What is Rebate Forecasting?

Rebate programs can be complex, with intricate terms and conditions that can make it difficult to accurately predict the financial outcomes.

Rebate forecasting addresses this challenge by providing businesses with a structured approach to estimate potential rebate earnings based on historical data, sales trends, and program parameters.

In this blog, we will explore the concept of rebate forecasting in detail.

Table of Contents:

- What is Rebate Forecasting?

- 3 Key Factors Involved in Rebate Forecasting

- The Importance of Rebate Forecasting in Financial Planning

- Common Challenges in Rebate Forecasting

- Best Practices for Rebate Forecasting

- Forecasting for Different Rebate Types

- Key Methods and Approaches for Rebate Forecasting

Jump to a section that interests you, or keep reading.

What is Rebate Forecasting?

Rebate forecasting is the process of estimating future rebate payments a business expects to issue or receive based on rebate agreements and historical data.

This involves predicting the total rebate amounts owed to customers or expected from suppliers within a specific period, usually tied to contractual agreements, sales volumes, or customer behaviors. Rebate forecasting is an important tool for financial planning, which helps businesses predict future cash flows, reduce financial surprises, and ensure accurate budgeting.

3 Key Factors Involved in Rebate Forecasting

Customer Purchasing Behaviors

Customer purchasing behaviors significantly influence rebate forecasting because many rebate programs are based on the volume of purchases a customer makes over a set period. For instance, customers who are expected to reach higher purchase thresholds are entitled to larger rebates, thus affecting the forecast. Analyzing historical purchase patterns, such as seasonality, growth trends, and loyalty, helps businesses to more accurately predict how much a customer will spend and, consequently, how much rebate they will earn or owe. Understanding these patterns allows businesses to make more informed estimates about future rebates and adjust their forecasting models as needed.

Rebate Eligibility Conditions

Rebate eligibility conditions vary widely depending on the terms of each rebate agreement. These conditions involve thresholds such as purchase volumes, sales goals, or specific product categories. Rebates are also contingent upon customer behavior or performance metrics, such as meeting sales targets or maintaining a certain volume of purchases within a specific time frame. Because these conditions are complex and vary from one customer or supplier to another, understanding them is crucial for accurate forecasting. Businesses must track these conditions closely and ensure that their forecasting models are updated regularly to reflect any changes in eligibility criteria. Failure to account for these conditions can result in inaccurate rebate projections, potentially leading to financial mismanagement.

Timing of Accruals and Payments

The timing of accruals and payments is another critical factor in rebate forecasting. Rebates are often accrued over time and paid out according to specific schedules, such as monthly, quarterly, or annually. The accrual period for rebates might differ from the actual payment dates, making it essential to track when rebates are expected to be recognized as liabilities in financial statements. Accurate timing of these accruals helps businesses avoid cash flow issues, ensure correct financial reporting, and predict when payments will be made. Moreover, businesses must consider seasonal fluctuations, when customers might increase their purchases, potentially triggering larger rebate payments. Properly accounting for timing ensures that rebate forecasts reflect the most accurate and timely financial picture.

