The Complete Guide to Procurement Contracts

Procurement contracts are the foundation of business transactions, ensuring clarity, compliance, and risk management between buyers and sellers. These legally binding agreements define the terms for acquiring goods and services, covering aspects like pricing, quality, timelines, and liability.

Choosing the right type of contract is essential for financial stability, operational efficiency, and successful project execution. A poorly structured contract can lead to budget overruns, legal disputes, or compromised quality. This guide explores the various types of procurement contracts, key considerations for selection, contract management best practices, and the role of digital tools in streamlining procurement processes.

Table of Contents:

- What is a Procurement Contract?

- Types of Procurement Contracts

- Key Considerations When Choosing a Procurement Contract

- Contract Management Best Practices

- The Role of Digital Contract Lifecycle Management (CLM) Systems

- Common Mistakes to Avoid in Procurement Contracts

Jump to a section that interests you, or keep reading.

What is a Procurement Contract?

A procurement contract is a legally binding agreement between a buyer and a seller that governs the purchase of goods or services. This contract specifies the purchase terms, including price, quality, quantity, and delivery expectations, ensuring that both parties meet their obligations. The supplier is responsible for fulfilling the agreed-upon terms, while the buyer acknowledges receipt and processes payment accordingly.

Procurement contracts play a crucial role in reducing financial and operational risks. By clearly defining expectations, they help prevent disputes and ensure smoother transactions. These contracts vary depending on factors such as industry standards, project scope, and legal requirements. Selecting the right type of procurement contract is essential, as an inappropriate choice can lead to increased costs, inefficiencies, or potential legal issues.

Once signed, a procurement contract serves as a reference for both parties, outlining responsibilities and minimizing uncertainties. It establishes accountability, ensuring that the supplier delivers as promised and that the buyer provides timely compensation.

