The Complete Guide to the Order-to-Cash (O2C) Process

The Order-to-Cash (O2C) process is more than a finance workflow—it is the backbone of how businesses turn demand into revenue. Spanning every step from the moment a customer places an order to when payment is reconciled in accounts receivable, O2C integrates sales, operations, supply chain, and finance into one continuous cycle. When executed well, it fuels liquidity, accelerates growth, and strengthens customer loyalty; when mismanaged, it creates disputes, delays cash inflows, and erodes profitability.

This guide provides the most comprehensive view of the O2C lifecycle, covering definitions, stages, best practices, common pitfalls, enabling technologies, and model-specific adaptations.

Table of Contents:

- What Is the Order-to-Cash Process?

- Why Order-to-Cash Is Important?

- Key Stages in the Order-to-Cash Lifecycle

- Best Practices in the Order-to-Cash Process

- Common O2C Challenges & Barriers (and Solutions)

- Order-to-Cash for Different Business Models

- Conclusion

Jump to a section that interests you, or keep reading.

What Is the Order-to-Cash Process?

The Order-to-Cash (O2C) process—sometimes referred to as OTC—is the complete business cycle that begins the moment a customer places an order and concludes only when payment is received, processed, and reconciled in accounts receivable. This cycle is not a single handoff but a chain of interconnected steps, including order entry, credit management, fulfillment, shipping, invoicing, collections, and reporting. Each phase must operate seamlessly to ensure revenue moves quickly from a confirmed sale to usable cash.

For finance leaders, CFOs, and operations managers, O2C is more than a back-office routine. It is a strategic lever that determines how efficiently sales translate into working capital. A streamlined O2C process accelerates cash flow, strengthens liquidity, reduces days sales outstanding (DSO), and minimizes disputes that tie up capital. It also builds reliability in financial reporting, eases audit preparation, and underpins compliance with revenue recognition rules such as ASC 606. By contrast, inefficiencies—manual errors, billing delays, or weak credit controls—directly impact liquidity forecasts, increase the risk of bad debt, and complicate closing the books.

The impact of O2C extends beyond finance into every operational layer of the business. Sales teams depend on it to deliver on promises without pricing or contract errors. Supply chain and inventory management rely on accurate order data to prevent stockouts, overstocking, and shipment delays. Customer service uses it to provide clear visibility into order status and resolve disputes quickly. Accounts receivable functions lean on O2C to ensure payments are collected on time, while compliance teams rely on standardized records for regulatory accuracy. In short, the efficiency of the O2C cycle influences customer satisfaction, profitability, and operational resilience across the enterprise.

It is also important to distinguish O2C from the broader Quote-to-Cash (Q2C or QTC) cycle. While O2C starts after an order is confirmed, Q2C begins earlier, covering lead qualification, quote preparation, and pricing negotiations before order placement. O2C can therefore be seen as a critical subset of Q2C—where customer intent becomes a binding transaction and the company’s ability to execute is tested. Businesses that master O2C not only ensure cash flow stability but also create the foundation for scaling revenue operations efficiently.

Why Order-to-Cash Is Important?

The Order-to-Cash (O2C) process is central to financial health because it governs how quickly revenue is converted into usable cash. By compressing the time between order placement and payment reconciliation, businesses accelerate cash flow and strengthen working capital, ensuring they have funds available for payroll, supplier payments, acquisitions, and reinvestment in growth. Delays in O2C—from order errors to late invoicing—slow inflows, create liquidity strain, and amplify dependency on external financing.

Beyond finance, O2C directly shapes the customer experience. Customers expect their orders to be fulfilled quickly, billed accurately, and supported by transparent updates. A smooth cycle reduces disputes, eliminates confusion about what is owed and when, and ensures timely deliveries. This reliability builds trust, encourages repeat purchases, and fosters customer loyalty. In contrast, errors or delays in invoicing, fulfillment, or collections erode satisfaction and risk damaging long-term relationships.

