What is Days Deductions Outstanding (DDO)?

Maintaining a healthy cash flow is essential to sustaining growth, profitability, and financial stability. While most companies focus heavily on accelerating collections through metrics like Days Sales Outstanding (DSO), an equally critical yet often overlooked measure is Days Deductions Outstanding (DDO). DDO reveals how efficiently an organization resolves customer deductions—the short payments, disputes, and claims that temporarily withhold revenue and disrupt working capital.

Every open deduction represents money that’s owed but not yet realized, tying up liquidity and inflating operational costs. A high DDO indicates delays in addressing these disputes, signaling inefficiencies in communication, documentation, or process automation. Conversely, a low DDO reflects a streamlined, collaborative, and well-governed deduction management process that accelerates dispute resolution and strengthens financial health.

This comprehensive guide dives deep into everything you need to know about Days Deductions Outstanding (DDO)—from its definition and calculation methods to the root causes behind high DDO and proven strategies to reduce it.

Table of Contents:

- What is Days Deductions Outstanding (DDO)?

- Why Days Deductions Outstanding Matters?

- How to Calculate Days Deductions Outstanding (DDO)?

- Common Causes of High Days Deductions Outstanding (DDO)

- Best Practices to Reduce DDO

- Leveraging Technology to Optimize Deduction Management

Jump to a section that interests you, or keep reading.

What is Days Deductions Outstanding (DDO)?

Days Deductions Outstanding (DDO) is a crucial financial performance metric that measures the average number of days it takes a company to resolve customer deductions from outstanding invoices. It serves as a direct indicator of the efficiency and effectiveness of a business’s deduction management process, which is a core component of accounts receivable (A/R) operations.

In the A/R context, a deduction represents any short payment or dispute raised by a customer—often due to pricing errors, damaged goods, shipment discrepancies, promotional allowances, or contract-related adjustments. When such deductions occur, they delay the receipt of full payment and can tie up working capital. DDO quantifies how quickly and efficiently these deductions are resolved, providing visibility into both the operational health and financial agility of an organization.

Essentially, DDO answers a fundamental liquidity question: How long does it take for your business to recover money stuck in deductions? A low DDO value indicates an efficient dispute resolution process where deductions are handled promptly, minimizing the impact on cash flow. It reflects robust cross-departmental coordination, streamlined documentation, and a mature deduction management workflow. Conversely, a high DDO signals bottlenecks in communication, manual processing inefficiencies, or inadequate tracking systems that delay resolution, increase borrowing needs, and strain overall financial health.

Unlike Days Sales Outstanding (DSO), which measures the average time taken to collect payments from customers, DDO focuses specifically on how quickly open deductions are investigated and cleared. Both metrics complement each other—while DSO assesses the collection efficiency of the A/R process, DDO evaluates the speed and accuracy of deduction resolution. When analyzed together, they provide a holistic picture of an organization’s receivables performance and cash conversion efficiency.

From an operational perspective, DDO is more than a number—it is a reflection of a company’s internal collaboration, process automation, and data accessibility. Effective management of DDO requires clear communication between sales, logistics, billing, and finance teams to ensure that every deduction is validated, documented, and resolved within minimal time. Businesses that consistently maintain a low DDO typically leverage centralized data repositories, automated workflows, and predictive analytics to detect, categorize, and settle disputes faster.

Why Days Deductions Outstanding Matters?

