Retail Rebates

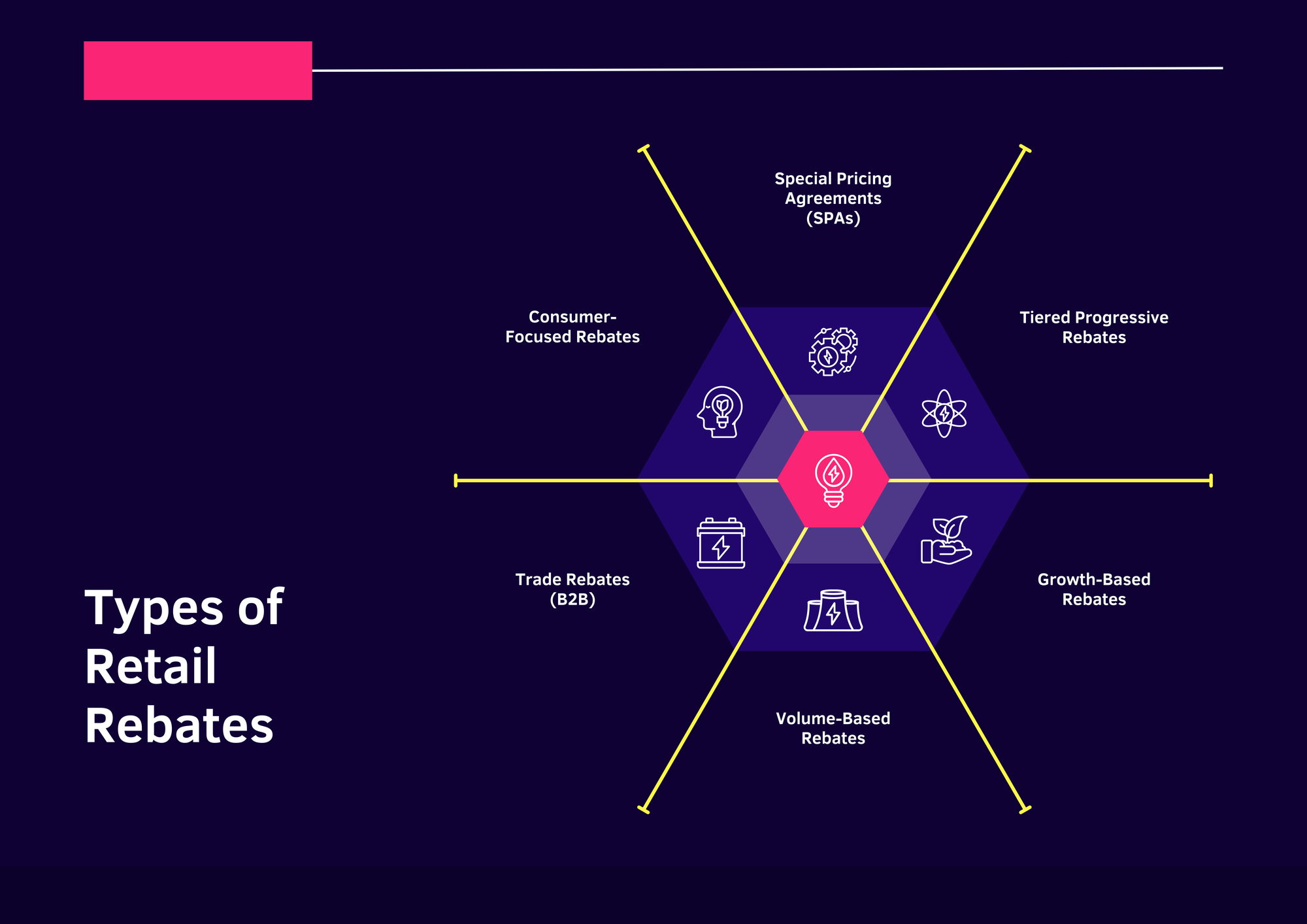

Retail rebate programs vary widely in structure, but each format serves a specific commercial purpose. Understanding these types is key to building rebate agreements that align supplier incentives with retail execution.

Consumer-Focused Rebates

Although not the focus of B2B retail rebate strategies, consumer-facing rebates are occasionally factored into supplier-retailer discussions when retailers are expected to facilitate or promote them. These include cashback offers and mail-in rebates targeted at end users. Retailers may be reimbursed for handling or distributing these incentives, especially during seasonal campaigns or time-bound promotions tied to specific SKUs. While the rebate is paid to the consumer, the retailer's role in execution may be governed by agreement terms.

