What is Deductions Management & How To Improve it with AI

In every business-to-business transaction, the expectation is simple: goods or services are delivered, and the customer pays the agreed amount. Yet, reality often differs. Customers may short-pay, dispute invoices, or deduct amounts for reasons ranging from damaged goods and shipment shortages to promotional claims and pricing errors. These deductions, while common, pose a serious challenge for accounts receivable teams. Left unmanaged, they drain cash flow, distort financial reporting, and strain customer relationships.

Deduction management is the structured process of identifying, validating, and resolving these short payments or claims. It is a critical function that protects revenue, maintains working capital, and safeguards profitability. However, traditional manual methods, reliant on spreadsheets, scattered documents, and endless back-and-forth communication, are slow, error-prone, and expensive, often costing hundreds of dollars per claim.

This guide provides a complete view of deduction management as well as discusses how AI-powered automation is redefining deduction management.

Table of Contents:

- What Are Deductions in Accounts Receivable?

- Why Deduction Management is Important?

- Types of Deductions

- The Deduction Management Process: Step-by-Step

- Key Challenges with Traditional Deduction Management

- Best Practices for Deduction Management

- How AI & Automation Improve Deduction Management?

- Final Thoughts

Jump to a section that interests you, or keep reading.

What Are Deductions in Accounts Receivable?

In accounts receivable, deductions represent the portion of an invoice that a customer withholds or short pays instead of remitting the full billed amount. They arise when a customer disputes an invoice, identifies discrepancies, or claims entitlement to a discount or adjustment. The withheld amount is subtracted from the payment, creating a deduction that must be validated and resolved by the accounts receivable (AR) team.

When an invoice is not paid in full, the situation may be described as a short pay. In some cases, customers proactively submit a claim explaining why they believe they owe less than the invoice total. In other cases, they simply remit a reduced payment without additional documentation, leaving analysts to investigate the cause.

Common Reasons for Deductions

- Damaged Goods: Customers may withhold payment if products arrive broken, defective, or otherwise unsellable. For example, a retailer receiving damaged items during transit may deduct the value of those items from the payment they remit.

- Billing Errors: Discrepancies between agreed-upon terms and the invoice often lead to deductions. Errors could include incorrect quantities, wrong product descriptions, or misapplied tax or shipping charges. Even small billing mistakes, when multiplied across high-volume transactions, can result in significant deductions.

- Shipment Shortages: If the quantity of goods delivered does not match the purchase order, customers deduct the value of missing items. Proof of Delivery (POD) and Bill of Lading (BoL) documents often become critical in validating whether the shortage was genuine.

- Trade Promotions and Discounts: Many companies, especially in the consumer packaged goods (CPG) sector, offer promotions, rebates, or volume discounts. If customers believe these were not reflected in the invoice, they will deduct the expected discount amount. For instance, if a buyer was promised a 10% promotional rebate but the invoice billed full price, they may deduct the rebate value when paying.

- Pricing Disputes: Deductions frequently occur when the invoiced price differs from the contract price or agreed terms. For example, if a customer agreed to $5 per unit but was billed $6, they would deduct the $1 per unit difference from their payment. Such disputes often require analysts to cross-check contracts, invoices, and claims to confirm validity.

- Returns: When customers return unsold or incorrect merchandise, they may deduct the corresponding amount from payments instead of waiting for a credit note to be issued.