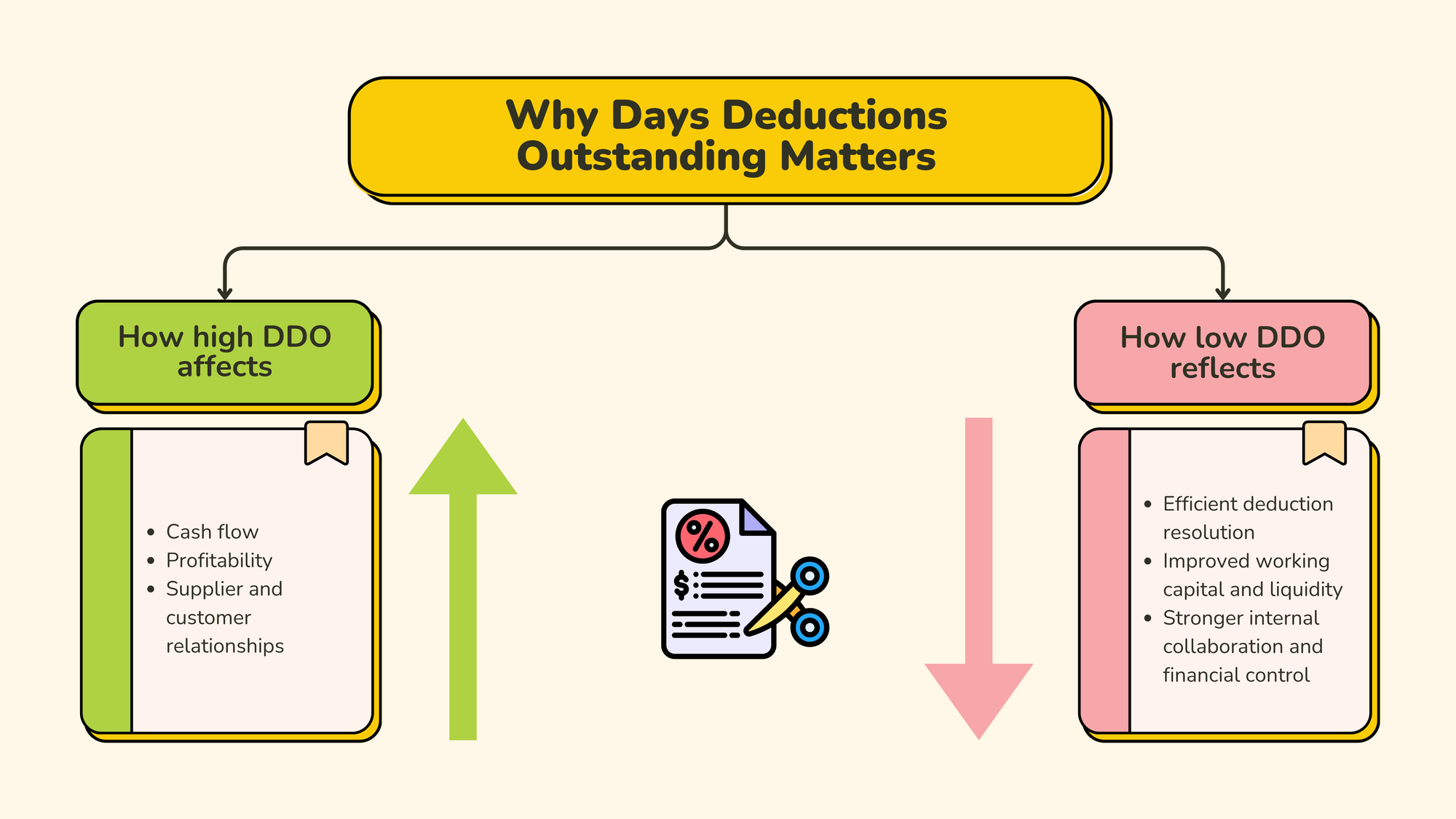

Days Deductions Outstanding (DDO) is more than just a metric—it is a critical reflection of a company’s financial health, operational maturity, and process efficiency. In the realm of accounts receivable, DDO quantifies how effectively a business identifies, investigates, and resolves customer deductions. Because deductions directly impact incoming cash flow, the speed and accuracy with which they are cleared determine how much working capital remains available for daily operations and growth initiatives.

A high DDO is an early warning sign of financial inefficiency and process breakdowns. When deductions remain unresolved for long periods, they tie up capital that could otherwise be used to support operations, invest in inventory, or pay suppliers. This stagnation leads to cash flow constraints, often forcing companies to depend on external financing to maintain liquidity. Additionally, delayed resolutions can distort profitability—each open deduction represents potential revenue that has not yet been recovered. Over time, unresolved disputes accumulate into financial leakage, reducing margins and impacting overall earnings performance.

High DDO also weakens supplier and customer relationships. From the customer perspective, frequent billing errors, poor communication, or long dispute cycles erode trust and satisfaction. On the supplier side, delayed cash inflows disrupt payment schedules and damage credibility, potentially increasing the cost of capital or limiting vendor support. In short, an elevated DDO exposes inefficiencies not only in financial systems but also in cross-functional collaboration and customer service delivery.

