Deductions Management Trend For Suppliers

Deductions management has emerged as one of the most critical—and complex—functions for suppliers. What was once a routine accounts receivable activity has now evolved into a strategic discipline that directly impacts profitability, customer relationships, and overall cash flow health. The rising sophistication of retailer audits, the surge in compliance requirements, and the lingering operational aftershocks of the pandemic have all converged to create a deductions environment that is more dynamic, data-intensive, and unforgiving than ever before.

This comprehensive guide explores the latest trends shaping deductions management for suppliers, the core challenges slowing resolution and recovery, and the strategic and technological levers needed to transform deductions from a reactive cost center into a proactive growth enabler.

Table of Contents:

- Deductions Management Trends: Why Suppliers Should Be Concerned

- Core Challenges in Modern Deductions Management

- Key Strategies for Effective Deductions Management

- The Technology Transformation in Deductions Management

- Continuous Improvement: The Future of Deductions Management

Jump to a section that interests you, or keep reading.

Deductions Management Trends: Why Suppliers Should Be Concerned

The landscape of deductions management has undergone a seismic shift in recent years, leaving suppliers facing an increasingly complex and demanding environment. What was once a manageable operational challenge has now evolved into a critical financial concern, as retailers become more sophisticated in detecting, enforcing, and recovering deductions. Suppliers are finding themselves at the center of a storm marked by rising deduction volumes, advanced compliance monitoring, and the resurgence of post-audit deductions—all of which threaten cash flow, profitability, and operational efficiency.

Rising Deductions Volume Post-COVID

In the post-pandemic economy, suppliers are grappling with an unprecedented surge in deductions. A staggering 68% of suppliers report that their deductions volume has continued to rise, underscoring a growing problem that can no longer be ignored. During the height of COVID-19, many retailers granted temporary waivers and leniencies to suppliers due to widespread operational disruptions. However, as the global supply chain stabilized and offices reopened, these waivers were rolled back, triggering a wave of chargebacks that caught many suppliers unprepared.

Simultaneously, the shift to remote work has exposed deep inefficiencies in deductions processes. Many teams continue to struggle with accessing backup documentation, collaborating across departments, and maintaining visibility into claims research—all vital steps in dispute resolution. Without centralized systems, suppliers often rely on scattered communication channels and manual document retrieval, which slows down response times and increases the likelihood of missed deadlines or incomplete claims.

The combined effect of revoked waivers, rising deductions, and remote work challenges has created a perfect storm for suppliers, forcing finance leaders to rethink their deductions management infrastructure and prioritize collaboration, visibility, and automation.

Retailers’ Growing Sophistication in Compliance Audits

Retailers are no longer playing catch-up when it comes to enforcing compliance. Thanks to sophisticated inbound audit solutions, they now detect and track supplier violations with unprecedented accuracy. According to industry experts, while large retailers in the early 2000s could identify around 80–85% of compliance issues, today’s advanced systems enable them to capture up to 95%, significantly increasing the volume of compliance deductions issued.

These systems allow retailers to monitor supplier performance in real time—tracking shipment accuracy, labeling compliance, packaging standards, and delivery timeliness. This heightened visibility has led to a surge in deductions raised against suppliers for even minor deviations from retailer requirements.

To make matters more challenging, retailers have also shortened the window for suppliers to dispute or resolve compliance-related deductions. This creates immense pressure on supplier deductions teams to locate backup documentation, validate data, and respond within tight deadlines. In an environment where compliance errors are easier to detect and harder to contest, suppliers must focus on building robust data visibility, error-free documentation, and seamless communication workflows to stay compliant and minimize revenue loss.

Expansion of Post-Audit Deductions

Beyond compliance deductions, suppliers are facing another growing threat—post-audit deductions, a trend that continues to expand as retailers become more aggressive in recovering historical funds. These deductions are typically raised long after transactions are completed, often more than a year after shipment, as retailers conduct deep, retrospective audits to identify missed discounts, pricing errors, overpayments, and unclaimed rebates.