Efficiency in O2C also translates into lower Days Sales Outstanding (DSO) and enhanced liquidity. Automating order entry, invoicing, and payment tracking shortens cycle times and minimizes outstanding receivables, giving finance leaders greater control over cash forecasting. Reliable inflows mean fewer surprises in accounts payable and less pressure during liquidity crunches.

Operationally, O2C is a backbone for efficiency and predictability. Integrated order, inventory, and receivables data prevent bottlenecks, reduce manual corrections, and provide accurate inputs for month-end close. Instead of scrambling to reconcile mismatched records, finance teams benefit from synchronized, real-time information that enables faster, more dependable financial reporting and supports confident forecasting for FP&A.

Finally, a structured O2C process strengthens internal controls, compliance, and audit readiness. Standardized workflows establish consistent audit trails, safeguard against fraud, and support adherence to complex frameworks like ASC 606. Clear documentation across order capture, billing, and collections provides assurance that reported revenue is accurate, complete, and defensible. This rigor not only reduces regulatory and legal risks but also builds confidence with auditors, investors, and stakeholders.

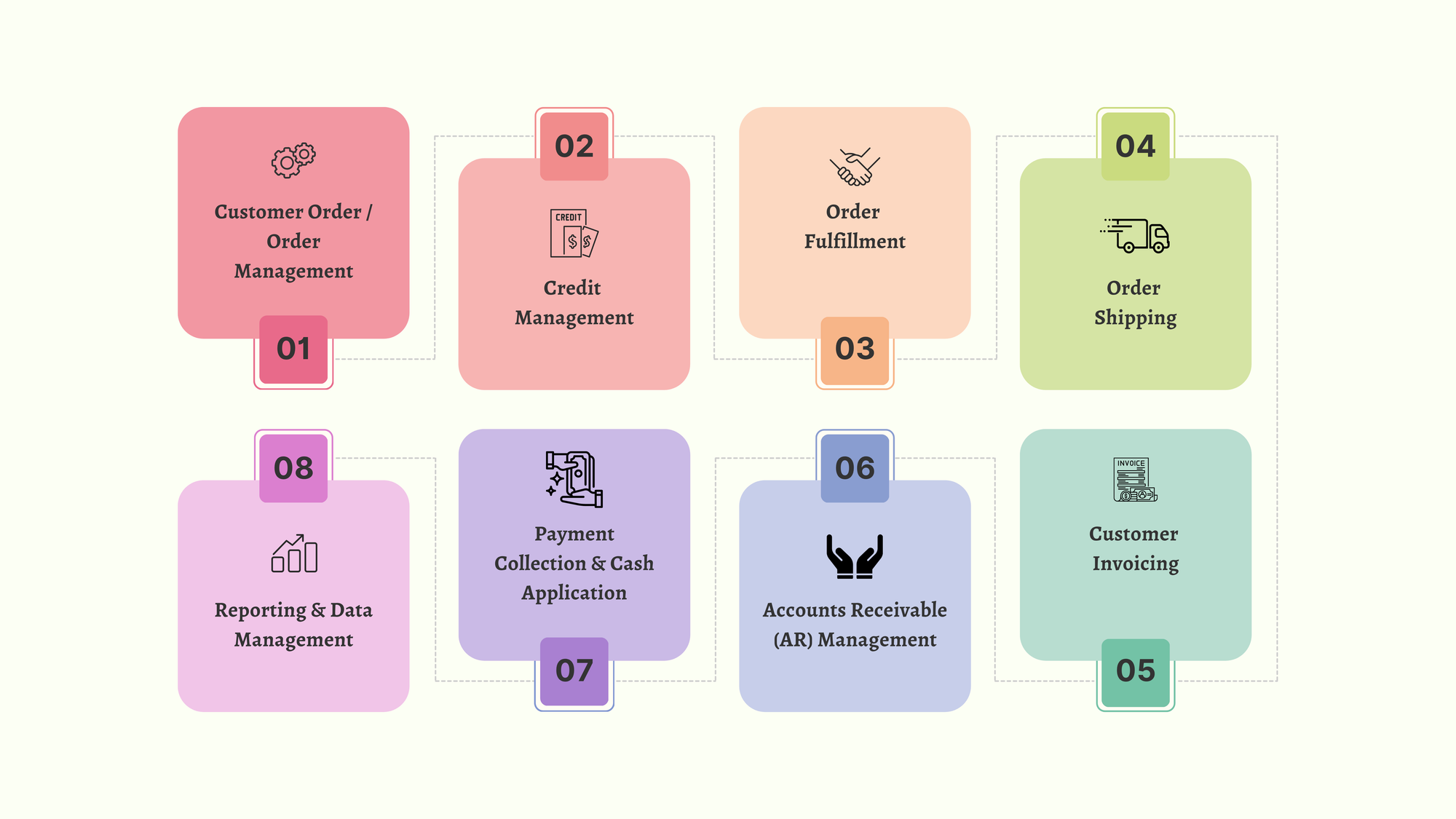

Key Stages in the Order-to-Cash Lifecycle

The Order-to-Cash (O2C) lifecycle is a structured series of interconnected steps that transform a customer order into recognized revenue and reconciled cash. Each stage contributes to accuracy, speed, and financial integrity. Optimizing the entire flow is essential because inefficiencies at any point cascade across operations, affecting customer satisfaction, liquidity, and compliance.

1. Customer Order / Order Management

The cycle begins when an order is placed—via ecommerce platforms, sales representatives, email, or phone. Capturing accurate information at this stage is critical, covering product codes, pricing, tax applicability, delivery requirements, and payment terms. An Order Management System (OMS) automates this process, routing orders across departments, validating data, and synchronizing with inventory to avoid over-promising. Effective validation ensures that incorrect SKUs, missing PO numbers, or tax miscalculations don’t snowball into costly downstream disputes. Preventing such errors reduces manual corrections, speeds up fulfillment, and strengthens customer confidence from the outset.

