Common Rebate Accounting Mistakes and How to Fix Them

The consequences of errors in rebate accounting extend beyond financial misstatements. It creates operational inefficiencies, missed opportunities, and potential regulatory penalties. For instance, a lack of transparency or oversight in rebate processes has led some businesses to costly disputes, misaligned financial forecasts, and lost revenue from unclaimed rebates.

This guide aims to help businesses identify the most common rebate accounting mistakes, understand their root causes and implications, and implement strategies to avoid them.

Table of Contents:

- Common Rebate Accounting Mistakes

- Consequences of Rebate Accounting Mistakes

- Strategies to Avoid Rebate Accounting Mistakes

- The Role of Rebate Management Systems

Jump to a section that interests you, or keep reading.

Common Rebate Accounting Mistakes

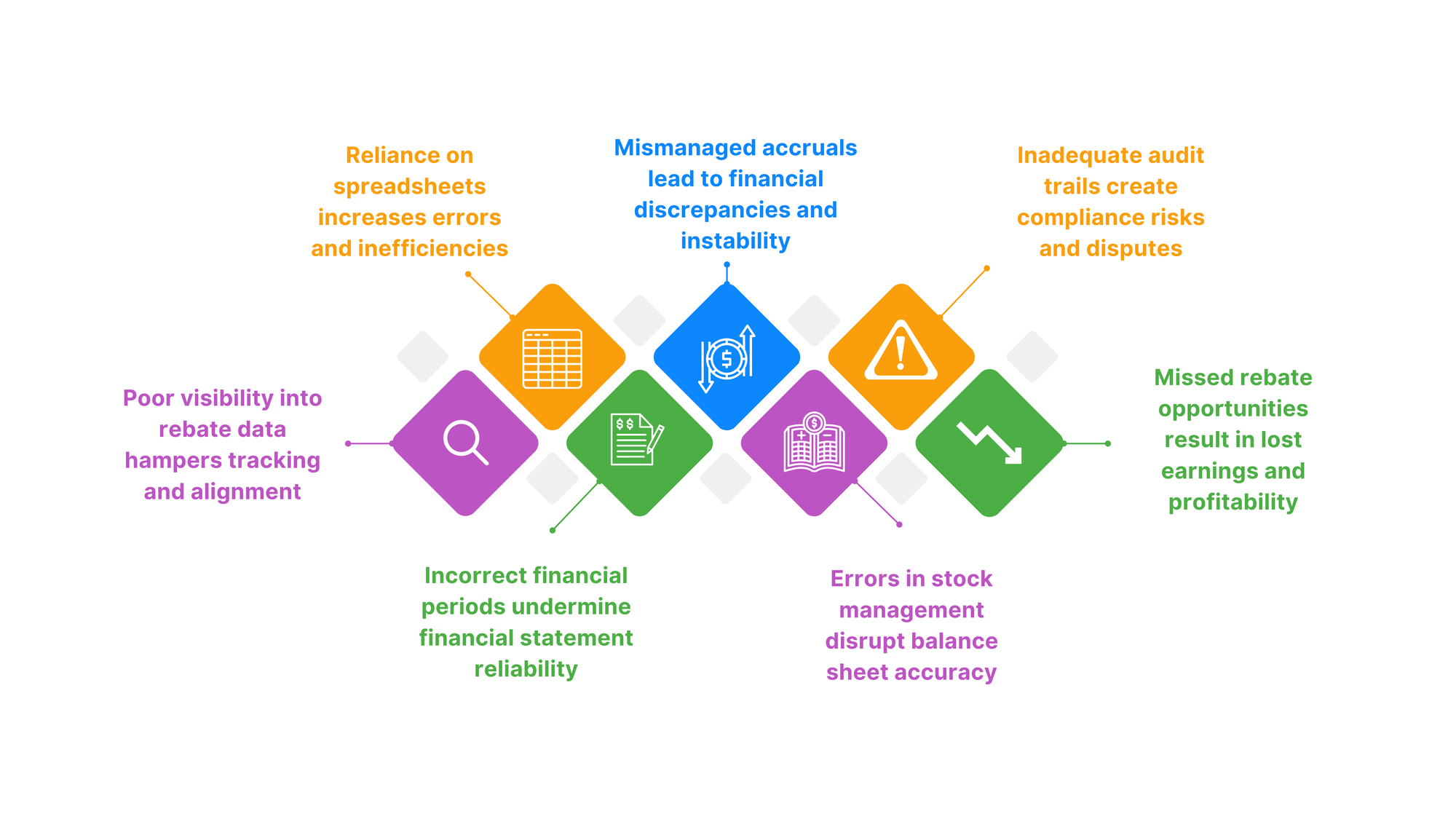

Poor visibility into rebate data hampers tracking and alignment

Poor visibility into rebate agreements often arises from disjointed processes and the lack of centralized data systems. Key departments such as finance, buying, and sales frequently operate in silos, which results in misaligned understanding of rebate terms. Contracts are stored in filing cabinets or fragmented across spreadsheets. This makes it difficult to access essential details or input new financial data accurately.