What makes post-audit deductions especially challenging is their delayed nature. Since the original transaction may be several fiscal periods old, locating invoices, freight documents, or proof of delivery can be difficult. Retailers often employ both internal audit teams and third-party audit firms to uncover discrepancies, increasing the frequency and complexity of these claims.

For suppliers, the result is a mounting administrative burden—hours spent gathering evidence, validating claims, and navigating lengthy dispute processes with limited documentation. The time lag not only hampers their ability to research and resolve claims effectively but also creates forecasting and budgeting challenges, as deductions appear long after revenue has been recognized.

To stay ahead of this expanding trend, suppliers must adopt proactive post-audit management strategies: maintaining organized, easily retrievable records, implementing technology that centralizes data, and tracking deduction histories for early detection of recurring audit patterns.

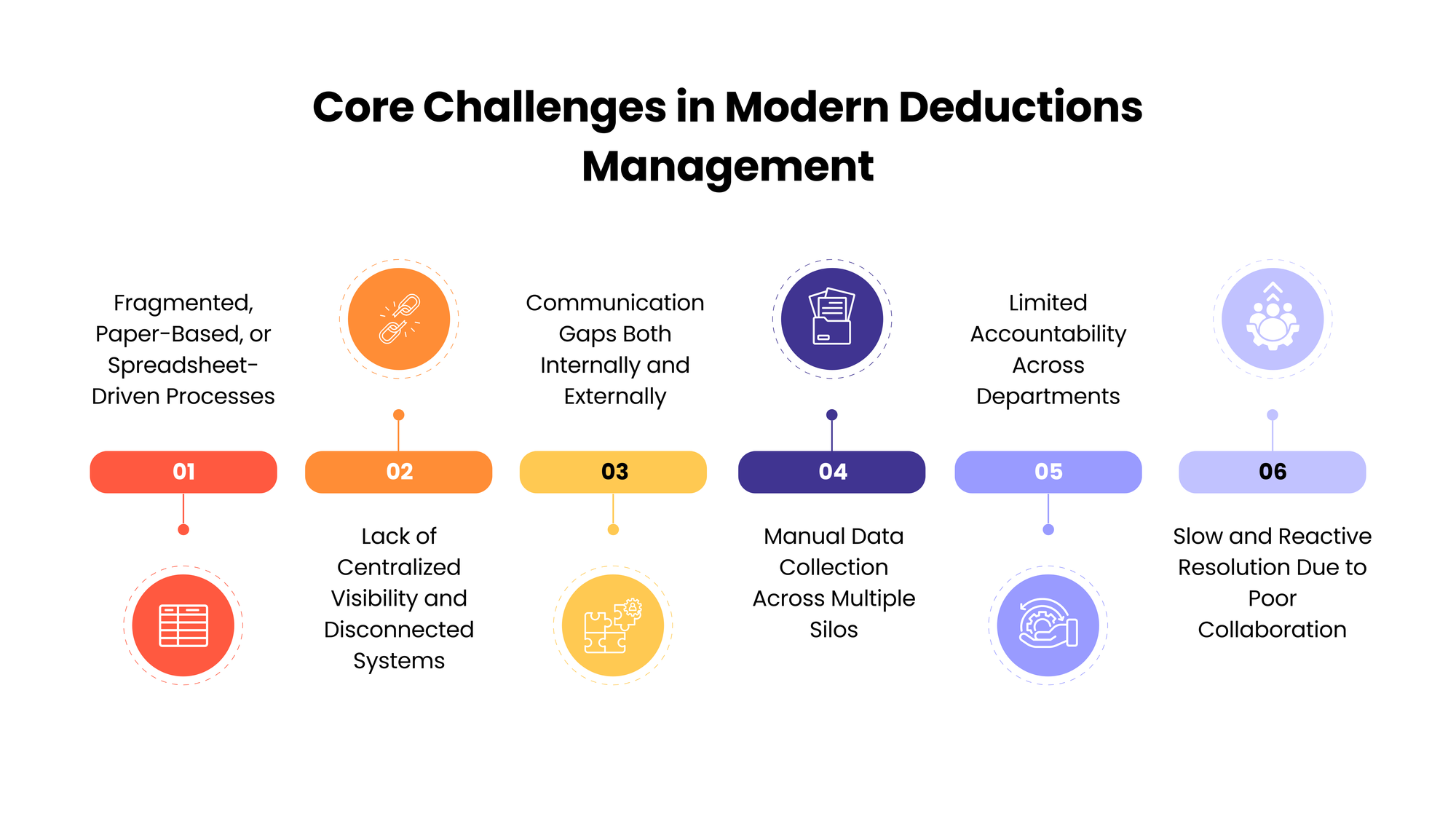

Core Challenges in Modern Deductions Management

Despite the growing awareness around the financial impact of deductions, many suppliers continue to face persistent challenges that erode profitability and efficiency. Modern deductions management has evolved into a complex, multi-stakeholder process—but outdated tools, disjointed communication, and fragmented ownership have created serious operational barriers. These issues, often interlinked, slow down resolution, obscure visibility, and perpetuate revenue leakage across the order-to-cash cycle.

Fragmented, Paper-Based, or Spreadsheet-Driven Processes

A major obstacle for most suppliers is the continued dependence on manual or semi-digital processes. Many organizations still rely on paper files, spreadsheets, and email threads to track and resolve deductions—a legacy practice that significantly limits accuracy, speed, and scalability. Such fragmented workflows make it nearly impossible to trace the lifecycle of a deduction, from creation to closure. As teams juggle multiple versions of files and scattered documentation, data inconsistencies and duplication of effort become inevitable. While this method might have sufficed decades ago, today’s volume and complexity of deductions demand integrated, technology-driven solutions that eliminate manual intervention and improve transparency across every claim.

Lack of Centralized Visibility and Disconnected Systems