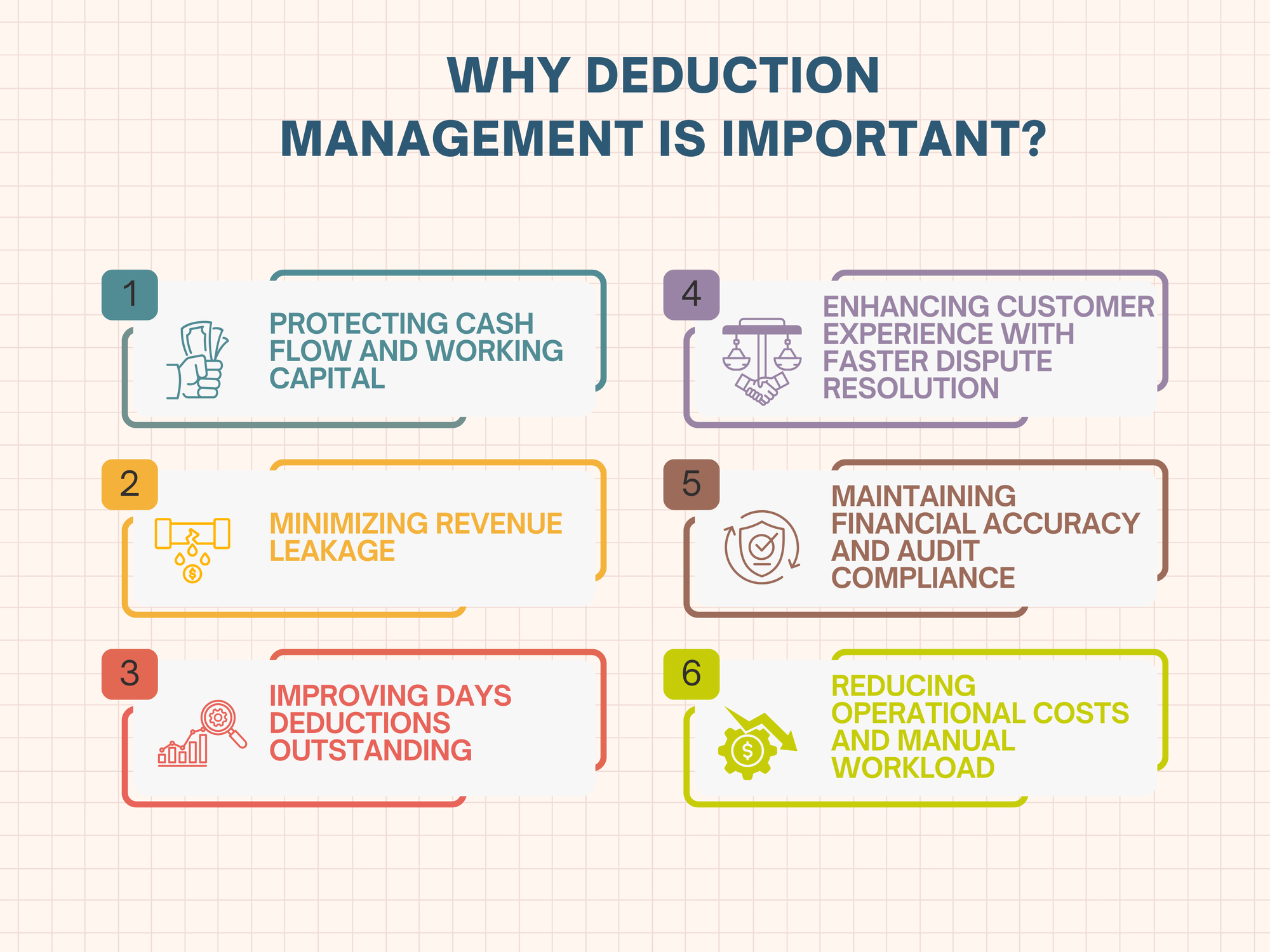

Why Deduction Management is Important?

Deduction management plays a central role in maintaining financial stability because every unresolved or mishandled deduction directly affects liquidity, profitability, and customer trust. Companies that treat it as a core accounts receivable function, rather than an afterthought, gain measurable advantages across their operations.

Protecting Cash Flow and Working Capital

Unaddressed deductions reduce the cash a business can collect, delaying inflows and straining day-to-day working capital. Manual investigation of hundreds or thousands of claims often means valid amounts remain outstanding for weeks or months, creating uncertainty in collections. A structured process ensures that disputes are handled quickly and revenue is realized in time to support operational expenses and investments.

Minimizing Revenue Leakage

Revenue leakage occurs when invalid or preventable deductions are never recovered. According to industry data cited in the blogs, deductions can account for up to 2% of total sales, and preventable or incorrect deductions average a 3.7% margin loss. Without proper validation, businesses may unnecessarily write off disputes just to clear them, causing avoidable losses that accumulate into millions of dollars annually. Strong deduction management reduces these unnecessary write-offs and maximizes net recovery rates.

Improving Days Deductions Outstanding (DDO)

Similar to Days Sales Outstanding (DSO), DDO measures how efficiently a business resolves open deductions. Prolonged resolution cycles increase aging receivables, complicate cash forecasting, and weaken liquidity. Effective deduction management reduces DDO by accelerating identification, validation, and closure of disputes, ensuring accounts are settled within tighter timelines. Companies using AI-driven systems report DDO reductions of 20% or more, directly improving their receivables performance.