Trade Rebates (B2B)

Trade rebates are the core structure in retail rebate management. These are negotiated directly between suppliers and the retailer or distributor and are designed to reward specific behaviors such as stocking priority SKUs, committing to exclusive supply terms, or participating in supplier-funded campaigns. These rebates often underpin trade spend budgets and are used to shift share-of-shelf, secure promotional placements, or align marketing calendars. Their influence extends beyond pricing into broader merchandising and planning decisions.

Volume-Based Rebates

Volume-based rebates reward retailers for achieving predefined purchase thresholds within a specific period. These agreements are straightforward and typically include fixed payout amounts once a unit or revenue target is hit. For example, a retailer might receive a flat 3% rebate on all purchases once it orders 10,000 units. These rebates encourage bulk purchasing, helping suppliers manage production at scale while offering retailers margin improvement tied to clear buying behavior.

Growth-Based Rebates

These rebates link incentives to increases in purchase volume over a previous period, typically year-over-year or quarter-over-quarter. Retailers qualify only when incremental growth is proven against a baseline, making them useful for supporting supplier goals in underperforming categories or newly launched lines. Growth-based rebates are often used as secondary incentives layered on top of standard volume deals, motivating retailers to stretch beyond existing commitments to unlock additional margin.

Tiered Progressive Rebates

Tiered progressive rebates apply a sliding scale to rebate payouts based on cumulative purchases, with rebate percentages increasing as higher thresholds are crossed. Unlike flat-volume rebates, where the full rebate applies only after a single benchmark is met, tiered structures offer rising incentives with each step. For example, a rebate might start at 1% for the first 1,000 units, increase to 3% for the next 2,000 units, and move to 5% beyond that. This creates a continuous reward model and encourages sustained buying momentum.

Special Pricing Agreements (SPAs)

SPAs are pre-arranged rebates that allow retailers to sell at a fixed, competitive price while recovering the margin difference post-sale through supplier reimbursement. These are commonly used in high-volume, price-sensitive categories or during large-scale promotions that require temporary price reductions. The rebate is paid retrospectively, based on units sold under the special pricing conditions, and must be tightly tracked to avoid leakage or disputes. Unlike other rebates that reward performance, SPAs ensure pricing consistency in the market without compromising supplier net revenue.

The Retail Rebate Management Lifecycle

Retail rebate programs follow a structured lifecycle that spans strategic planning through payout and performance evaluation. Each stage contributes to how well rebates support both the supplier’s commercial goals and the retailer’s margin objectives.

Strategy and Planning

The lifecycle begins with setting specific business goals that rebates are intended to support, such as accelerating sales in targeted product lines, improving vendor compliance, or boosting quarterly revenue from key accounts. This phase requires cross-functional input to ensure thatthe rebate strategy complements broader pricing, product placement, and revenue management plans. Programs are most impactful when aligned with commercial calendar milestones and strategic assortment objectives.

Budgeting and Forecasting

Once objectives are clear, rebate program costs must be projected at both the program and partner levels. Retailers estimate total liability based on partner sales forecasts, then allocate funds across multiple rebate types—volume, growth, tiered, etc.—based on historical performance and expected ROI. Forecasting precision is critical, as underestimation can cause payment delays while overestimation ties up funds unnecessarily. Budgeting also considers the mix of high- and low-margin products covered under rebate terms.

Designing Rebate Structures

This stage involves selecting the rebate format that matches the commercial behavior retailers want to encourage. Each structure must include clearly defined thresholds, payout rates, claim rules, and valid timeframes. Definitions such as “net sales” or “units shipped” must be unambiguous. Agreements also require legal vetting to ensure compliance with pricing laws, anti-kickback regulations, and trade promotion standards. Rebate terms should be enforceable and structured to reduce ambiguity in future claim audits.

Communication and Rollout

Rebate terms must be rolled out with consistency across internal and external stakeholders. Internally, sales teams need to understand rebate eligibility so they can negotiate effectively. Procurement and finance teams need visibility to track exposure and prepare for payment cycles. Externally, suppliers and partners should receive clear documentation outlining qualification rules, timelines, and reporting expectations. Documentation should be standardized, with explicit formulas and examples to avoid misinterpretation.