In many organizations, deductions data resides across different systems—ERP, CRM, billing, logistics, and customer portals—none of which communicate seamlessly. This lack of centralized visibility forces teams to jump between platforms, wasting hours locating invoices, shipment records, or proof of delivery. Without a unified view, identifying trends, root causes, or recurring deduction types becomes nearly impossible. The absence of a centralized repository also delays decision-making, as stakeholders lack real-time insight into the status of claims, open disputes, or pending validations. Consequently, deductions remain unresolved longer, inflating Days Deductions Outstanding (DDO) and undermining cash flow predictability.

Communication Gaps Both Internally and Externally

Communication breakdowns—within supplier teams and between suppliers and retailers—are among the most frequent triggers of deductions. Misaligned expectations, unacknowledged purchase order (PO) changes, or unclear documentation often result in chargebacks that could have been avoided with clearer communication. For instance, merchants frequently alter POs multiple times—sometimes even after shipment—forcing suppliers to reprocess orders, adjust packaging, or reship goods, which often leads to shortages or overages and subsequent deductions.

Internally, communication challenges between sales, logistics, customer service, and accounts receivable teams create similar friction. When messages are fragmented across multiple tools like emails, chats, and spreadsheets, crucial updates are lost, slowing down resolution and accountability. A unified communication framework—both customer-facing and internal—is therefore essential to maintain accuracy and prevent avoidable deductions.

Manual Data Collection Across Multiple Silos

The inability to easily gather and consolidate data is a hidden drain on efficiency. Many deductions teams spend disproportionate time manually pulling information from siloed systems, matching it against claims, and preparing backup documentation. This tedious, error-prone process consumes resources that could be better allocated toward analysis and prevention. Moreover, manual data handling increases the likelihood of incomplete or outdated information entering dispute cases, weakening suppliers’ ability to challenge invalid deductions effectively. Without automation or integrated data management, the deductions function remains reactive, slow, and vulnerable to human error.