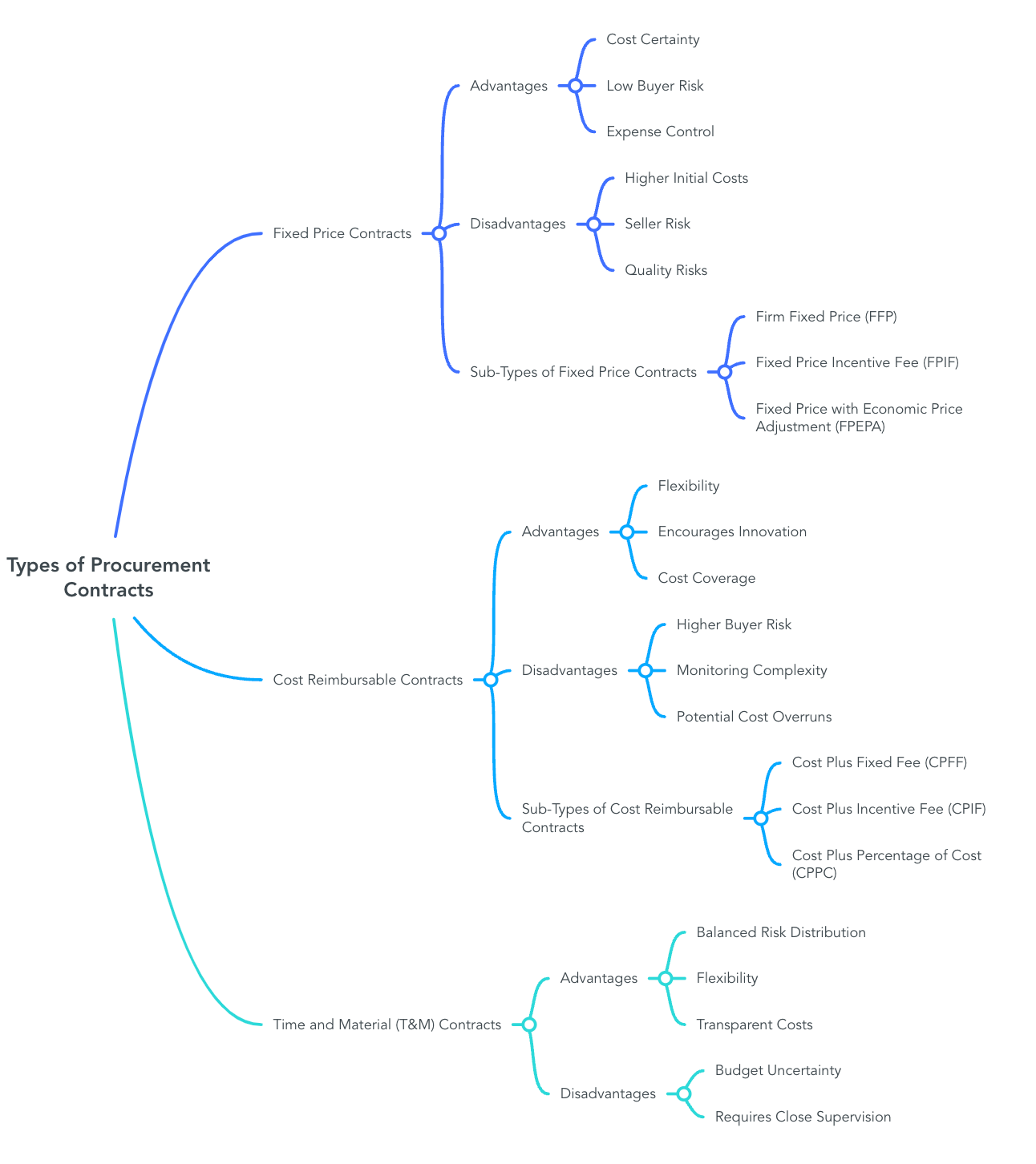

Types of Procurement Contracts

Fixed Price Contracts

A fixed price contract is a straightforward agreement where the buyer and seller agree on a predetermined price for goods, services, or project completion. Once established, the cost remains unchanged, regardless of actual expenses incurred. This contract type is best suited for projects with well-defined scopes, minimal uncertainties, and clear deliverables.

Advantages:

- Cost Certainty: Since the price is fixed, buyers can budget accurately without concerns about cost fluctuations.

- Low Buyer Risk: Sellers bear any unexpected cost increases, ensuring financial predictability for buyers.

- Expense Control: Helps buyers manage project budgets effectively.

Disadvantages:

- Higher Initial Costs: Sellers may include a risk buffer in pricing to cover unforeseen expenses, potentially leading to higher upfront costs.

- Seller Risk: If material costs or unforeseen issues arise, sellers may struggle to maintain profitability.

- Quality Risks: In competitive bidding, sellers might submit low bids to win contracts, increasing the risk of cost-cutting measures that could impact quality.

Sub-Types of Fixed Price Contracts

- Firm Fixed Price (FFP): The price and timeframe are set at the contract's outset, and the seller must complete the work within these constraints, with no price adjustments allowed.

- Fixed Price Incentive Fee (FPIF): Includes a bonus for exceptional performance, such as early completion while maintaining quality standards.

- Fixed Price with Economic Price Adjustment (FPEPA): Common in long-term projects, this contract allows price modifications based on inflation, often using the Consumer Price Index (CPI) as a benchmark.

Cost Reimbursable Contracts

A cost reimbursable contract, also known as a cost-reimbursement contract, requires the buyer to cover all actual costs incurred by the seller, along with a predetermined fee for profit. These contracts are ideal for projects with uncertain scopes or evolving requirements, such as research, development, or complex infrastructure projects.

Advantages:

- Flexibility: Adjustments can be made as project requirements change.

- Encourages Innovation: Allows room for modifications without strict financial constraints.

- Cost Coverage: Ensures sellers are reimbursed for investments made in project execution.

Disadvantages:

- Higher Buyer Risk: The final cost remains uncertain, making budgeting more challenging.

- Monitoring Complexity: Requires strict oversight to prevent excessive spending.

- Potential Cost Overruns: Without proper tracking, expenses can exceed initial estimates.

Sub-Types of Cost Reimbursable Contracts

- Cost Plus Fixed Fee (CPFF): The buyer reimburses all costs and pays a fixed profit fee. High-risk projects, such as hazardous material research, often use this model.

- Cost Plus Incentive Fee (CPIF): Similar to CPFF but includes incentives for meeting performance goals, such as completing the project under budget. If the project exceeds the budget, both buyer and seller share the additional expenses.

- Cost Plus Percentage of Cost (CPPC): The seller is reimbursed for actual costs plus a percentage-based profit. Buyers must closely monitor expenses to prevent excessive spending.

Time and Material (T&M) Contracts

A time and material (T&M) contract is structured around the cost of labor (billed at hourly or daily rates) and materials used in project execution. This contract is commonly applied when project scope is uncertain, and the buyer needs flexibility in adjusting labor and material requirements.

Advantages:

- Balanced Risk Distribution: The buyer and seller share cost uncertainties.

- Flexibility: Adjustments to workforce and materials can be made as needed.

- Transparent Costs: Payments are based on actual expenses incurred.

