The Impact of Rebates on Profit Margins

Are rebates helping or hurting your margins?

Rebates can be a powerful sales driver by incentivizing purchases and boosting revenue. But what about the bottom line?

While rebates can attract customers and move products, they also directly impact profit margins. Understanding this complex relationship is important for any business using or considering rebate programs.

This post dives deep into how rebates affect margins and explores the different types of rebates, as well as their potential impact on profitability.

Table of Contents:

- How Can Rebates Boost Sales and Revenue While Potentially Eroding Margins if Poorly Managed?

- How Volume-Based Rebates Affect Margins?

- How Growth Incentive Rebates Affect Margins?

- How Product Mix Rebates Affect Margins?

- Role of Rebates in Margin Protection

- Best Practices for Managing Rebates to Optimize Margins

- Role of Rebate Management Systems in Protecting Margins

Jump to a section that interests you, or keep reading.

How Can Rebates Boost Sales and Revenue While Potentially Eroding Margins if Poorly Managed?

Rebates help increase sales and revenue by incentivizing specific behaviors from buyers. Properly structured rebates drive larger purchase volumes, encourage repeat purchases, and strengthen relationships with trading partners.

By rewarding actual purchase behavior rather than promises, rebates ensure businesses gain measurable value from their incentive programs.

For instance, volume-based rebates encourage buyers to meet specific purchasing thresholds, while value-based rebates reward larger order values. Both strategies align with the goal of boosting top-line revenue through strategic incentives.

However, the same rebates that promote revenue growth can erode margins if not carefully managed. One common issue arises when businesses over-rely on rebates without aligning them with clear objectives.

Offering rebates without fully understanding their impact on profitability can lead to unintended consequences, such as trading partners misinterpreting incentive structures or focusing on products that dilute profitability.

For example, rebates applied to high-margin items can reduce overall earnings if screen margins are not carefully monitored, causing trading operations to lose clarity on actual profits.

Complex rebate structures also contribute to margin erosion. As rebate programs grow in size and diversity, managing their intricacies becomes challenging.

Overlapping discounts, errors in calculation, and poorly communicated terms can result in overpayments or lost revenue.

For instance, businesses relying on manual processes and spreadsheets struggle to handle the complexity of multi-tiered rebate programs, which leads to inefficiencies and revenue leakage.

In addition, poorly managed rebates can undermine trading partner trust. Ambiguity in rebate calculations or inconsistent application of terms discourages partners from fully participating in the program, ultimately affecting sales performance.

This lack of transparency not only limits the potential of rebates to drive growth but also damages their perceived value among stakeholders.

To avoid margin erosion while capitalizing on the benefits of rebates, businesses must design incentive programs that align with strategic goals, monitor their performance rigorously, and invest in rebate management tools.

How Volume-Based Rebates Affect Margins?

Volume-based rebates are incentives that suppliers offer to encourage buyers to purchase larger quantities by providing financial returns once specific purchase volumes are achieved. Here is how they affect margins:

Volume-based rebates are incentives that suppliers offer to encourage buyers to purchase larger quantities by providing financial returns once specific purchase volumes are achieved. While these rebates can boost sales and strengthen supplier-buyer relationships, they also have implications for profit margins.

Margin Reduction per Unit

When a buyer qualifies for a rebate, the cost per unit decreases due to the rebate received. This reduction means that, although sales volumes increase, the profit margin per unit sold diminishes.

For instance, a supplier sells a product for $10 per unit, with a production cost of $6 per unit (profit margin is $4/unit). They offer a $1 rebate per unit for purchases exceeding 5,000 units.

If a buyer purchases 6,000 units, then without the rebate, the revenue will be $60,000, and the profit will be $24,000 for the supplier. But considering the rebate, the supplier gives a $6,000 rebate back to the buyer, which reduces the total profit to $18,000.

The profit margin drops from $4/unit to $3/unit because of the rebate.

Overall Profit Increase

Despite the lower margin per unit, the total profit can rise because of the higher sales volume. The key is to ensure that the increased sales compensate for the reduced margin per unit.

In the above example, if a buyer purchases 6,000 units, then considering the rebate, the supplier gives a $6,000 rebate back to the buyer, which makes a total profit of $18,000.

If the buyer purchases 7,000 units, the supplier gives a $7,000 rebate back to the buyer. The supplier’s revenue will be $70,000, and profits will be $21,000. The increase in sales volume (1,000 additional units) results in an additional $3,000 profit (as compared to 5,000 units sold), even though the per-unit margin remains reduced at $3/unit due to the rebate.

If the buyer purchases 8,000 units, the supplier gives a $8,000 rebate back to the buyer. The supplier’s revenue will be $80,000, and profits will be $24,000. Again, the additional sales (1,000 more units) result in an increase of $3,000 in total profit.

