Guide to the Deductions Management Process

Deductions management has evolved from being a routine accounts receivable function to a strategic imperative for maintaining financial accuracy and cash flow health. Every deduction—whether due to pricing discrepancies, shortages, trade promotions, or returns—directly impacts revenue recovery, customer relationships, and overall working capital efficiency. Yet, for many organizations, managing these deductions remains a persistent challenge marked by manual processes, fragmented communication, and delayed resolutions.

Traditional deduction handling relies heavily on spreadsheets, emails, and scattered documentation, making it time-consuming, error-prone, and costly. Analysts spend hours gathering proofs of delivery, validating invoices, and chasing approvals often without real-time visibility or structured accountability. This manual complexity not only slows down dispute resolution but also drives revenue leakage and profit dilution.

However, as transaction volumes surge and customer expectations grow, leading enterprises are turning to automation and artificial intelligence (AI) to reimagine the deductions lifecycle. Modern deductions management systems bring together automated data capture, AI-powered matching, intelligent prioritization, and integrated collaboration creating a seamless, end-to-end workflow that transforms inefficiency into insight.

This comprehensive guide explores everything you need to know about the deductions management process from traditional workflows and their limitations to the transformative potential of AI-driven automation.

Table of Contents:

- The Traditional Deductions Management Process

- Challenges in Manual Deductions Management

- Steps of an Optimized Deductions Management Process

- Leveraging Automation and AI for Deductions Management

Jump to a section that interests you, or keep reading.

