The Complete Guide to Rebate Agreements

Rebate agreements are essential tools in business relationships, providing incentives for buyers while ensuring suppliers maintain strong sales volumes. These agreements outline the conditions under which buyers receive financial benefits based on their purchasing activity, promoting long-term partnerships and mutual profitability.

A well-structured rebate agreement includes clear eligibility criteria, precise calculation methods, and defined payment terms, reducing the risk of disputes and ensuring compliance.

Understanding every aspect of a rebate agreement—from structuring the rebate tiers to managing reporting requirements and legal considerations—is crucial for both parties. This guide covers all essential elements, offering a complete resource for businesses looking to implement or refine their rebate agreements effectively.

Table of Contents:

- Key Components of a Rebate Agreement

- Eligibility and Conditions for Rebates

- Payment Terms for Rebates

- Reporting and Documentation Requirements

- Confidentiality and Data Protection

- Termination and Modification of the Agreement

- Legal Considerations and Compliance

- Common Challenges and How to Avoid Them

Jump to a section that interests you, or keep reading.

Key Components of a Rebate Agreement

A rebate agreement is a structured contract that outlines the terms under which a buyer qualifies for rebates based on purchase volumes. To ensure clarity and enforceability, the agreement must include the following components:

1. Parties Involved

The agreement must clearly define the supplier and buyer, including their legal names, identification numbers, and contact details. The supplier can be a manufacturer, wholesaler, or distributor, while the buyer is typically a retailer or business entity. Ensuring proper identification helps establish accountability and prevents disputes.

2. Agreement Duration

A rebate agreement must specify the exact start and end date. The duration determines the period during which purchases contribute to rebate eligibility. Some agreements include provisions for renewal, while others require renegotiation at the end of the term.

3. Volume Rebate Structure

The structure defines the rebate percentages based on purchase amounts. Suppliers typically set multiple tiers, where higher spending leads to greater rebate percentages. For example, a supplier might offer:

- 5% rebate on purchases exceeding $10,000

- 10% rebate on purchases above $20,000

Clearly defining these thresholds ensures transparency in rebate calculations.

4. Eligibility and Conditions

To qualify for rebates, buyers must adhere to specific conditions. These may include maintaining a minimum purchase volume, placing orders within the agreed timeframe, and ensuring timely payments. If these conditions are not met, the buyer may forfeit their rebate entitlement.

5. Rebate Calculation Method

Rebates can be calculated on a quarterly, monthly, or annual basis. The agreement should specify how the total purchase volume is assessed and how rebates are determined. A common method involves summing all eligible purchases over the defined period and applying the rebate percentage accordingly.

6. Payment Terms

The agreement must outline when and how rebates are issued. Typically, rebates are credited to the buyer’s account or issued as direct payments within a set timeframe, such as 30 days after the end of each quarter. Clear payment terms prevent misunderstandings regarding when the buyer will receive their rebate.

7. Reporting and Documentation Requirements

Both parties must maintain accurate records to verify rebate eligibility. Buyers may be required to submit periodic purchase reports, while suppliers must track sales data. The agreement should detail the format, frequency, and method of reporting to ensure smooth rebate processing.

8. Confidentiality and Data Protection

Since rebate agreements involve sensitive business data, both parties must commit to confidentiality. The agreement should include clauses preventing the disclosure of purchase records, rebate structures, and financial details to third parties. Proper data security measures should also be implemented.

9. Termination and Modification

The contract must specify conditions under which either party can terminate the agreement. A common requirement is a 60-day written notice before termination. The agreement should also allow modifications, provided both parties consent in writing. This ensures flexibility in adjusting rebate terms if necessary.