2. Credit Management

When orders involve credit terms, assessing customer financial risk protects the business from defaults. This includes running credit checks for new customers, monitoring payment histories for existing accounts, and establishing appropriate credit limits and terms. Automation and AI/ML-driven scoring improve precision by factoring in external data, payment patterns, and predictive indicators. Dynamic reviews—updating limits and terms in real time—are far more effective than static credit approvals, reducing exposure to bad debt while ensuring that low-risk customers move quickly to fulfillment.

3. Order Fulfillment

Once cleared, orders move to fulfillment: picking, packing, and shipping, or manufacturing for built-to-order products. Integration with inventory management systems ensures stock levels are accurate, preventing delays caused by stockouts or overselling. Capturing Proof of Delivery (POD) is essential not only for customer transparency but also for compliance with accounting standards like ASC 606, which require confirmation of control transfer before revenue recognition. Real-time tracking of fulfillment milestones eliminates bottlenecks and provides the finance team with reliable data for invoicing and reporting.

4. Order Shipping

Shipping execution determines whether promises made at order entry are delivered. This stage requires close coordination of logistics, carrier pickups, and delivery schedules. Automated systems generate tracking numbers, send customer notifications, and update order status in real time. For companies shipping internationally, compliance with customs requirements and accurate documentation is crucial to avoid border delays and penalties. Regular audits of shipping performance safeguard service quality, ensuring customers receive goods on time and at expected cost.

5. Customer Invoicing

Invoices connect operational execution with financial recognition. Accuracy here is paramount: invoices must include order specifics, unit prices, applicable taxes, credit terms, discounts, and delivery dates. Automated invoicing systems eliminate delays between fulfillment and billing, while reducing errors that frequently trigger disputes or late payments. E-invoicing, increasingly mandated by regulators in many regions, streamlines delivery, supports digital audit trails, and ensures faster processing by customers’ AP departments. Conversely, reliance on manual invoicing increases risk of errors, slows collections, and undermines cash forecasts.