Enhancing Customer Experience with Faster Dispute Resolution

Timeliness matters not only for cash recovery but also for maintaining strong customer relationships. Customers expect their disputes to be acknowledged and resolved promptly once supporting documents are submitted. Delays create frustration, strain business partnerships, and may even lead to canceled or reduced orders. A well-defined deduction management process provides transparency, faster resolution, and clear communication — improving customer satisfaction while protecting long-term business relationships.

Maintaining Financial Accuracy and Audit Compliance

Every deduction affects receivables, revenue recognition, and financial reporting. Inaccurate handling can distort projections, reduce visibility into true performance, and create compliance risks during audits. Proper documentation, centralized data, and timely ERP updates ensure accuracy in financial records and traceability of every action taken. This audit-ready approach safeguards the business against regulatory or contractual disputes.

Reducing Operational Costs and Manual Workload

Researching deductions manually is costly, averaging $200–$300 per claim when considering analyst time, cross-department communication, and repetitive data entry. Inefficient processes demand more full-time employees to manage disputes, yet still result in slow resolutions. Automated deduction management minimizes manual aggregation, research, and reporting, reducing resource costs while freeing analysts to focus on high-value recovery opportunities. Companies using automation report up to 40% increases in analyst productivity and 41% fewer staff required to manage deductions.