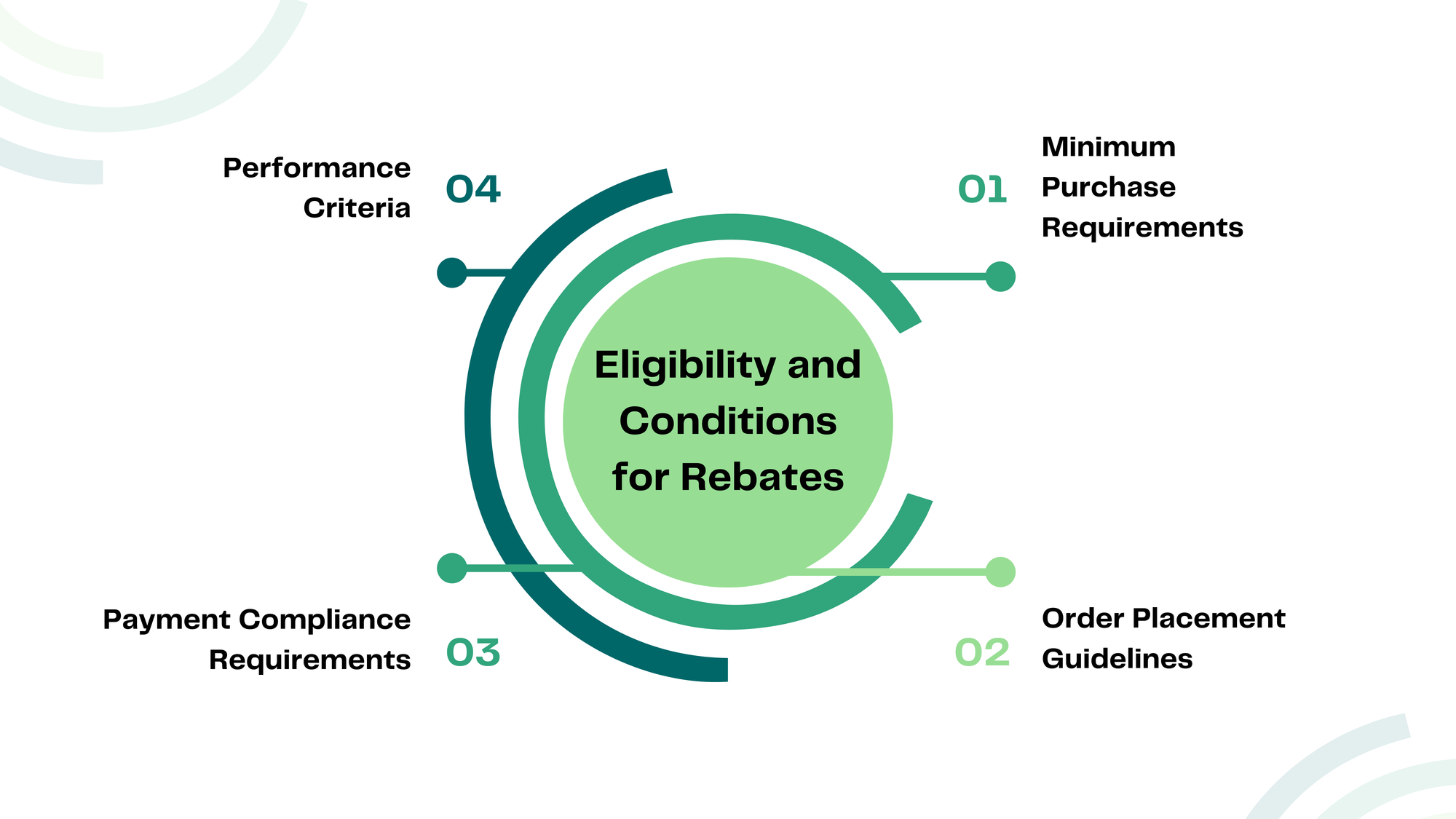

Eligibility and Conditions for Rebates

A rebate agreement establishes specific conditions that a buyer must meet to qualify for volume rebates. These conditions ensure that the buyer maintains a consistent purchasing relationship with the supplier while adhering to the agreed-upon terms. Failure to meet these conditions can result in disqualification from the rebate program. The key eligibility criteria include minimum purchase thresholds, order placement requirements, payment compliance, and performance standards.

Minimum Purchase Requirements

To qualify for rebates, the buyer must achieve a specified purchase volume within the agreement’s timeframe. The supplier sets these thresholds to incentivize higher spending.