Tracking and Monitoring

Accurate rebate execution requires real-time tracking capabilities that allow retailers to monitor sales performance against qualifying thresholds. This includes visibility by SKU, customer, region, or time period. Retailers rely on performance dashboards to flag at-risk programs and benchmark participation across partners. Commonly tracked metrics include participation rate (how many partners are eligible and enrolled), claim rate (the portion of eligible rebates actually claimed), and ROI based on net margin impact after rebate costs.

Processing Claims and Payouts

After performance data is validated, retailers move to the claims processing phase. This involves verifying that all qualifying purchases meet the agreed criteria, and that the correct rebate tier has been applied. In manual workflows, this step is prone to delays, errors, and disputes. Automated systems, by contrast, allow for faster validation using integrated data and rule-based logic. Timely and accurate payments are critical to preserving supplier relationships and financial credibility.

Auditing and Reconciliation

Rebate auditing ensures the accuracy of payouts and confirms compliance with agreement terms. This involves matching internal records with supplier-submitted claims, checking for duplicate entries, missed rebates, or overpayments. Audits also verify that payment timing aligns with contractual obligations. Strong documentation practices during earlier phases reduce the burden at this stage and help resolve discrepancies faster.

Reviewing and Optimizing

After program closeout, rebate performance is reviewed to identify which programs delivered the intended results and which underperformed. Retailers analyze trends across partners, categories, and timeframes to pinpoint inefficiencies or missed opportunities. Underperforming programs may be phased out, restructured, or combined with alternative incentives. In some cases, in-cycle changes are necessary to adjust for market shifts or misaligned targets, particularly when programs are multi-quarter or annual.

Common Challenges in Retail Rebate Management

Despite their commercial importance, retail rebate programs are often burdened with operational complexity. Challenges typically stem from fragmented systems, inconsistent processes, and lack of alignment between teams and partners. These issues can erode financial accuracy, delay payments, and damage supplier trust.

Managing Multiple Concurrent Rebate Programs

Retailers often run several rebate schemes at once, spanning different brands, categories, and customer segments. When programs overlap in timing or apply to the same SKUs, conflicting eligibility criteria and thresholds become difficult to track. Prioritization becomes unclear for both internal teams and suppliers, especially when one rebate program influences performance in another. Without a centralized structure, navigating multiple active deals increases the likelihood of missed qualifications and accounting discrepancies.

Data Accuracy and Integration

Rebate execution depends on accurate, timely data, but retailers frequently rely on scattered sources—ERP systems, CRM tools, spreadsheets, and manual logs. This fragmentation causes inconsistencies in identifying eligible transactions, calculating volume thresholds, or confirming sales during specific periods. Even minor discrepancies in SKU codes or date ranges can result in rejected claims or misclassified rebate tiers. Without integrated data pipelines, real-time tracking and reconciliation remain difficult.

Manual Processing Bottlenecks

Many rebate workflows are still managed through spreadsheets or manual data entry. This slows down the entire claims process, from submission through validation and payout. Staff must manually verify line-level transactions, interpret complex rebate rules, and cross-check claims with agreements. This workload not only delays payments but also increases the risk of human error, leading to underpayments, overpayments, or disputes that require further investigation.

Poor Stakeholder Communication

Rebate programs touch multiple teams—sales, procurement, finance, and external suppliers. Poor communication leads to misunderstandings about qualification rules, deadlines, and payout criteria. Sales teams may misinform suppliers about thresholds, or finance may interpret contract terms differently than procurement. This misalignment can cause partners to miss claims or submit incorrect data, eroding confidence in the rebate process and generating friction during reconciliation.

Auditing Gaps

Rebate audits are often incomplete or inconsistent due to missing documentation or mismatched records. Without a clear audit trail, it becomes difficult to confirm whether all qualifying transactions were captured or whether payments reflect the correct tier and timing. Retailers may also struggle to defend decisions in supplier disputes, especially when agreements lack detailed definitions or historical data is fragmented. This can lead to revenue leakage and reputational strain.

Best Practices for Retail Rebate Management

Successful retail rebate management depends on structured workflows, clean data, and consistent oversight. These practices reduce operational strain, strengthen partner trust, and support accurate financial outcomes. The following approaches help eliminate inefficiencies and reinforce control over customer rebate programs.