Limited Accountability Across Departments

Another pervasive issue is the absence of shared ownership across departments. Deductions often sit at the intersection of sales, credit, collections, logistics, and finance, yet no single team assumes complete responsibility for resolution. As a result, crucial tasks—like documentation validation or dispute escalation—get delayed or overlooked. Sales teams may neglect proper deal documentation, while receivables teams struggle to research claims without context. This fragmented accountability not only delays recovery but also allows the same deduction causes to recur, compounding financial losses over time. Establishing cross-functional accountability and clear escalation protocols is critical to closing this gap.

Slow and Reactive Resolution Due to Poor Collaboration

The combined effect of disconnected systems, manual workflows, and weak accountability is a deductions process that is slow, reactive, and prone to bottlenecks. Each dispute involves multiple touchpoints—sales orders, freight data, invoices, retailer portals—and when collaboration between teams is inefficient, even simple claims can take weeks to resolve. Delayed responses to retailers reduce the likelihood of successful disputes and lead to permanent revenue write-offs. Furthermore, when resolution processes depend on individual employees’ knowledge rather than standardized systems, progress halts during absences or transitions, exposing the organization to even greater delays.

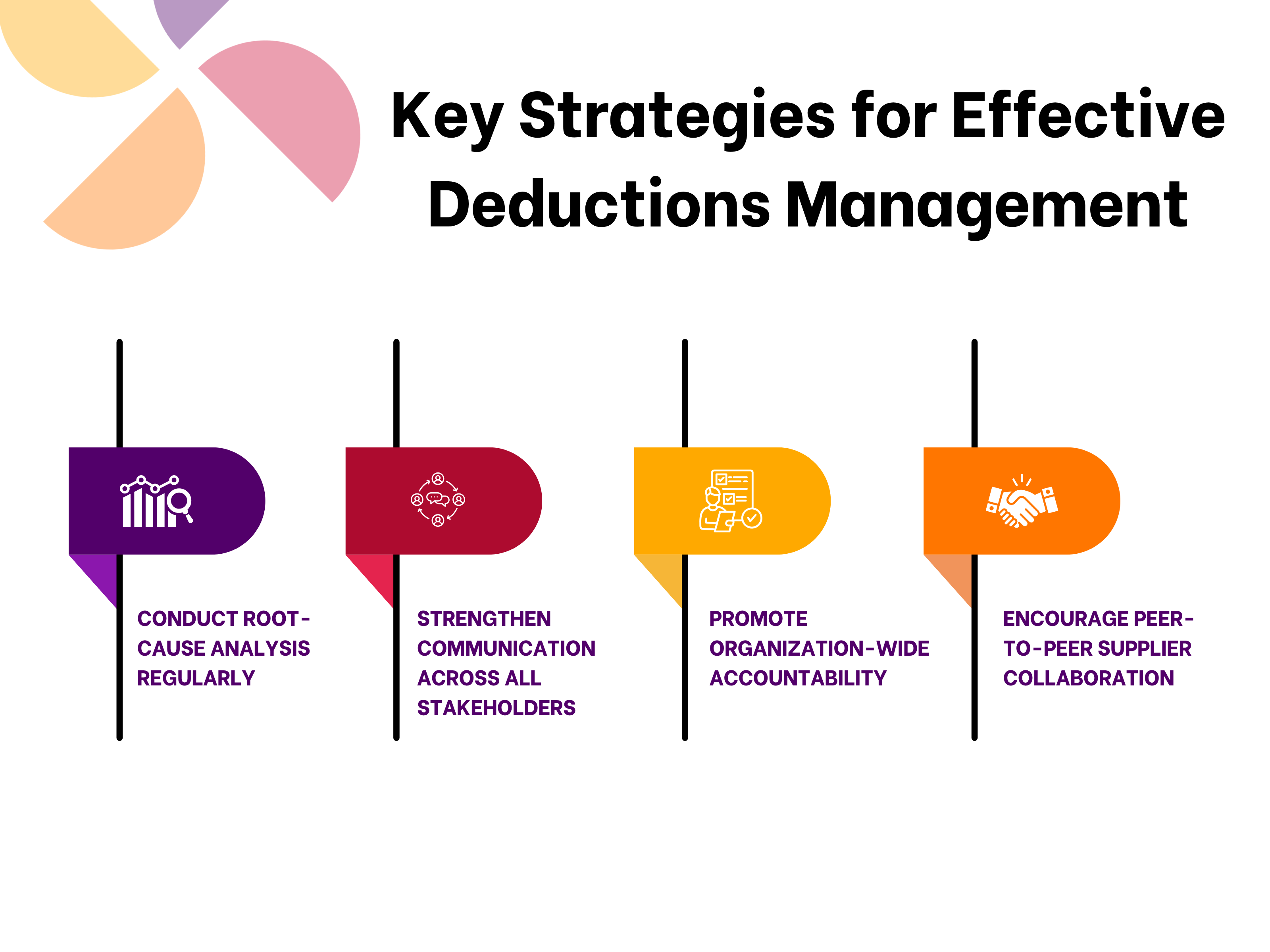

Key Strategies for Effective Deductions Management

In an environment where rising deduction volumes and complex retailer requirements threaten margins, effective deductions management demands more than just quick fixes—it requires structured, data-driven strategies that address the root causes, foster collaboration, and embed accountability across the organization. Suppliers that successfully implement these strategies can transform deductions management from a reactive cost center into a proactive value driver.

Conduct Root-Cause Analysis Regularly

The foundation of effective deductions management lies in understanding why deductions occur. Non-trade deductions such as returns, damages, or shortages often originate from preventable operational issues—shipment inaccuracies, labeling errors, or communication lapses. Conducting root-cause analysis allows suppliers to identify these recurring pain points, isolate process breakdowns, and implement corrective actions that eliminate the source of future claims.

