Rebate Accounting: Procedures, Best Practices, & More

Rebate accounting ensures that rebates are accurately recorded to reflect their impact on a company’s revenue, expenses, and profitability. Mismanagement in this area can lead to financial misstatements, compliance violations, and strained relationships with stakeholders.

Let’s explore what rebate accounting is and why it matters, as well as its procedural complexities, compliance considerations, and best practices to simplify the process.

Table of Contents:

- What Is Rebate Accounting?

- Why Rebate Accounting Matters?

- Types of Rebates

- Accounting Procedures for Rebates

- Legal and Compliance Considerations

- Challenges in Rebate Accounting

- Solutions to Simplify Rebate Accounting

- Best Practices for Rebate Accounting

- Conclusion

Jump to a section that interests you, or keep reading.

What Is Rebate Accounting?

Rebates, which are retroactive payments made to buyers after a sale, differ from discounts as they are not applied at the point of purchase but are conditional upon meeting specific criteria. Accurate rebate accounting ensures that these incentives are correctly recognized and integrated into financial statements, aligning with both regulatory standards and business objectives.

Why Rebate Accounting Matters?

Rebate accounting matters because it underpins accurate financial reporting, compliance, profitability analysis, and systematic management of rebate obligations. Without it, businesses risk financial inaccuracies, regulatory non-compliance, and missed opportunities to maximize the value of rebate programs.

One of the primary reasons rebate accounting matters is its effect on financial reporting accuracy. Rebates alter the cost of goods sold (COGS), net sales, and overall profit margins, making it essential for businesses to record them in accordance with standards like GAAP or IFRS. Misstatements caused by inaccurate rebate recording can lead to regulatory non-compliance and potential financial penalties.

For businesses relying on rebates as a key sales or procurement strategy, accounting practices ensure decision-making clarity. By analyzing rebate performance, businesses can assess whether specific rebate programs are achieving goals like driving customer loyalty, increasing purchase volumes, or boosting sales of specific products. This insight helps businesses fine-tune rebate strategies for better financial outcomes.

Rebate accounting is crucial for managing liabilities and obligations. Rebates create commitments that must be accurately tracked and reported as liabilities on balance sheets until they are fulfilled. This prevents underestimating financial obligations and ensures compliance with audit requirements. Failing to account for these liabilities can lead to discrepancies during financial reviews and audits.

Rebate accounting also impacts cash flow management by tracking receivables from vendor rebates and payables to customers. Properly recorded rebates help businesses forecast cash inflows and outflows more accurately so that they are prepared to meet obligations without liquidity issues.

Compliance with rebate agreements and legal regulations further highlights the importance of rebate accounting. Many rebate programs involve complex terms, such as tiered thresholds or product-specific criteria. Mismanagement of these agreements can result in disputes with suppliers or customers, damaging relationships and profitability.

Modern businesses recognize the operational benefits of rebate accounting for process optimization and efficiency. Automation tools can simplify rebate tracking, ensure timely recognition, and provide real-time reporting. This reduces errors associated with manual methods and offers actionable insights into rebate program performance.

Types of Rebates

Below is a detailed breakdown of the different types of rebates, categorized by their nature and purpose.

1. Customer Rebates

Customer rebates are financial incentives given directly to customers after a sale to encourage purchases promote loyalty, or clear inventory. These rebates aim to increase sales volume, introduce new products, or incentivize specific buying behaviors. The main types of customer rebates include:

- Sales Rebates: Offered post-purchase based on the total sales value achieved. Customers are rewarded with higher rebate amounts as their spending increases. These are helpful in boosting short-term sales and encouraging higher transaction values.

- Volume Rebates: Designed to promote bulk purchases, these rebates are tiered, providing greater rewards as customers buy larger quantities. For example, a customer will receive a 1% rebate for the first 1,000 units purchased, 2% for the next 1,000, and so on.

- Product-Specific Rebates: Used to target specific products, often during promotional campaigns, such as launching new items or clearing out older inventory. Customers only qualify for rebates on designated items.