Conversely, a low DDO is a hallmark of operational excellence. It indicates that the company’s deduction resolution processes are efficient, timely, and well-coordinated across teams such as sales, logistics, and finance. Fast dispute closure leads to improved working capital and liquidity, ensuring that cash tied up in deductions is quickly released back into circulation. This contributes directly to a healthier balance sheet and a more predictable cash conversion cycle.

A consistently low DDO also demonstrates strong internal collaboration and financial control. It reflects the presence of structured workflows, centralized documentation, and proactive communication—factors that prevent disputes from escalating or recurring. Organizations that maintain low DDO values typically employ automation, digital document repositories, and analytics to detect root causes and address them efficiently.

How to Calculate Days Deductions Outstanding (DDO)?

Days Deductions Outstanding (DDO) quantifies the average time required to resolve customer deductions from outstanding invoices. Calculating DDO helps measure how efficiently a business manages disputes and recovers withheld amounts. Different organizations apply varying methods based on whether they track deduction value, case volume, or time-weighted efficiency. Below is a complete breakdown of all recognized calculation approaches.

Formula (Value-Based Method)

The value-based method is the most widely used formula to determine DDO in financial terms. It measures how long, on average, it takes to resolve each dollar of deduction.

Formula:

DDO = Total Outstanding Deductions / Average Daily Deductions Incurred

Example:

If a company has $25,000 in outstanding deductions and incurs an average of $2,500 in daily deductions,

DDO = 25,000 / 2,500 = 10 days

This means it takes an average of 10 days to recover each dollar tied up in deductions.

Interpretation:

A lower DDO reflects fast deduction resolution and healthy cash flow, while a higher DDO signals delays in recovering withheld amounts and possible inefficiencies in deduction management.

Formula (Count-Based Method)

The count-based method focuses on operational efficiency and measures the time taken to close individual deduction cases rather than monetary value.

Formula:

DDO = Number of Open Deductions / Average Number of Deductions Resolved Daily

Example:

If a company currently has 100 open deductions and resolves an average of 5 per day,

DDO = 100 / 5 = 20 days

This means it takes an average of 20 days to close each deduction case.

Interpretation:

This approach is particularly useful for companies managing a high volume of smaller deductions, such as in retail or consumer goods, where the number of cases is more critical than total deduction value.

Alternative Approach (Research-Based Formula)

A third calculation method, used in research and industry benchmarking, integrates both value and time to provide a more analytical view of deduction management performance.

Formula:

DDO = Number of Open Deductions / (Average Deduction Value × Periods)

This variation assesses deduction resolution over multiple accounting periods and is especially relevant for organizations handling complex or recurring deductions such as rebates, trade promotions, or freight claims.

Common Causes of High Days Deductions Outstanding (DDO)