Disadvantages:

- Budget Uncertainty: Final project costs can fluctuate due to hourly labor and material price changes.

- Requires Close Supervision: Buyers must actively monitor costs to prevent overbilling or inefficiencies.

Importance of a “Not-to-Exceed” Clause

To prevent uncontrolled spending, T&M contracts often include a “not-to-exceed” clause, which sets a maximum cost limit for the project. This ensures that while the contract remains flexible, it does not result in unmanageable financial overruns.

Key Considerations When Choosing a Procurement Contract

Project Scope Clarity

The level of detail in project specifications directly influences the choice of procurement contract. If the scope is well-defined with clear deliverables, a fixed price contract is preferable, as it provides cost certainty. However, when requirements are uncertain or subject to change, cost reimbursable or time and material (T&M) contracts allow for adjustments. Unclear scope increases the likelihood of disputes, delays, and budget overruns, making flexibility an important factor in contract selection.

Risk Allocation Between Buyer and Seller

Different contract types shift financial and operational risks between parties. In a fixed price contract, sellers bear the risk of cost overruns, material price fluctuations, and unforeseen challenges. To compensate, they often include a cost buffer in their pricing. In cost reimbursable contracts, buyers assume most of the risk, covering all project costs, including unexpected ones. This model is used in complex or evolving projects where the risk of underestimating expenses is high. T&M contracts distribute risk more evenly, as the buyer pays for actual labor and materials while maintaining some control over the budget.

Market Conditions and Inflation Risks

Economic conditions, material availability, and price volatility play a crucial role in contract selection. Fixed price contracts are less suitable for long-term projects in unstable markets, as sellers must anticipate future cost increases, often inflating their initial bids. Fixed price with economic price adjustment (FPEPA) contracts help mitigate inflation risks by allowing price modifications based on economic indices such as the Consumer Price Index (CPI). In contrast, cost reimbursable contracts naturally adjust to market fluctuations since buyers cover actual expenses.

Budget Predictability vs. Flexibility

Organizations must balance cost control with adaptability. Fixed price contracts offer budget predictability, making them ideal for projects with strict financial limits. However, they lack flexibility, as any additional work outside the original scope may require renegotiation. Cost reimbursable contracts provide greater adaptability, allowing for changes as the project evolves, but come with uncertain final costs. T&M contracts strike a middle ground, enabling flexibility while incorporating cost controls through provisions like the “not-to-exceed” clause, which sets a spending cap to prevent budget overruns.

Contract Management Best Practices

Defining Clear Contract Terms and Deliverables

Well-defined contract terms minimize misunderstandings and disputes. A procurement contract must outline the scope of work, pricing structure, payment terms, quality standards, timelines, and penalties for non-compliance. Fixed price contracts require precise deliverables and performance criteria to prevent cost disputes. In cost reimbursable and time and material (T&M) contracts, defining acceptable cost categories, reimbursement methods, and project milestones ensures accountability. Ambiguities in contract language can lead to financial and operational risks, making clarity in documentation essential.

Negotiation Strategies for Procurement Contracts

Effective negotiation secures favorable terms while balancing risk distribution. In fixed price contracts, buyers should assess whether sellers have included excessive buffers in their pricing due to potential risks. Sellers, on the other hand, must ensure that pricing covers all contingencies without overcommitting to unrealistic costs. For cost reimbursable contracts, buyers should establish cost monitoring mechanisms to prevent overspending, while sellers should negotiate fair profit margins and reimbursement terms. In T&M contracts, setting a “not-to-exceed” clause helps prevent cost escalations. Evaluating seller stability, past performance, and market conditions before finalizing agreements strengthens negotiation outcomes.

Performance Monitoring and Compliance Checks

Continuous oversight ensures that suppliers adhere to contractual obligations. Buyers must track project milestones, quality benchmarks, and delivery schedules. In fixed price contracts, monitoring ensures that sellers do not compromise quality to manage costs. In cost reimbursable contracts, expense tracking prevents excessive spending, and in T&M contracts, verifying labor hours and material usage controls unnecessary expenditures. Regular audits, progress reviews, and vendor assessments help identify risks early, enabling corrective actions before major issues arise.

Handling Contract Amendments and Changes

Adjustments to procurement contracts may be necessary due to unforeseen circumstances, scope changes, or economic shifts. Fixed price contracts typically require renegotiation for modifications, while cost reimbursable and T&M contracts offer more flexibility. Any amendments must be documented in writing, detailing revised costs, timelines, and responsibilities. Buyers should evaluate how changes impact overall project budgets and completion timelines, while sellers should ensure that revised terms remain commercially viable. Proactive communication between parties reduces conflicts and maintains contract integrity.