However, the accuracy of any analysis depends on the quality and completeness of data. Many suppliers struggle to perform meaningful evaluations because their deduction data is fragmented across multiple systems. Having a centralized, well-organized database ensures that all deduction types, reasons, and resolutions are easily traceable. Once suppliers can visualize where deductions originate—be it in logistics, order management, or billing—they can take targeted measures to address them.

Root-cause analysis also enables long-term prevention. By tracking deduction trends and connecting them to specific operational lapses, suppliers can refine upstream processes—improving order accuracy, strengthening compliance, and minimizing disputes. Regular, data-backed root-cause assessments not only reduce avoidable deductions but also empower teams to make strategic, evidence-based decisions that enhance profitability over time.

Strengthen Communication Across All Stakeholders

Inefficient communication is one of the most pervasive causes of deduction disputes. Gaps in coordination—whether between suppliers and retailers or within internal teams—often result in errors, delays, and missed opportunities for resolution. Strengthening communication requires both transparency and structure across all stakeholder interactions.

Between suppliers and retailers, proactive and consistent communication is essential. Purchase order (PO) changes, in particular, are a frequent source of conflict. Retailers modify POs an average of 4.4 times after suppliers begin processing orders, forcing suppliers to restart fulfillment, repackage shipments, or correct errors mid-process. When these updates aren’t communicated or acknowledged promptly, suppliers risk shipping incorrect quantities or items—triggering shortages, overages, and costly chargebacks. Establishing a centralized communication platform or customer portal ensures that all messages, changes, and approvals are captured in real time, preventing missed updates and reducing friction.

Internally, communication must extend seamlessly across accounts receivable, sales, logistics, shipping, and customer service teams. Deduction resolution often requires inputs from multiple departments, and fragmented conversations through emails or spreadsheets delay progress. Implementing integrated systems that enable cross-functional visibility and collaboration accelerates resolution, reduces manual follow-ups, and fosters accountability. When teams communicate effectively both internally and externally, they not only resolve disputes faster but also prevent many from arising in the first place.