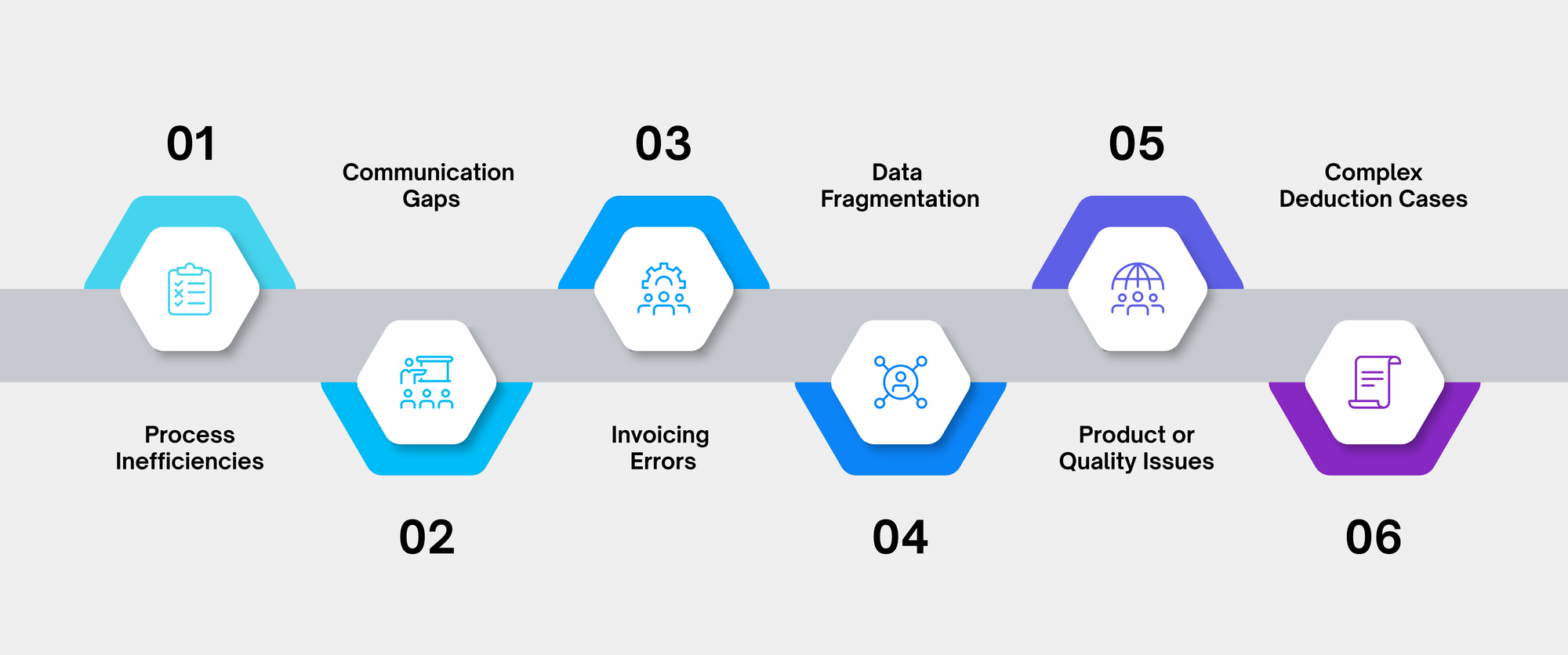

A high Days Deductions Outstanding (DDO) value signals underlying inefficiencies in an organization’s deduction management process. When deductions remain unresolved for prolonged periods, they not only delay cash recovery but also expose operational gaps across systems, communication, and documentation. Understanding the root causes behind elevated DDO is essential for identifying where process improvements and automation can deliver the greatest impact.

Process Inefficiencies

One of the most significant contributors to high DDO is manual and fragmented deduction management. Relying on spreadsheets, disconnected tools, and email-driven workflows slows down resolution cycles and increases the risk of data loss or duplication. Without standardized procedures, analysts spend excessive time searching for information, validating documents, or updating multiple systems. The absence of automation in tasks like deduction tracking, reason code assignment, and document validation creates a heavy operational burden, leading to delayed resolution and inconsistent accuracy.

Communication Gaps

Poor coordination between departments—particularly Accounts Receivable, Sales, Logistics, and Compliance—is another key driver of prolonged deduction cycles. When critical information such as deal sheets, proof of delivery, or invoice details is not shared efficiently, analysts are left without the context needed to resolve disputes. Unclear role ownership and the absence of structured escalation mechanisms further exacerbate delays. Without seamless communication channels or automated workflows, teams resort to lengthy email exchanges and manual follow-ups, which impede visibility and accountability throughout the resolution process.

Invoicing Errors

Incorrect or incomplete invoices are a common root cause of deductions and directly inflate DDO. Pricing discrepancies, missing item details, or incorrect tax calculations lead customers to short-pay invoices or raise disputes. Each error triggers additional verification steps, forcing deduction analysts to reconcile records manually and coordinate across billing and sales teams. These repetitive, preventable issues extend dispute lifecycles, negatively impacting both cash flow and customer satisfaction.

Data Fragmentation

The lack of a centralized repository for deduction-related documents severely hampers resolution speed. When key records such as deal sheets, shipping documents, bills of lading, or proof of delivery are scattered across multiple systems or stored locally by different departments, retrieving them becomes time-consuming and error-prone. Fragmented data visibility means analysts spend more time searching for evidence than resolving disputes. Without a single, accessible source of truth, organizations face reduced transparency, duplicated efforts, and increased DDO.

Product or Quality Issues

Persistent product quality problems—such as damaged goods, shipment discrepancies, or delivery delays—frequently lead to customer deductions. Every unresolved complaint translates into an open deduction, prolonging DDO. These issues typically originate in upstream operations but cascade into financial delays downstream. When logistics and product quality teams lack synchronized documentation or verification checks, validating customer claims becomes slow and complex, directly inflating DDO.

