The Complete Guide to Post-Audit Deductions

Post-audit deductions have become one of the most persistent and costly challenges facing manufacturers, distributors, and CPG suppliers today. These retrospective claims—often raised months or even years after a transaction—can drain cash flow, distort revenue accuracy, and consume countless hours in research and reconciliation. What makes them particularly problematic is their unpredictable nature: auditors revisit old payments, pricing structures, and promotional deals looking for missed discounts, overpayments, or unresolved discrepancies, often without full access to the original supporting data. As a result, suppliers are left to defend against deductions that can be partially or entirely invalid—yet the burden of proof always lies with them.

In an industry where margins are already thin, post-audit deductions represent a silent profit killer. They emerge from a perfect storm of complex trade terms, fragmented systems, inconsistent documentation, and limited cross-department visibility. And while each claim may seem small in isolation, collectively they can amount to hundreds of thousands—or even millions—of dollars in lost revenue each year. Managing them effectively requires more than reactive dispute resolution; it demands proactive governance, data integrity, and technology-enabled collaboration.

This complete guide breaks down everything you need to know about post-audit deductions—what they are, why they happen, and how to manage them efficiently.

Table of Contents:

- What Are Post-Audit Deductions?

- Common Causes of Post-Audit Deductions

- How to Prepare for Post-Audit Deductions?

- Efficient Post-Audit Deduction Management

- Handling and Disputing Post-Audit Claims

- The Role of Continuous Audits and Internal Reviews

Jump to a section that interests you, or keep reading.

What Are Post-Audit Deductions?

Post-audit deductions are retroactive claims made by retailers or their third-party auditors after reviewing previously settled transactions. These deductions typically arise months or even years—often up to three years—after the original sale, when an audit of payments, invoices, and trade agreements uncovers supposed discrepancies such as missed discounts, overpayments, incorrect pricing, or unclaimed promotional allowances. In essence, they are deductions from current invoice payments for past expenses that the auditor believes were owed but not accounted for at the time of transaction.

Unlike standard deductions that occur within the normal billing cycle, post-audit deductions are retrospective in nature and highly complex due to their age and volume. By the time they surface, the records and supporting documentation required to validate or dispute them may no longer be easily accessible. This creates a significant challenge for suppliers, as the burden of proof lies entirely on them to disprove the claim. If they fail to respond quickly and conclusively, the retailer or auditor proceeds with the deduction, reducing cash flow and potentially forcing unnecessary write-offs.

Common Causes of Post-Audit Deductions

Post-audit deductions stem from a combination of operational oversights, data inconsistencies, and contractual ambiguities that auditors can exploit years after a transaction is completed. These deductions are often less about deliberate financial discrepancies and more about weak internal processes and fragmented documentation. Understanding their root causes is critical to preventing unnecessary revenue losses and strengthening compliance across finance, sales, and trade promotion functions.

One of the most prevalent causes is misinterpretation of promotional terms and trade agreements. Retailers and auditors often misunderstand the scope or validity of a deal due to unclear documentation, vague offer sheets, or missing details such as product quantities, price points, and promotion duration. Ambiguity in date definitions—such as whether a promotion applies to the order date, ship date, or receipt date—creates further confusion and opens the door for auditors to reinterpret terms in their favor. When these deal parameters are not standardized and explicitly documented, they invite claims that are technically disputable but difficult to disprove.

Another major source of post-audit deductions is duplicate or multiple deductions for the same allowance or credit. These “double” or even “triple-dipping” errors occur when previously settled or invalid claims are reintroduced years later because the auditor lacks access to full historical data. In some cases, deductions that were repaid to the supplier are claimed again, either accidentally or due to missing records in the customer’s system. Without a comprehensive, automated deduction tracking mechanism, it becomes almost impossible for suppliers to cross-reference and verify whether a deduction is legitimate or redundant.

Inadequate documentation and poor record retention also play a major role. Because post-audits often occur two or three years after the original transaction, supporting materials such as invoices, proofs of delivery, trade deal sheets, and promotional performance reports may no longer be easily accessible. Without a structured document management or audit trail system, responding to these claims within the retailer’s short research window becomes extremely difficult, forcing many companies to accept deductions by default rather than through verification.