The Traditional Deductions Management Process

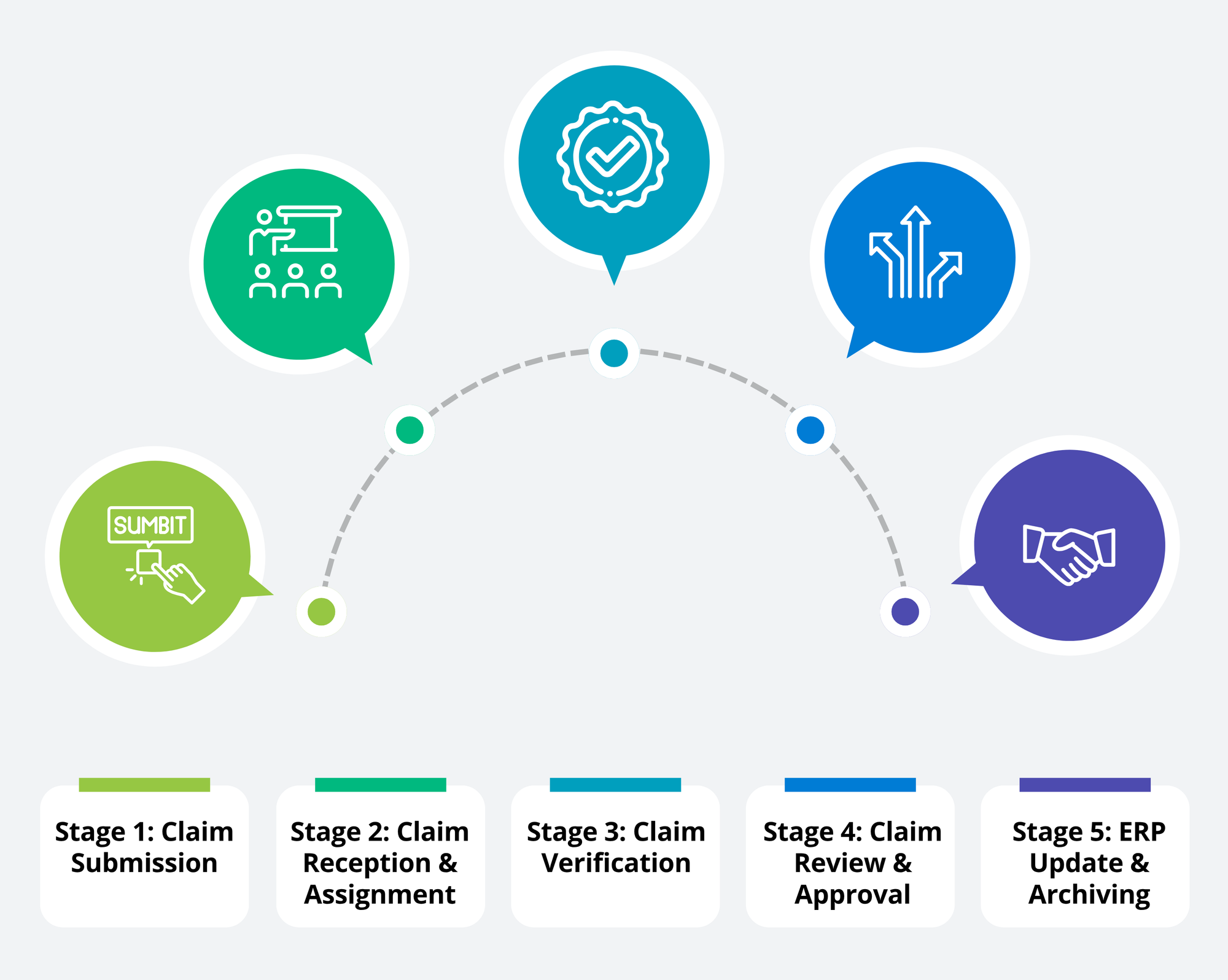

Traditional deductions management is a sequential, manually driven process that requires significant time and effort from accounts receivable (AR) teams. Each claim moves through multiple stages, involving data gathering, verification, review, and recording — often without centralized visibility or automation. While the process aims to ensure accuracy and accountability, its manual nature makes it cumbersome, error-prone, and resource-intensive.

Below is the complete breakdown of the process and its inherent limitations.

Stage 1: Claim Submission

In the traditional process, deduction claims can originate from multiple customer touchpoints, including electronic data interchange (EDI) systems, payment portals, emails, phone calls, fax, or even postal mail. Some customers dispute invoice amounts before payment, while others short-pay the invoice and provide little or no documentation to justify the deduction. This lack of standardization across submission channels forces analysts to constantly monitor every communication platform to capture and record new claims.

Because there is no unified intake mechanism, claims data ends up dispersed across spreadsheets, emails, and personal notes. Without a centralized repository, it becomes difficult to track submission dates, claim ownership, or resolution progress. This fragmented inflow not only increases the risk of missed claims but also creates confusion when analysts must reconcile claims against open invoices or previous communications.

Stage 2: Claim Reception & Assignment

Once a claim is received, it must be assigned to an analyst for investigation. In most organizations, this allocation is done manually — through spreadsheets, shared inboxes, or email forwarding. Analysts are then expected to prioritize claims based on criticality, such as the claim amount, customer relationship, or potential impact on cash flow.

However, when hundreds of claims arrive daily from multiple customers, manual prioritization quickly becomes overwhelming. The absence of a systematic queue or visibility dashboard makes it nearly impossible to assess workloads or progress at a glance. This not only delays critical claims but also causes overlapping responsibilities, rework, and inconsistent customer response times. As a result, AR teams lose valuable time organizing data instead of resolving deductions.

Stage 3: Claim Verification

Claim verification is the most labor-intensive phase, where analysts act as detectives, piecing together information from various sources to validate the deduction. They must cross-reference invoices, proofs of delivery (PODs), bills of lading (BoLs), contracts, and promotion agreements to confirm whether the deduction is legitimate.

The challenge lies in the fact that these documents are scattered across different departments and systems — sales, logistics, finance, or third-party portals. Missing or inaccessible documents lead to “hurry-up-and-wait” scenarios that stall investigations. Analysts often depend on colleagues for specific information, and if key personnel are unavailable or documents misplaced, resolution timelines stretch further.

This fragmented approach not only delays decision-making but also heightens the risk of human error. Each missed validation, misfiled document, or untracked communication can result in incorrect conclusions — either wrongly approving invalid deductions or failing to credit legitimate ones.

Stage 4: Claim Review & Approval

After an analyst has gathered all the required evidence and assessed the claim’s validity, it proceeds to the review and approval stage. Valid claims need to be honored through credit memos or adjustments, while invalid ones are disputed with the customer. Typically, this decision must pass through one or more layers of management approval.

