What is a Pharmacy Benefits Manager (PBM)?

Pharmacy benefit managers, commonly known as PBMs, play a central yet often debated role in how Americans access prescription medications.

In recent years, PBMs have drawn increased attention from the media and policymakers at both the federal and state levels. Still, because they work largely behind the scenes within the pharmaceutical supply chain, many people aren’t fully aware of their existence. Even those familiar with PBMs may find their operations and responsibilities confusing, especially within the broader healthcare system.

So, let’s break down what PBMs are and why they matter.

Table of Contents:

- What Is a Pharmacy Benefit Manager (PBM)?

- What Are the Responsibilities of a Pharmacy Benefit Manager?

- Handling Drug Rebates

- How Do PBMs Work with Pharmaceutical Companies?

- How Do PBMs Work with Employers?

Jump to a section that interests you, or keep reading.

What Is a Pharmacy Benefit Manager (PBM)?

At a basic level, a PBM is an administrator that manages prescription drug claims for “payers.” These payers can include employers, labor unions, municipalities, health plans (commercial, Medicaid, and Medicare Part D), and other organizations that offer prescription coverage to their members.

To carry out this role, PBMs negotiate contracts with pharmaceutical manufacturers and retail pharmacies to balance medication access with cost control.

They also manage many operational tasks such as plan design, eligibility management, ID card production, formulary creation and updates (the list of covered drugs), and numerous other behind-the-scenes processes.

For example, an employer may rely on a PBM to ensure employees can access prescribed medications through their health benefits.

What Are the Responsibilities of a Pharmacy Benefit Manager?

Most PBM responsibilities fall into two broad areas: structuring prescription benefit plans and ensuring patients have access to appropriate medications to support their health.