Data fragmentation across systems contributes significantly to the problem. When promotional details, accrual balances, invoices, and settlements are stored in disconnected platforms—or worse, in email threads or individual computers—there is no single source of truth to validate claims. This lack of data integration leads to mismatched records, overlooked settlements, and increased vulnerability to auditor errors. Additionally, when companies manage promotions manually through spreadsheets or non-standardized templates, it becomes nearly impossible to track the full lifecycle of a trade agreement.

Pricing discrepancies and missed discount applications are another recurring trigger. These may occur when invoice prices differ from agreed promotional rates or when early payment discounts and allowances are not correctly recorded. Auditors actively search for such inconsistencies, especially when systems fail to reconcile billing adjustments across periods or when credit memos are not properly applied.

Breakdowns in internal communication amplify the risk further. When sales, finance, and trade promotion teams operate in silos, important updates—such as revised deal terms or rebate settlements—may not be shared consistently. This lack of cross-functional visibility enables auditors to flag transactions as noncompliant, even when the issue stems from internal misalignment rather than genuine errors.

Finally, auditor-driven factors also contribute to the volume of post-audit deductions. Commission-based third-party auditors have strong financial incentives to identify as many deductions as possible, which often leads to aggressive interpretations of terms, speculative claims, and overreach into areas outside contractual scope. Combined with limited access to supplier data, this incentive-driven behavior results in a high percentage of inaccurate deductions that must be manually contested.

