How to Optimize Gross-to-Net Calculations in Pharma?

Accurate revenue calculation is critical in the pharmaceutical industry, where pricing complexity, regulatory oversight, and multiple deduction layers directly affect financial reporting and compliance. The Gross-to-Net (GTN) process sits at the center of this effort, translating gross sales into actual realized revenue by accounting for rebates, discounts, chargebacks, returns, and government pricing obligations.

Optimizing GTN calculations requires stronger data control, better system integration, and disciplined management of deductions and contracts. The following areas are key to improving GTN accuracy.

Table of Contents:

- Start with Reliable Gross Sales Data

- Consolidate Data Using CRM and ERP Systems

- Manage Complex GTN Deductions More Precisely

- Incorporate Government Pricing and Regulatory Data

- Align Production and Contract Manufacturing Data

- Maintain Contract Accuracy for Allowances and Rebates

- Use Historical Data to Improve Forecasting

Jump to a section that interests you, or keep reading.

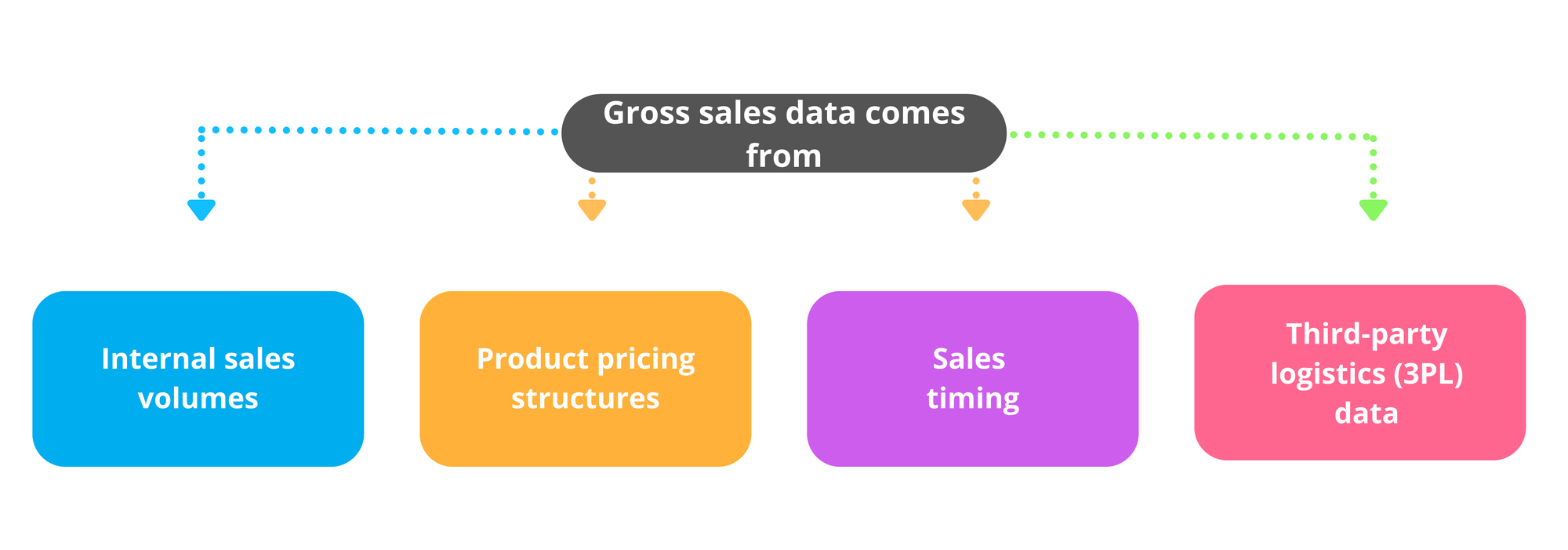

Start with Reliable Gross Sales Data

Gross sales are the foundation of GTN calculations. They are derived by multiplying a drug’s list price by the number of units sold. However, capturing this data accurately is often challenging due to multiple inputs.

Gross sales data typically comes from:

- Internal sales volumes

- Product pricing structures

- Sales timing

- Third-party logistics (3PL) data

Tracking this information across regions and distribution channels becomes complex when data formats, timing, and availability differ. Improving GTN begins with ensuring consistency and completeness at this initial stage.

Consolidate Data Using CRM and ERP Systems

Optimized GTN calculations depend on integrating sales, pricing, and distribution data from multiple sources into a unified view.

Platforms such as Salesforce, Oracle NetSuite, and SAP help centralize sales information and provide real-time visibility.

For life sciences organizations, NetSuite for Life Sciences combined with NetSuite Analytics Warehouse (NSAW) can function as a centralized data warehouse, bringing together internal, 3PL, and external data to support GTN reporting.