6. Accounts Receivable (AR) Management

After invoicing, the focus shifts to monitoring receivables. AR teams track open invoices, aging reports, and disputes, ensuring payment expectations are clear and issues are resolved promptly. Automation flags overdue accounts, triggers reminders, and provides dashboards to manage large volumes of receivables efficiently. Rapid resolution of invoice errors—whether from misapplied payments or incorrect details—maintains cash flow predictability. Effective AR management directly supports accurate liquidity planning and reliable financial forecasts.

7. Payment Collection & Cash Application

Payment collection encompasses receiving funds through diverse methods—ACH, wire transfers, checks, credit cards, or digital wallets—and ensuring they are processed securely and efficiently. Cash application then matches these payments to the correct invoices, reducing unapplied or misapplied cash that complicates reporting. Automation and AI improve match rates, accelerate reconciliation, and minimize manual effort. For overdue payments, businesses enforce credit holds, apply penalties, and escalate collections tactfully while preserving customer relationships. Strong processes here reduce DSO and enhance working capital.

8. Reporting & Data Management

The final stage involves consolidating data from across the O2C cycle to generate actionable insights. Key metrics include Days Sales Outstanding (DSO), order cycle time, AR turnover, and invoice accuracy rates. ERP systems and analytics platforms provide a single source of truth, enabling finance leaders to identify bottlenecks, monitor compliance, and align performance with strategic objectives. Advanced techniques like process mining and AI-driven analytics detect inefficiencies early, while comprehensive digital audit trails ensure regulatory compliance and audit readiness. With integrated reporting, companies can continuously refine the O2C process, driving both financial and operational resilience.

Best Practices in the Order-to-Cash Process

An efficient Order-to-Cash (O2C) process doesn’t happen by accident—it requires deliberate structure, disciplined execution, and continuous optimization. The following best practices, drawn from proven frameworks and modern O2C implementations, ensure accuracy, speed, and resilience across the cycle.

1. Streamline Order Entry and Validation

Errors introduced at order capture ripple through the entire process, causing fulfillment delays, billing disputes, and customer dissatisfaction. Establishing clear workflows and automating order entry minimizes manual input and ensures validation of pricing, taxes, credit terms, and product availability upfront. Standardized order formats reduce misinterpretations and cut down on costly rework.

2. Standardize Policies and Workflows Across Departments

Fragmented processes create silos, inconsistent data, and operational bottlenecks. Defining policies for credit approvals, billing cycles, dispute resolution, and collections enforces discipline across teams. Documented, standardized workflows create predictability, strengthen controls, and enable scalability without adding unnecessary headcount.

3. Enhance Customer Communication

Transparent communication builds trust and reduces disputes. Automated alerts for order confirmation, shipment tracking, invoice delivery, and payment reminders keep customers informed at every stage. Proactive updates on potential issues—such as delivery delays—help manage expectations and preserve long-term relationships.

4. Integrate Inventory, Shipping, Invoicing, and AR

Siloed systems delay data flow and create reconciliation challenges. Integration ensures inventory levels are accurate before accepting orders, shipments are aligned with commitments, invoices are generated promptly after fulfillment, and receivables are updated in real time. A unified data environment eliminates duplication and enhances visibility across the cycle.

5. Monitor and Manage Credit Risk Continuously

Static credit reviews expose businesses to avoidable bad debts. Leveraging credit management tools to monitor customer payment behavior, adjust limits dynamically, and trigger alerts for deteriorating risk strengthens revenue protection. Continuous monitoring ensures resources are extended only to creditworthy customers without introducing bottlenecks for low-risk accounts.

6. Automate Wherever Possible

Manual steps in invoicing, receivables, or reporting slow operations and introduce error risk. Automation enables faster invoice generation, electronic delivery, auto-matching of payments, and prioritized collections workflows. AI-driven tools can enhance cash application, dispute resolution, and collections prioritization, ensuring human effort focuses on exceptions rather than routine tasks.