For example:

- A buyer purchasing between $10,000 and $19,999 may receive a 5% rebate.

- A buyer spending $20,000 or more may receive a 10% rebate.

These tiers encourage larger purchases while ensuring that only buyers meeting the minimum spending level are eligible.

Order Placement Guidelines

The agreement may specify how orders must be placed for them to be counted toward rebate eligibility. Buyers must follow the supplier’s ordering procedures, including submitting orders within defined timeframes and ensuring they meet product or quantity requirements. If the buyer fails to place orders in the specified manner, the supplier may exclude those purchases from rebate calculations.

Payment Compliance Requirements

Timely payment is a fundamental condition for rebate eligibility. Buyers must adhere to the supplier’s payment terms, ensuring that invoices are settled on time. Late payments can disqualify a buyer from receiving rebates, even if they meet purchase volume requirements. The agreement may specify a grace period for payments, but consistent non-compliance can lead to rebate forfeiture.

Performance Criteria

Beyond purchase volume and payment compliance, some agreements include additional performance requirements. These may involve maintaining a steady purchase pattern, meeting specific sales targets for the supplier’s products, or providing sales reports to verify the resale of purchased goods. The supplier may also require the buyer to submit periodic reports detailing purchase data to validate rebate calculations.

Payment Terms for Rebates

The payment terms in a rebate agreement define when and how the buyer receives rebate payments after meeting the eligibility criteria. These terms outline the timing of payments, the mode of disbursement, and any deductions or adjustments that may apply. Clear payment terms ensure transparency between both parties and prevent disputes regarding rebate calculations or disbursements.

Timing of Payments

Rebates are typically processed on a scheduled basis, ensuring the buyer receives payments after the supplier verifies purchase volumes. The agreement may specify one of the following timeframes:

- Quarterly Payments: Rebates are calculated at the end of each quarter, with payments issued within 30 days after the quarter concludes.

- Annual Settlements: In some agreements, rebates are reviewed annually, with payments disbursed after validating the total purchases over the contract period.

- Specified Timeframe Post-Purchase: Some suppliers define a fixed period (e.g., within 30 days of validation) for processing and issuing rebate payments.

Mode of Payment

The agreement establishes how rebates will be disbursed. The most common payment methods include:

- Credit to Buyer’s Account: The rebate amount is applied as a credit, reducing the buyer’s future payable balance with the supplier.

- Direct Payment: The supplier transfers the rebate amount via bank transfer or check, providing the buyer with immediate financial benefits.

Deductions or Adjustments

Rebate payments may be subject to deductions or modifications based on specific factors outlined in the agreement. These include:

- Unmet Purchase Volume: If a buyer falls short of a required threshold, the rebate percentage may be adjusted accordingly.

- Payment Delays: Late payments on invoices may result in reduced or forfeited rebates.

- Returns and Cancellations: Any returned goods or canceled orders that were initially counted toward rebate eligibility may lead to recalculated payments.