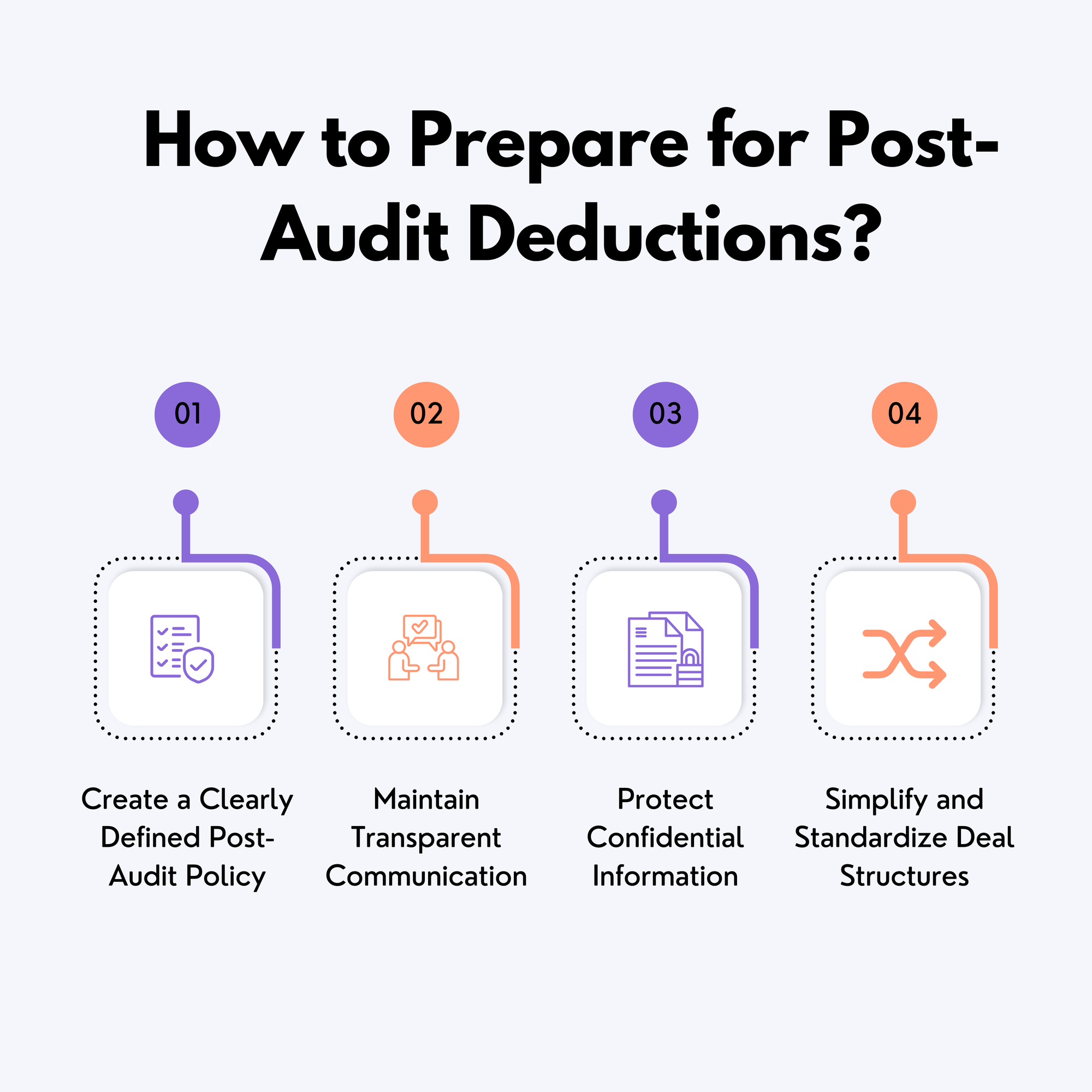

How to Prepare for Post-Audit Deductions?

Preparation is the most powerful defense against post-audit deductions. Because these claims can surface years after transactions close, companies must establish preventive structures—policies, communication channels, confidentiality safeguards, and standardized documentation—that ensure every deduction can be verified quickly and accurately. A proactive approach not only minimizes invalid claims but also strengthens relationships with retail partners by setting clear, professional boundaries.

1. Create a Clearly Defined Post-Audit Policy

A formal, CEO-signed post-audit policy is the first and most critical layer of defense. This document establishes the company’s official stance and procedures for handling post-audit claims, placing clear parameters around what is acceptable and what is not. It should be shared directly with both customers’ executive management and their commissioned post-auditors so that your expectations are formally recorded and acknowledged.

The policy must specify how far back an audit may go, ideally capping the allowable timeframe to 12–24 months. Many retailers attempt audits on transactions older than two years, which makes verification nearly impossible. Defining this limit protects your team from excessive retroactive claims.

Equally important is setting documentation standards. Every claim must be supported by verifiable proof such as invoices, trade deal agreements, proof of performance, or delivery records. Incomplete or undocumented claims should be automatically rejected in alignment with Sarbanes-Oxley and internal audit requirements.

Include a mandatory investigation grace period, typically 90 days, during which the supplier is allowed to research the claim before any deduction occurs. This window ensures time to validate data, locate records, and prepare a proper response.

Lastly, the policy should define the escalation and enforcement process—outlining who within the company handles disputes, when to involve customer management, and how to resolve ongoing disagreements. Having these protocols documented and consistently applied builds a reputation for fairness and professionalism, while signaling to auditors that your company takes compliance seriously.

2. Maintain Transparent Communication

Post-audit disputes often escalate due to a lack of clear, structured communication. Maintaining open and ongoing dialogue with retailers’ audit teams is essential to prevent misinterpretations and redundant claims. Establishing consistent communication channels early in the relationship helps both parties understand expectations for documentation, timelines, and response procedures before a dispute ever arises.

Suppliers should proactively communicate their audit policy to all relevant stakeholders—buyers, accounts payable managers, and audit contacts—and ensure that internal teams are aligned on how to handle auditor inquiries. In many cases, auditors may attempt to restrict communication solely between themselves and the supplier, excluding the retailer’s management team. Avoid this isolation by ensuring that communication includes both the auditor and the customer’s internal management.

Transparent communication ensures faster resolution, prevents procedural misunderstandings, and minimizes the chances of claims slipping through due to missed deadlines or misrouted correspondence.

3. Protect Confidential Information

During the audit process, sensitive company data—such as promotional strategies, pricing structures, and trade terms—may come under review. This information is considered confidential trade intelligence and must be treated as such. Many post-audit firms handle audits for multiple retailers, and without explicit restrictions, there is a risk of data sharing or cross-client application of proprietary information.

To mitigate this, suppliers should clearly communicate that their marketing plans, pricing models, and promotional programs are confidential and may not be shared or reused outside the scope of the current audit. This clause should be included in both customer agreements and audit policy documents. Vigilance in protecting trade secrets not only safeguards competitive advantage but also ensures that sensitive information isn’t used to generate unrelated or invalid claims with other clients.

4. Simplify and Standardize Deal Structures

Complexity and ambiguity in trade agreements are among the leading causes of post-audit deductions. The more unclear a promotion’s terms are, the more opportunity auditors have to interpret them incorrectly. Companies should therefore standardize trade promotion templates and deal documentation formats to eliminate gray areas and enforce consistency across all departments.

Every promotional offer should clearly state the specific quantities, pricing, effective dates, and eligibility criteria. Ambiguous date terms—such as “ship date,” “order date,” or “receipt date”—should be explicitly defined to prevent confusion about when an allowance applies.