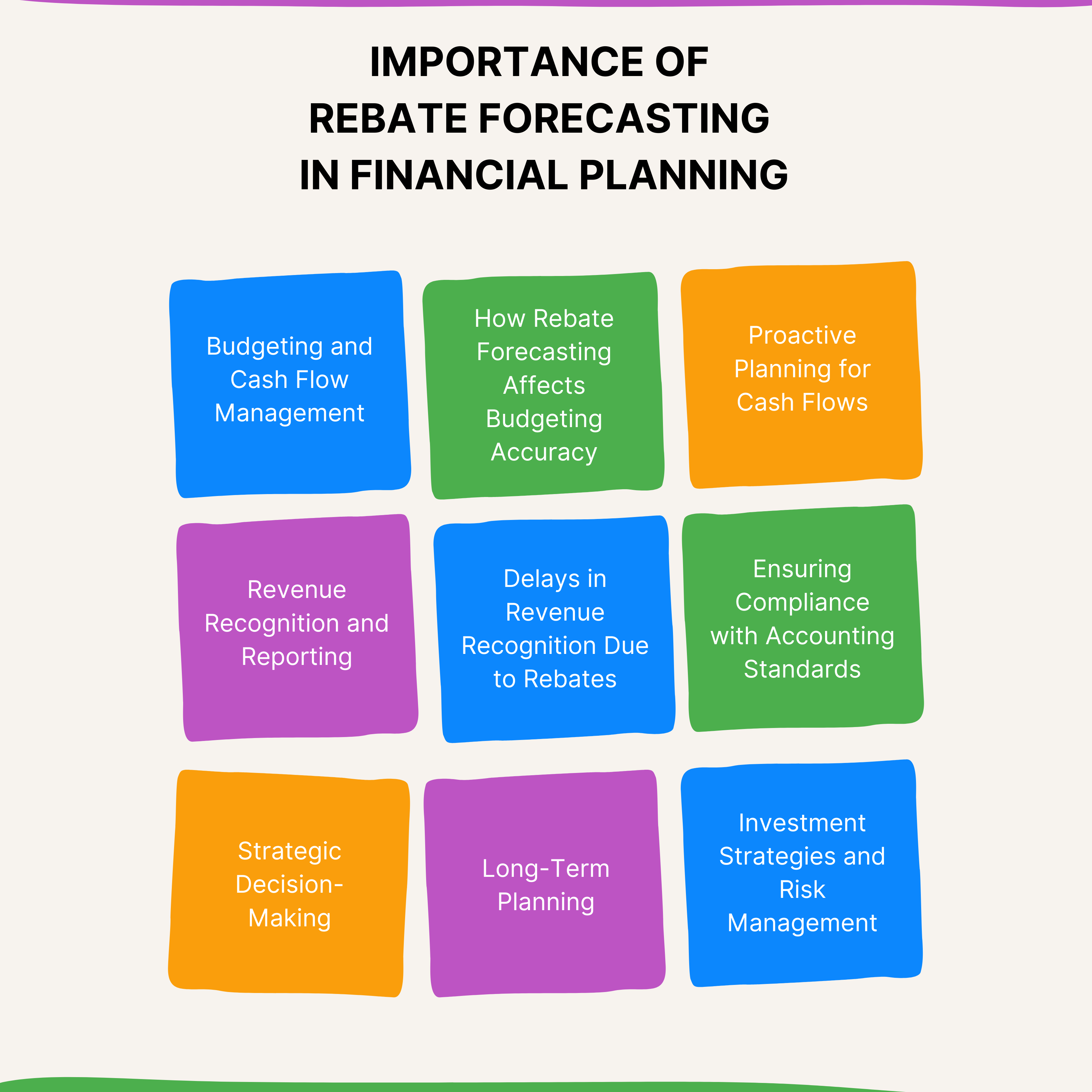

The Importance of Rebate Forecasting in Financial Planning

Budgeting and Cash Flow Management

Rebate forecasting is integral to budgeting and cash flow management. It provides businesses with a clearer picture of the potential rebate payouts they need to prepare for and allocate funds accordingly. When rebates are not properly forecasted, a business faces unanticipated cash outflows that disrupt operations or delay other critical financial commitments. Accurate rebate forecasts help businesses to anticipate these expenses and ensure they have sufficient liquidity to meet obligations. Furthermore, by forecasting rebates in alignment with expected sales or purchase volumes, businesses can better plan their budget and avoid underestimating or overestimating their cash flow needs.

Affects Budgeting Accuracy

Rebate forecasting directly impacts the accuracy of a company's budget by providing data-driven insights into expected rebate liabilities. If rebates are not correctly forecasted, it could lead to either excess provision for rebates or inadequate reserves, both of which cause imbalances in the budget. An accurate forecast helps businesses to precisely match their financial liabilities with expected revenues so that they don’t overcommit to other areas or face unmanageable financial pressures. By incorporating detailed forecasts of rebate payments, businesses can allocate resources to key projects or areas of growth while keeping their financial commitments in check.