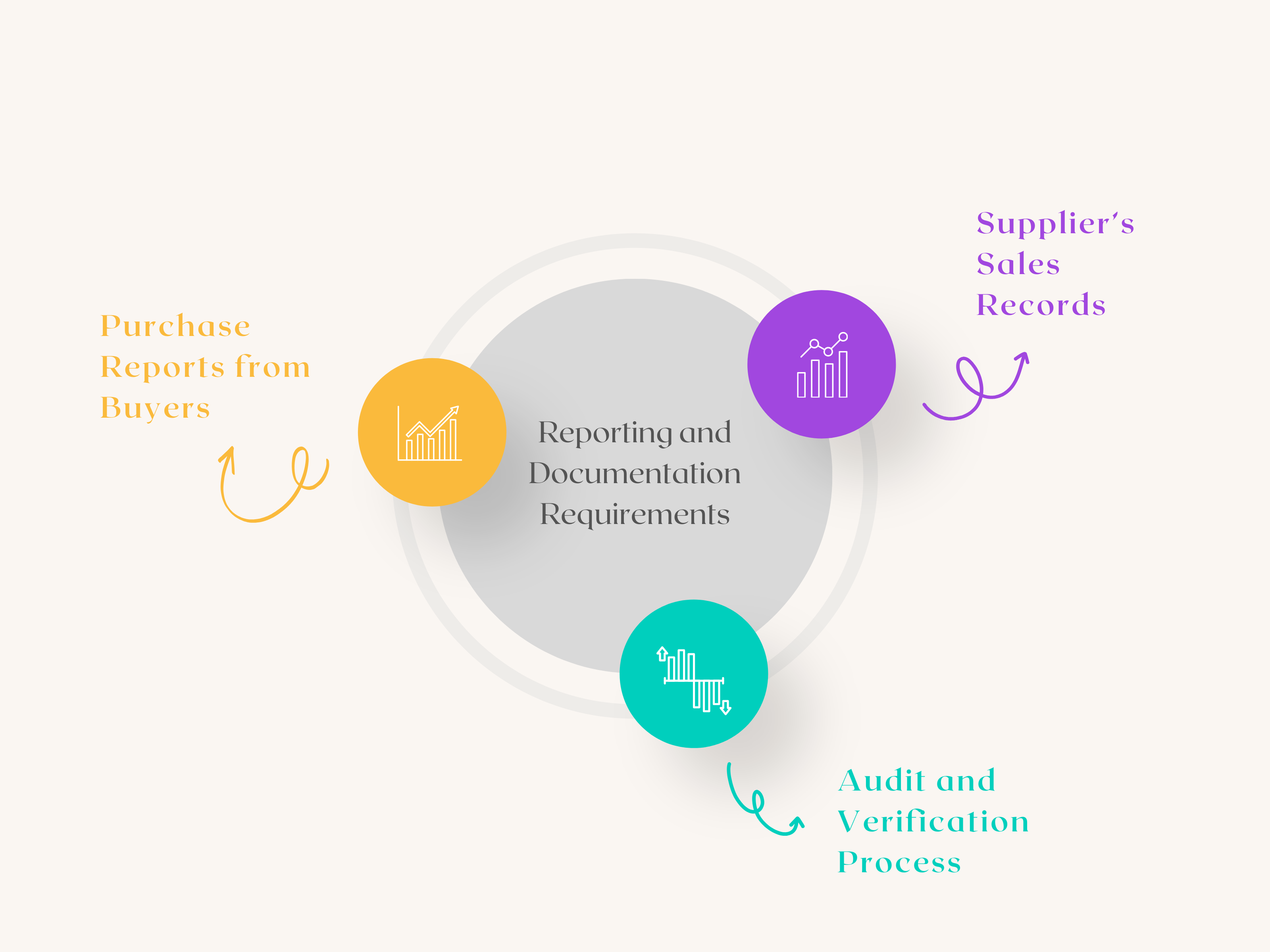

Reporting and Documentation Requirements

Accurate reporting and documentation are essential in a rebate agreement to ensure proper calculation, validation, and payment of rebates. Both the buyer and the supplier must maintain and exchange detailed records to confirm rebate eligibility. This section outlines the reporting obligations for buyers, the supplier’s responsibility in tracking sales, and the procedures for audits and verification.

Purchase Reports from Buyers

Buyers are required to submit regular purchase reports, which serve as the basis for determining rebate eligibility. These reports must contain:

- Detailed Transaction Records: A breakdown of all purchases made during the rebate period, including product descriptions, quantities, and invoice amounts.

- Frequency of Submission: Reports may be required on a quarterly or annual basis, depending on the agreement. Timely submission ensures that rebates are processed without delays.

- Supporting Documents: Buyers may need to provide invoices or proof of payments to validate the reported purchase volumes.

Supplier’s Sales Records

The supplier must maintain comprehensive records of all sales transactions to cross-check the buyer’s reported data. These records typically include:

- Internal Sales Data: A database of invoices issued to the buyer, capturing total purchase values and rebate-eligible transactions.

- Rebate Calculation Logs: A record of how rebates were computed based on predefined volume thresholds and percentages.

- Adjustments for Returns or Cancellations: Any modifications to purchase volumes due to product returns or canceled orders must be reflected in the supplier’s records.

