The Complete Guide to Customer Rebates

Customer rebate programs have become a structured and data-rich way for businesses to drive repeat purchases, optimize margins, and encourage customer retention without the immediate margin erosion of point-of-sale discounts. Unlike general rebate or incentive models, customer rebates are highly targeted, rules-based promotions tied directly to sales data, product eligibility, and customer profiles. They offer post-purchase value while maintaining full-price sales at the point of transaction. When executed properly, these programs not only incentivize behavior but also generate detailed insights that enhance future marketing, pricing, and supply chain decisions. This guide breaks down every key component of a customer rebate from foundational definitions and types to structural frameworks, operational benefits, and practical pitfalls to avoid.

Table of Contents:

- What is a Customer Rebate?

- Customer Rebates vs. Point-of-Sale Discounts

- Core Benefits of Customer Rebate Programs

- Types of Customer Rebates

- Customer Rebate Program Structure

- Best Practices for Building and Running Customer Rebate Programs

- Common Pitfalls and How to Avoid Them

Jump to a section that interests you, or keep reading.

What is a Customer Rebate?

A customer rebate is a post-purchase incentive offered by a manufacturer, wholesaler, or distributor to a customer. Unlike upfront discounts, which reduce the price at the time of sale, rebates are structured to be claimed after a qualifying purchase is made. The customer pays full price at checkout and then submits a request to receive a specific amount back, typically in the form of cash-equivalent compensation.

At its core, a customer rebate acts as a reward for completing certain purchase conditions. It’s not automatically granted it requires proof of purchase, such as a receipt or invoice, and must be claimed through a defined redemption process. This usually includes submitting documentation through a digital portal or via email within a certain time frame.

Customer rebates can take several forms:

- Prepaid cards (commonly Visa or Mastercard)

- Digital transfers (direct deposit or PayPal)

- Physical checks

What makes customer rebates different from general discounts is their timing and intent. A discount reduces the upfront cost to attract impulse purchases. A rebate, on the other hand, delays the reward to encourage repeat buying behavior, larger basket sizes, and post-sale engagement.

In business systems, customer rebate programs are tied closely to defined rules—only specific products, customer types, timeframes, or shipping details may qualify. Eligibility is verified using data from sales orders (often uploaded through CSV files), and only transactions that meet every defined criterion are considered valid for rebate payout.

The combination of delayed reward, structured conditions, and data-backed verification sets customer rebates apart from other price-based promotions.

Customer Rebates vs. Point-of-Sale Discounts

Both customer rebates and point-of-sale (POS) discounts are promotional tools aimed at encouraging purchases, and they share some structural similarities. Each relies on clearly defined eligibility rules, including product types, customer segments, transaction dates, and qualifying sales conditions. In both cases, timing matters whether based on order date, ship date, or invoice date, and promotion triggers are tied to specific events within the transaction cycle.

However, their differences are substantial, especially in execution, customer engagement, and financial treatment.

The redemption process is the most obvious distinction. In a POS discount, the benefit is immediate, the customer receives a lower price at the time of purchase. With a customer rebate, the full amount is paid upfront, and the reward is delivered only after the customer submits proof of purchase and completes the redemption process. This process may involve uploading documents or filling out forms through a dedicated rebate platform.

From an accounting perspective, rebates are typically booked as a post-sale expense, while POS discounts are treated as a reduction in revenue at the point of sale. This affects how revenue and promotional costs are reported in financial statements.

Customer behavior is also influenced differently. Discounts create instant gratification but may not drive long-term loyalty. Rebate programs, especially when structured around cumulative spending or multi-transaction thresholds, encourage repeat purchases and sustained engagement. Customers are motivated to continue buying to reach the rebate criteria, which extends brand interaction and increases total spend.

Choosing rebates over discounts often aligns with goals such as improving cash flow, since customers pay the full amount upfront, or gathering customer data for ongoing marketing efforts. Rebates also offer better control over offer distribution. Unlike discount codes, which can be easily shared or leaked, rebate eligibility is tied to actual purchases and customer profiles.

Core Benefits of Customer Rebate Programs

Customer rebate programs offer distinct advantages that go beyond simple price reductions, directly supporting sustained revenue growth, customer engagement, and operational efficiency.

First, rebates play a central role in encouraging repeat purchases and building brand loyalty. Unlike limited-time discounts that often attract one-off buyers, rebate programs are designed to reward cumulative behavior. By requiring multiple qualifying transactions or spend thresholds, rebates keep customers returning to meet eligibility criteria. This creates ongoing engagement with the brand rather than a short-lived boost in sales.

These programs also lead to higher order values. When incentives are tied to minimum spending thresholds, such as a rebate that activates at $50 customers are more likely to increase their cart size to qualify. This behavior consistently drives larger transaction sizes and overall revenue gains, often across multiple purchases when rebates are structured over time.