- Flat Rebates: The simplest form of rebate, where a fixed percentage or nominal amount is returned based on either the total spend or the quantity purchased. For instance, a customer receives a 5% rebate on all purchases within a set period.

- Value Rebates: These focus on the monetary value of purchases rather than quantity. Customers who reach a specific spending threshold are rewarded with a percentage or lump-sum rebate.

2. Vendor Rebates

Vendor rebates are incentives provided by suppliers or manufacturers to their business customers, such as retailers or distributors. These rebates aim to encourage loyalty, meet sales targets, or promote specific products. Key types of vendor rebates include:

- Supplier Rebates: Given by suppliers to businesses as a reward for achieving predefined purchase milestones, such as exceeding a target order volume or increasing sales within a specific time frame. These rebates reduce the cost of goods sold (COGS) and improve profitability for the vendor.

- Tiered Rebates: Structured in a way that rewards businesses progressively as they achieve higher purchasing volumes. For instance, a supplier offers incremental rebates at different purchase thresholds, providing greater savings as purchasing increases.

3. Inventory Rebates

Inventory rebates specifically relate to products held in inventory and are tied to how and when the rebates are accounted for. The accounting treatment for these rebates significantly impacts financial reporting and profitability assessment.

- Point of Sale Rebates: These rebates are recognized as revenue only when the inventory is sold to the end customer. This ensures that rebates directly reflect the profitability of the actual sale.

- Point of Purchase Rebates: Recorded at the time of inventory purchase from the supplier, these rebates are treated as a reduction in the cost of inventory. This approach aligns the rebate value with the initial cost of acquiring the goods.

Inventory rebate accounting ensures businesses accurately capture the financial impact of rebates on inventory valuation and sales margins.

4. Special Incentives

Special incentives include advanced rebate mechanisms to align closely with business goals, such as securing long-term contracts, competing in price-sensitive markets, or offering tailored pricing solutions.

- Ship-and-Debit Agreements: Under this mechanism, distributors lower prices for their customers and recover the difference from suppliers. These agreements often go by different names in various industries such as chargebacks in equipment manufacturing or POD (Payment on Delivery) in packaging sectors.

- Special Pricing Agreements (SPAs): Typically used in B2B environments, SPAs allow suppliers to offer discounted pricing to specific customers in exchange for commitments such as long-term partnerships or guaranteed order volumes. These agreements create predictable and stable pricing models, benefitting both suppliers and their customers.