Strategic Pricing

Suppliers must design rebate structures to balance incentivizing higher purchases and maintaining acceptable profit margins. Good rebate management can lead to increased revenue without significantly compromising overall profitability.

Considerations:

-

Threshold Setting: Establishing appropriate volume thresholds is important. Setting them too low will erode margins without significantly boosting sales while setting them too high will not provide sufficient incentive for buyers.

-

Retrospective vs. Non-Retrospective Rebates: In retrospective (or retroactive) rebates, once a threshold is surpassed, the highest rebate rate applies to all units purchased during the period. In non-retrospective (or incremental) rebates, the rebate applies only to units within each specific tier. Retrospective rebates can lead to more substantial margin reductions per unit compared to non-retrospective ones.

-

Growth Incentive Rebates: These rebates reward buyers for increasing their purchase volume over a baseline, encouraging growth while allowing suppliers to manage margins by setting appropriate rebate levels for incremental growth.

How Growth Incentive Rebates Affect Margins?

Growth incentive rebates encourage higher sales volume by rewarding customers who exceed sales targets. For example, a company offers a 5% rebate if a distributor increases purchases by 20% year-over-year. This encourages the distributor to increase their purchase by 20% every year, and economies of scale reduce the company's per-unit cost. The rebate reduces the selling price per unit slightly, but the larger volume spreads fixed costs, lowering per-unit costs. The result is higher overall profitability due to the cost savings from economies of scale, even if per-unit revenue is slightly reduced by the rebate.

However, if sales growth does not meet expectations or if the rebate is too high, margins will be eroded. For example,

- A supplier sells a product for $10 per unit.

- Production cost is $6 per unit, so the profit margin is $4 per unit.

- The supplier offers a 10% rebate if a buyer increases purchases by just 5% compared to the previous year.

Baseline Sales (Without Rebate)

-

Last year's sales: 10,000 units

- Revenue = 10,000 × $10 = $100,000

- Total Costs = 10,000 × $6 = $60,000

- Profit = Revenue − Costs = $40,000

Sales with Rebate (Target Growth of 5%)

- New sales target: 10,500 units (5% growth over 10,000 units).

- Revenue = 10,500 × $10 = $105,000.

- Total Costs = 10,500 × $6 = $63,000.

- Rebate cost = 10,500 × $10 × 10% = $10,500.

- Profit = Revenue − Costs − Rebate = $105,000 − $63,000 − $10,500 = $31,500.

Comparison

- Without Rebate: Profit = $40,000.

- With Rebate: Profit = $31,500.

Key Observations

- The rebate reduced profit by $8,500, even though sales grew by 5%.

- The additional 500 units sold added only $2,000 in gross profit (500 × $4/unit), but the rebate cost was significantly higher at $10,500.

Why This Erodes Margins

- The rebate percentage (10%) was too high relative to the incremental sales achieved (only 5% growth).

- The incremental revenue from growth was insufficient to cover the cost of the rebate.

How to Avoid This Issue

- Set Higher Growth Targets: Align rebates with meaningful growth thresholds (e.g., 15% or 20% growth).

- Use Tiered Rebates: Offer lower rebates for minimal growth and higher rebates for substantial growth.

- For example: 5% rebate for 10% growth, 10% rebate for 20% growth.

- Analyze Historical Trends: Use data to determine realistic sales growth potential and design rebates accordingly.

- Cap the Rebate: Limit the maximum rebate amount to prevent excessive margin erosion.

How Product Mix Rebates Affect Margins?

Product Mix rebates encourage buyers to purchase a broader or targeted range of products.

They promote the sale of higher-margin or underperforming products, improving profitability.

For example,

A supplier sells two types of products:

- Premium Product: $50 selling price with a $20 margin.

- Standard Product: $30 selling price with a $5 margin.

To promote the premium product, the supplier offers a 5% rebate if at least 40% of a customer’s order consists of premium products.

- A customer purchases 1,000 units, including 400 premium and 600 standard products.

- Revenue = (400 × $50) + (600 × $30) = $38,000.

- Profit before rebate = (400 × $20) + (600 × $5) = $11,000.

- Rebate = $38,000 × 5% = $1,900.

- Profit after rebate = $11,000 − $1,900 = $9,100.

Without the rebate, the customer might only purchase standard products:

- Revenue = 1,000 × $30 = $30,000.

- Profit = 1,000 × $5 = $5,000.

The rebate incentivized the customer to include premium products, resulting in significantly higher revenue and profit even after deducting the rebate.