One of the most strategic advantages is the ability to collect high-value customer data. Email addresses, purchase history, product preferences, and behavioral trends are all captured through rebate registration and redemption processes. This data enables tailored marketing and deeper customer insights, which are more difficult to obtain through traditional discounting methods.

Rebates also provide support for immediate cash flow. Since customers pay the full price at the time of purchase and only receive compensation later once the rebate is claimed, businesses retain full revenue upfront. This contrasts with discounts, which reduce the transaction amount immediately and require a higher sales volume to offset margin losses.

Lastly, customer rebate programs enable more controlled and secure digital engagement. Unlike discount codes, which are easily shared or misused, rebates are issued based on verified purchases and unique customer identifiers. This limits abuse and ensures that promotions are targeted and earned. The digital nature of modern rebate platforms through prepaid cards, online wallets, or bank transfers also streamlines customer interactions and reinforces brand credibility through a more seamless, tech-enabled experience.

Types of Customer Rebates

Customer rebate programs can be structured in multiple ways, depending on the reward mechanism, timing of redemption, and the entity being incentivized. Understanding these categories is essential for setting up rebate programs that align with business goals and customer behavior.

By Reward Type

-

Percentage-Based Rebates

These rebates return a fixed percentage of the purchase amount to the customer once the eligibility criteria are met. They are commonly used to drive volume purchases and are often tied to cumulative sales thresholds. The variable nature allows for flexible alignment with margins and encourages higher spending. -

Fixed Amount Rebates

A predetermined dollar value is returned regardless of the purchase size, once conditions are satisfied. This type simplifies communication and redemption expectations, especially in promotions targeting a specific product or set of SKUs.

By Redemption Style

-

Instant Rebates

Automatically applied at the point of sale, these rebates reduce the transaction amount immediately. While categorized under rebate programs, they function similarly to discounts and do not require customer action post-purchase. They are best used when simplicity is a priority, but they offer less post-sale engagement or data capture. -

Deferred Rebates

These require the customer to pay the full amount upfront and initiate the rebate process afterward. This approach improves immediate cash flow for the business while extending the customer interaction cycle. It also allows for validation of purchase behavior, proof of eligibility, and targeted fulfillment of rewards through checks, prepaid cards, or digital transfers.

By Target

-

Individual Customer Rebates

These are assigned at the individual level, where the customer is uniquely identified and the rebate is calculated based on their personal transaction history. Redemption is tied directly to that customer’s activity. -

Account-Based Rebates

Structured around entities involved in the transaction such as Ship To, Bill To, or Beneficiary these programs apply rebates based on collective purchases across different touchpoints within an account. This is particularly relevant for B2B environments where multiple branches or departments contribute to total volume, and the rebate is tied to the broader organization rather than a single buyer.

Each rebate type serves a distinct purpose, and businesses often combine them to meet promotional, operational, and financial goals.

Customer Rebate Program Structure

A customer rebate program is built around a structured template that defines how rebates are issued, tracked, and redeemed. The structure ensures consistency, compliance with internal business rules, and the ability to scale rebate offers across customer segments and product categories. Below are the essential components of a standardized customer rebate program format.

The foundation of any customer rebate initiative is a program template. This template is created by manufacturers, wholesalers, or distributors and acts as the blueprint for individual rebate offers. It standardizes rules for eligibility, timelines, product coverage, and reward triggers, ensuring that rebate programs align with internal business processes.

Program Terms

-

Customer Eligibility Rules

Rebate eligibility is defined at the customer level, with supported types including:- Customer: Identified end-user or buyer entity.

- Ship To: Location where goods are delivered.

- Bill To: Entity responsible for payment.

- Beneficiary: The party intended to receive the rebate reward.

-

Timeframe

Rebate periods are governed by date-based criteria, allowing flexibility based on business needs. Supported date contexts include:- Requested Ship Date

- Actual Ship Date

- Invoice Date

- Order Date

- Requested Arrival Date

These options make it possible to control eligibility windows based on logistics, billing, or sales cycle considerations.

-

Additional Conditions

Further qualifiers add precision to rebate targeting. Conditions may include:- Order Line Type: Differentiates between types of line items.

- Order Type: Sales orders, returns, etc.

- Salesperson: Enables performance-based rebate tracking.

- Warehouse: Rebates may vary based on the fulfillment center.

- Customer/Ship To/Bill To: Additional filters for transactional specifics.

-

Product Eligibility

Eligibility is based on product-level rules:- Item: Specific SKUs or product lines.

- All Items: Broad inclusion of any item listed in the item master. For a sale to qualify under “All Items,” the products must exist in both the sales order and the item master records.

Sales Data Sources

To validate purchases and calculate rewards, sales data must be captured and matched accurately:

- Sales Order Import: Sales data is usually uploaded via CSV files or through system integrations.