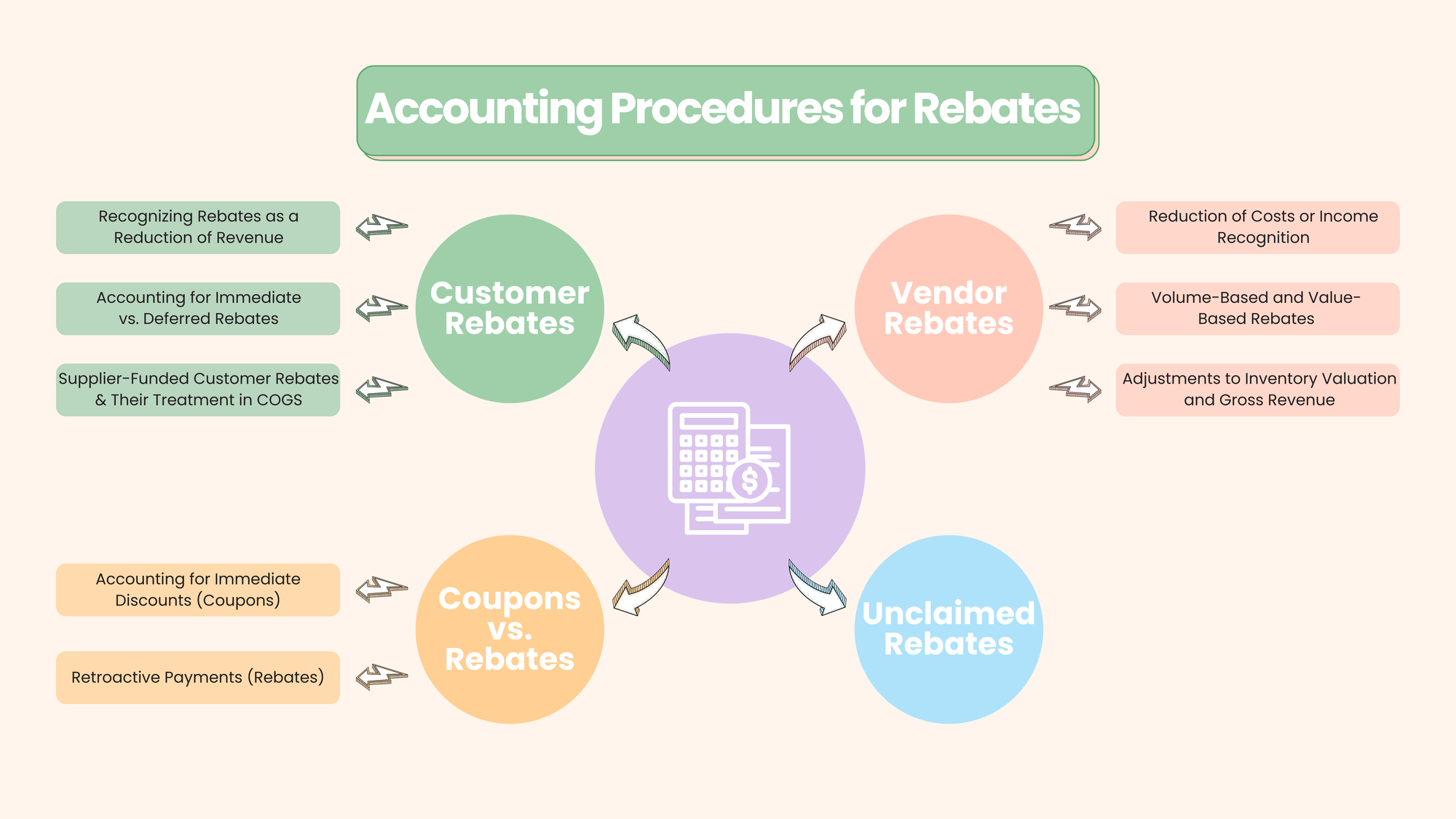

Accounting Procedures for Rebates

Customer Rebates

The accounting treatment of these rebates depends on their nature and timing.

-

Recognizing Rebates as a Reduction of Revenue: Customer rebates are recorded as a reduction in revenue, ensuring that net sales figures accurately reflect the economic impact of the rebate. For instance, if a $1,000 sale includes a $100 rebate, the revenue is recorded as $900.

-

Accounting for Immediate vs. Deferred Rebates: Immediate rebates, such as point-of-sale reductions, are recognized in the same accounting period as the sale. Deferred rebates, redeemable post-purchase, are recorded as liabilities until claimed, reflecting the obligation to the customer. The recognition timing aligns with the terms of the rebate agreement. For example, a company sells a product for $1,000 and offers two types of rebates:

-

Immediate Rebate: A $50 discount is applied at the point of sale. The sale is recorded as $950 ($1,000 - $50 rebate) in the same period the sale occurs. The company immediately reduces revenue by the $50 rebate amount.

-

Deferred Rebate: A $100 mail-in rebate, which the customer can claim after the purchase. The $100 rebate is not immediately deducted from revenue but is recorded as a liability, as it represents an obligation to the customer. When the customer claims the rebate, the liability is cleared, and cash is reduced.

-

-

Supplier-Funded Customer Rebates and Their Treatment in COGS: When suppliers fund customer rebates, these rebates reduce the cost of goods sold (COGS) for the vendor, as the supplier reimburses the vendor for the rebate. For example, if a supplier offers a $200 rebate on a car, the dealership accounts for this as a reduction in the wholesale purchase price of the car, rather than affecting its revenue.

Vendor Rebates

Vendor rebates are provided by suppliers to incentivize higher purchases and are recorded differently based on their purpose and timing.

-

Reduction of Costs or Income Recognition: Rebates tied to inventory purchases are recorded as a reduction in inventory costs, lowering COGS when the inventory is sold. If rebates are given as rewards for achieving sales targets, they are recorded as other income. This distinction ensures the financial statements align with the rebate's intent.