Cross-functional collaboration is essential. Sales, finance, trade marketing, and supply chain teams must all be involved in designing, approving, and recording promotions to ensure accuracy and shared understanding. Tight internal controls on sales agreements not only prevent misinterpretations but also provide auditors with clear, defensible documentation if claims arise later.

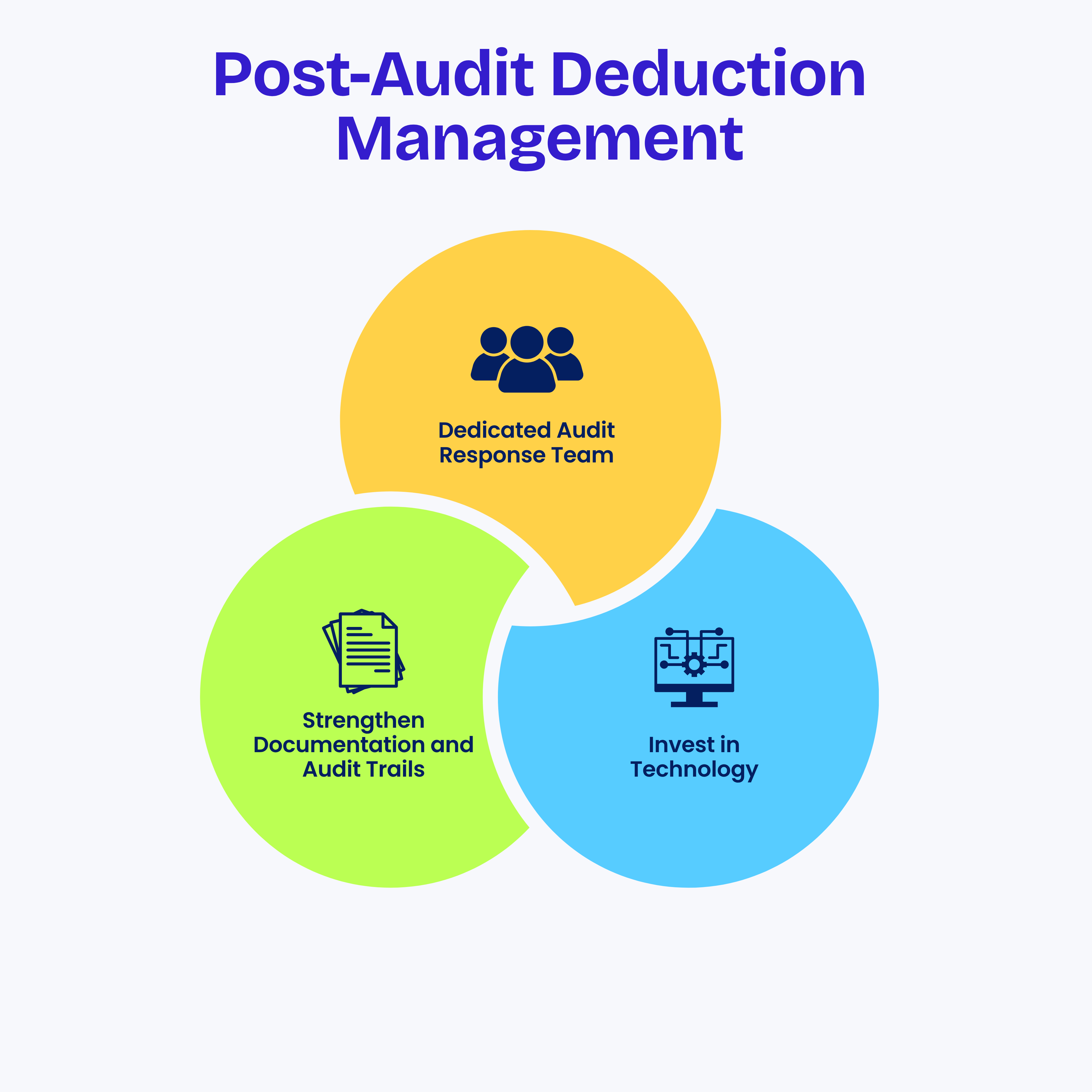

Efficient Post-Audit Deduction Management

Effectively managing post-audit deductions requires a structured, disciplined approach that balances people, process, and technology. Because these deductions often emerge long after the original transaction—and within narrow investigation windows—organizations must operate with precision, speed, and data-driven transparency. Efficient post-audit deduction management is built on three pillars: a dedicated team, robust documentation practices, and intelligent automation that ensures every claim is tracked, verified, and resolved before it becomes a costly write-off.