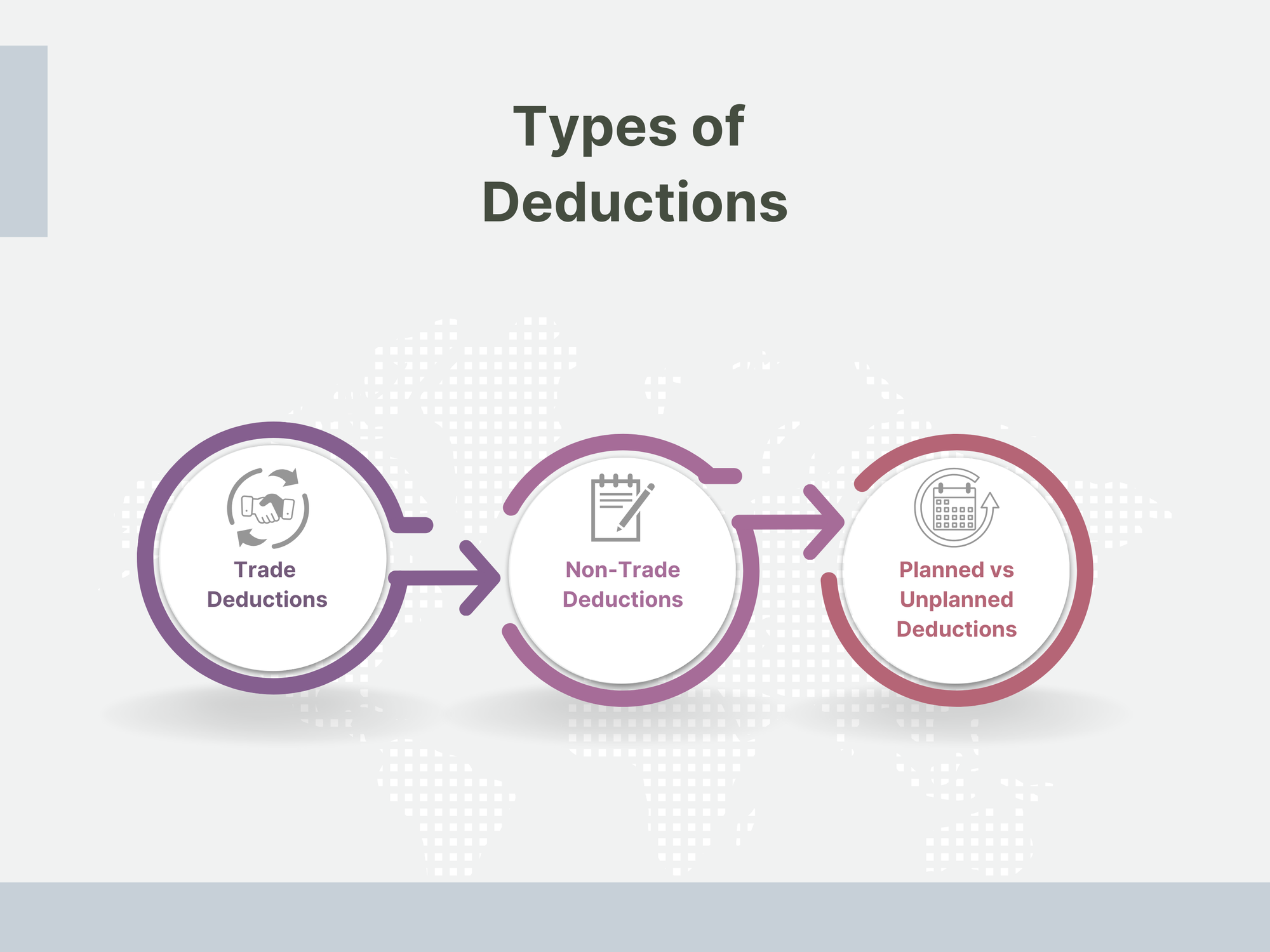

Types of Deductions

Deductions in accounts receivable can take multiple forms depending on their origin, purpose, and validity. Understanding the different categories helps companies prioritize claims, assign them to the right teams, and prevent revenue leakage. Broadly, deductions fall into trade and non-trade categories, and they can be classified further as planned or unplanned.

Trade Deductions

Trade deductions arise from promotional or contractual agreements between a business and its customers. These may include:

Promotions and Rebates: Buyers may claim rebates for volume-based purchases, seasonal campaigns, or contractually agreed promotions that were not reflected in the invoice.

Discounts: Customers may deduct earned discounts such as early payment benefits or negotiated reductions tied to sales programs.

Although trade deductions are expected as part of sales strategies, the challenge lies in validating whether the claim amount matches the agreed promotion, timeline, or terms. If not monitored, invalid trade claims can slip through, eroding margins.

Non-Trade Deductions

Non-trade deductions stem from operational discrepancies or disputes unrelated to promotions. Common examples include:

- Pricing Errors: Occur when the invoice price differs from the contractual or agreed price. For instance, if a product was contracted at $5 per unit but invoiced at $6, the customer may deduct the $1 difference per unit.

- Shortages: Customers reduce payments if fewer units are delivered than ordered, often verified using Proof of Delivery (POD) and Bill of Lading (BoL) documents.

- Damages: Goods that arrive defective, broken, or unsellable lead customers to withhold the equivalent value from payment.

- Returns: Unsold, incorrect, or unwanted merchandise returned by customers often results in deductions until credit memos are issued.

Non-trade deductions are particularly resource-intensive to investigate because they require detailed cross-checking of shipment records, invoices, and customer communications.

Planned vs Unplanned Deductions

Planned Deductions are expected, pre-negotiated adjustments such as promotional rebates, volume discounts, or trade allowances. Businesses anticipate these as part of the sales cycle and budget for them accordingly.

Unplanned Deductions occur without prior agreement, usually from disputes over pricing, shortages, damages, or unauthorized returns. These are often the most disruptive since they require immediate validation to avoid unnecessary revenue loss.

The Deduction Management Process: Step-by-Step

The deduction management process is a structured workflow within accounts receivable that ensures disputed or short-paid amounts are validated, resolved, and accurately reflected in financial records. While each organization’s process varies depending on size, customer base, and system maturity, the essential steps remain consistent.

1. Claim Submission

The process begins when a customer disputes an invoice or short pays the billed amount. Claims can arrive through multiple channels: EDI transmissions, customer web portals, email, fax, phone calls, traditional mail, or direct short payment on invoices. In some cases, customers provide supporting documentation such as debit memos or claim copies; in others, analysts must chase the customer to identify the reason for the deduction.

2. Claim Reception and Assignment

Once received, the deduction claim is logged and assigned to a deductions analyst. Assignment can be manual or automated depending on the organization’s setup. The analyst becomes responsible for end-to-end investigation and resolution of the claim.

3. Prioritizing Claims

Analysts prioritize claims based on predefined criteria such as deduction value, urgency, customer relationship importance, or aging status. High-value claims or disputes from strategic customers are typically escalated, while smaller claims may follow a standard queue. Without prioritization, teams risk delays in addressing critical disputes.