-

Volume-Based and Value-Based Rebates: Vendor rebates are often structured around purchase volume or value. For instance, volume-based rebates reward higher purchase quantities, while value-based rebates are calculated based on monetary thresholds. Accurate tracking is critical to properly accrue and allocate these rebates.

-

Adjustments to Inventory Valuation and Gross Revenue: Rebates related to inventory purchases adjust the valuation of inventory on the balance sheet. If rebates are earned at the point of purchase, they reduce inventory costs. Alternatively, if earned at the point of sale, they directly impact gross revenue.

Coupons vs. Rebates

Although similar in concept, coupons, and rebates differ in their timing and accounting treatment.

- Accounting for Immediate Discounts (Coupons): Coupons reduce the sales price at the point of purchase and are recorded as a direct reduction in revenue.

- Retroactive Payments (Rebates): Rebates are retroactive payments made post-purchase and are treated as liabilities until redeemed. Unlike coupons, they do not immediately affect revenue but impact financial statements when claimed.

For example, if a customer uses a $20 coupon for a $200 item, the revenue recorded is $180. In contrast, rebates are offered post-purchase, creating a liability until redeemed. For example, a $50 rebate on a $500 phone does not affect revenue at the point of sale but is recorded as a liability. When the customer redeems the rebate, the liability is reversed, and the cash outflow is recorded.

Unclaimed Rebates

Unclaimed rebates, though not redeemed by customers, still require proper tracking and reporting. Unclaimed rebates are initially recorded in the same manner as claimed rebates, typically as liabilities. This ensures that the obligation is accounted for accurately during the relevant period.

Businesses must report unclaimed rebates based on local unclaimed property laws. For instance, unclaimed rebate amounts may need to be submitted to the state controller’s office to comply with escheatment laws, ensuring regulatory adherence.

Legal and Compliance Considerations

Accurate rebate accounting requires strict adherence to legal and regulatory frameworks to ensure transparency, prevent financial misstatements, and maintain compliance. Let’s address the critical aspects of adhering to accounting standards and the role of audit trails in achieving compliance.

Adherence to Accounting Standards

Compliance with established accounting standards is fundamental for proper rebate accounting, particularly when rebates influence revenue recognition and expense reporting. These standards aim to standardize rebate accounting practices while accommodating variations in rebate agreements, such as customer rebates funded by suppliers or tiered vendor rebates.

GAAP and IFRS Guidelines

The Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS) provide comprehensive guidelines for rebate accounting. Under these standards, rebates must be treated consistently to ensure that revenue, expenses, and liabilities are accurately reported. Key principles include recognizing rebates either as a reduction in revenue or as adjustments to the cost of goods sold (COGS), depending on their nature and terms.

Specific Rules for Rebate Accounting

- ASC 705-20: This rule under GAAP stipulates that cash consideration received from a vendor is generally considered a reduction of the vendor's product cost unless it serves as reimbursement for specific and identifiable expenses incurred.

- IFRS 15: Focuses on revenue recognition, requiring that rebates be accounted for as variable considerations. It emphasizes aligning rebate recognition with the satisfaction of performance obligations to ensure accurate reflection of financial outcomes in the accounting period when revenue is earned.

Audit Trails and Transparency

Robust audit trails are essential for demonstrating compliance with financial regulations and maintaining the integrity of financial records.

- Maintaining Detailed Records: A well-documented audit trail ensures that all rebate agreements, calculations, and claims are traceable and verifiable. Records should include detailed information about the terms of rebate agreements, calculation methodologies, payment schedules, and proof of fulfillment. Maintaining this level of detail simplifies internal reviews and external audits and reduces the risk of discrepancies or penalties.

- Using Digital Tools for Audit Management: Digital tools, such as rebate management software, simplify the creation and maintenance of audit trails. These tools centralize documentation, automate data recording, and provide real-time tracking of rebate transactions. Features like automated logs, version histories, and secured storage ensure that data remains accurate, organized, and easily accessible for audit purposes. Integrating these tools with enterprise resource planning (ERP) systems allows businesses to achieve smooth compliance and reduce the manual effort involved in preparing for audits.