Promote Organization-Wide Accountability

Successful deductions management is not the responsibility of a single department—it’s a shared organizational commitment. Every function that interacts with customers, invoices, or orders influences deduction outcomes. Yet, many companies isolate the deductions team and overlook the broader impact of sales, credit, collections, and cash application on dispute prevention and resolution.

Leaders must embed clear accountability across departments by setting expectations for documentation accuracy, timely responses, and consistent collaboration. For instance, sales teams must maintain transparent deal documentation to minimize disputes, while AR and collections teams should ensure all supporting information is readily available for quick validation. Management should also align performance metrics and KPIs to include deduction-related goals, encouraging each team to view deduction reduction as a shared success metric rather than a specialized task.

When accountability is collective, teams become proactive instead of reactive. Processes are standardized, bottlenecks are eliminated, and recurring deduction causes are addressed more effectively. Leadership plays a pivotal role here—setting the tone for collaboration, providing visibility into progress, and ensuring that all stakeholders remain aligned with the organization’s financial objectives.

Encourage Peer-to-Peer Supplier Collaboration

Beyond internal strategies, collaboration among suppliers themselves has become an emerging best practice in deductions management. Engaging in peer-to-peer communication forums allows suppliers working with the same retailers to share insights, exchange best practices, and discuss what works—and what doesn’t—when navigating deduction challenges.

Organizations like the Retail Value Chain Federation (RVCF) have pioneered supplier forums that facilitate direct dialogue between retailers and their supplier networks. These platforms enable open discussions about common deduction patterns, audit procedures, and process improvements that benefit both sides. For suppliers, such collaboration helps uncover retailer-specific trends, benchmark performance, and learn how others successfully prevent or resolve similar disputes.

In an ecosystem where retailers continuously refine their audit and compliance processes, collective supplier knowledge becomes a powerful resource. Peer collaboration fosters a community of shared intelligence, reduces redundancy in problem-solving, and accelerates the industry’s overall maturity in managing deductions efficiently.

The Technology Transformation in Deductions Management

The deductions management function, once dominated by manual workflows and fragmented tools, is now undergoing a profound technological transformation. With retailers becoming more sophisticated and deductions volumes rising, suppliers can no longer afford outdated systems that rely on spreadsheets or manual validation. The future of deductions management is being redefined by automation, AI, and cloud technology—driving greater speed, visibility, and control across every stage of dispute resolution.

The Decline of Paper-Based and Manual Processes

For decades, suppliers managed deductions using paper documents, Excel sheets, and disconnected tools. These legacy systems may have worked in the past, but today, they are a critical bottleneck that slows progress and obscures insight. Paper-based and manual processes require extensive human intervention to enter, track, and reconcile data—leaving room for errors, lost information, and inefficiencies that drain time and revenue.

In the modern deductions environment, where speed and accuracy are essential, such methods are no longer viable. The growing complexity of retailer requirements, combined with the scale of transactions, has exposed the limitations of manual management. Modern organizations are shifting toward integrated, cloud-based platforms that bring all deductions data, documents, and communications into a single, centralized hub. This evolution enables teams to access information instantly, collaborate efficiently, and gain complete visibility into claim lifecycles—empowering suppliers to transition from reactive resolution to proactive prevention.

The Rise of AI-Powered Automation

Artificial intelligence and automation have emerged as the backbone of next-generation deductions management. Unlike manual workflows, which rely on repetitive data entry and email-based communication, AI-driven solutions can collect, categorize, and analyze data automatically, streamlining every stage of the process—from claim receipt to resolution.

Automation accelerates data gathering by pulling information from invoices, retailer portals, and proof-of-delivery documents without human intervention. It speeds up claim validation, automatically matching claims against predefined business rules and transaction histories to determine legitimacy. AI also enhances communication workflows by routing disputes, updates, and documentation to the right stakeholders instantly, ensuring faster turnaround times.