- Linkage to Item Master: All eligible products must be listed in the item master to ensure accurate matching and processing.

Reward Triggers

Rebate issuance depends on specific performance metrics or transaction milestones:

- Purchase Thresholds: Minimum spend amounts that unlock rebate eligibility.

- Number of Transactions: Customers may need to complete a set number of purchases to qualify.

- Specific SKUs: Certain products may be tagged as rebate-eligible, allowing manufacturers to push particular items through targeted incentives.

Best Practices for Building and Running Customer Rebate Programs

Running an efficient customer rebate program requires more than just offering incentives it demands structured execution, clarity in communication, and reliable tracking. The following best practices are essential for building and managing customer rebate programs that are both functional and aligned with business goals.

Clear Terms and Simple Redemption

Programs should clearly define all eligibility criteria, such as applicable products, customer types, timeframes, and purchase conditions. Customers must know exactly what is required to qualify and how to redeem the rebate. Ambiguity leads to friction, which can reduce participation and increase support requests. A straightforward redemption process, typically requiring proof of purchase such as an invoice or receipt, ensures customers can complete the process without confusion.

Communicate via Email, SMS, and Post-Purchase Flows

Email marketing remains one of the most reliable tools for ongoing engagement. Collecting customer email addresses during rebate registration allows companies to trigger follow-up sequences, send reminders, and notify recipients about rebate status. SMS updates and automated post-purchase messages further streamline the experience and keep customers informed, which helps maintain interest and reduces drop-off rates during the claim process.

Trackable Data Points for Each Rebate Issued

Each rebate issued should be supported by data that confirms eligibility and enables performance tracking. Capturing details like order number, date of purchase, qualifying product SKUs, and rebate amount ensures transparency and facilitates audits. When this data is centralized, businesses can assess program performance, monitor customer behavior, and adjust terms in real time based on actual results.

Integration with CRM and Analytics Platforms

For maximum utility, rebate programs should integrate with customer relationship management (CRM) tools and analytics platforms. This allows teams to view rebate data alongside customer profiles, purchasing history, and marketing engagement metrics. Insights from these integrations help refine future rebate offers, segment customers more precisely, and tailor messaging to maximize participation and ROI.

Digital-First Delivery Over Physical Mail

Digital rebate distribution via prepaid cards, bank transfers, or digital wallets provides a faster and more reliable experience than physical mail. Traditional methods like mailed checks introduce delays, risk of loss, and higher fulfillment costs. A digital-first approach also reduces misuse, since access is restricted to verified customers, unlike static promo codes, which can be widely shared and abused online.