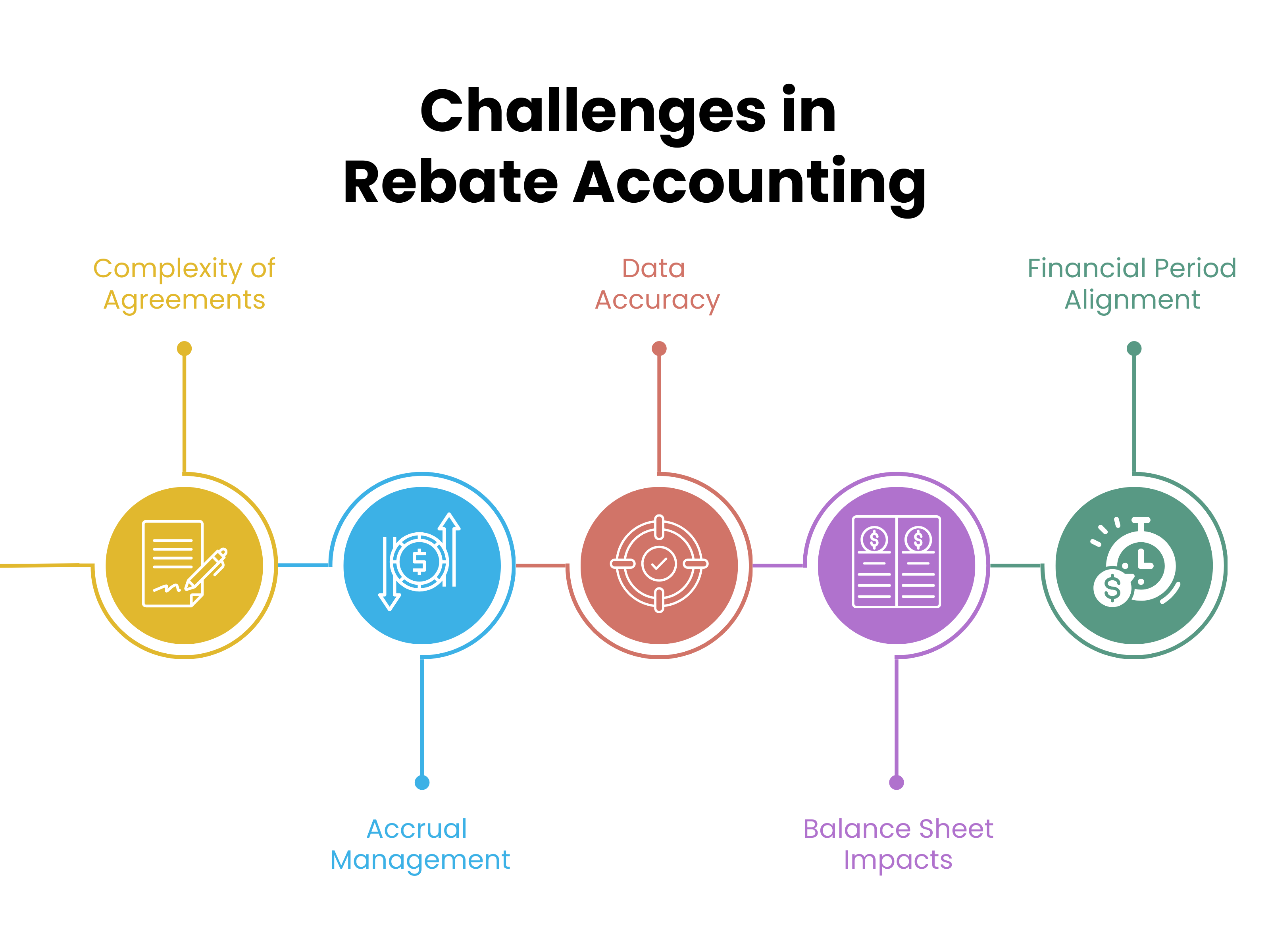

Challenges in Rebate Accounting

Rebate accounting is a nuanced process that demands precision, organization, and consistent oversight. Despite its importance, several challenges complicate its execution. Here are the key hurdles that businesses face in managing rebate accounting.