However, manual approval processes are plagued by inefficiency. Approvals are usually sought through emails or offline discussions, making it easy for requests to get lost in inboxes, delayed due to unavailability, or overlooked altogether. Inconsistent approval hierarchies and lack of clear accountability further slow down the process. Even minor communication lapses can cause unnecessary delays in closing claims, affecting both customer satisfaction and the accuracy of financial reporting.

Stage 5: ERP Update & Archiving

Once a claim is resolved, the final decision — whether a write-off, recovery, or credit issuance — must be updated in the company’s ERP system. Analysts manually enter all relevant data, attach supporting documents, and adjust balances. This step often includes printing or digitally filing documents for archiving and audit purposes.

However, this manual data entry introduces a high risk of keying errors, duplicate entries, and mismatched records. Because documentation is stored in disparate systems or physical files, there is no unified view of claim history. Managers lack visibility into which deductions were settled, how long they took, or what their financial impact was. Consequently, tracking trends or identifying recurring deduction types becomes nearly impossible.

Challenges in Manual Deductions Management

Manual deductions management, though structured in theory, becomes a web of inefficiencies when applied at scale. As claim volumes grow and customer expectations rise, finance teams face operational roadblocks that drain time, resources, and profitability. The process—spanning claim intake, verification, approval, and record updates—is heavily dependent on human intervention, fragmented communication, and disconnected systems. Below are the critical challenges that make manual deduction handling one of the most resource-intensive and error-prone functions in Accounts Receivable.

Time-Consuming & Error-Prone

Manual deductions management demands extensive human effort at every stage. Analysts must identify claims from multiple channels—emails, EDI feeds, faxes, and portals—and manually enter details into spreadsheets or ERP systems. Each claim involves tedious cross-verification of invoices, proofs of delivery, and contracts, often requiring back-and-forth coordination across departments. This reliance on manual research creates enormous delays and significantly increases the likelihood of typographical errors, oversight, or misinterpretation. The more claims an organization processes, the more its accuracy erodes. Small mistakes—like entering an incorrect invoice number or overlooking a credit note—can easily lead to misclassified claims, unresolved disputes, or even revenue loss.

Limited Visibility

The traditional process lacks a centralized information repository. Claim details, supporting documents, and analyst notes are scattered across emails, shared drives, spreadsheets, or even paper files. Without a unified system, managers cannot view claim status, aging, or pending actions at a glance. This fragmented visibility prevents effective prioritization—teams may waste time on low-value claims while high-impact disputes remain unresolved. The absence of real-time dashboards also means that leadership cannot accurately measure deduction performance or identify bottlenecks. Consequently, critical decision-making—like forecasting recoveries or determining analyst workloads—becomes guesswork rather than data-driven management.

Delayed Resolution

Manual deduction handling is inherently slow because each step depends on human coordination and document retrieval from different departments. A single claim might require inputs from AR, sales, logistics, and customer service teams, each operating within their own systems. Analysts often wait for missing proofs of delivery or customer confirmations, while communication trails stretch across multiple email threads. This “hurry-up-and-wait” dynamic delays resolution, disrupts cash application cycles, and increases days deductions outstanding (DDO). Even minor process breakdowns—like an unavailable approver or a missing file—can freeze progress entirely. The end result is delayed collections, dissatisfied customers, and reduced operational efficiency.

Incorrect Accounting & Profit Dilution

When manual errors, delayed resolutions, and visibility gaps combine, they directly impact financial accuracy. Deductions that remain unresolved for long periods distort revenue projections and cash flow forecasts. Incomplete or inaccurate updates to ERP systems lead to mismatched balances, duplicate write-offs, or missing credits. Over time, these discrepancies cause profit dilution, as businesses either accept unauthorized deductions or overlook recoverable amounts. The inability to consistently validate and record claims also undermines audit readiness and financial compliance. Essentially, every manual inefficiency translates into revenue leakage and reduced profit margins.