The Role of Digital Contract Lifecycle Management (CLM) Systems

Contract Lifecycle Management (CLM) systems streamline procurement contract processes by centralizing contract creation, execution, tracking, and compliance management. These tools eliminate manual errors, ensure version control, and provide real-time visibility into contract performance. By automating key workflows such as approval processes, renewal alerts, and amendment tracking, CLM systems reduce administrative burdens and enhance contract oversight. Organizations managing high volumes of procurement contracts benefit from improved efficiency and risk mitigation through structured contract governance.

Benefits of Automation in Procurement

Automated contract management reduces human intervention in repetitive tasks, lowering the risk of compliance failures and missed deadlines. Procurement teams gain from faster contract execution, enhanced supplier collaboration, and improved audit readiness. CLM tools help in monitoring supplier adherence to contractual obligations, ensuring timely payments, and mitigating financial exposure. Automation also enables better cost control by flagging potential overspending in cost reimbursable and time and material contracts. The ability to set automated alerts for contract expirations and performance reviews prevents disruptions in procurement operations.

Features to Look for in a CLM System

An ideal CLM system should offer contract creation templates, e-signature capabilities, workflow automation, real-time analytics, and centralized document storage. Robust compliance tracking ensures adherence to regulatory and organizational requirements. Integration with procurement and enterprise resource planning (ERP) systems enhances data consistency across financial and operational processes. AI-driven contract analysis can identify risks and suggest optimization strategies. Customizable approval workflows and access controls enhance security while enabling efficient contract negotiation and execution.

Common Mistakes to Avoid in Procurement Contracts

Overlooking Contract Flexibility

Rigid procurement contracts can create operational challenges, especially in projects with evolving requirements or market fluctuations. Contracts should include provisions for modifications, allowing adjustments to pricing, scope, or timelines when necessary. Fixed price contracts, while ensuring cost predictability, may not be suitable for long-term engagements if they lack flexibility for economic price adjustments. Similarly, time and material contracts should define cost limits to prevent budget overruns. Without structured flexibility, parties may struggle to accommodate unforeseen circumstances, leading to disputes or project delays.

Choosing the Wrong Contract Type for the Project

Selecting an unsuitable contract type can result in financial losses, inefficiencies, and disputes. Fixed price contracts are appropriate for well-defined projects, while cost reimbursable contracts are better suited for uncertain or evolving scopes. Using a fixed price contract for a project with unpredictable costs may pressure sellers to cut corners to maintain profitability. Conversely, applying a cost plus percentage of cost contract without stringent cost controls can lead to excessive expenses. Time and material contracts should be used when labor and material costs vary, but they require clear rate agreements and spending caps. Matching the contract type to project requirements ensures fair risk distribution and cost control.

Inadequate Supplier Evaluation

Selecting a supplier based solely on the lowest bid can lead to quality issues, delays, or financial instability. Evaluating a supplier’s track record, financial health, and capacity to fulfill contractual obligations is crucial. In fixed price contracts, sellers may submit unrealistically low bids to win contracts, increasing the risk of cost-cutting or non-compliance. Due diligence in assessing past project performance, reliability, and adherence to deadlines ensures a stable procurement process. Proper vetting minimizes the risk of engaging with vendors unable to meet quality and delivery expectations.

Lack of Contingency Planning

Failing to account for potential risks can lead to disruptions in procurement projects. Economic fluctuations, supplier insolvency, and unforeseen delays require contingency measures. Fixed price contracts should account for potential inflationary impacts, while cost reimbursable contracts should define clear expense monitoring mechanisms. Time and material contracts must include a "not-to-exceed" clause to prevent uncontrolled cost escalation. Establishing alternative supplier arrangements, defining escalation procedures, and setting contractual dispute resolution methods ensure operational continuity and financial stability.

Conclusion

A well-structured procurement contract ensures transparency, cost control, and smooth execution of business agreements. Selecting the right contract type requires careful assessment of project scope, risk allocation, market conditions, and budget flexibility. Proper contract management, including clear deliverables, performance monitoring, and adaptability, helps mitigate risks and maintain supplier relationships. Digital contract lifecycle management (CLM) tools further enhance efficiency by automating contract workflows, ensuring compliance, and reducing administrative burdens. Avoiding common procurement mistakes, such as inadequate supplier evaluation or lack of contingency planning, is crucial for long-term success. By implementing the right procurement strategies, businesses can secure reliable supplier partnerships, control costs, and drive operational efficiency.