4. Gathering Documents

The next step is collecting all necessary backup documents to verify the claim. These may include Proof of Delivery (POD), Bill of Lading (BoL), order invoices, sales invoices, pricing contracts, trade promotion agreements, tax receipts, debit memos, or claim copies from customer portals. In manual processes, analysts spend 30–40% of their time retrieving these documents, often from multiple systems or external portals.

5. Research and Validation

Once documents are gathered, the analyst investigates whether the claim is valid or invalid. This involves cross-checking invoices against contracts, verifying shipment quantities against delivery records, and confirming whether promotions or discounts were applied correctly. Invalid claims — such as customers claiming unauthorized discounts or disputing accurate invoices — must be clearly documented for denial. Valid claims require preparing the necessary adjustments.

6. Requesting Missing Data from Stakeholders

If documentation is incomplete or discrepancies remain unresolved, analysts coordinate with internal stakeholders — such as sales, logistics, or customer service teams — to obtain missing data. This step can be a bottleneck in manual processes, as it often requires multiple rounds of communication across departments.

7. Claim Review and Approval

Before a claim can be finalized, it usually requires approval from managers or higher-level stakeholders. For example, trade promotion deductions may first need approval from the salesperson, then from an AR manager. In manual setups, approval requests can be delayed by email backlogs or lack of visibility, slowing the resolution timeline.

8. Customer Communication

After validation and approval, the analyst communicates the outcome to the customer. If the claim is valid, a credit memo or debit memo is issued. If invalid, the analyst prepares and sends denial correspondence, often attaching relevant documents like PODs or invoices to justify rejection. Timely and clear communication at this stage improves recovery rates and customer satisfaction.

9. ERP and TPM Updates

Validated claims are then synced with core systems such as ERP (Enterprise Resource Planning) and TPM (Trade Promotion Management). Updates include adjusting invoice balances, issuing credit or debit memos, and closing out customer account statuses. Without integration, this step requires manual data entry, increasing the risk of errors.

10. Reporting and Tracking

The final step is reporting on deduction activity for visibility and performance monitoring. Traditionally, reports are created manually in spreadsheets, requiring analysts to compile data from scattered sources. Metrics such as deduction volume, average resolution time, recovery rates, and open claim status provide insights for managers to identify bottlenecks, recurring issues, and opportunities for process improvement.

Key Challenges with Traditional Deduction Management

Traditional deduction management processes rely heavily on manual effort, fragmented systems, and reactive communication. While functional, they consume significant time and resources, leading to inefficiencies that impact profitability and customer relationships. Below are the core challenges businesses face with legacy approaches.

Manual, Time-Consuming Investigations

Analysts spend disproportionate time searching for claim-related data across emails, customer portals, ERP systems, and spreadsheets. Each claim requires gathering Proof of Delivery (POD), Bill of Lading (BoL), invoices, and contracts — often from multiple stakeholders. Industry data shows analysts devote 30–40% of their time just aggregating backup documents, making the overall resolution cycle unnecessarily long.

Prone to Errors and Inconsistencies

Manual data entry, fragmented communications, and reliance on spreadsheets increase the risk of typos, misinterpretation, or overlooked documents. These inconsistencies can result in incorrect deductions being approved, invalid claims going undetected, or accurate claims being rejected, ultimately damaging financial accuracy and customer trust.

Limited Visibility and Tracking

Without real-time dashboards, deduction teams cannot monitor claim status efficiently. Tracking depends on spreadsheets and email threads, which lack transparency and delay prioritization of high-value claims. Executives struggle to identify root causes or spot patterns, making it harder to address systemic issues or forecast future deduction trends.

No Central Repository for Data and Documents

Documentation is often scattered across portals, emails, local drives, and filing systems. With no single repository, analysts waste time searching for claim notes or supporting files, while managers lack traceability for audits. Missing documents also stall investigations and create compliance risks.

Bottlenecks in Approvals and Communication

Approvals typically require multiple layers of sign-off, such as sales teams for trade deductions and AR managers for final validation. In manual environments, approval requests are sent via email, where they can be delayed, overlooked, or lost. Cross-department communication is equally fragmented, with analysts chasing responses across sales, logistics, and finance teams, creating bottlenecks that prolong resolution times.