Lack of Traceability

Manual processes fragment communication across teams and customers, making it difficult to trace claim progress or accountability. Conversations may be spread across emails, calls, or meeting notes, with no centralized log of actions taken. When customers request status updates, analysts must manually search through emails or ask colleagues for context. This lack of traceability not only slows response times but also risks inconsistent messaging and strained customer relationships. Furthermore, when disputes escalate or audits occur, reconstructing the full resolution history becomes a painstaking, error-prone exercise that consumes valuable analyst time.

High Operational Costs

Manual deductions management carries a significant financial burden. The cumulative time spent on claim research, data entry, follow-ups, and documentation drives up overhead costs. Studies show that it can cost a company between $200 and $300 to research and resolve a single deduction, especially when multiple departments and approval layers are involved. For businesses processing thousands of claims monthly, these inefficiencies translate into millions in avoidable expenses. Compounding this is the fact that manual processes require more full-time employees (FTEs) to maintain throughput, further inflating labor costs without proportional improvement in recovery outcomes.

The Broader Impact

These challenges create a domino effect across the organization. Time lost on manual tasks reduces the capacity for strategic work such as root-cause analysis or deduction prevention. Limited visibility impairs financial forecasting, while slow resolutions weaken customer trust. Each inefficiency compounds into a cycle of higher costs, lower accuracy, and reduced profitability. In short, manual deductions management transforms what should be a controlled financial process into a constant firefight — reactive, fragmented, and expensive.

Steps of an Optimized Deductions Management Process

Optimizing the deductions management process requires blending the rigor of traditional discipline with the intelligence and efficiency of automation. The goal is to transform a reactive, manual operation into a proactive, data-driven system that reduces resolution time, minimizes revenue leakage, and enhances financial control. By integrating technology into each stage of the deductions lifecycle, organizations can streamline workflows, strengthen collaboration, and make decisions based on real-time insights rather than fragmented data.

Below are the five essential steps of an optimized deductions management process that deliver both operational efficiency and strategic visibility.

Step 1: Identify Deductions Early

The foundation of an efficient deductions process lies in early detection. Timely identification ensures that discrepancies are addressed before they snowball into unresolved claims or write-offs. Optimized systems continuously monitor incoming payments, remittance details, and invoices to flag any mismatched amounts, short-pays, or disputes automatically.

Artificial intelligence (AI) and data recognition tools compare payment data against expected invoice amounts and instantly detect variances related to pricing discrepancies, product shortages, returns, promotions, or freight allowances. Unlike traditional processes where analysts manually review statements or rely on customer notifications, automated systems capture deductions the moment they occur. This early identification accelerates investigation, shortens dispute cycles, and helps businesses maintain cleaner, more predictable cash flows.

Step 2: Collect Supporting Documentation

Once a deduction is detected, the next step is to gather all supporting documentation needed to validate it. In a manual setup, analysts spend hours retrieving invoices, proofs of delivery (PODs), bills of lading (BoLs), promotional agreements, and claim documents from various departments or portals. This fragmented approach causes delays and increases the risk of missing critical evidence.

An optimized, automated system eliminates these inefficiencies through auto-capture capabilities. AI and robotic process automation (RPA) tools automatically download claim documents from customer portals, email attachments, and ERP records — often achieving 90% automation in document retrieval. All relevant files are stored in a centralized digital repository, ensuring immediate accessibility for every stakeholder involved. This single source of truth not only expedites validation but also supports compliance and audit readiness by maintaining a verifiable record of all deduction-related documentation.

Step 3: Categorize and Review

After gathering documentation, deductions must be organized and reviewed systematically. Analysts categorize deductions based on their nature — such as trade (promotions, discounts, rebates) or non-trade (pricing errors, shortages, returns) — and further refine classification based on claim type or customer pattern. This structured categorization streamlines workflows by enabling targeted routing and clearer accountability.

Automation enhances this step through auto-coding and machine learning (ML) algorithms that classify claims accurately without manual tagging. The system also evaluates the financial impact and automatically prioritizes high-value, high-frequency, or time-sensitive claims, allowing analysts to focus their efforts where it matters most. This smart categorization and prioritization minimize backlogs, prevent duplication of effort, and ensure that the most critical deductions receive immediate attention.