Proactive Planning for Cash Flows

With rebate forecasting, businesses can engage in proactive cash flow planning to avoid any unexpected financial movements. Rebates often represent significant financial outflows that, without proper forecasting, can lead to cash flow surprises. By forecasting rebate amounts accurately, companies can identify when these payments will occur and adjust their operational strategies accordingly. For instance, businesses can adjust their procurement strategies, reduce discretionary spending, or plan payment schedules in anticipation of large rebate payouts. Proactively managing cash flow ensures that a company can remain financially stable and avoid crises caused by unexpected or unplanned rebate-related expenses.

Revenue Recognition and Reporting

Rebate forecasting is essential for accurate revenue recognition and reporting. Rebates are typically accounted for as a reduction in revenue or as an expense in financial statements, depending on the rebate agreement's nature. If rebates are not accurately forecasted and recorded, businesses can experience delays in revenue recognition. These delays may lead to discrepancies between actual and reported revenue, affecting financial performance metrics and causing issues with auditors and investors. Ensuring that rebates are forecasted correctly allows businesses to align their revenue recognition with their operational performance and avoid financial misreporting.

Delays in Revenue Recognition Due to Rebates

Delays in revenue recognition can arise when rebate payments or accruals are not properly forecasted or accounted for. Rebates, by their nature, are often deferred or conditional on meeting certain performance thresholds, which can lead to delayed recognition of revenues. If businesses do not factor in these delays when forecasting rebates, it can distort their income statements and create inaccuracies in financial reporting. Moreover, companies can misstate their current financial position, leading to challenges in managing investor expectations or meeting regulatory requirements. Accurate rebate forecasting helps mitigate these delays and ensures that revenue is recognized in the correct period, contributing to more reliable financial reporting.

Ensuring Compliance with Accounting Standards

Accurate rebate forecasting is also critical for ensuring compliance with accounting standards such as IFRS or GAAP. Rebates are complex financial transactions that involve timing, accruals, and conditional payments, all of which need to be properly accounted for in line with industry accounting standards. Failure to forecast rebates correctly will lead to violations of these standards, resulting in potential penalties, restatements of financial results, or a loss of credibility with stakeholders. By forecasting rebates with precision, businesses can ensure that they maintain compliance with all relevant accounting regulations and standards, as well as avoid costly mistakes and legal challenges.

Strategic Decision-Making

Rebate forecasting influences strategic decision-making by providing businesses with the financial clarity needed to make informed choices. Accurate forecasts help businesses determine the true cost of sales, including rebates, and adjust pricing strategies, sales targets, or promotional efforts accordingly. Forecasting rebates also helps companies assess the success of their rebate programs and helps them identify areas where they need to renegotiate terms or restructure agreements with customers or suppliers. These insights support leaders to make data-driven decisions that align with long-term business goals, rather than reacting to financial surprises that arise from inaccurate forecasting.

Long-Term Planning

Rebate forecasting aids in long-term planning by providing businesses with an understanding of how rebate structures will impact future cash flows and profitability. As rebate agreements often span multiple years, accurate forecasting helps businesses plan for the financial implications of these agreements over time. Long-term forecasting also allows companies to identify trends in rebate payouts so that they can adjust their business strategies accordingly. By understanding how rebates will evolve, businesses can anticipate their financial obligations, identify potential cost savings, and better prepare for future growth.

Investment Strategies and Risk Management

Rebate forecasting also plays an important role in investment strategies and risk management. Investors and stakeholders look at rebate forecasts to assess the financial stability and profitability of a business. Inaccurate rebate forecasting can create uncertainty around future cash flows, which leads to poor investment decisions or concerns about a company’s financial health. Additionally, rebate forecasting allows businesses to identify risks associated with rebate programs, such as unexpected changes in customer buying patterns or shifts in market conditions that could affect rebate eligibility. By accurately forecasting rebates, businesses can mitigate these risks, protect profitability, and make more informed investment decisions that align with their long-term objectives.