The benefits are tangible: real-time visibility, centralized documentation, and accurate, analytics-ready reporting. Teams can monitor deduction trends, track open disputes, and make informed decisions backed by live data. AI-driven systems also minimize manual data entry, reducing the risk of errors and freeing teams to focus on higher-value analysis rather than repetitive administrative tasks. As a result, suppliers gain not only efficiency but also a strategic edge in managing and preventing deductions at scale.

Automation Is Not Magic — Process Optimization Comes First

While automation is powerful, it is not a cure-all. Industry experts emphasize that automating a flawed process only results in a flawed automated process. Without clean data and optimized workflows, even the most advanced automation will fail to deliver meaningful improvement. Before implementing technology, suppliers must assess and refine their current processes to ensure they are logical, standardized, and scalable.

The path to successful automation begins with four key steps:

- Identify pain points and bottlenecks: Understand where delays and inefficiencies occur—whether in data collection, validation, or communication.

- Map data flow and ensure integrity: Consolidate data from multiple systems into a single source of truth to eliminate duplication and errors.

- Define automation objectives and success metrics: Set measurable goals—such as reduced resolution time, improved dispute accuracy, or lower Days Deductions Outstanding (DDO).

- Partner with experienced solution providers: Collaborate with technology vendors who understand both the technical and operational dimensions of deductions management.

This structured approach ensures automation complements existing workflows rather than complicating them. When applied to optimized processes, automation delivers transformative results—driving precision, speed, and scalability across the entire deductions function.

Growing Adoption of Automation Among Suppliers

The industry has already begun its shift toward automation, with 55% of suppliers actively pursuing digital transformation initiatives in deductions management and another 28% planning to begin soon. This steady adoption reflects a growing recognition that manual processes cannot sustain modern business complexity.

The COVID-19 pandemic served as a major catalyst, exposing the fragility of paper-based systems and accelerating the need for cloud-based automation. Remote work made it clear that teams needed instant, digital access to claims data, supporting documents, and collaboration tools—something only automated systems could provide.

In the post-pandemic world, suppliers are increasingly focused on building data-driven, AI-empowered deductions ecosystems. These systems not only streamline claim resolution but also leverage analytics to predict and prevent future deductions. The result is a more agile, resilient, and insight-driven deductions function—one that enables suppliers to safeguard revenue, strengthen retailer relationships, and achieve financial excellence in an ever-evolving market.

Continuous Improvement: The Future of Deductions Management

The future of deductions management lies in evolution—moving beyond reactive resolution toward a proactive, predictive, and continuously improving model. As retailers become more data-driven and audit processes more sophisticated, suppliers must match that precision by building intelligent, self-improving deductions frameworks that anticipate problems before they occur. Continuous improvement is not a one-time initiative but a strategic shift in mindset—where technology, analytics, and cross-functional collaboration combine to drive efficiency, accuracy, and resilience across the entire deductions lifecycle.

Moving from Reactive to Predictive Deductions Management

Traditional deductions management has long been reactive—teams responding to chargebacks only after they occur, often under tight deadlines and with limited visibility. This approach drains time, delays cash recovery, and prevents organizations from identifying systemic flaws. The next frontier is predictive deductions management, where suppliers use data-driven insights to foresee and eliminate root causes before they translate into financial losses.

By analyzing historical deduction data, transaction patterns, and retailer behaviors, suppliers can predict which customers, SKUs, or fulfillment processes are most likely to generate future deductions. This enables proactive intervention—correcting data mismatches, refining order processes, or enhancing compliance before issues arise. Predictive management transforms deductions from an after-the-fact exercise into a strategic control mechanism that safeguards profit margins and strengthens customer relationships.