Step 4: Investigate and Resolve

Investigation is the analytical core of deductions management — the stage where validation, root cause analysis, and resolution converge. Traditionally, this involves extensive manual research, customer communication, and cross-departmental coordination, all of which prolong resolution times.

In an optimized environment, automation centralizes collaboration. A unified deductions dashboard allows the Accounts Receivable (AR), sales, logistics, and customer service teams to work together within one shared interface. AI provides contextual insights by analyzing historical claim data and recommending the best course of action — whether to issue a credit, dispute a claim, or escalate for approval.

Root cause analysis becomes data-driven. The system tracks recurring issues such as incorrect pricing, missed promotional credits, or shipment errors, allowing businesses to eliminate systemic flaws instead of repeatedly resolving the same problems. The ultimate objective is not just to close claims quickly, but to achieve mutual resolution with customers and reduce the likelihood of recurrence.

This collaborative, insight-based approach also strengthens customer relationships. By providing transparent communication and faster resolutions, companies demonstrate accountability and reliability, improving customer satisfaction while protecting revenue integrity.

Step 5: Update Systems & Records

The final step ensures that the resolution outcomes are accurately reflected in the organization’s financial systems. In a traditional setup, this requires analysts to manually enter data into the ERP, issue credit memos, update balances, and archive records — a slow process susceptible to errors and inconsistencies.

Optimized deductions management replaces these manual updates with automated ERP integration. Once a deduction is resolved, the system automatically posts results to connected platforms such as ERP or CRM systems, adjusting accounts receivable balances and applying credits or recoveries in real time. Each action is recorded in an audit trail, ensuring full traceability for compliance and performance tracking.

Over time, the data captured through automated updates feeds into analytics dashboards that highlight deduction patterns, process bottlenecks, and recovery performance. This continuous feedback loop enables ongoing improvement — empowering finance leaders to refine workflows, prevent recurring issues, and align deductions strategy with organizational goals.

Leveraging Automation and AI for Deductions Management

The shift from manual to automated deductions management marks a transformative leap in how finance teams handle disputes, recover revenue, and maintain cash flow integrity. Traditional methods rely heavily on human effort to gather data, verify claims, and communicate across departments — a process prone to errors, delays, and inefficiencies. Automation, supported by Artificial Intelligence (AI) and Robotic Process Automation (RPA), replaces these repetitive manual tasks with an intelligent, self-operating system that processes deductions faster, with higher accuracy and complete transparency.

This transformation is not about removing human oversight but elevating the analyst’s role from clerical verification to strategic decision-making. Automation ensures that humans no longer serve as the “glue” holding the deductions process together; instead, the system orchestrates data flow, prioritization, and collaboration autonomously. This evolution toward Autonomous Receivables enhances speed, reduces operational costs, and creates a real-time, data-driven environment for deductions resolution.

What Is Automated Deductions Management?

Automated Deductions Management is an advanced, technology-driven approach that digitizes and standardizes every phase of the deductions process — from claim intake to resolution and reporting. Instead of relying on manual verification or multiple disconnected systems, automation creates a centralized digital platform that captures, classifies, routes, and resolves claims seamlessly.

At its core, automation in Accounts Receivable (AR) eliminates tedious, error-prone activities such as claim data entry, document retrieval, and approval tracking. Using machine learning, AI, and RPA, the system intelligently identifies valid deductions, matches them to supporting documents, and updates records in real time — all without human intervention in most cases.

Unlike basic automation, which performs repetitive rule-based tasks, autonomous systems operate with cognitive intelligence. They analyze data, learn from historical resolution patterns, and make recommendations or decisions autonomously. For example, when a customer submits a deduction claim through email or EDI, the system automatically extracts the relevant details, matches them to invoices, checks for discrepancies, and either resolves the claim instantly or routes it for review based on predefined business logic.

The result is an ecosystem where AI ensures precision, RPA ensures speed, and analytics ensure continuous improvement — collectively minimizing manual intervention and enabling faster, data-backed decision-making.

Key Automation Features

Automated Data Capture

Automation begins by consolidating data from multiple claim submission channels such as EDI feeds, emails, PDFs, web portals, and scanned documents. AI-powered recognition tools extract and digitize claim details — including customer ID, invoice number, and deduction amount — eliminating the need for manual entry. This automated capture ensures no claim slips through the cracks, regardless of its submission format.

