A Guide to Reducing Revenue Leakage with Improved Rebate Management

Revenue leakage is a persistent challenge for businesses across the supply chain that silently drains potential profits. This phenomenon occurs when revenue that should rightfully belong to the company fails to be captured, often due to operational inefficiencies, errors, or inadequate processes. For B2B organizations, where complex trading agreements and performance-based incentives are the norm, revenue leakage can result in significant financial losses.

One major contributor to revenue leakage is ineffective rebate management. Rebates can become liabilities when managed poorly. Issues such as manual calculations, unclear payment terms, delayed invoice processing, and pricing inaccuracies frequently lead to misallocated funds, disputes, and even damaged customer relationships. In many cases, organizations unknowingly pay unwarranted rebates, which further exacerbates the problem.

Addressing these inefficiencies is important for maintaining profitability and safeguarding revenue streams. This blog will explore how strategic rebate management can help plug revenue gaps, optimize cash flow, and build stronger, more transparent relationships with trading partners.

Table of Contents:

- What is Revenue Leakage?

- The Role of Rebates in Revenue Management

- 3 Steps to Pinpoint and Address Revenue Leakage

- 4 Strategies for Better Rebate Management

- The Value of Advanced Rebate Management Software

Jump to a section that interests you, or keep reading.

What is Revenue Leakage?

Revenue leakage is the unnoticed or unintended loss of income that occurs when a company fails to capture the full revenue it is entitled to. This issue is particularly significant for businesses in the B2B sector, where complex agreements and operational inefficiencies can lead to substantial financial drain. It manifests in various forms, from pricing errors to delayed invoice processing, and often stems from a lack of streamlined processes and accurate data management.

Common Causes of Revenue Leakage

Revenue leakage arises from a combination of manual errors, outdated systems, and unclear operational workflows:

Manual Processes and Human Error: Reliance on spreadsheets and manual calculations introduces significant risks, as errors in rebate calculations or misinterpretations of agreements can lead to overpayments or unclaimed rebates.

Unsent Invoices and Unclear Payment Terms: Inadequate invoice management, where invoices are delayed or overlooked entirely, prevents businesses from collecting payments promptly. Additionally, manually drafted agreements often lack clear payment deadlines, which leads to confusion and missed revenue collections.

Pricing Inaccuracies: Poorly managed pricing strategies can result in expired promotional discounts being applied or volume discounts extended to customers who no longer qualify. These errors directly diminish profitability and can harm customer relationships.

Ineffective Rebate Practices: Managing rebates without proper systems results in misallocated payments, disputes, and a lack of transparency in performance tracking.

Impact on Businesses

The financial and operational consequences of revenue leakage are far-reaching. Companies not only face direct monetary losses but also experience inefficiencies in managing trading agreements, which in turn hinder their ability to capitalize on growth opportunities.

Relationships with customers and trading partners become strained due to disputes over incorrect payments or delays in fulfilling agreements. Furthermore, the inability to accurately analyze rebate performance and related data results in missed chances for upselling, cross-selling, and better targeting of strategic customers.

The Role of Rebates in Revenue Management

Rebates play an important role in revenue management by serving as strategic tools for driving sales and building stronger relationships with trading partners. These financial incentives are specifically designed to reward customer loyalty, encourage repeat purchases, and attract new business.

By aligning rebate programs with specific sales objectives, businesses can influence customer behavior in meaningful ways. For instance, value incentive rebates promote upselling by motivating customers to purchase higher-value products, while product mix incentives encourage cross-selling by driving interest in complementary offerings. Retention rebates, on the other hand, are useful for securing contract renewals and re-engaging lost customers to ensure steady revenue streams over time.

While rebates hold substantial potential for improving revenue management, their complexity presents huge risks if not managed properly. When properly implemented, rebate programs provide tangible benefits such as improved sales performance, improved customer retention, and increased profitability. However, the intricate nature of rebate agreements involving volume triggers, performance metrics, and conditional terms introduces the potential for costly mismanagement. Without precise tracking and accurate calculations, businesses may inadvertently overpay customers, delay payments, or fail to recognize earned revenue. These missteps not only lead to revenue leakage but also strain relationships with trading partners, diminishing trust and future collaboration opportunities.

