Deduction Types and Strategies: A Complete Guide

Deductions are an unavoidable part of doing business between manufacturers, distributors, and retailers. While they can sometimes feel like a constant headache for Accounts Receivable teams, the key to mastering deduction management lies in understanding their types, causes, and how to address them strategically.

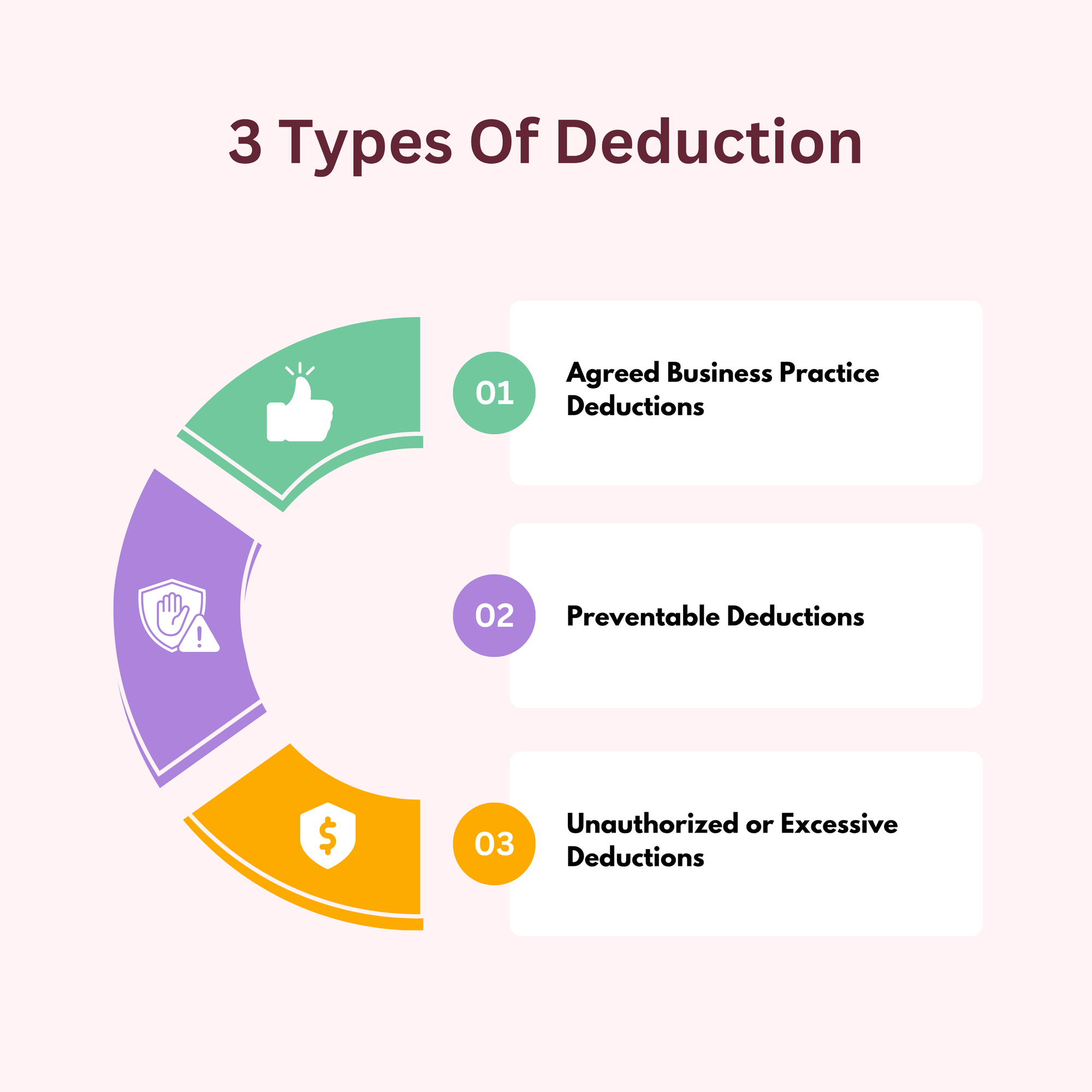

This guide explores the three main types of deductions—Agreed Business Practices, Preventable Deductions, and Unauthorized Deductions—and outlines actionable steps to reduce deduction-related revenue leakage.