Embedding Analytics to Identify Trends and Prevent Future Chargebacks

Data analytics has become the cornerstone of modern deductions management. With advanced analytics capabilities embedded into integrated systems, suppliers can detect recurring trends, deduction frequency spikes, and process inefficiencies in real time. Instead of relying on anecdotal evidence, teams can quantify the exact causes—whether it’s a recurring labeling issue, frequent PO changes from a specific retailer, or shipment inconsistencies from a certain warehouse.

Analytics also empowers suppliers to benchmark performance across time, customers, and regions—providing clarity on where the most significant revenue leakage occurs. These insights form the foundation for preventive action plans—refining operational processes, reinforcing training, or automating high-risk touchpoints. In effect, analytics doesn’t just explain the past; it equips organizations to shape a more controlled, error-free future.

Continuous Process Review and Cross-Departmental Learning Loops

Sustainable improvement requires continuous process evaluation and learning loops that involve every department contributing to deductions outcomes. Since deductions intersect multiple functions—sales, logistics, AR, credit, and compliance—each team must routinely assess how their processes affect dispute frequency and resolution speed.

Establishing feedback loops ensures that lessons from each deduction are not lost but instead drive future improvements. For instance, recurring disputes caused by inaccurate PO data can trigger collaboration between sales and order management to tighten validation protocols. Similarly, repeated delays in documentation can prompt process redesign in AR or customer service teams. Regular audits, team debriefs, and performance reviews ensure that every deduction becomes a learning opportunity—gradually strengthening the organization’s resilience against future losses.

By institutionalizing these learning cycles, suppliers can create a culture of accountability and adaptability, ensuring that efficiency gains compound over time instead of fading after short-term fixes.

Integrating Automation, AI, and Analytics for Long-Term Sustainability

The convergence of automation, artificial intelligence (AI), and analytics marks the next stage in the evolution of deductions management. Automation eliminates manual tasks, ensuring faster data capture, claim validation, and workflow routing. AI augments decision-making, analyzing large datasets to flag anomalies, predict disputes, and recommend resolutions. Meanwhile, analytics provides the visibility to measure outcomes, benchmark performance, and track continuous progress.

When integrated seamlessly, these technologies form a self-sustaining ecosystem—one that learns from every transaction and optimizes itself over time. AI-driven insights feed into automated workflows, while analytics track outcomes and identify new improvement areas, completing the continuous improvement cycle. This synergy enables suppliers to scale deductions management intelligently, reducing Days Deductions Outstanding (DDO), improving dispute win rates, and freeing teams to focus on strategic analysis instead of repetitive execution.

Ultimately, this technological integration ensures long-term sustainability. Suppliers no longer rely on reactive firefighting but on a data-enriched, proactive deductions ecosystem that evolves with business needs and market dynamics. As automation handles routine processes, AI sharpens predictive accuracy, and analytics drives transparency, deductions management transforms from a back-office function into a strategic capability that safeguards revenue, enhances retailer relationships, and supports financial excellence.

Conclusion

Deductions management is no longer a back-office function—it is a strategic differentiator for suppliers determined to protect revenue, optimize cash flow, and strengthen retailer partnerships. As the deductions landscape continues to evolve—with rising volumes, complex compliance audits, and expanding post-audit scrutiny—the ability to adapt will define which suppliers lead and which fall behind.

Success in this environment demands a shift from reactive dispute handling to a proactive, predictive, and continuously improving framework. Root-cause visibility, real-time communication, and data integrity must serve as the foundation, while automation, AI, and analytics power the next stage of transformation. Suppliers that embrace integrated, cloud-based platforms and align people, processes, and technology will not only reduce Days Deductions Outstanding (DDO) but also create a resilient, insight-driven deductions ecosystem that evolves with their business.

The future of deductions management belongs to those who think beyond resolution—those who anticipate issues before they arise, learn from every deduction, and use technology to turn complexity into control. In doing so, suppliers can transform what was once a source of leakage into a source of strength—driving profitability, operational excellence, and long-term competitive advantage.