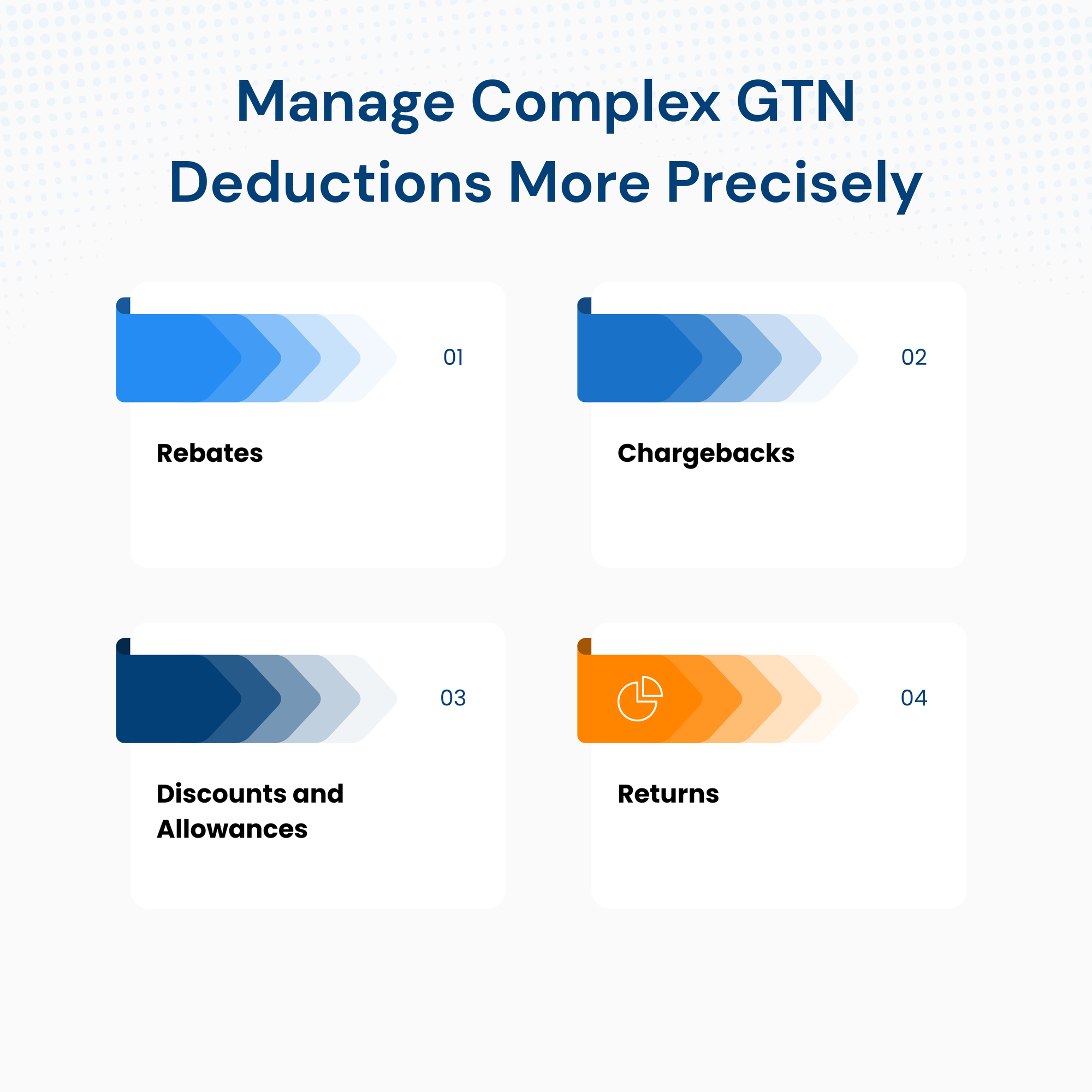

Manage Complex GTN Deductions More Precisely

Once gross sales are established, several deductions must be applied to arrive at net sales. Each category introduces its own challenges.

Rebates

Rebates offered to PBMs, insurers, or patients are often tiered and contract-driven. Their calculation and forecasting require specialized systems such as Model N, IntegriChain, and Vista.

Chargebacks

Chargebacks provided to wholesalers or group purchasing organizations (GPOs) involve high transaction volumes and require careful reconciliation to avoid revenue leakage.

Discounts and Allowances

Temporary price reductions and financial incentives can change frequently. Tools like Zilliant and Vendavo support real-time management of shifting discount structures.

Returns

Returns driven by shelf life, market demand, and quality standards can significantly affect GTN. Forecasting tools such as SAS and IBM help analyze return trends more accurately.

Incorporate Government Pricing and Regulatory Data

Government programs add another layer of complexity to GTN calculations. Medicaid rebates and VA pricing must be incorporated accurately to remain compliant.

Tools such as Medi-Span and 1WorldSync support tracking of government pricing requirements.

Regulatory compliance also depends on updated reporting and training. Platforms like ComplianceWire and Veeva Systems help manage regulatory data and compliance workflows.

Align Production and Contract Manufacturing Data

GTN accuracy is influenced not only by sales but also by upstream operations. Data from Contract Manufacturing Organizations (CMOs) must align with sales and distribution figures.

Consistent coordination between production volumes, quality standards, and GTN reporting helps reduce product returns and supports compliance across the supply chain.

Maintain Contract Accuracy for Allowances and Rebates

Contracts with payers, PBMs, providers, and GPOs define rebate rates, discount structures, and allowances. These agreements are often complex and frequently updated.

Contract lifecycle management platforms such as ContractLogix and Icertis help track contract changes and ensure deductions are reflected correctly in GTN calculations.

Use Historical Data to Improve Forecasting

Accurate GTN calculations rely on detailed financial records, including:

- Accruals

- Adjustments

- Historical actuals

Maintaining strong documentation supports forecasting, trend analysis, and audits. When combined with predictive analytics, historical data helps minimize discrepancies and strengthens decision-making around pricing and revenue planning.

Conclusion

Optimizing Gross-to-Net calculations in pharma requires disciplined data management, integrated systems, accurate handling of deductions, and strong contract and compliance oversight. By improving how gross sales data is captured, deductions are calculated, and regulatory requirements are incorporated, companies gain a clearer view of actual revenue and business performance—supporting more reliable reporting and planning.