7. Regular KPI Tracking and Performance Reviews

Monitoring key metrics—such as Days Sales Outstanding (DSO), order cycle time, invoice accuracy, and AR turnover—provides insight into process health. Regular reviews identify bottlenecks early, inform process refinements, and drive accountability across departments. Data-driven decision-making prevents reactive firefighting and supports proactive improvements.

8. Ensure Compliance and Robust Data Security

Regulatory compliance and data protection are non-negotiable. Businesses must enforce audit-ready documentation, standardized billing practices, and secure handling of customer data. Strong internal controls and encryption safeguard sensitive financial information, minimizing the risk of fraud, breaches, or non-compliance penalties.

9. Foster Cross-Functional Collaboration

Because O2C spans sales, operations, and finance, collaboration is critical. Shared platforms and integrated dashboards align teams around common goals and provide a single source of truth. Cross-functional reviews encourage joint problem-solving, reduce finger-pointing, and ensure collective accountability for performance.

10. Train Staff and Listen to Feedback

Technology is only as effective as the people using it. Ongoing training ensures teams understand tools, policies, and best practices. Listening to both staff and customers highlights recurring pain points—whether delayed shipments or confusing invoices—that may not be visible in performance data. Continuous feedback loops foster trust, engagement, and iterative improvement.

Common O2C Challenges & Barriers (and Solutions)

Despite its critical role in cash flow and customer satisfaction, the Order-to-Cash (O2C) process is often hindered by operational inefficiencies and structural weaknesses. Left unaddressed, these issues increase costs, extend Days Sales Outstanding (DSO), and strain customer relationships. Below are the most common barriers businesses face, along with strategies to overcome them.

1. Manual Errors in Order Entry, Invoicing, and AR

Human-driven processes are prone to mistakes—misentered SKUs, incorrect pricing, or misplaced decimal points—that ripple through fulfillment, billing, and collections. Such errors create disputes, delay payments, and consume valuable staff time in corrections.

Solution: Automate order capture, invoice generation, and cash application. Validation rules and pre-billing checks catch discrepancies early, reducing the need for downstream rework.

2. Delays in Order Processing and Fulfillment

Slow order verification or inefficient warehouse management causes missed delivery windows, damaging both cash flow and customer satisfaction.

Solution: Implement Order Management Systems (OMS) with real-time inventory integration. Automation accelerates verification, and coordinated warehouse systems ensure accurate, timely fulfillment.

3. Billing Inaccuracies and Disputes

Invoices with errors—wrong amounts, missing discounts, or inconsistent tax application—often result in payment holds. Dispute resolution is resource-intensive and extends DSO.

Solution: Use automated invoicing systems integrated with order and fulfillment data. Standardized invoice formats and digital delivery minimize discrepancies and accelerate customer approvals.

4. Inefficient Collections and Poor Visibility into Receivables

Without real-time tracking, businesses lack clarity on overdue accounts, leading to inconsistent follow-ups and missed cash flow targets.

Solution: Deploy AR automation that flags overdue invoices, triggers payment reminders, and prioritizes collections. Dashboards provide visibility into receivables, enabling proactive action and accurate cash forecasting.

5. Static or Inconsistent Credit Management

Extending credit without continuous monitoring increases exposure to bad debt, while overly rigid policies can alienate reliable customers.

Solution: Adopt dynamic credit management using automated scoring and AI/ML-based risk assessment. Adjust limits and terms in real time based on payment history and external data.

6. Inventory Mismatches Leading to Stockouts or Overstock

Disconnected inventory systems create discrepancies between what is promised and what can be delivered. Stockouts lead to cancellations, while overstock inflates carrying costs.

Solution: Integrate inventory management with OMS and ERP systems for real-time visibility. Automated updates synchronize stock levels across sales, fulfillment, and finance.

7. Communication Breakdowns with Customers

Lack of proactive updates on orders, invoices, or disputes creates confusion, frustration, and delays in payment.

Solution: Establish automated notifications for order confirmation, shipment tracking, invoicing, and overdue reminders. Transparent communication builds trust and reduces dispute rates.