Common Challenges in Rebate Forecasting

Complexity of Rebate Agreements

Rebate agreements often contain intricate structures with multiple variables, such as tiered rebate levels, volume-based discounts, and performance targets. These complexities make it difficult to forecast rebates accurately, as each agreement may have different conditions, payment schedules, and triggers. Additionally, factors like retroactive rebates or adjustments further complicate the forecasting process. Businesses need to manage these complexities by tracking each agreement's specific terms and ensuring that they account for all relevant conditions when predicting future rebate payouts. Failure to manage these details can lead to inaccurate forecasts, which can distort financial planning and budgeting.

Varied Eligibility Conditions

Eligibility conditions for rebates vary significantly depending on customer behavior, sales volumes, purchase frequencies, or specific product requirements. These conditions introduce a layer of unpredictability, as it’s difficult to assess whether a customer will meet the required thresholds for receiving a rebate. Even minor fluctuations in purchasing patterns or changes in customer behavior can result in significant variations in the expected rebates. For instance, a customer may have fluctuating purchase volumes, which can lead to rebates that were not anticipated during the initial forecast. Properly accounting for these variable eligibility criteria is crucial to avoid overestimating or underestimating rebate liabilities.

Shifting Market Conditions, Customer Behaviors, and Product Dynamics

Market conditions, customer behaviors, and product dynamics are constantly changing, making rebate forecasting a moving target. Market disruptions, economic shifts, or sudden changes in consumer demand can alter purchasing patterns, which directly affect rebate eligibility and amounts. Similarly, customer behaviors are rarely static. Customers might switch purchasing preferences, or product demand could fluctuate due to seasonal trends, promotional offers, or competitor activity. These variables pose significant challenges to accurately forecasting rebates, as predicting future behavior in such a dynamic environment requires continual adjustment and flexibility in forecasting models. Without accounting for these external factors, forecasts may quickly become outdated, leading to inaccurate rebate predictions.

Managing and Analyzing Data

The management and analysis of data is a central challenge in rebate forecasting. Rebate forecasts depend on large volumes of transactional and historical data, which must be processed, analyzed, and integrated to produce accurate forecasts. Collecting this data from various departments (e.g., sales, finance, procurement) and ensuring its accuracy can be time-consuming and difficult. Furthermore, making sense of this data requires analytical tools and methods. Without proper data management and analysis systems in place, businesses risk missing key insights or failing to track important variables that influence rebate calculations. This not only impacts forecasting accuracy but can lead to missed opportunities for optimizing rebate agreements or identifying cost-saving measures.

Diverse Data Sources Requiring High Accuracy and Consistency

Rebate forecasting draws on data from a variety of sources, including sales records, transaction histories, customer behavior analytics, and market trends. These data sources must be integrated and analyzed consistently to ensure that the forecast is reliable. However, discrepancies between data sets or inconsistencies in data quality can lead to inaccurate forecasts. For example, if data from sales records is inconsistent with marketing or promotions data, it can create a misalignment in expected rebate payouts. The challenge lies in ensuring that all data sources are accurate, up-to-date, and aligned with each other to form a cohesive and realistic forecast.

The Risk of Human Error in Manual Processes (Spreadsheets, etc.)

One of the most significant challenges in rebate forecasting is the reliance on manual processes, such as using spreadsheets to track and calculate rebates. While spreadsheets are widely used for their flexibility, they are prone to human error, such as incorrect data entry, formula mistakes, or misinterpretation of complex rebate terms. The risk of these errors increases as the scale and complexity of rebate agreements grow. As businesses handle larger volumes of data and more sophisticated rebate structures, the likelihood of errors in spreadsheets also rises. These mistakes can have serious financial implications, leading to misreported liabilities, incorrect budget forecasts, or missed rebate opportunities. Additionally, manual processes are time-consuming and limit a company's ability to make real-time adjustments or updates, further affecting the accuracy of forecasts.