Complexity of Agreements

The complexity of rebate agreements poses significant challenges for businesses, particularly when handling a diverse range of conditions.

Rebate agreements differ in their structure, with unique thresholds, tiered incentives, and eligibility criteria. This variability necessitates customized tracking and calculation, increasing administrative workload and the likelihood of errors.

Rebate programs also vary widely across regions and industries, requiring businesses to account for localized market dynamics. For example, the same vendor offers different rebate terms in separate markets, which adds to the complexity of agreement management.

Accrual Management

Accrual management is an important component of rebate accounting, as it involves anticipating future liabilities based on historical and forecasted sales data.

Tiered rebate structures, where the rebate percentage increases with higher volumes or values, require meticulous tracking of cumulative purchases or sales. Failure to track these accurately can result in under- or over-accrual, directly affecting financial statements.

Businesses relying on manual methods or spreadsheets face significant risks. Spreadsheets are prone to errors, lack scalability, and cannot handle complex rebate calculations, which leads to delays and inaccuracies in accrual reporting.

Data Accuracy

Accurate data is the backbone of rebate accounting, yet ensuring precision becomes difficult in practice.

Manual data entry introduces the risk of inaccuracies, such as misaligned figures or omissions, which cascade into larger reporting issues.

Miscommunication between sales, procurement, and accounting teams leads to discrepancies in understanding rebate terms and misalignment in how rebates are recorded or reported.

Balance Sheet Impacts

Rebate accounting has direct implications on the balance sheet, making accuracy paramount.

Rebates create liabilities that must be carefully tracked and reported to avoid misrepresentation of the company’s financial health. Mismanagement will inflate or understate liabilities, skewing the balance sheet and impacting stakeholder confidence.

Financial Period Alignment

Accurately aligning rebates with the correct accounting period is important to maintaining consistency and compliance.

Rebates must be recorded in the financial period in which the related revenue or purchase occurs. Errors in timing such as recognizing rebates too early or late can disrupt the integrity of financial reporting, creating downstream issues that affect subsequent periods.

Solutions to Simplify Rebate Accounting

Rebate accounting, with its inherent complexities, requires addressing common challenges through the below given solutions to improve financial outcomes.

Automation and Technology Integration

One of the most impactful ways to simplify rebate accounting is by leveraging automation tools and software.

Dedicated rebate management platforms automate complex calculations, track rebate performance, and manage accruals in real time. These systems eliminate the need for manual data entry to reduce errors and improve efficiency.

Rebate software integrated with enterprise resource planning (ERP) systems ensures smooth data flow between procurement, sales, and accounting. This synchronization allows for accurate rebate tracking, faster reconciliation, and reliable reporting.

Advanced analytics features provide insights into rebate performance to help businesses identify trends, forecast outcomes, and refine rebate strategies. Automated reports ensure stakeholders have access to accurate, up-to-date information.

Standardized Processes and Documentation

Standardization minimizes errors and ensures consistent application of rebate policies.

Establish clear, standardized procedures for tracking, calculating, and recording rebates across departments. Aligning processes helps prevent discrepancies and create accountability.

Maintain comprehensive records of rebate agreements, including terms, calculations, and redemption data. Centralized documentation ensures accessibility and supports audit readiness.

Create alignment between sales, procurement, and finance teams to ensure that rebate agreements are clearly communicated and accurately implemented.

Improved Data Accuracy and Tracking

Accurate data is important for accurate rebate accounting.

Consolidate data from various sources into a single platform to ensure consistency and reduce the risks of duplication or errors.

Automated systems validate data in real-time to ensure accuracy in rebate tracking and calculations. This reduces the potential for discrepancies caused by manual entry or outdated spreadsheets.

Use software tools to manage tiered rebate accruals accurately to ensure that liabilities are forecasted and recorded correctly.

Audit-Ready Systems and Transparency

Compliance and audit readiness are integral to rebate accounting.