1. Dedicated Audit Response Team

A specialized post-audit response team is the cornerstone of efficient deduction management. Unlike general accounts receivable personnel, these trained specialists possess deep knowledge of customer contracts, promotional terms, and audit procedures. Their expertise enables them to quickly identify discrepancies, assemble documentation, and communicate effectively with auditors.

This team should prioritize post-audit claims as time-sensitive cases, since retailers typically impose short research or response windows before deductions are finalized. Immediate acknowledgment of each claim and a structured workflow ensure no item falls through the cracks.

To drive continuous improvement, the team must track key performance indicators (KPIs), such as resolution time, recovery rate, and repeat claim frequency. Monitoring these metrics highlights recurring problem areas—whether they stem from specific customers, deduction types, or internal process gaps—and supports data-driven decision-making for long-term prevention.

Establishing clear ownership also reduces cross-departmental confusion. When accountability is centralized, post-audit claims are handled with consistency, speed, and accuracy, ultimately improving recovery outcomes and preserving customer trust.

2. Strengthen Documentation and Audit Trails

Comprehensive documentation is the foundation of defending post-audit claims. Because these deductions can reference transactions up to two or three years old, quick access to complete and accurate records determines whether a company can disprove or must absorb a claim.

A centralized document management system is essential. All relevant data—invoices, proof of payments, trade promotion agreements, deal sheets, and settlement records—should be stored in a unified repository, eliminating the need to search through disconnected folders, emails, or local drives. This structured accessibility allows teams to retrieve records instantly and validate whether a deduction has already been taken, preventing duplicate or triple claims.

Traceability is key. Every post-audit claim should be linked back to its original transaction, with a documented audit trail showing when and how the charge was created, approved, or resolved. Maintaining this lineage not only strengthens your position during disputes but also satisfies compliance standards such as Sarbanes-Oxley by proving full financial accountability.

An organized, traceable documentation ecosystem also enhances collaboration between departments—finance, sales, trade marketing, and operations—ensuring that everyone works from a single version of the truth.

3. Invest in Technology

Modern technology is the greatest enabler of efficiency, accuracy, and scalability in post-audit deduction management. Manual processes and spreadsheets cannot keep up with the volume, complexity, and time sensitivity of today’s retail audits. Implementing advanced automation and integrated systems transforms deduction management from a reactive process into a proactive, data-driven discipline.

a. Deduction Management Software

A dedicated deduction management platform centralizes and automates the entire claim lifecycle—from intake and validation to dispute and resolution. By linking invoices, sales data, trade deal sheets, and accrual balances in a single database, it eliminates fragmented data silos and accelerates claim verification.

Such systems automatically identify potential duplicates, ensuring that deductions are not taken multiple times for the same transaction. They also generate analytics and KPI dashboards to track trends across deduction types, customer behaviors, and root causes. This visibility empowers teams to refine policies, prevent future errors, and strengthen overall deduction recovery performance.

b. Trade Promotion Management (TPM) Systems

TPM solutions play a vital role in the post-audit defense framework by maintaining a comprehensive digital audit trail for every promotional activity. Each change—whether to pricing, funding, or terms—is logged with timestamps, user IDs, and reasons for modification. This level of transparency eliminates ambiguity and provides indisputable proof during audits.

TPM systems also consolidate proof of performance, contract attachments, and approval workflows into a single, easily accessible record. When integrated with accounts receivable platforms, they deliver end-to-end visibility into every deduction, ensuring no promotional payment or allowance is validated without supporting evidence.

In addition, real-time analytics within TPM systems highlight compliance gaps and performance variances, enabling teams to address potential audit risks before they materialize into deductions.

c. Automation and Workflow Management

Automation brings speed, consistency, and control to deduction handling. Automated approval workflows ensure that every promotion, claim, and settlement follows a documented process, capturing the full chain of authorization. Real-time alerts notify teams of new audit claims or pending tasks, preventing missed deadlines and improving responsiveness.

Centralized workflow tools eliminate manual searches and disconnected communication trails, allowing finance and trade teams to collaborate seamlessly. This automation not only reduces the administrative burden but also reinforces compliance by keeping every approval, adjustment, and resolution traceable in the system.