Table of Contents:

- 1. Agreed Business Practice Deductions

- 2. Preventable Deductions (The Biggest Opportunity)

- 3. Unauthorized or Excessive Deductions

- Why Preventable Deductions Deserve the Most Focus

- A Step-by-Step Action Plan to Reduce Deductions

- The Bottom Line: Deduction Reduction Equals Profit Improvement

Jump to a section that interests you, or keep reading.

1. Agreed Business Practice Deductions

Agreed deductions are legitimate and pre-approved as part of the business relationship. These serve as structured financial adjustments tied to marketing or sales programs.

Common Examples:

- Promotional Allowances: Temporary price reductions or promotional discounts

- Co-op Advertising: Shared marketing or advertising costs between supplier and retailer

- Markdowns: Price adjustments to clear old or slow-moving stock

- Coupons and Rebates: Discounts passed on to consumers or retailers

- Slotting or Display Fees: Payments for shelf space or promotional displays

These deductions are expected and contractual, but they require proper documentation to ensure they’re correctly applied and reconciled.

Pro Tip: Use automated trade promotion management (TPM) systems to link deductions directly to approved promotional deals. This improves traceability and prevents duplicate or unearned claims.

2. Preventable Deductions (The Biggest Opportunity)

Preventable deductions are avoidable errors caused by process gaps, poor communication, or inaccurate data. These are the most damaging and costly deductions—but also the easiest to fix with the right systems and discipline.

Common Causes:

- Incorrect or outdated pricing data

- Delayed or missing credit memos

- Misinterpreted or undocumented promotions

- Shipping or billing errors (e.g., incorrect quantities or SKUs)

- Compliance violations like wrong packaging, late delivery, or missing paperwork

- Contract term mismatches between customer and supplier systems

Why These Matter Most

Preventable deductions make up an estimated 60–70% of all deduction volume across industries. Each preventable claim represents a breakdown in internal processes — not just a customer issue.

Suppliers that address these root causes often see faster cash conversion, improved supplier scorecard performance, and better customer satisfaction.

Best Practices to Reduce Preventable Deductions:

- Validate price, quantity, and terms before invoicing.

- Maintain real-time synchronization between ERP and customer systems.

- Use EDI compliance monitoring to reduce data mismatches.

- Establish a deduction root cause tracking system for continuous improvement.

3. Unauthorized or Excessive Deductions

Unauthorized deductions are invalid or excessive claims made by customers—often unintentionally due to system errors, or occasionally as part of post-audit processes.

Examples Include:

- Duplicate deductions for the same issue

- Unearned discounts (taken early or outside agreement terms)

- Post-audit claims raised years after the transaction

- System errors or misapplied payments

- Rarely, intentional over-deductions

To manage these effectively, companies need documentation control and dispute resolution workflows that can validate or reject such claims quickly.

Pro Tip: Adopt AI-powered deduction resolution tools that automatically match claims against invoices, proof of delivery (POD), and promotional agreements. This shortens resolution time and protects margins.

Why Preventable Deductions Deserve the Most Focus

Many suppliers blame customers for being “deduction-happy,” but in reality, most deductions trace back to internal supplier errors. Poor data quality, inconsistent documentation, and disconnected systems create opportunities for disputes.

In retail and consumer goods, Supplier Scorecards are used to evaluate vendors on metrics such as:

- On-time, In-Full (OTIF) delivery

- Invoice and EDI accuracy

- Labeling and packaging compliance

- Return and claim processing times

More deductions lead to lower scores — which can hurt your supplier reputation and even future business opportunities.

Action Step: Request your scorecard regularly to understand customer perceptions and identify where process improvements will have the most impact.