But if customers purchase only low-margin products to qualify for the rebate, it reduces overall profitability. For example,

A supplier offers a 3% rebate for any order exceeding 1,000 units but doesn’t specify product mix requirements.

- A customer orders 1,000 units of a low-margin product with a $30 selling price and a $2 margin per unit.

- Revenue = 1,000 × $30 = $30,000.

- Profit before rebate = 1,000 × $2 = $2,000.

- Rebate = $30,000 × 3% = $900.

- Profit after rebate = $2,000 − $900 = $1,100.

In this case, the rebate significantly reduces the already slim profit margin, and the supplier might even lose money if additional costs (e.g., logistics) are factored in.

To prevent the negative impact, suppliers should design product mix rebates with clear conditions, such as setting minimum thresholds for higher-margin items or excluding low-margin products from rebate calculations.

Role of Rebates in Margin Protection

Unlike upfront discounts, rebates require buyers to achieve specific performance thresholds, such as purchase volume or value, before earning rewards. This structure ensures that discounts are granted only when they contribute to the desired business objectives, which safeguards profitability.

By focusing on actual buyer behavior, rebates minimize the risk of over-discounting on unfulfilled commitments. For example, volume-based rebates ensure that buyers who commit to purchasing 1,000 units are only rewarded after meeting the target, which prevents revenue leakage from partial purchases. This approach mitigates the risk of margin erosion caused by premature or unearned discounts.

Rebates also provide flexibility in customizing programs to target specific buyer behaviors to improve profitability. Growth incentive rebates encourage sustained purchasing increases to align customer behavior with long-term margin goals.

Product mix rebates promote the sale of higher-margin or slower-moving items to support both inventory management and revenue diversification. Each type of rebate can be strategically designed to optimize financial outcomes without compromising profitability.

Another critical aspect of rebates in margin protection is their ability to shield pricing integrity within multi-tiered reseller chains. By masking the exact price offered to end-users, rebates maintain control over margins across various levels of the distribution chain. This helps businesses avoid margin dilution in markets where competitive pricing pressures are high.