Best Practices for Rebate Forecasting

Regular Updates and Reviews of Rebate Forecasts

Rebate forecasting requires continuous monitoring and adjustment to reflect actual business performance and market conditions. Regular updates ensure that the forecast remains relevant and accurate over time. It is crucial to compare the forecasted data with actual sales and rebate payouts frequently to identify discrepancies or trends that require adjustments. Monthly or quarterly reviews allow for timely corrections and adjustments, preventing major forecasting errors from affecting financial planning and decision-making. These reviews also provide insights into customer behavior shifts, market conditions, and sales performance, which could influence rebate obligations. Establishing a schedule for updates and consistently revisiting forecasts allows businesses to stay aligned with evolving sales patterns and rebate agreements.

Cross-Department Collaboration and Input from All Relevant Teams

Effective rebate forecasting is not the responsibility of one department alone. It is essential to involve all relevant teams—such as sales, finance, and operations—in the forecasting process. Collaboration ensures that forecasts reflect a comprehensive understanding of sales goals, operational changes, customer trends, and financial objectives. For instance, the sales team can provide insights into customer purchasing patterns and future sales forecasts, while finance can offer guidance on cash flow implications and accounting standards. Operations can offer information on product availability and supply chain dynamics that may influence sales volumes and, consequently, rebate liabilities. Integrating inputs from all departments promotes more accurate and holistic forecasting, ultimately leading to better alignment across the organization and more reliable financial planning.

Implementing Automated Tools to Reduce Manual Errors and Streamline the Forecasting Process

Manual forecasting processes are prone to human error, particularly when spreadsheets or outdated systems are used. Implementing automated tools can greatly reduce these risks by streamlining the entire rebate forecasting process. These tools can automatically pull data from sales and financial systems, calculate expected rebates based on preset formulas, and adjust forecasts in real-time based on the most recent performance data. Automated forecasting tools enhance accuracy, reduce time spent on manual data entry, and ensure that the latest market trends and business performance are reflected in the forecast. Furthermore, automation can facilitate scalability, as businesses with large volumes of transactions or multiple rebate agreements benefit from systems that can handle complex calculations efficiently.

Continuous Training for Staff on Rebate Management and Forecasting Tools

Staff proficiency in rebate management and forecasting tools is crucial for the accuracy and reliability of forecasts. Continuous training ensures that employees remain updated on the latest forecasting methods, tools, and technologies available. Rebate management can be intricate, and understanding how to navigate complex rebate agreements, calculate different types of rebates, and apply forecasting techniques is essential for achieving accurate predictions. Regular training programs and workshops help staff stay informed about evolving industry practices, new software capabilities, and best practices in forecasting. Investing in the development of employees’ skills not only improves forecasting accuracy but also enhances their ability to collaborate effectively across departments and contribute to the overall success of rebate management processes.

Forecasting for Different Rebate Types

Volume-Based Rebate Forecasting

Volume-based rebates are calculated based on the quantity of products sold rather than the revenue generated. This type of rebate is common in industries where the value of sales is tied more closely to the volume of goods purchased rather than the sales price. Forecasting volume-based rebates requires tracking sales volumes and applying appropriate rebate percentages based on those volumes. The challenge with volume-based forecasting is that it relies heavily on accurately predicting customer purchasing behaviors and the quantity of goods expected to be sold. This forecast may also involve different rebate formulas, such as Single Volume Total Amount or Single Volume Per Unit, which adjust the rebate based on total sales volume or per-unit sales, respectively.

- Single Volume Total Amount: This formula calculates a fixed rebate based on a specified total volume threshold. For example, if a customer purchases 100,000 units in a quarter, a set rebate amount is given, irrespective of the price per unit.

- Single Volume Per Unit: This formula calculates the rebate per unit sold. For example, if a customer buys 10,000 units and the per-unit rebate is $2, the total rebate would be $20,000.

Forecasting volume-based rebates involves using historical data to predict the total volume of units expected to be sold in future periods, adjusting these predictions based on sales trends and customer purchasing behaviors.

Revenue-Based Rebate Forecasting

Revenue-based rebates are calculated based on the total sales revenue generated rather than the quantity of items sold. These types of rebates are typically used when the value of sales is a more important factor than the quantity. Forecasting revenue-based rebates requires predicting the total sales revenue expected during a given period, then applying the rebate percentage based on that total. This forecasting method takes into account factors like sales price, product mix, and market conditions, which can impact overall sales revenue.