Audit and Verification Process

To ensure compliance, an audit and verification process is often included in the agreement. This process helps confirm that rebate calculations are accurate and that both parties adhere to the agreement’s terms. Key elements include:

- Data Reconciliation: The supplier cross-checks the buyer’s purchase reports against internal sales records to verify eligibility.

- Compliance Reviews: The supplier may review payment history, ensuring that only buyers who meet the minimum purchase and order placement conditions qualify for rebates.

- Right to Audit Clause: Some agreements allow for a formal audit by an independent party or internal finance teams to prevent discrepancies and maintain transparency.

Confidentiality and Data Protection

Maintaining confidentiality and securing data are essential aspects of a rebate agreement, as both parties handle sensitive financial and transactional information. To prevent unauthorized access, misuse, or disclosure, specific measures must be in place. These include safeguarding sales data, implementing legally binding agreements, and adopting security protocols to protect confidential information.

Ensuring Confidentiality of Sales Data

Both the supplier and buyer must ensure that all sales data, purchase records, and rebate calculations remain confidential. This includes:

- Restricted Access: Only authorized personnel should handle rebate-related documents to prevent unauthorized viewing or tampering.

- Limited Disclosure: Data should only be shared with relevant departments responsible for processing rebates, financial reconciliation, or audits.

- Data Sharing Protocols: If information needs to be exchanged, it should be done through secure communication channels with clear guidelines on handling and storing records.

Non-Disclosure Agreements (NDA)

To formalize confidentiality obligations, an NDA is often incorporated into the rebate agreement. This legally binding document ensures that:

- Both parties agree not to disclose rebate structures, purchase volumes, or financial details to external parties.

- Restrictions remain in place even after the agreement ends, preventing either party from using confidential information for competitive advantage.

- Legal recourse is available in case of a breach, ensuring that violations can lead to penalties or other corrective actions.

Security Measures for Sensitive Information

To further protect sensitive rebate-related data, suppliers and buyers should implement robust security measures, such as:

- Data Encryption: All digital records, including purchase reports and rebate calculations, should be encrypted to prevent unauthorized access.

- Secure Storage: Physical documents should be stored in locked cabinets, while electronic files must be protected with password authentication and access control systems.

- Regular Security Audits: Periodic reviews of data protection protocols should be conducted to ensure compliance with confidentiality agreements.

Termination and Modification of the Agreement

A rebate agreement must clearly define the conditions for termination and modification to ensure both parties understand their rights and obligations. This includes specifying the notice period required for termination, the circumstances that may lead to ending the agreement, and the procedures for modifying or renegotiating terms.

Notice Period for Termination

Either party may terminate the agreement by providing prior written notice. The notice period varies based on mutual agreement and is typically 30 or 60 days before the contract expiration. This ensures a smooth transition and allows sufficient time for outstanding rebates to be settled.

Conditions Under Which the Agreement Can Be Terminated

Termination may occur under the following circumstances:

- Breach of Agreement: If either party fails to meet rebate eligibility conditions, does not comply with purchase volume commitments, or violates payment terms, the agreement may be terminated.

- Failure to Provide Reports: If the buyer does not submit required purchase reports or the supplier fails to maintain sales records, termination may be initiated due to lack of transparency.

- Financial Insolvency: If either party faces financial difficulties that prevent them from fulfilling their contractual obligations, the agreement may be canceled.

- Mutual Agreement: Both parties may choose to end the contract early if they determine that continuing is no longer beneficial.

Modification and Renegotiation Clauses

To accommodate changes in market conditions, purchasing behavior, or financial considerations, the agreement may include a modification and renegotiation clause. This allows for:

- Adjustments to Rebate Structures: If purchase volumes increase or decrease significantly, parties may renegotiate rebate percentages.

- Revisions to Payment Terms: Modifications can be made to the timing or method of rebate payments based on financial feasibility.

- Updated Reporting Requirements: If tracking and verification methods change, the reporting process may be adjusted accordingly.

Legal Considerations and Compliance

A rebate agreement must adhere to legal and regulatory standards to ensure compliance with industry requirements, taxation policies, and dispute resolution mechanisms. Both suppliers and buyers must understand the legal implications to avoid contractual breaches or financial penalties.