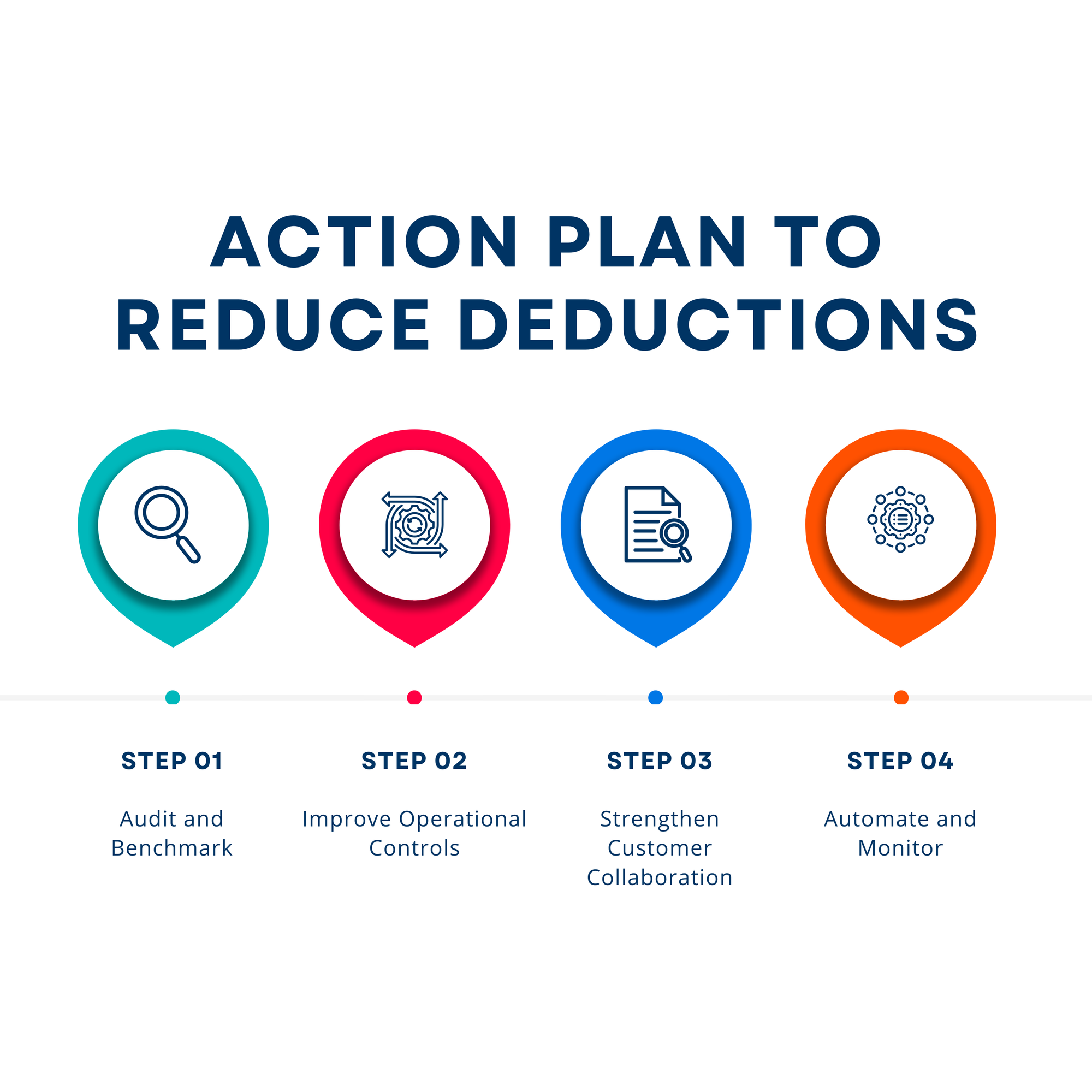

A Step-by-Step Action Plan to Reduce Deductions

Reducing deductions requires a cross-functional approach involving Sales, Finance, Supply Chain, and Customer Service teams. Here’s how to start:

1. Audit and Benchmark

- Review your order-to-cash process end-to-end to identify handoff points and bottlenecks.

- Analyze deductions by type, customer, and reason code.

- Benchmark your deduction rate — typically 2–5% of gross sales in most industries.

2. Improve Operational Controls

- Standardize invoice formats for easy customer validation.

- Reconcile pricing and terms with key accounts periodically.

- Pre-edit orders to catch pricing or promotion mismatches.

- Maintain a compliance management system to track each customer’s requirements.

3. Strengthen Customer Collaboration

- Visit customer teams to understand their deduction processes.

- Communicate all pricing, promotion, and product data clearly and on time.

- Document and archive special deals and non-standard agreements.

- Align your reconciliation format with what the customer expects.

4. Automate and Monitor

- Use automation and AI for deduction matching and root-cause analysis.

- Set up alerts for recurring deduction patterns.

- Integrate dispute management dashboards for visibility across teams.

- Start collection follow-ups earlier to improve payment rates.

The Bottom Line: Deduction Reduction Equals Profit Improvement

Reducing deductions isn’t just about recovering lost dollars — it’s about improving operational efficiency and building stronger, data-driven relationships with customers.

Companies that focus on preventable deductions, automation, and cross-functional accountability can reduce their deduction volume by up to 50%, leading to faster collections, fewer disputes, and higher margins.

By applying these deduction management strategies, you’ll not only safeguard profits but also position your organization as a trusted, compliant, and efficient supplier.