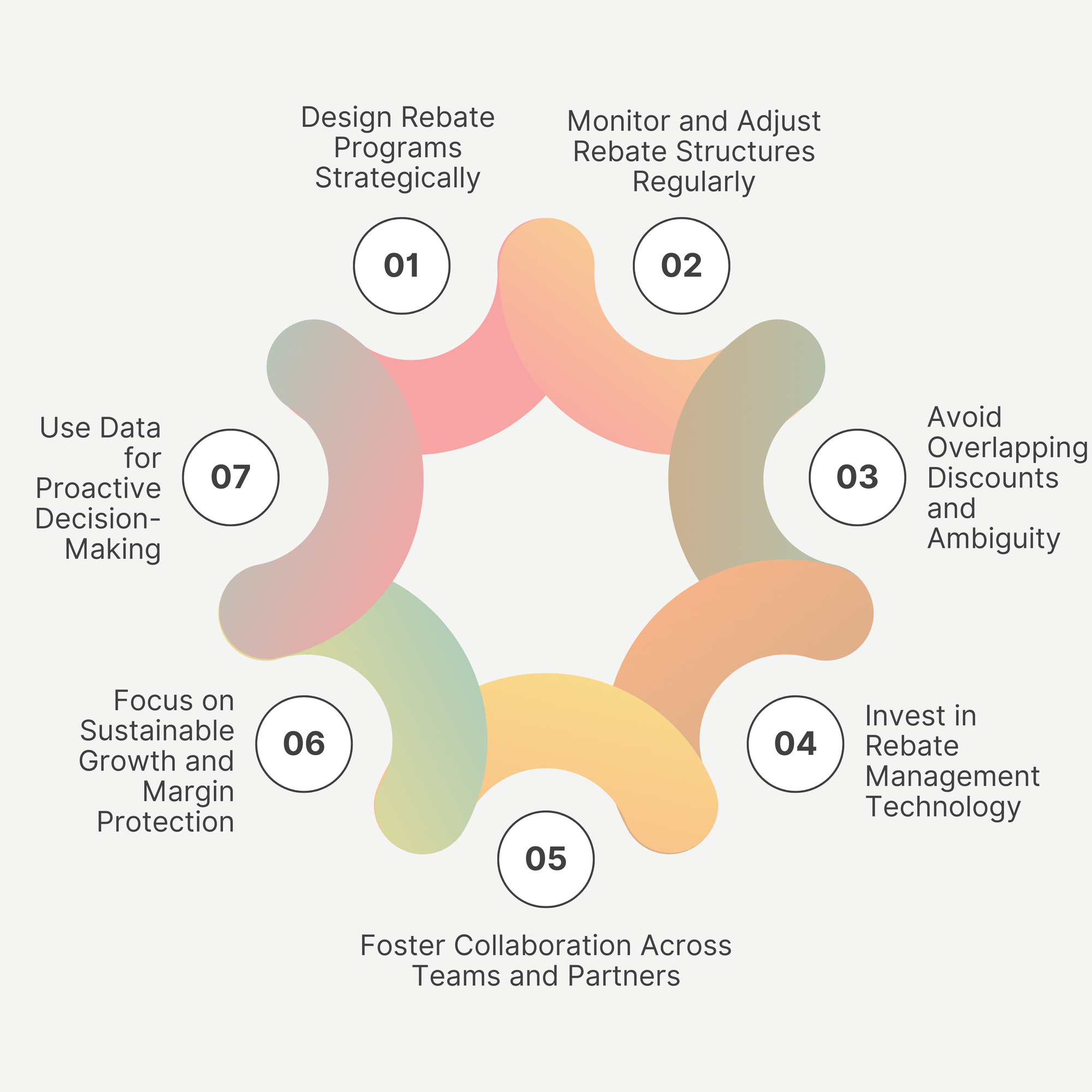

Best Practices for Managing Rebates to Optimize Margins

Adopting these best practices ensures rebates serve as a valuable tool for margin optimization.

1. Design Rebate Programs Strategically

Rebate programs should be tailored to encourage specific buyer behaviors, such as increasing purchase volume, diversifying product orders, or achieving growth milestones. Start by aligning rebates with clear business objectives and profitability targets.

For example, use tiered volume rebates to drive higher order quantities without compromising margins, or value-based rebates to incentivize larger transactions while maintaining profitability across all price thresholds. Avoid generic rebate structures that may dilute margins by rewarding behaviors unrelated to your financial goals.

2. Monitor and Adjust Rebate Structures Regularly

Consistent monitoring of rebate performance is important to identify potential inefficiencies. Real-time tracking and data analysis help businesses to understand how rebates are impacting revenue and margins.

For instance, retrospective evaluations can reveal whether certain rebate thresholds are eroding margins due to high payout percentages. Use these insights to adjust structures and ensure that incentives remain both competitive and profitable.

3. Avoid Overlapping Discounts and Ambiguity

Ensure that rebate programs are free from overlapping terms and unnecessary complexity. Overlapping discounts, such as combining upfront discounts with high rebate percentages, can lead to significant margin erosion. Clearly define terms and thresholds to eliminate ambiguity and prevent miscalculations that could result in overpayments or loss of trust among trading partners.

4. Invest in Rebate Management Technology

Manual processes and spreadsheets are insufficient for managing the complexities of modern rebate programs. Enterprise-grade rebate management tools automate calculations, track performance metrics, and integrate with ERP systems for data validation. These solutions also provide accrual transparency to ensure liabilities are accurately calculated and aligned with cash flow. Look for software with features like real-time dashboards, partner collaboration tools, and automated payment calculations to simplify operations and improve accuracy.

5. Foster Collaboration Across Teams and Partners

Collaboration between sales, finance, and channel management teams ensures that rebate programs are designed and executed with a holistic view of their impact on margins. Clear communication with trading partners about performance goals and rebate terms builds trust and encourages participation. Transparent reporting tools, such as partner portals, help partners track their progress and ensure mutual understanding of rebate calculations.

6. Focus on Sustainable Growth and Margin Protection

Rebates should drive long-term growth without jeopardizing profitability. For instance, avoid aggressive rebate percentages on high-margin products that could reduce overall earnings. Instead, use growth incentives to align partner sales goals with your business trajectory so that both revenue expansion and margin protection. Similarly, product mix rebates can be applied to move slower-moving inventory while safeguarding profitability.

7. Use Data for Proactive Decision-Making

Use data analytics to assess the ROI of rebate programs and identify patterns that affect margins. For example, analyze sales and payout data to determine which rebates yield the highest returns and which require adjustments. Accurate data enables proactive decisions to help businesses refine programs and target the most impactful incentives.

Role of Rebate Management Systems in Protecting Margins

However, the role of rebates in protecting margins depends heavily on good management. Poorly structured programs, such as those with overlapping discounts or unclear terms, can dilute profitability. For instance, aggressive rebate percentages on high-margin products can undermine earnings if not carefully monitored. Similarly, failing to track performance in real-time or relying on manual processes can lead to overpayments, revenue leakage, and reduced trust among trading partners.

To maximize the role of rebates in margin protection, businesses must use rebate management tools like Speedy Labs. These solutions automate calculations, provide real-time visibility, and align incentives with financial objectives.

Schedule a demo with our team to explore how Speedy Labs can help you improve your rebate program’s performance and protect your margins..