3 Steps to Pinpoint and Address Revenue Leakage

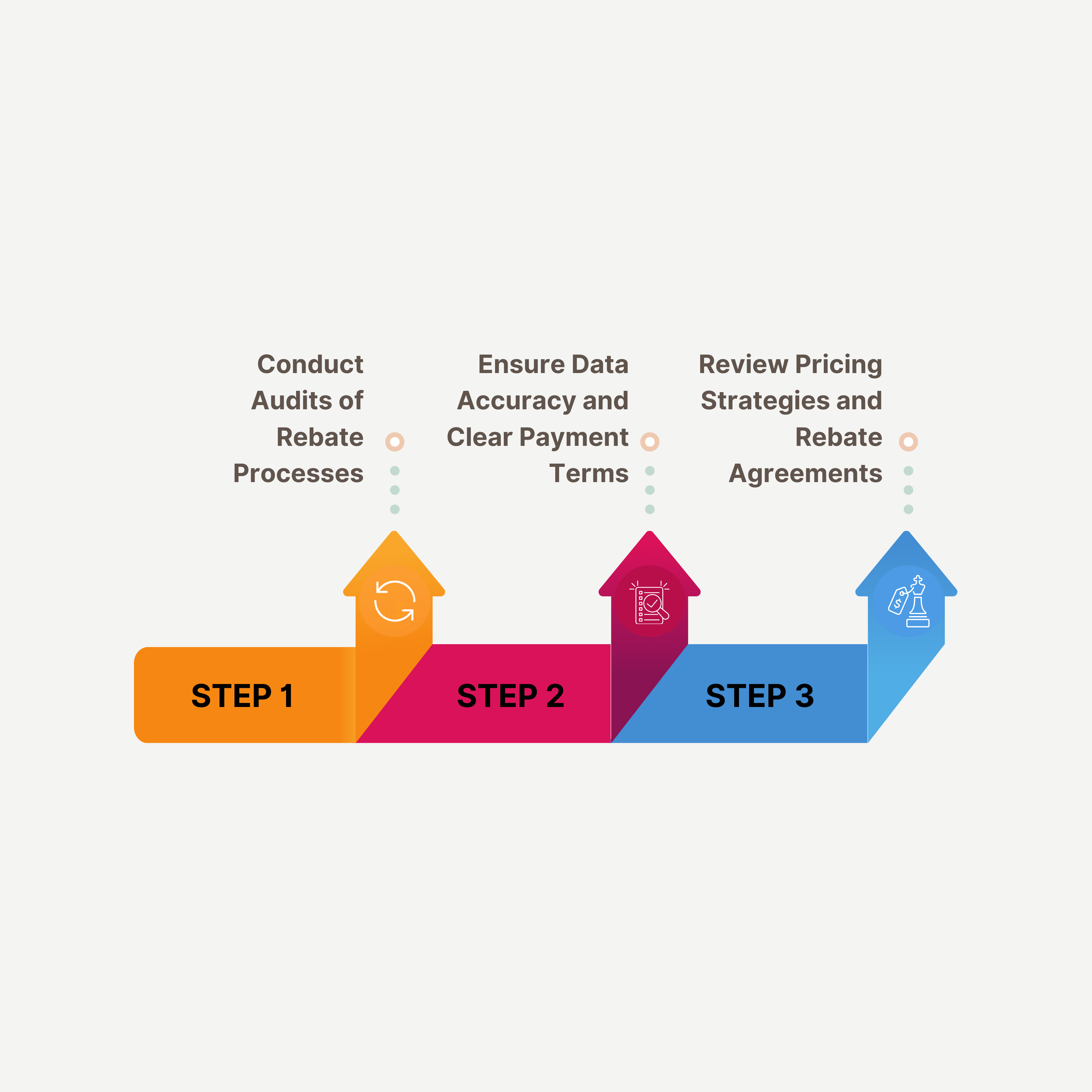

Effectively identifying and addressing revenue leakage requires a structured approach that focuses on uncovering inefficiencies and errors within rebate management processes. By taking the following steps, businesses can systematically locate and resolve sources of lost revenue:

1. Conduct Audits of Rebate Processes

Begin by performing a comprehensive audit of your existing rebate management workflows. This involves scrutinizing manual processes, identifying reliance on spreadsheets, and assessing the use of outdated tools. Manual calculations and fragmented systems are prone to errors, misinterpretations, and miscalculations, which result in both overpayments and missed rebate claims. Regular audits help organizations detect and rectify these vulnerabilities so that processes align with contractual obligations and revenue expectations.