Industry-Specific Regulations (Retail, Wholesale, Manufacturing)

Rebate agreements vary across industries due to different regulatory frameworks:

- Retail: Agreements must align with consumer protection laws, ensuring that rebates are applied fairly and transparently. Misrepresentation of rebate terms can lead to legal disputes.

- Wholesale: Bulk purchase rebates must comply with trade laws governing fair competition and supplier-buyer relationships to prevent monopolistic practices.

- Manufacturing: Agreements must adhere to supply chain regulations, ensuring rebates do not violate contractual obligations with distributors or third-party partners.

Tax Implications of Rebates

Tax treatment of rebates depends on local regulations and the financial impact on both parties:

- Supplier’s Tax Considerations: Rebates may be classified as sales discounts or deductions, affecting taxable revenue. Proper documentation is required to ensure compliance with tax authorities.

- Buyer’s Tax Considerations: Rebates may reduce the cost of goods sold (COGS) or be treated as taxable income. Businesses must accurately record rebates to reflect the correct financial position.

- VAT/GST Implications: In some regions, rebates may be subject to Value-Added Tax (VAT) or Goods and Services Tax (GST), requiring proper invoicing and reporting.

Dispute Resolution Methods

To address disagreements, rebate agreements should outline dispute resolution methods:

- Negotiation: Both parties attempt to resolve issues through direct discussion before escalating the matter.

- Mediation: A neutral third party facilitates discussions to reach a mutually acceptable solution.

- Arbitration: If mediation fails, disputes may be settled through binding arbitration, where an arbitrator makes a final decision.

- Legal Action: As a last resort, disputes may be taken to court, following jurisdictional laws outlined in the agreement.

