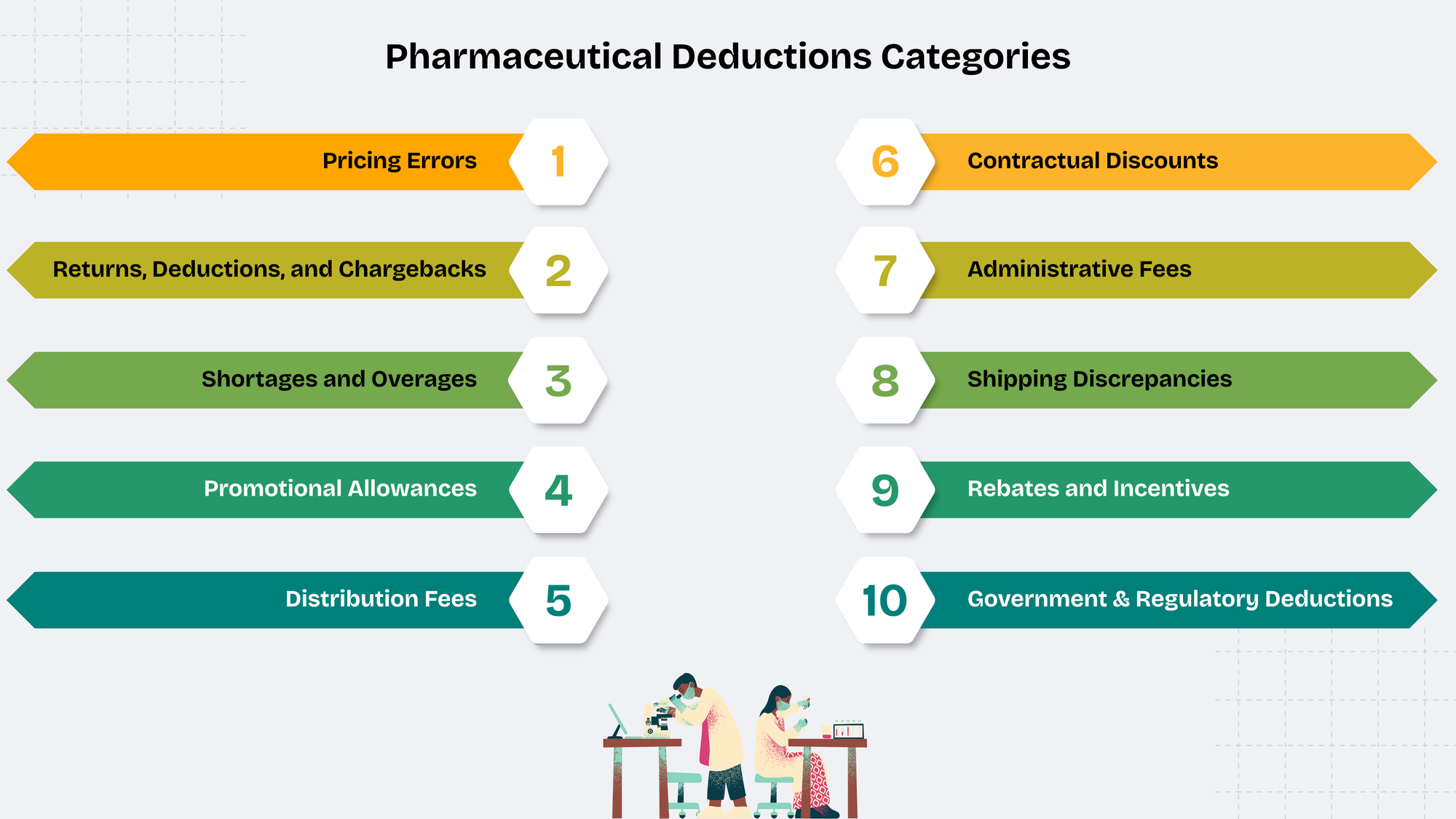

Pharmaceutical Deductions Categories

In the pharmaceutical industry, managing accounts receivable deductions is not just a financial task—it’s a critical process that directly affects profitability. With some deduction categories experiencing error rates as high as 50–75%, even small discrepancies can translate into substantial financial losses. These challenges are amplified by the complexity of contracts, regulatory programs, and distribution channels unique to the pharma sector.

Below are the most prevalent types of deductions affecting pharmaceutical manufacturers and distributors, along with the reasons behind them:

Table of Contents:

1. Pricing Errors

2. Returns, Deductions, and Chargebacks

3. Shortages and Overages

4. Promotional Allowances

5. Distribution Fees

6. Contractual Discounts

7. Administrative Fees

8. Shipping Discrepancies

9. Rebates and Incentives

10. Government and Regulatory Deductions

Jump to a section that interests you, or keep reading.

1. Pricing Errors

Pricing discrepancies are one of the most common causes of deductions. These occur when there’s a mismatch between the invoiced price and the contracted price, often due to misapplied discounts or incorrect promotional pricing. Given the volume of contracts in pharma, even small pricing deviations can add up quickly.

2. Returns, Deductions, and Chargebacks

The pharmaceutical supply chain sees frequent product returns—often because of expiration, damage, or overstock at the customer level. Chargebacks are another major deduction category: wholesalers sell products to pharmacies or healthcare providers at prices lower than the manufacturer’s invoice price, triggering a refund obligation back to the wholesaler.

3. Shortages and Overages

When there’s a difference between the quantity ordered, shipped, or received, deductions arise. Shortages are more frequent, but even overages can create accounting mismatches that require resolution.

4. Promotional Allowances

Manufacturers often offer marketing or co-op programs, rebates, and promotional discounts. Deductions occur when claimed benefits differ from the agreed terms or when customers submit claims lacking proper documentation.

5. Distribution Fees

Distributors may charge fees for logistics, handling, or storage services. These fees can lead to disputes if they don’t align with contractual terms, resulting in unauthorized deductions.

6. Contractual Discounts

Pharmaceutical contracts often include provisions for volume or early payment discounts. If these are incorrectly applied or misinterpreted during billing, the result is an inaccurate deduction.

7. Administrative Fees

Fees charged for order processing or other administrative services can be challenged if deemed excessive or not pre-approved under contract terms.

8. Shipping Discrepancies

Deductions may occur when delivery schedules, packaging conditions, or shipment documentation fail to meet expectations—especially in cases of damage, delay, or non-compliance with shipping requirements.

9. Rebates and Incentives

Rebate programs and incentive-based agreements are prone to disputes when claim documentation is incomplete or when terms are misinterpreted. This often requires extensive reconciliation and validation of supporting data.

10. Government and Regulatory Deductions

Pharmaceutical companies are subject to government pricing programs such as Medicaid, as well as other regulatory fees. Errors in reporting or calculation can result in mandatory deductions that require detailed compliance reviews.

Addressing Pharmaceutical Deductions

Effectively managing deductions in the pharmaceutical sector requires a structured, data-driven approach. Key practices include:

- Comprehensive reconciliation of accounts and claims

- Strict contract compliance monitoring

- Accurate and timely billing practices

- Proactive dispute resolution to minimize revenue leakage

Conclusion

Pharmaceutical deductions represent one of the most intricate areas of revenue management, given the interplay of pricing, contracts, returns, and regulatory factors. Companies that take a proactive, technology-supported approach can significantly reduce financial exposure while maintaining operational precision.