When calculating revenue-based rebates, businesses often use formulas that depend on Last Year Revenue, adjusted by sales goal increases or other factors. For instance, using the Seasonal Naive Method, businesses might forecast this year’s revenue-based rebate by adjusting last year’s revenue for a specific month using the sales goal increase percentage.

Revenue-based rebate forecasting is crucial for businesses where revenue fluctuations are significant, and accurately predicting rebates based on revenue is essential for financial planning. This approach is sensitive to price changes, market demand, and customer purchasing behavior.

Key Methods and Approaches for Rebate Forecasting

Seasonal Naive Method

The Seasonal Naive Method is a forecasting technique that adjusts the accrual forecast for the current year based on last year’s revenue, taking into account any projected sales goals. The formula for this method involves multiplying last year’s revenue for a specific month by the sales goal increase percentage. This method is particularly useful when there are seasonal trends in customer behavior and purchasing patterns. By adjusting for these trends, businesses can predict future rebates more accurately, assuming that the patterns observed in the previous year will continue. For example, if last year’s revenue for a specific month was $10,000 and the sales goal increase is 5%, this year’s accrual forecast for that month would be $10,500. This method is most effective in scenarios where there is a clear seasonal impact on purchasing volumes.

Average Method

The Average Method is used when the rebate accrual needs to be forecasted in a more uniform or flat manner across the year. In this method, businesses calculate the average revenue for the entire previous year and then adjust it by the sales goal increase percentage to predict future rebate amounts. The formula considers the total revenue from the previous year, divided by the number of months in that year, and then adjusted by the sales goal increase. This method is often used when there are no significant seasonal fluctuations or when the business wants to smooth out its accruals across the year. For instance, if total revenue for the last year was $120,000, the average monthly revenue would be $10,000. Applying a 5% increase would give a forecasted accrual of $10,500 per month for the current year.

Forecasting Intervals

-

Monthly, Quarterly, Semi-Annually, Annually

Forecasting rebates requires adjustments based on the interval or payment period outlined in the rebate agreements. These intervals can range from monthly to annually, and they directly influence how forecasts are calculated and distributed. Each interval type—monthly, quarterly, semi-annually, or annually—has its own method of predicting and adjusting accruals to match the timeframes for which payments are scheduled.

- Monthly Forecasting: For monthly forecasting, businesses need to calculate the rebate accruals for each month, adjusting based on the historical data for that month, along with expected sales increases.

- Quarterly Forecasting: In quarterly forecasting, the rebate amounts are generally calculated on a three-month basis, often with a focus on the quarterly trends rather than individual months. The total for the quarter is split evenly or according to expected patterns over the three months.

- Semi-Annual Forecasting: For semi-annual periods, the rebate is spread over six months, which can provide a broader view of financial planning and more flexibility to adjust for trends.

- Annual Forecasting: In annual forecasting, the full year's rebate is calculated based on total yearly revenue, which is divided evenly across the months or adjusted based on expected seasonal fluctuations.

Adjusting forecasts based on the payment period for each line item is crucial to ensuring accurate and timely rebate projections. For example, a line item with an annual payment cycle requires a different approach than one with monthly or quarterly payments, as the timing of accruals and adjustments will differ.

-

Adjusting Forecasts Based on Payment Period

The payment period of each line item in a rebate agreement determines how the forecast should be structured. For monthly intervals, businesses forecast for each month, while for quarterly, semi-annual, or annual intervals, adjustments are made according to the total rebate amount divided by the number of months in the period. For instance, if an annual rebate agreement is worth $12,000, the monthly forecast would be $1,000. However, if the agreement is quarterly, then the forecast for each of the three months in the quarter would be $4,000, assuming equal distribution.

Conclusion

Accurate rebate forecasting is essential for businesses to optimize their rebate programs, improve cash flow, and make informed business decisions. Businesses can maximize the value of their rebate programs and achieve their financial goals by implementing robust forecasting methods and leveraging available data.