Lack of Denial Correspondence Automation

Invalid claims must be rejected promptly to maximize recovery. However, most legacy systems do not offer automated denial correspondence. Analysts are forced to draft and send rejection emails or portal updates manually, often without attaching sufficient supporting documents. This not only slows the denial process but reduces the likelihood of recovering invalid deductions.

Difficulty Predicting Deduction Validity

One of the biggest inefficiencies is the inability to predict whether a deduction is valid or invalid. Since only 3–5% of deductions are typically invalid, teams spend time investigating every claim equally, investing 20x more effort identifying invalids compared to processing valid ones. Without AI-driven prediction models, prioritization is nearly impossible, causing analysts to waste time on low-value tasks.

High Costs of Processing

The cumulative effect of these inefficiencies makes deduction management expensive. Research indicates it costs $200–$300 to research and resolve a single deduction, factoring in analyst labor, document retrieval, stakeholder communication, and manual reporting. For businesses handling thousands of deductions monthly, these costs can escalate rapidly, consuming both resources and margins.

Best Practices for Deduction Management

Effective deduction management requires more than resolving disputes as they arise. Businesses must establish structured practices that combine process discipline, centralized information, proactive communication, and data-driven insights. These best practices not only accelerate resolution but also strengthen customer relationships and reduce revenue leakage.

Defining Robust Workflows for All Deduction Types

Different deduction types — trade, non-trade, shortages, pricing disputes, returns, or promotions — demand different resolution paths. A robust workflow framework ensures each deduction follows a predefined process tailored to its category, reducing confusion and delays. For example, a trade deduction may require validation against promotional agreements, while a shortage deduction depends on shipment records and Proof of Delivery. Clearly defined workflows standardize responses, enforce accountability, and enable timely resolutions.

Centralizing Deduction-Related Information

Fragmented storage of documents across emails, spreadsheets, and portals creates inefficiencies. Centralizing all claim-related data — invoices, PODs, BoLs, debit memos, contracts, and correspondence — into a single repository allows analysts to search, filter, and retrieve information instantly. A centralized system also ensures visibility for managers, simplifies audit compliance, and provides traceability across the deduction lifecycle.

Maintaining Clear Communication with Customers

Customer experience is heavily influenced by how quickly and transparently disputes are handled. Maintaining consistent communication ensures customers know when their claim was received, its current status, and the outcome. Clear, timely updates prevent dissatisfaction and reduce the risk of strained relationships. Prompt responses also improve the chances of recovering disputed amounts, especially in cases of invalid claims.

Building Approval Matrices for Faster Collaboration

Many deductions require multi-level approvals, particularly in trade promotions or high-value disputes. Establishing structured approval matrices — where responsibilities and thresholds are clearly defined for sales teams, AR managers, and finance — prevents bottlenecks. Automated workflows or predefined escalation rules further accelerate collaboration across departments and eliminate delays caused by lost or ignored email approvals.

Regular Reporting and Root-Cause Analysis

Beyond resolving individual claims, businesses must track deduction metrics to identify systemic issues. Regular reporting on volumes, resolution times, DDO, and recovery rates provides visibility into team performance. Root-cause analysis of recurring deductions, such as frequent billing errors or repeated promotional disputes, helps organizations implement preventive measures, reducing future disputes and operational strain.

Proactive Denial Correspondence to Recover Invalid Deductions

Recovering invalid deductions depends on timely and well-documented denial communication. Best practices include sending standardized denial letters promptly, attaching proof such as invoices or delivery documents, and using automated systems to push denial notices directly to customer portals. Proactive correspondence not only increases the likelihood of recovering invalid claims but also demonstrates professionalism in dispute resolution.

Using Analytics to Spot Trends & Prevent Recurring Deductions

Advanced analytics can reveal patterns in deduction activity, such as specific customers frequently claiming pricing errors or recurring shortages linked to logistics partners. By spotting these trends, companies can address root causes — whether revising billing processes, tightening shipping controls, or renegotiating customer agreements. Analytics also guide strategic decision-making, enabling businesses to predict potential deduction risks and allocate resources to high-impact areas.

How AI & Automation Improve Deduction Management?

Traditional deduction management often traps businesses in cycles of manual research, fragmented communication, and delayed resolutions. AI-driven automation redefines the process by replacing repetitive tasks with intelligent systems that predict, classify, validate, and resolve disputes with speed and accuracy. Instead of spending weeks chasing documents and approvals, analysts can focus on high-value deductions where recovery is possible.