Digital tools automatically generate audit trails to capture all actions related to rebate agreements, calculations, and claims. These records ensure traceability and simplify compliance with financial regulations.

Rebate management platforms offer transparency by providing stakeholders with real-time access to rebate data. Features like supplier and vendor portals allow third parties to view rebate terms and performance and reduce disputes.

Scalability and Efficiency

As rebate programs grow in complexity, systems must be scalable to handle increased volumes and variety.

Automated systems can handle diverse rebate types, including tiered, volume-based, and product-specific rebates, without increasing administrative burden.

Transitioning from spreadsheets to automated systems prevents bottlenecks, reduces errors, and supports growth by helping teams manage larger rebate portfolios.

Best Practices for Rebate Accounting

Implementing the below given best practices in rebate accounting to ensure compliance and optimize your financial outcomes.

Conduct Regular Rebate Accounting Audits

Auditing rebate processes identify inefficiencies, ensure compliance, and reduce financial risks.

Ensure rebate agreements are easily accessible to all stakeholders. Centralize records using digital tools to eliminate reliance on spreadsheets, which can be error-prone and difficult to share.

Evaluate for potential non-compliance, unpaid rebates, and data inaccuracies. Addressing risks early prevents reputational damage, audit penalties, and profitability loss.

Standardize Processes Across Departments

A unified approach to rebate accounting ensures consistency and reduces miscommunication.

Align sales, procurement, and accounting teams to eliminate silos and ensure all parties understand rebate terms and conditions. Clear communication promotes collaboration and prevents errors in calculations or claims processing.

Use centralized platforms to maintain clear, detailed records of rebate agreements, redemption data, and calculations. Organized documentation supports audit readiness and improves accountability.

Use Automation and Technology

Implementing technology simplifies rebate management, reduces manual work, and improves accuracy.

Automate calculations, track accruals and monitor performance metrics in real time. Automation reduces errors and increases efficiency, particularly for tiered and volume-based rebates.

Integrate rebate systems with enterprise resource planning (ERP) platforms to synchronize data across procurement, inventory, and finance. Use analytics to track rebate performance, identify trends, and refine rebate programs. Timely insights help businesses adapt strategies and forecast rebate liabilities.

Focus on Data Accuracy

Accurate data is important for reliable rebate accounting and financial reporting.

Consolidate all rebate-related data into a single source of truth. Avoid multiple data repositories to reduce discrepancies and ensure consistency. Implement real-time validation for rebate calculations to identify and rectify discrepancies immediately. Use automated checks to avoid manual entry errors.

Ensure Compliance and Audit Readiness

Adherence to financial standards like GAAP and IFRS is critical for compliance and stakeholder trust.

Record every rebate agreement, claim, and calculation step to create a transparent audit trail. Use digital tools to ensure records are easily retrievable and securely stored.

Regularly verify that rebates are recorded in the correct financial period to avoid downstream impacts and ensure compliance with revenue recognition principles.

Regularly Review and Optimize Rebate Programs

Ongoing evaluation helps improve the profitability of rebate programs.

Assess the impact of rebate programs using metrics like redemption rates and customer behavior. Adjust strategies based on findings to maximize ROI. Regularly update rebate structures to reflect changes in market conditions, customer preferences, and supplier relationships.

Conclusion

Rebate accounting is a cornerstone of strategic financial management that impacts profitability, compliance, and business relationships. Accurate handling of rebates ensures transparency in financial reporting, aligns with accounting standards like GAAP and IFRS, and mitigates risks associated with misstatements and regulatory non-compliance. As your rebate programs turn complex with varying structures and conditions, managing them accurately requires strong systems, technology, and clear processes.

Rebate management tools like Speedy Labs handle the intricate calculations, tracking, and reporting that modern rebate programs demand. They automate processes to eliminate the risks associated with manual entry and spreadsheet dependency so that all data is precise and audit-ready.

Integrated with enterprise systems like ERP, they provide real-time insights into rebate performance to forecast liabilities, identify trends, and make informed decisions.

Schedule a demo with our team to see how Speedy Labs can help you simplify the complexities of rebate accounting.