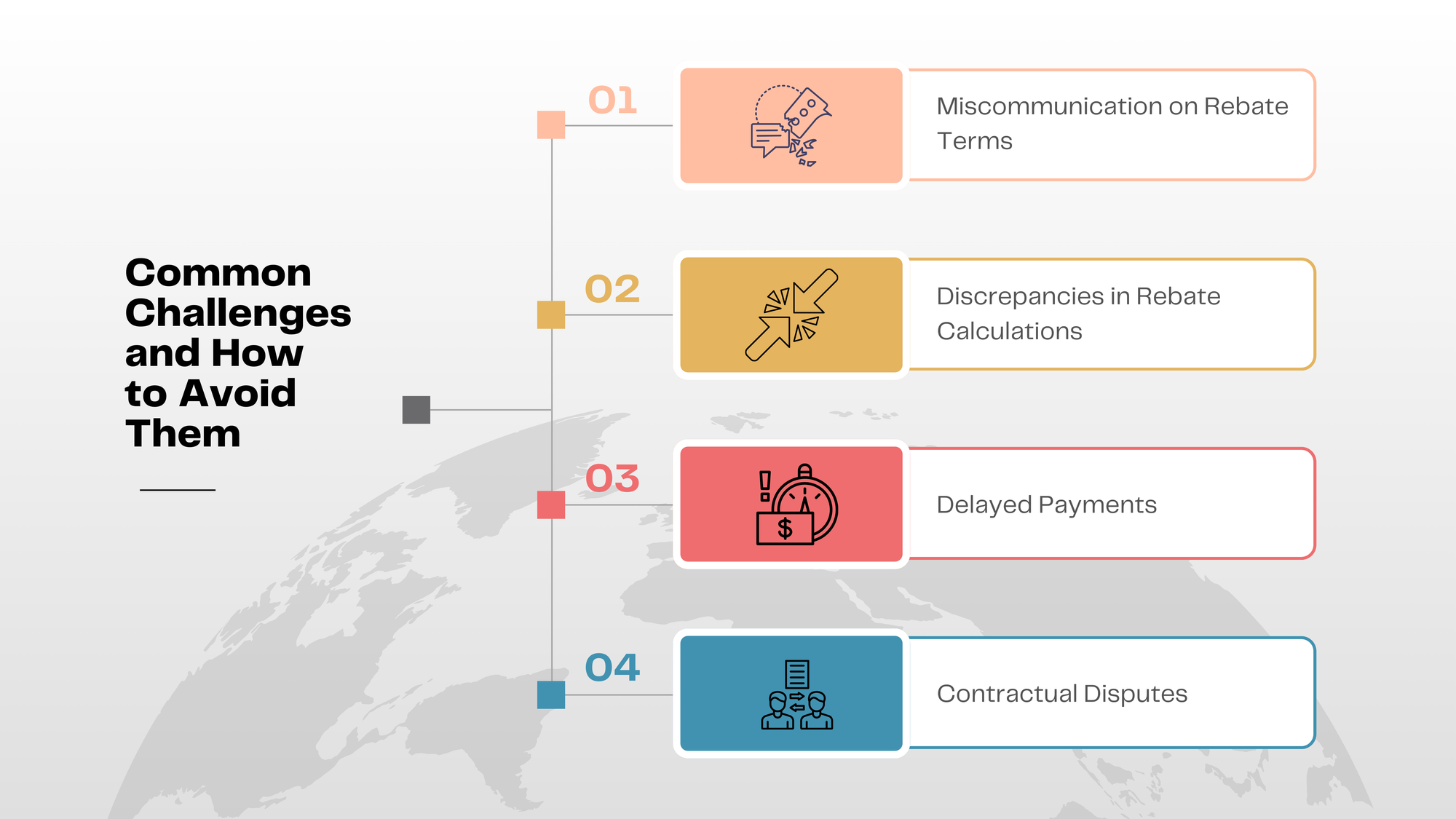

Common Challenges and How to Avoid Them

Rebate agreements are structured to benefit both suppliers and buyers, but several challenges can arise if terms are unclear, calculations are incorrect, or payments are delayed. Addressing these issues in advance ensures a smooth rebate process and minimizes conflicts.

Miscommunication on Rebate Terms

Unclear or ambiguous rebate structures can lead to misunderstandings between parties, resulting in disputes or unfulfilled expectations. To avoid this:

- Clearly define rebate tiers, eligibility criteria, and calculation methods within the agreement.

- Ensure both parties acknowledge the terms by signing the agreement.

- Maintain written records of all communications regarding rebate terms to prevent discrepancies.

Discrepancies in Rebate Calculations

Errors in rebate calculations may arise due to inconsistent purchase tracking, incorrect formula application, or unverified sales data. To prevent this:

- Require both parties to maintain accurate purchase and sales records.

- Implement an audit and verification process to validate purchase volumes before issuing rebates.

- Use automated rebate management systems to reduce manual errors in calculations.

Delayed Payments

Suppliers may fail to issue rebates within the agreed timeframe due to administrative delays, financial constraints, or disputes over eligibility. To mitigate this:

- Specify a clear payment schedule in the agreement, such as within 30 days after the end of each quarter.

- Define the mode of payment (credit to the buyer’s account or direct payment) and ensure compliance.

- Establish a tracking mechanism to monitor rebate processing and flag any delays for immediate resolution.

Contractual Disputes

Disagreements over rebate eligibility, termination clauses, or modifications to the agreement can lead to legal conflicts. To avoid disputes:

- Include a structured dispute resolution clause covering negotiation, mediation, arbitration, and legal action if necessary.

- Allow for modification and renegotiation clauses, ensuring flexibility in adjusting rebate structures when needed.

- Clearly outline termination conditions, including the required notice period and acceptable reasons for ending the agreement.

Conclusion

A well-drafted rebate agreement fosters transparency, strengthens business relationships, and ensures financial incentives are distributed fairly. Clear communication, accurate record-keeping, and adherence to agreed terms help prevent disputes and delays. By incorporating structured payment schedules, defined eligibility criteria, and robust compliance measures, both suppliers and buyers can maximize the benefits of their rebate program. Addressing potential challenges proactively and including provisions for termination, modification, and dispute resolution will further safeguard the interests of both parties. Whether creating a new agreement or optimizing an existing one, a comprehensive and well-managed rebate structure is key to maintaining a stable and rewarding business arrangement.