Centralize All Rebate Agreements and Performance Data

Storing rebate contracts, thresholds, and performance metrics in a unified system prevents fragmentation. A centralized repository—often part of a rebate management platform—ensures stakeholders access current rebate terms and eliminates version control issues. It also allows for SKU-level drilldowns, customer-level tracking, and accurate tier monitoring, which are critical for identifying eligibility and maintaining compliance across large retail programs.

Automate Wherever Possible (Claims, Approvals, Reporting)

Manual workflows introduce delays and errors. Automation accelerates claim validation, enforces eligibility checks, and ensures timely processing. Automated systems can flag discrepancies in sales data, apply correct rebate logic, and initiate approvals with audit-ready logs. This reduces workload on finance teams and enhances transparency for suppliers and customers expecting timely payouts.

Keep Rebate Terms Simple, Measurable, and Enforceable

Complex rebate structures increase the risk of misinterpretation and non-compliance. Retailers benefit from setting clear conditions, such as defined volume brackets, fixed timeframes, and unambiguous product criteria. Simpler terms reduce friction in execution, help suppliers track their progress, and minimize back-and-forth during claim reconciliation.

Maintain Clear and Proactive Communication with All Stakeholders

Rebate success hinges on alignment across internal teams and external partners. Sharing rebate program details with sales, procurement, finance, and suppliers ensures consistent understanding of eligibility, timelines, and expected outcomes. Proactive communication prevents disputes and gives suppliers clarity to plan promotions or adjust purchasing behaviors accordingly.

Schedule Regular Rebate Reviews (Quarterly or Monthly)

Rebates should be assessed frequently, not just post-cycle. Monthly or quarterly reviews help catch underperformance early, realign strategies, and make timely corrections. These reviews also support mid-cycle changes to poorly performing programs and offer data for forecasting rebate liabilities in advance of payment periods.

Integrate Rebate Data into Broader Sales and Financial Planning

Rebate liabilities affect revenue recognition and margin forecasting. Integrating rebate accruals, earnings, and projected payouts into the financial planning process ensures that P&L statements reflect true profitability. Alignment with sales planning helps assess the influence of rebates on purchase volumes and promotional behavior.

Validate Rebates Through Audit Trails and System Controls

Auditability safeguards rebate accuracy. All rebate programs should include system-driven checks for threshold achievement, claim legitimacy, and payment matching. Transparent audit trails allow retailers to defend payouts, resolve supplier disputes, and identify gaps in rebate execution. System controls prevent overpayments, duplicate claims, or unintentional inclusion of ineligible sales.

Role of Technology in Retail Rebate Management

Technology is central to maintaining accuracy, speed, and control in retail customer rebate programs. With rising program complexity and growing volumes of claim data, legacy tools and manual workflows cannot support modern rebate demands. Purpose-built platforms eliminate friction across planning, execution, and analysis.

Manual systems—typically spreadsheets and email-based workflows—create significant bottlenecks. Rebate terms stored in disconnected files lead to outdated or misaligned records. Data entry errors and inconsistent formula logic introduce miscalculations in claim values. Manual reconciliation delays payouts and restricts timely visibility into performance. This makes it harder to enforce compliance, confirm eligibility, or avoid disputes. Without real-time data, decision-makers lack the insights needed to adjust underperforming programs or accurately forecast liabilities.

Retail rebate software must support the nuances of customer-facing programs. Systems should include configurable workflows tailored for promotional rebates, volume incentives, or special pricing deals. Real-time data integration with ERP, CRM, and POS systems ensures that claims match actual sales transactions and that partner performance is tracked accurately. Approval workflows should be rule-based, enabling finance and commercial teams to validate rebate claims without delay. Role-based dashboards give each team—sales, finance, procurement—only the data they need, reducing clutter and miscommunication. Automation of accruals, claim validation, and reporting helps retailers stay audit-ready while keeping rebate accounting aligned with revenue cycles.

Conclusion

Retail rebate management is far more than an administrative function—it’s a strategic activity that influences margins, market share, and customer loyalty. But success depends on more than well-crafted offers. Teams must align rebate structures with business goals, monitor performance in real-time, and resolve claims accurately and efficiently. Manual workarounds can’t keep up with today’s volume and complexity.

Retailers who centralize rebate data, simplify terms, and adopt purpose-built tools gain tighter financial control and clearer program outcomes. With the right approach, rebates stop being a cost center and start becoming a reliable way to build repeat purchases, move inventory, and improve financial predictability.