This lack of clarity hampers the ability to track rebate performance, assess net pricing, or evaluate progress against deal criteria. Without transparency, businesses are prone to rebate discrepancies, missed opportunities, and disputes over claims. Real-time access to rebate data is important to prevent such issues, allowing all parties to monitor performance, ensure mutual alignment, and capitalize fully on agreed trading deals.

Reliance on spreadsheets increases errors and inefficiencies

Relying on spreadsheets for rebate accounting introduces significant limitations in accuracy and efficiency. Manual data entry is inherently prone to human error, such as misplacing decimal points or omitting critical details, which can lead to incorrect calculations and distorted financial outcomes. The time required to compile and update complex rebate data across numerous products, suppliers, and customers further strains resources, delaying critical reporting and decision-making.

Spreadsheets also lack the capability to handle real-time updates or accommodate the intricacies of tiered and multi-period rebate agreements. Changes to rebate terms mid-agreement require labor-intensive updates, which increases the risk of errors. Such hand-crafted solutions are not scalable for businesses managing large volumes of rebate deals, leaving them vulnerable to missed targets and lost income.

Mismanaged accruals lead to financial discrepancies and instability

Rebate accruals, which represent income earned but not yet received, can become disconnected from actual payments due to inaccurate forecasting or inconsistent tracking. These discrepancies are particularly prevalent in tiered deals, where future rebate earnings depend on achieving progressive thresholds. Estimating accruals for such agreements requires precise reporting and forecasting, but manual processes fall short, leading to overstated or understated earnings.

When accrual estimates deviate significantly from actual rebate receipts, realignments become necessary. This process can create abrupt spikes or drops in income statements and erode trust in financial figures, complicating year-to-date profit analysis. Misaligned accruals also pose risks of misstated profits, which affect compliance and financial planning. A system for accurate accrual tracking is important to avoid these pitfalls and ensure financial stability.

Inadequate audit trails create compliance risks and disputes

Manual audit processes result in gaps in record-keeping and increase the likelihood of errors and omissions. Without a robust audit trail, discrepancies between supply and purchase records are common, which creates challenges in reconciling rebate claims and payments. The absence of clear and accurate records undermines transparency and hinders both internal and external audits. This lack of clarity not only jeopardizes compliance but also escalates disputes over the terms and calculations of rebate agreements. A reliable audit trail is important for verifying rebate performance, supporting claims, and providing a strong foundation for reviewing and renegotiating trade agreements.

Missed rebate opportunities result in lost earnings and profitability

Outdated or inaccurate data impacts rebate collection and leads to unclaimed earnings and reduced profitability. Manual systems fail to track contract renewals, which results in missed deadlines and expired opportunities. Also, unmet deal criteria, such as volume thresholds in tiered rebates, arise from inadequate tracking, which prevents businesses from maximizing potential benefits. For instance, failing to recognize proximity to a higher rebate tier can leave substantial value on the table. These inefficiencies diminish cash flow and limit the full realization of rebates, especially in complex, long-term trading agreements.

Errors in stock management disrupt balance sheet accuracy

Managing rebate amounts in stock introduces layers of complexity, particularly when large volumes of rebates are processed alongside frequent product movements in the supply chain. Rebate values must be accurately accrued in the balance sheet but can only be released to the profit and loss (P&L) statement once the associated stock is sold. Incorrect reconciliation between balance sheets and sub-ledgers can obscure financial accuracy and lead to unresolved errors that carry over into year-end reports. In severe cases, uncollected rebate debtors resulting from these errors can adversely impact the next financial period, straining both compliance and profitability.

Incorrect financial periods undermine financial statement reliability

Accurate rebate accounting requires matching expenses and revenues within the same financial period to present a true picture of business performance. Errors in closed financial periods disrupt this alignment, which cascades inaccuracies into subsequent periods. For example, when rebates are incorrectly recorded in a prior closed period, the adjustments necessary to fix these errors distort the following period’s results. Such discrepancies undermine the reliability of financial statements, complicate tax calculations, and affect overall financial planning. Properly managing entries in the correct period is important to maintain consistency and ensure compliance with accounting standards.

Consequences of Rebate Accounting Mistakes

Financial Impact

Rebate accounting mistakes directly affect the accuracy of financial statements, leading to overstated or understated profits. Mismanaged rebate accruals and errors in reconciliation distort revenue recognition and impact profitability calculations and cash flow forecasts.

Additionally, inefficiencies in manual processes, such as reliance on spreadsheets or outdated systems, increase operational costs and drain valuable resources. When rebates are not collected in full due to inaccuracies, the business suffers further financial losses, which undermines its ability to meet planned targets and objectives.