2. Ensure Data Accuracy and Clear Payment Terms

Data discrepancies are a huge contributor to revenue leakage, especially when inconsistent or outdated information is used in rebate calculations. Ensuring that all data is accurate, current, and uniformly maintained across systems is important to preventing errors. Additionally, trading agreements must include unambiguous payment terms with clearly defined due dates and conditions. Vague or inconsistent terms can cause delays, missed payments, or disputes. A centralized rebate management platform can help ensure that all parties operate from a single source of truth to minimize confusion and improve accountability.

3. Review Pricing Strategies and Rebate Agreements

Examine your pricing strategies and rebate structures to identify potential inefficiencies or inaccuracies. Common issues include promotional pricing being extended beyond its intended timeframe and volume discounts being applied to customers who no longer qualify. Such errors not only result in direct financial losses but can also erode customer trust and damage brand reputation. By conducting regular reviews of rebate agreements, businesses can verify that terms are being upheld and adjust them proactively to prevent future revenue leakage.

4 Strategies for Better Rebate Management

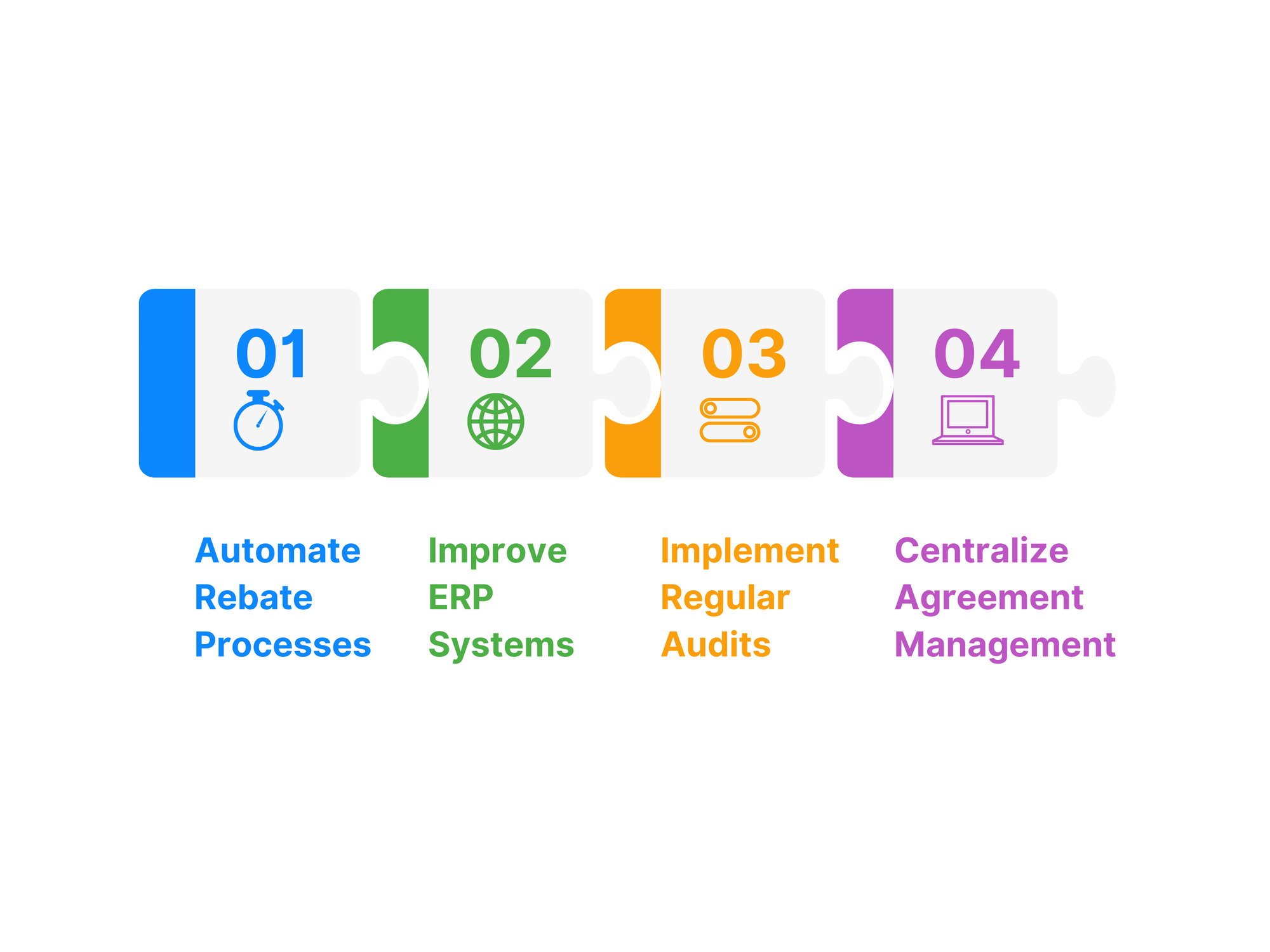

1. Automate Rebate Processes

Manual rebate management using spreadsheets is fraught with risks, particularly as business operations grow in complexity. Errors in calculations, delays in processing, and inconsistencies in data handling result in revenue leakage and operational inefficiencies.

Transitioning to advanced rebate management tools eliminates these vulnerabilities by automating calculations, workflows, and reporting. Automation improves accuracy, reduces the likelihood of human error, and significantly improves efficiency by processing large volumes of data in real time. With automated systems, businesses gain immediate access to insights and analytics for faster and more informed decision-making.

2. Improve ERP Systems

While Enterprise Resource Planning (ERP) systems offer basic functionality for rebate management, they often fall short when handling complex agreements and performance metrics.

Organizations can bridge this gap by integrating a dedicated rebate management solution with existing ERP systems. Such integrations ensure smooth data flow for improved visibility into rebate agreements and performance metrics. Real-time tracking of sales and rebate outcomes becomes more accessible for businesses to monitor progress against contractual obligations and adjust strategies proactively to minimize revenue leakage.

3. Implement Regular Audits

Establishing a routine for conducting audits and compliance checks is important for ensuring rebate accuracy and adherence to agreements. Regular reviews of rebate processes help detect and address discrepancies early, whether in calculation errors, missed obligations, or outdated terms.

Compliance checks also ensure that rebate practices align with regulatory requirements to reduce legal and financial risks. Engaging external auditors or consultants periodically provides an objective perspective and highlights areas for improvement.