8. Compliance Risks, Audit Trail Gaps, and Fraud

Inadequate documentation, inconsistent billing records, or unsecured data expose businesses to regulatory penalties, audit failures, and fraud.

Solution: Standardize O2C workflows, enforce digital recordkeeping, and implement secure financial systems. Detailed audit trails and encryption safeguard both compliance and customer data.

9. Disconnected Systems (CRM, ERP, Billing)

Siloed platforms create data handoff issues, reconciliation challenges, and reporting delays. Finance, sales, and operations operate on different versions of the truth, slowing decision-making.

Solution: Integrate CRM, ERP, billing, and AR systems into a unified data environment. Cross-functional platforms improve visibility, reduce manual reconciliations, and enable end-to-end analytics.

Order-to-Cash for Different Business Models

While the Order-to-Cash (O2C) process follows the same fundamental structure across industries—order capture through payment reconciliation—the execution differs significantly depending on the business model. Tailoring O2C workflows to industry-specific needs ensures compliance, customer satisfaction, and efficient cash flow management.

1. Subscription Businesses

Recurring revenue models such as streaming, SaaS subscriptions, and delivery services introduce complexity into billing and collections. Unlike one-time sales, these businesses must generate invoices at fixed intervals for each active customer, often in very high volumes. Billing amounts may vary due to promotional discounts, tiered pricing, or overage charges, requiring flexible invoicing systems capable of managing variable structures. Revenue recognition also poses challenges, particularly when subscriptions include free trials, bundled services, or usage-based elements. Manual billing is unsustainable at scale; automation and integrated ERP platforms are essential to maintain accuracy, generate audit-ready records, and manage recurring invoices without overwhelming finance teams.

2. SaaS and Usage-Based Pricing

Software-as-a-Service (SaaS) models frequently combine flat subscription fees with variable usage charges. This creates unique demands on the O2C cycle: invoices must reflect accurate consumption data, apply discounts, and handle transitions from free trials to paid plans seamlessly. Overages or tier upgrades must be calculated and billed without delay, requiring integration between product usage tracking systems and invoicing platforms. Ensuring compliance with revenue recognition rules such as ASC 606 is especially important, as revenue must align with actual service delivery. Automated billing and revenue management tools help SaaS companies manage complexity while reducing disputes and accelerating collections.

3. B2B with Credit Terms

In B2B environments, extending credit is standard practice but also introduces risk. Large orders often require upfront credit checks, approval workflows, and ongoing monitoring of customer payment behavior. Static credit policies expose businesses to unnecessary bad debt, while inconsistent handling of disputes can tie up receivables and strain customer relationships. A robust O2C cycle for B2B must include dynamic credit management, automated scoring, and proactive communication when accounts fall overdue. Dispute resolution tools and clear escalation processes are critical to preserving customer trust while ensuring timely collections. For CFOs and AR leaders, effective credit and dispute management directly impacts liquidity and customer retention.

4. Ecommerce

High-volume ecommerce businesses rely on speed and accuracy in O2C execution. Orders are typically placed through digital platforms and must trigger immediate order confirmation, inventory checks, and fulfillment workflows. Any delays in processing, incorrect stock data, or slow invoicing erode customer satisfaction and lead to cancellations. Automated OMS systems, real-time inventory integration, and digital invoicing ensure that orders are processed at scale with minimal manual intervention. Payment gateways that support multiple methods—from credit cards to digital wallets—further streamline collections. For ecommerce, O2C is not just a financial process but a core component of the customer experience, where rapid fulfillment and transparent updates are decisive competitive differentiators.

Conclusion

A well-managed Order-to-Cash cycle does far more than process sales—it transforms revenue operations into a competitive advantage. By streamlining order entry, automating invoicing, integrating systems, and applying analytics to receivables, businesses can shorten cycle times, reduce Days Sales Outstanding (DSO), and safeguard liquidity. Just as importantly, O2C builds trust with customers through accurate billing, timely communication, and reliable delivery, turning operational excellence into customer loyalty.