AI Validity Prediction

One of the most powerful features of AI in deduction management is its ability to determine the likelihood of a claim being valid or invalid. By analyzing over 20+ variables such as dispute type, deduction amount, customer details, and shipping information, along with 12 months of dispute resolution history, the system generates a probability score. This allows analysts to focus on invalid claims — which typically account for only 3–5% of all deductions but require 20x more effort to identify when processed manually. The result is faster prioritization, higher recovery rates, and reduced wasted effort.

Claim Backup Automation

Analysts spend 30–40% of their time aggregating claim documents like debit memos, PODs, invoices, and claim copies from customer portals and emails. Claim backup automation eliminates this burden by auto-collecting and linking documents directly to deductions within the system. This ensures every claim is research-ready, freeing analysts to move immediately to validation rather than administrative work.

Auto-Coding Deductions

Categorizing deductions by customer name, reason code, or dispute type is essential for routing them to the correct teams. Automation uses pre-built libraries of reason code identification algorithms (developed from hundreds of implementations) to code deductions instantly. For example, retailers like Walmart use specific codes for shortages; auto-coding ensures these claims are tagged and routed correctly without manual intervention.

Pricing Deduction Research Automation

Pricing disputes arise when customers claim they were billed more than agreed. Automation verifies these disputes by aggregating claim data, cross-checking it against internal contracts and ERP records, and performing 4-way matches between the deduction, claim backup, invoice, and pricing contract. This ensures discrepancies are caught quickly and accurately, avoiding unnecessary approvals of invalid pricing claims.

Trade Promotion Auto-Matching

Trade promotions are a common source of deductions, but validating them manually is like “searching for a needle in a haystack.” Automated systems perform 3-way matching between claim backup line items, trade promotion agreements, and master data to confirm whether deductions align with valid promotions. This allows invalid promotional claims to be flagged quickly, reducing leakage from overextended trade allowances.

POD Automation

For shortage or delivery-related disputes, Proof of Delivery documents are critical. AI systems automatically collect PODs from carrier portals, emails, or system integrations and match them to the deduction. They can also differentiate between signed and unsigned PODs, providing immediate evidence to support or deny a claim without waiting for manual retrieval.

Dispute Denial Automation

Recovering invalid deductions depends on timely, professional communication with customers. Automated denial correspondence tools generate pre-configured email packages or portal submissions, attaching supporting documents such as invoices, PODs, or contracts. This ensures denial notices are sent quickly, reducing delays and increasing the likelihood of recovering withheld funds.

Automated Workflows

Complex deductions often require approval across multiple departments — sales, AR, finance, or logistics. Automated workflows establish role-based approval matrices, ensuring the right stakeholders are engaged at the right stage. Collaboration occurs within a centralized platform, eliminating the delays and miscommunication caused by back-and-forth emails.

Real-Time Monitoring and Dashboards

Automation also provides real-time visibility into deduction queues, claim statuses, and team productivity. Dashboards display key metrics such as volumes, resolution times, and recovery rates, helping managers identify bottlenecks, monitor high-priority claims, and guide resource allocation. This level of transparency was nearly impossible with manual spreadsheets, where reporting often lagged behind actual claim activity.

Final Thoughts

Deductions are inevitable in retail and consumer goods, but revenue loss and inefficiency don’t have to be. A modern deduction management process, powered by AI and automation, ensures that every dispute is researched, validated, and resolved quickly while protecting margins and strengthening customer relationships. Companies that move beyond manual processes gain faster resolution cycles, lower operational costs, and greater visibility into recurring issues, turning deduction management from a cost center into a driver of financial performance.

With AI purpose-built for retail deductions, SpeedyLabs helps finance and AR teams auto-capture claims, link supporting documents like PODs, BOLs, and invoices, validate against promotions and accruals, and prioritize disputes with explainable AI scoring. The result: faster recoveries, higher win rates, and fewer repetitive deductions in the future.

SpeedyLabs goes beyond resolution with prevention analytics, identifying shortage and damage patterns, catching price or allowance exceptions before they escalate, and alerting Sales or Operations when deduction risks spike. Its glass-box AI approach ensures every recommendation is explainable, giving teams the confidence to act decisively.

Resolve retail deductions with AI. Recover more & faster. Get in touch with SpeedyLabs today to see how.