4. Centralize Agreement Management

Centralizing rebate contracts and agreements in a single, cloud-based platform ensures that all stakeholders have consistent access to critical information. This approach reduces the risk of misplaced or outdated agreements and improves collaboration between internal teams and trading partners.

Assigning specific stakeholders to manage agreements ensures clear accountability for tracking obligations, deadlines, and performance metrics. Regular reviews and timely updates to agreements further prevent issues such as unclaimed rebates or extended discount periods. This helps businesses to maintain control over their rebate programs and optimize outcomes.

The Value of Advanced Rebate Management Software

Core Features of Modern Solutions

A standout feature of these platforms is their real-time calculation engines, which ensure that rebates are accurately calculated as transactions occur. These engines eliminate the risks of human error and outdated data inherent in manual systems.

Customizable dashboards provide users with immediate visibility into rebate performance, presenting key metrics and analytics in an intuitive, actionable format.

Another important feature is configurable workflows, designed to accommodate the diverse needs of different stakeholders. These workflows help track rebate agreements, sales performance, and customer claims so that each step, from calculation to approval, is aligned with organizational objectives. These tools reduce administrative burdens and improve efficiency by automating tasks such as claim validation and payment authorization.

How Technology Prevents Revenue Leakage?

Rebate management software plays an important role in addressing revenue leakage by tackling inefficiencies and inaccuracies head-on. Automated calculations and workflows minimize the risk of errors in rebate processing, while centralized platforms ensure that all stakeholders work from a consistent, up-to-date data source.

Enhanced transparency into agreements, terms, and performance metrics helps businesses validate claims swiftly and accurately to avoid disputes and unnecessary payments.

Additionally, the insights generated by these systems are invaluable for shaping revenue growth strategies. Advanced analytics provide detailed reports on customer purchasing behaviors for organizations to identify opportunities for upselling, cross-selling, and targeting strategic customers with tailored incentives. This data-driven approach not only improves revenue potential but also strengthens trading relationships by delivering value to partners in a timely and reliable manner.

Modern rebate management solutions provide businesses with the tools they need to prevent revenue leakage, maintain compliance, and unlock opportunities for sustained profitability.

Conclusion

Now is the time to take control of your rebate processes and secure your bottom line. Explore how rebate management software like Speedy Labs can help your business reduce financial risks and improve efficiency and profitability.

Contact our team to schedule a demo and discover how the right tools can transform your approach to revenue management.