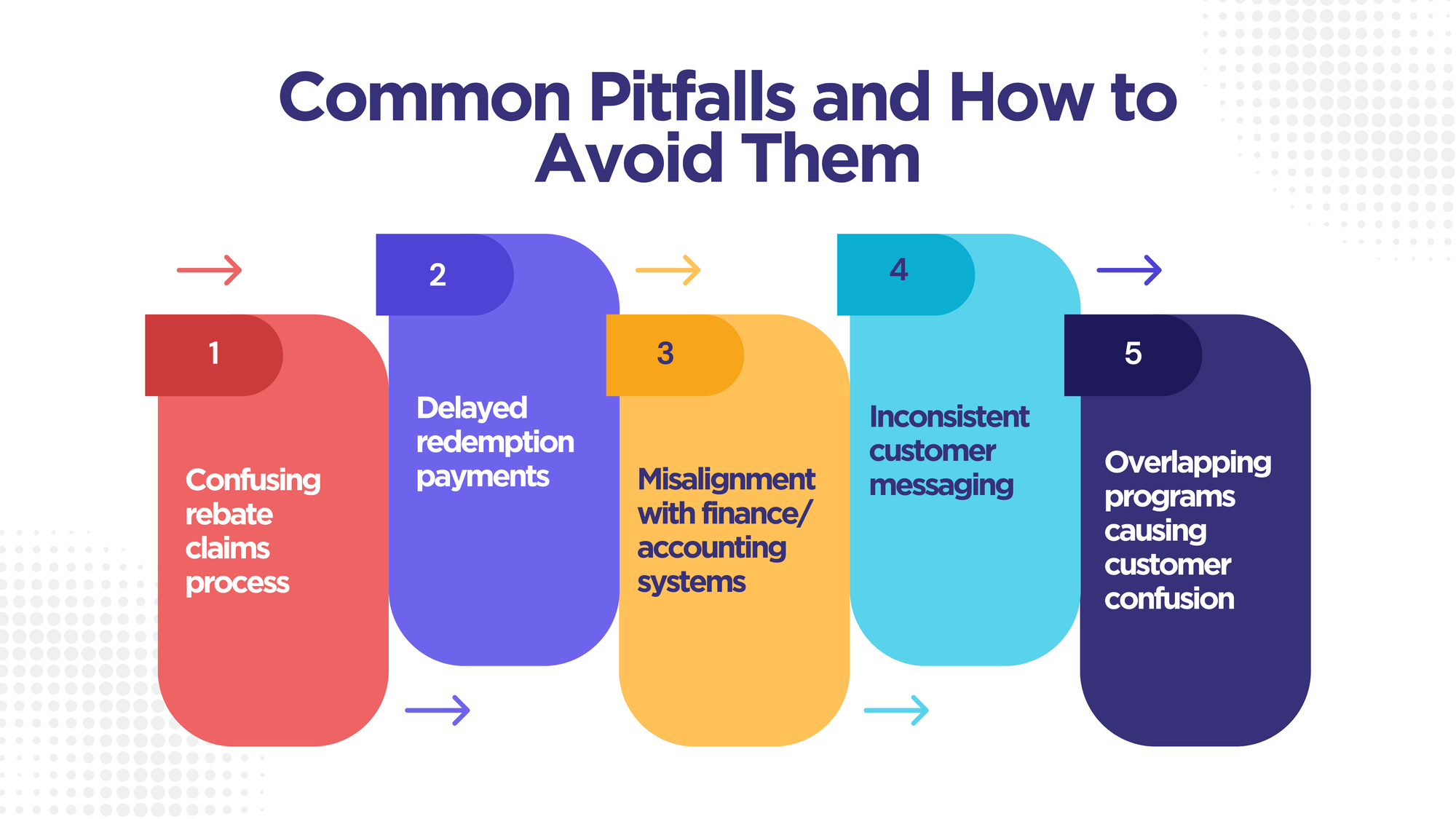

Common Pitfalls and How to Avoid Them

A well-structured customer rebate program can support sales, loyalty, and customer engagement, but only when it avoids common execution flaws. Several recurring issues reduce the effectiveness of rebate programs, undermine trust, and increase administrative overhead. Addressing these areas early ensures better outcomes for both the business and its customers.

Confusing Rebate Claims Process

One of the most common issues in customer rebate programs is a complicated or unclear redemption process. When eligibility terms, required documentation, or claim submission steps are ambiguous, customer participation drops. To avoid this, programs should establish detailed but simple rules and offer a straightforward submission workflow that clearly outlines what customers need to do after purchase. Including a checklist of proof of purchase requirements and creating a digital submission form can prevent confusion and reduce support inquiries.

Delayed Redemption Payments

Customer confidence erodes when rebate payments are slow or unpredictable. Delays in issuing prepaid cards, bank transfers, or checks can lead to dissatisfaction and discourage repeat participation. Ensuring prompt processing and setting clear timelines for reward delivery backed by operational capacity keeps the customer experience intact. Using digital delivery methods significantly shortens turnaround times and improves reliability.

Misalignment with Finance/Accounting Systems

Rebate programs that operate separately from core finance or ERP systems often result in reconciliation challenges, misreporting, or compliance issues. Accurate accounting treatment of customer rebates is critical because they impact revenue recognition and margins. Programs should be designed to feed data into financial systems, reflecting actual sales activity, thresholds met, and funds disbursed. Integration also supports better forecasting and financial planning tied to promotional campaigns.

Inconsistent Customer Messaging

Rebate programs rely heavily on clear and consistent communication. Incoherent messaging across channels email, SMS, website banners, or post-purchase notifications creates friction and lowers trust. Customers should receive the same program details regardless of the touchpoint. Aligning all communication through a central content source and using automated flows for confirmation and status updates ensures uniformity and reduces confusion.

Overlapping Programs Causing Customer Confusion

Running multiple customer rebate programs without clear distinctions can lead to misunderstandings about eligibility or how rebates stack. Customers may not know which program applies to their purchase, especially if similar conditions are involved. This dilutes the impact and can lead to claims being submitted incorrectly or disputes over rewards. To prevent this, businesses should avoid overlapping conditions, maintain separate identifiers for each rebate program, and clarify applicable offers during the sales and checkout process.

Conclusion

Customer rebate programs, when designed with clarity and supported by accurate data systems, offer a repeatable and trackable method for influencing purchasing behavior, boosting order size, and gathering actionable customer insights. Their post-purchase nature protects cash flow while reinforcing brand loyalty, making them well-suited for businesses looking to deepen long-term value rather than chasing short-term volume spikes. However, the strength of a rebate program depends on the precision of its structure, consistency in communication, and alignment with financial operations. As more brands shift toward outcome-driven incentives, customer rebate programs stand out for their ability to reward loyalty without compromising upfront revenue. A well-implemented rebate strategy isn’t just a promotional tool, it’s a disciplined business system.