Handling and Disputing Post-Audit Claims

When post-audit deductions arise, a structured and disciplined dispute process is essential to minimize financial exposure and maintain control. Every claim must be treated as a formal financial assertion requiring evidence-based validation. The first step is documentation verification—immediately review the claim for completeness, ensuring that it includes invoices, trade agreements, proof of delivery, and promotional validation. Claims lacking proper documentation should be rejected outright, citing corporate policy and compliance standards such as Sarbanes-Oxley, which prohibit the acceptance of unsupported charges.

For claims that are incomplete, inconsistent, or clearly inaccurate, swift escalation is crucial. If auditors or intermediaries remain unresponsive or inflexible, the issue should be taken directly to customer management rather than confined within the auditor’s limited communication channel. Direct dialogue with the retailer’s finance or procurement leadership often accelerates fair resolution and prevents the auditor from controlling the narrative.

Organizations should also avoid settling claims hastily for the sake of convenience. Although lump-sum settlements may seem efficient, they often encourage auditors to continue targeting the company for similar “gray area” deductions in the future. Instead, insist that every line item be validated individually—documented, researched, and disputed where invalid. Consistency in this approach builds a reputation for fairness and firmness, signaling that the company enforces its policies rigorously and will not accept baseless deductions.

Equally important is maintaining a complete communication record for every interaction. All correspondence, supporting evidence, and decision histories should be documented in centralized systems to strengthen audit defensibility and future reference. Over time, this meticulous documentation becomes both a learning resource and a legal safeguard.

Ultimately, consistent enforcement of established policies—without exception—builds a “no-pushover” reputation among auditors and retailers alike. Companies known for disciplined processes and strong documentation are far less likely to face recurring or inflated claims.

The Role of Continuous Audits and Internal Reviews

Continuous internal auditing is the backbone of proactive post-audit deduction prevention. Instead of waiting for external auditors to identify discrepancies, companies must take control of their own financial integrity by conducting internal audits at regular intervals. These internal checks help detect compliance gaps, reconcile unsettled claims, and validate that all trade activities align with contract terms and system records.

Reviewing contracts, settlements, and invoice histories on a consistent basis allows teams to catch potential anomalies before they escalate into post-audit deductions. Each internal review cycle should also verify the accuracy of accrual balances, promotional funding records, and credit memos, ensuring that all adjustments are properly applied and documented.

Maintaining a “living audit trail” through digital systems is vital. Automated audit logs within trade promotion and deduction management platforms record every modification—who made it, when, and why—creating complete transparency for both internal and external scrutiny. This continuous visibility drastically reduces the likelihood of errors being misinterpreted as unpaid obligations years later.

For maximum effectiveness, companies should perform quarterly audits of trade programs, customer terms, and accrual reconciliations. These routine reviews ensure that discrepancies are addressed in real time rather than discovered retrospectively during a retailer’s post-audit.

Through a disciplined cycle of internal auditing, data validation, and performance monitoring, organizations move from reactive problem-solving to predictive risk management. This shift transforms post-audit deduction handling from a recurring financial burden into a controlled, continuously improving process that protects revenue, strengthens compliance, and enhances long-term customer trust.

Conclusion

Post-audit deductions are not just accounting nuisances—they are financial, operational, and reputational challenges that can quietly erode profitability if left unmanaged. As the landscape of retail and trade promotions grows increasingly data-driven and complex, the ability to respond to, analyze, and prevent these deductions has become a defining capability of high-performing finance organizations. Companies that treat post-audit deduction management as a strategic function—rather than an afterthought—gain far more than cost recovery; they build stronger audit resilience, enforce data discipline, and strengthen relationships with their retail partners.

The path forward lies in combining structured policies, clear communication, and intelligent automation. A well-defined post-audit policy backed by centralized documentation, robust deduction management software, and continuous internal reviews transforms chaos into control. Moreover, organizations that emphasize root cause analysis and continuous improvement move beyond merely responding to deductions—they predict and prevent them.

In the end, post-audit deductions are inevitable, but losses from them are not. With disciplined processes, transparent collaboration, and data-backed technology, every claim can be addressed with confidence, every dollar accounted for, and every customer relationship reinforced by fairness and professionalism. The companies that master this will not only protect their profits but elevate their entire approach to revenue integrity and operational excellence.