Complex Deduction Cases

Not all deductions are straightforward. Multi-layered disputes involving promotions, rebates, freight claims, or trade allowances require multi-departmental validation, contract verification, and financial reconciliation. These cases tend to remain open for extended periods due to the complexity of documentation, variable claim legitimacy, and limited process automation. Without clear categorization and prioritization mechanisms, such deductions often clog the resolution pipeline, raising overall DDO.

Best Practices to Reduce DDO

Addressing the causes of high DDO requires structured process redesign, automation, and proactive monitoring. The following best practices provide actionable strategies to enhance deduction resolution efficiency and accelerate cash recovery.

Centralized Data Repository

Establish a single, unified repository for all deduction-related documents, including invoices, deal sheets, proofs of delivery, and shipping records. A centralized system reduces document retrieval time, enhances visibility, and ensures all stakeholders access consistent, verified data during the resolution process.

Standardized Communication Workflows

Replace ad hoc email exchanges with structured, automated workflows that define clear escalation paths and task ownership. Standardized workflows enhance cross-team visibility, ensure accountability, and minimize delays caused by manual communication gaps.

Streamlined Correspondence Automation

Implement predefined communication templates for common deduction scenarios such as missing backup documentation, invalid claims, or invoice mismatches. Automating these interactions reduces repetitive analyst effort and accelerates customer response times, improving resolution turnaround.

Automated Reason Code Mapping

Use AI-powered tools to automatically match customer reason codes with internal classifications. This eliminates manual data entry, reduces the potential for human error, and allows deduction teams to focus on higher-value activities such as trend analysis and root cause identification.

Predictive Deduction Validity Tracking

Adopt machine learning models that evaluate historical data and predict the likelihood of a deduction being valid or invalid. Automated deduction validity scoring helps teams prioritize genuine claims, avoid wasted effort on invalid disputes, and achieve faster resolution cycles.

Regular Process Audits

Conduct cross-functional audits to identify recurring bottlenecks, communication failures, or documentation inconsistencies. Continuous review ensures processes remain aligned with changing business requirements and promotes ongoing improvement in DDO performance.

Leveraging Technology to Optimize Deduction Management

Modern technology plays a central role in transforming deduction management from a manual, reactive process into a proactive, data-driven function.

Automation of Deduction Processes

Automate repetitive deduction management tasks such as data capture, claim validation, and correspondence tracking. Automation eliminates manual bottlenecks, ensures accuracy, and shortens resolution timelines, directly lowering DDO.

Predictive Analytics for Deduction Validity

Utilize AI-based predictive analytics to assess deduction legitimacy in real time. By analyzing historical payment behavior, claim frequency, and deduction patterns, predictive models enable proactive decision-making and more efficient resource allocation.

Centralized Data Management Systems

Adopt digital repositories and integrated data management platforms to consolidate all deduction documentation. Centralization enhances collaboration, enables real-time data sharing across departments, and prevents duplication or data loss.

Real-Time Reporting and Dashboards

Deploy real-time analytics dashboards that provide instant visibility into deduction trends, open case counts, and resolution performance metrics. KPI-based dashboards help managers identify process bottlenecks early, track team productivity, and make data-driven adjustments.

System Integration

Integrate deduction management software seamlessly with ERP and A/R systems to ensure data synchronization and process continuity. End-to-end integration streamlines workflows, reduces manual input errors, and improves the accuracy of deduction tracking and reporting.

Conclusion

Effective management of Days Deductions Outstanding (DDO) is not just about resolving disputes—it’s about driving financial agility, operational efficiency, and organizational accountability. A low DDO is a hallmark of companies that manage their receivables proactively, communicate seamlessly across teams, and leverage automation and analytics to eliminate process delays. By contrast, a persistently high DDO highlights systemic inefficiencies that can quietly erode liquidity and profitability over time.

As businesses evolve, deduction management must evolve with them. The integration of AI, predictive analytics, and centralized data systems now empowers finance teams to predict deduction validity, automate reason coding, and gain real-time visibility into performance metrics. Organizations that adopt these technologies not only shorten resolution cycles but also build a sustainable competitive edge through faster cash recovery and stronger customer relationships.

In essence, DDO is more than a performance metric—it’s a financial health indicator that connects process efficiency with business profitability. Companies that continuously monitor and optimize their DDO are better equipped to convert disputes into resolutions, data into insights, and cash delays into opportunities for growth.