Operational Impact

Inefficient rebate management delays critical processes and hampers timely decision-making across departments. For instance, when rebate agreements lack visibility or are mismanaged, the buying, finance, and sales teams struggle to align their efforts, which creates bottlenecks. A significant reliance on a small group of individuals with specialized knowledge of rebate systems introduces vulnerability, as their absence or errors disrupt operations. This dependency limits scalability and leaves the business exposed to potential operational downtime.

Compliance Risks

Poor rebate accounting practices increase the risk of non-compliance, which makes audits more challenging. Missing or inaccurate records complicate the validation of rebate agreements and create discrepancies that may lead to disputes with suppliers or regulators. Such failures expose businesses to potential fines and penalties, as seen in high-profile cases like Tesco’s £129 million fine due to rebate mismanagement. Compliance risks also undermine trust and credibility, both internally and externally, and damage the business’s reputation in the marketplace.

Strategies to Avoid Rebate Accounting Mistakes

The following strategies will help organizations handle the challenges of rebate management with confidence and accuracy.

Implement Clear Processes

A structured and transparent approach to rebate accounting begins with the systematic recording of all rebate agreements. By ensuring every contract detail is documented and accessible to relevant departments, such as finance, sales, and purchasing, businesses can minimize ambiguity. Using electronic sign-offs for rebate agreements helps reduce misunderstandings and ensures that all stakeholders are aligned on the terms. Also, real-time tracking of performance against rebate deals provides a continuous overview of progress. This helps companies to identify discrepancies or missed targets promptly and take corrective action before they escalate.

Invest in Technology

Adopting dedicated rebate management systems offers a comprehensive solution to the challenges of manual rebate accounting. These systems simplify processes and reduce errors by automating critical tasks such as accrual tracking and reporting. Automated accrual tracking ensures that earned rebates are accurately accounted for in real time and reflect changes in tiered or mid-period agreements without manual intervention. Real-time reporting and alerts keep teams informed about rebate performance, contract deadlines, and unclaimed opportunities for facilitating timely decisions. Integration with purchasing and financial systems ensures smooth data flow to improve accuracy in calculations and reporting while reducing the administrative burden on teams.

Strengthen Internal Controls

Robust internal controls are essential to ensure accuracy and prevent rebate accounting errors. Regular reconciliation of balance sheets to sub-ledgers is important for identifying and resolving discrepancies promptly and maintaining financial integrity. Comprehensive audit trails provide a clear and detailed record of rebate transactions for easy verification during internal and external audits. Transparency across departments, such as finance, purchasing, and sales, ensures alignment in rebate management and reduces the likelihood of miscommunication or misalignment that could lead to errors.

Regular Review and Forecasting

Periodic assessment of rebate agreements helps businesses stay ahead of potential risks and ensures that contracts remain relevant and achievable. Using forecasting tools helps in accurately estimating earnings from tiered incentives and reduces the likelihood of mismanaged accruals or missed thresholds. Regular evaluations of rebate performance help businesses monitor compliance with financial goals, adapt to market changes, and optimize rebate agreements for better profitability.

Collaborate Across Teams

Rebate management requires alignment and collaboration among finance, purchasing, and sales teams. By encouraging interdepartmental communication, businesses can ensure that all teams understand their roles and the broader impact of rebate agreements. Educating stakeholders on the importance of accurate rebate accounting further minimizes errors, as teams are better equipped to handle complex agreements. Clear communication about deal terms and progress helps avoid misunderstandings so that all departments work towards shared objectives.

The Role of Rebate Management Systems

Switching from manual processes to automated rebate management systems addresses the limitations of traditional methods by improving accuracy and efficiency. Automated systems eliminate the risk of human error inherent in manual data entry to ensure that calculations and reports are precise. They also reduce dependency on individual employees with specialized knowledge and make rebate management more resilient to personnel changes. By providing real-time access to accurate data, these systems help with better decision-making. This way, businesses can identify opportunities, address risks, and track performance against rebate agreements effectively.

A well-designed rebate management system includes tools to improve collaboration and transparency. Collaborative online platforms enable both internal teams and external stakeholders, such as suppliers, to access a shared version of agreements for mutual alignment. Automated alerts notify users of upcoming opportunities, potential risks, and missed thresholds to help businesses stay proactive and capitalize on rebate agreements. Centralized data storage further simplifies rebate management by consolidating contract details, performance metrics, and audit trails into one accessible platform. This enables smooth negotiations, clear audits, and comprehensive oversight of rebate processes.

Final Thoughts

Accurate rebate accounting is critical for maintaining financial integrity and ensuring compliance with regulatory requirements. By avoiding these common pitfalls, businesses can build strong relationships with suppliers, improve cash flow, and gain a competitive advantage.

Speedy Labs provides a centralized platform designed to simplify rebate management, reduce manual errors, and ensure transparency across your organization. With real-time data access, automated calculations, and robust audit trails, Speedy Labs helps businesses track rebate performance and maximize the value of their agreements.

Schedule a demo with our team to explore how Speedy Labs simplifies rebate management and improves your financial operations.