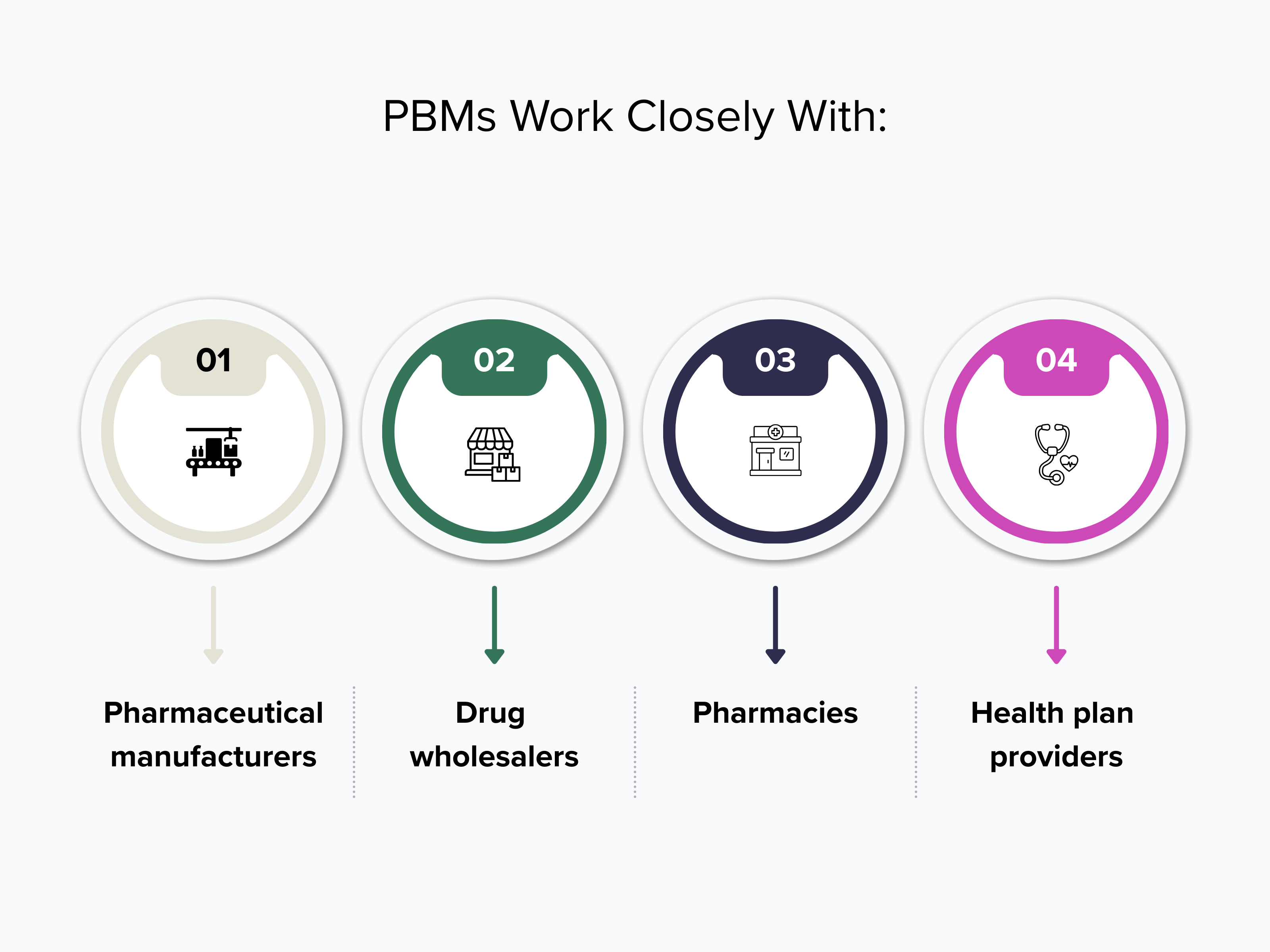

To meet these goals, PBMs work closely with several parties, including:

- Pharmaceutical manufacturers

- Drug wholesalers

- Pharmacies

- Health plan providers

PBMs oversee more than 80% of pharmacy benefit negotiations and related activities in the United States for a wide range of clients. Because of this reach, they play a major role in determining drug pricing, rebates, and reimbursement structures across the healthcare system.

Handling Drug Rebates

Drug rebates are often a point of debate because they’re negotiated between PBMs and pharmaceutical manufacturers on a drug-by-drug basis and paid directly to PBMs. Depending on the agreement a PBM has with an employer, plan sponsor, or other stakeholders, some or all of these rebates may be passed back to them.

In some cases, PBMs aren’t required by contract to return any portion of the rebates, allowing them to retain part or all of the rebate amount. At Capital Rx, however, rebates are fully passed through to the plan sponsor.

How Do PBMs Work with Pharmaceutical Companies?

As mentioned earlier, PBMs maintain direct relationships with drug manufacturers and generate revenue through these partnerships. That said, these relationships can be complex. Negotiations often involve financial pressures and potential conflicts of interest that create challenges for both sides.

Because PBMs act as an intermediary between manufacturers and patients, they play a key role in determining how affordable medications are for those who need them. To support patient access, PBMs must put pricing structures and programs in place that balance cost considerations with clinical suitability.

How Do PBMs Work with Employers?

PBMs also contract directly with employers to design prescription benefit plans. Once a plan is established, the PBM administers the benefits and ensures employees understand what coverage is available to them.

Employers can choose from several pricing models and drug cost benchmarks, each with its own trade-offs.

Three commonly used pricing model categories include:

- Traditional Pricing: A negotiated percentage discount off the Average Wholesale Price (AWP), applied across retail, mail-order, and specialty pharmacies.

- Pass-Through Pricing: Negotiated drug pricing where formulary rebates are passed to patients at the point of sale or returned to the insurer, depending on contract terms.

- National Average Drug Acquisition Cost (NADAC) Pricing: Pricing based on the estimated invoice cost pharmacies pay for medications in the U.S. This model reflects average real-world acquisition costs rather than manufacturer list prices, avoiding the inflation commonly associated with AWP.

Conclusion

Pharmacy benefit managers play a central role in how prescription drugs are priced, accessed, and delivered across the U.S. healthcare system. While they often operate out of public view, their decisions influence everything from formulary design and pharmacy networks to rebates, reimbursements, and out-of-pocket costs for patients.

Understanding how PBMs work—and how they interact with pharmaceutical manufacturers, employers, pharmacies, and health plans—brings much-needed clarity to a complex system. It also helps employers and plan sponsors ask better questions, evaluate pricing models more carefully, and choose partners that align with their priorities around transparency and patient access.

As healthcare continues to face cost pressures and regulatory scrutiny, the role of PBMs will remain under close examination. Greater awareness and informed decision-making can help ensure prescription benefit programs are designed with fairness, accountability, and patient needs at the center.