AI-Powered Deduction Matching

Once claim data is captured, AI algorithms automatically match deductions with relevant supporting documents — invoices, proofs of delivery (PODs), bills of lading (BoLs), contracts, or promotional records. This instant reconciliation replaces hours of manual cross-checking and ensures that every deduction is validated against accurate, system-sourced data.

Smart Prioritization

AI models also rank and prioritize deductions based on predefined parameters like claim amount, aging, customer importance, or potential cash flow impact. This smart prioritization directs analyst attention to high-risk or high-value deductions first, improving recovery rates and optimizing resource allocation.

Workflow Automation

With automation, every deduction type triggers a customized workflow. Pricing disputes may automatically route to the pricing team, while shortage claims go to logistics. Approvals are digital, rule-based, and trackable — removing delays caused by email chains and manual escalations. The result is a structured, end-to-end workflow that eliminates bottlenecks and enhances accountability.

Centralized Collaboration Hub

One of automation’s most transformative features is the creation of a unified collaboration dashboard for all stakeholders — AR teams, sales, logistics, and customer service. Every claim, document, and communication is housed within the same digital environment, ensuring real-time visibility and reducing back-and-forth communication. This centralization transforms deductions management from a fragmented process into a synchronized, collaborative ecosystem.

Auto Coding & Classification

Machine learning models auto-code and categorize deductions into precise types — such as trade, non-trade, pricing, or returns — based on content and historical data. This not only saves time but also ensures accuracy in reporting and trend analysis, enabling businesses to identify recurring deduction causes and prevent future disputes.

Touchless Resolution

Advanced automation introduces touchless claim resolution, where certain claims that meet predefined parameters (for example, small dollar value or verified promotional claim) are automatically processed and closed without human involvement. This allows analysts to focus exclusively on complex, high-value deductions that require judgment or negotiation.

Integrated ERP Sync

Finally, the automation platform integrates seamlessly with ERP systems (like SAP, Oracle, or NetSuite) and other financial tools. Once a claim is resolved, the system automatically updates the ERP with the outcome — issuing credit memos, reversing write-offs, or applying recoveries. This eliminates duplicate data entry, reduces reconciliation errors, and ensures financial records stay accurate and up to date across all systems.

Real-Time Analytics & Reporting

Automation doesn’t stop at process acceleration — it turns deductions management into a strategic intelligence hub. Real-time dashboards and analytics provide instant visibility into key performance indicators such as average resolution turnaround time, deduction volume, and recovery rate.

These insights help finance leaders track operational efficiency, identify bottlenecks, and detect recurring deduction patterns. For instance, if analytics reveal that a majority of deductions stem from a specific customer or recurring pricing issue, corrective action can be taken proactively, reducing future claims.

Automated systems also generate detailed reports on deduction trends, root causes, and resolution performance, enabling organizations to transition from reactive issue resolution to proactive prevention. This continuous feedback loop transforms raw transactional data into actionable intelligence, allowing businesses to enhance their deduction policies, refine approval hierarchies, and improve cash flow predictability.

Conclusion

Effective deductions management is no longer just about clearing disputes — it’s about protecting profitability and enabling financial precision across the entire order-to-cash cycle. A well-structured, technology-enabled deductions process allows businesses to move beyond reactive issue handling and toward proactive performance management. By integrating automation, AI, and analytics, organizations can uncover root causes, eliminate process inefficiencies, and establish a unified, transparent ecosystem that connects finance, sales, logistics, and customer service.

The benefits are measurable and far-reaching: faster resolution cycles, greater accuracy, centralized visibility, and reduced operational costs — all while strengthening trust with customers through transparent, timely communication. More importantly, automation empowers finance teams to focus on strategy rather than administration, turning deductions management into a profit-protecting, insight-generating function rather than a cost burden.

In a market where every transaction counts, mastering the deductions management process is not just good practice — it’s a competitive advantage. Businesses that embrace automation and data intelligence will not only recover revenue faster but also build the financial agility and foresight needed to thrive in a complex, ever-evolving commercial landscape.