What is a Conditional Rebate?

Conditional rebates have become a cornerstone in many industries, offering a flexible way for suppliers and buyers to align their goals and foster mutually beneficial relationships. By rewarding performance based on specific conditions, these rebate structures help optimize pricing strategies, drive sales growth, and manage demand fluctuations. However, setting up and managing a conditional rebate program comes with its challenges, from maintaining data accuracy to navigating legal complexities.

In this blog, we will explore the key components of conditional rebate programs, the role of technology in their management, and the legal, accounting, and compliance aspects that organizations must consider to ensure their success.

Table of Contents:

- What are Conditional Rebates?

- Types of Conditional Rebates

- How Conditional Rebates Work?

- Structure of a Conditional Rebate Program

- Industries Where Conditional Rebates Are Heavily Used

- Benefits of Using Conditional Rebates

- Risks and Challenges of Conditional Rebates

- Best Practices for Setting Up, Tracking, and Managing Conditional Rebates

- Role of Technology in Managing Conditional Rebates

- Legal, Accounting, and Compliance Aspects Unique to Conditional Rebates

Jump to a section that interests you, or keep reading.

What are Conditional Rebates?

A conditional rebate is a type of sales-based promotion where a buyer receives a rebate contingent upon meeting specific, predefined conditions. Unlike unconditional rebates, which are automatically applied, conditional rebates require the buyer to fulfill certain criteria before qualifying for the rebate.

The fundamental mechanism of a conditional rebate operates on an "if, then" basis. This means that if a customer satisfies a particular condition, then they are eligible to receive a rebate. These conditions are typically outlined in a contractual agreement between the buyer and the seller and are often linked to purchasing behaviors or sales performance metrics.

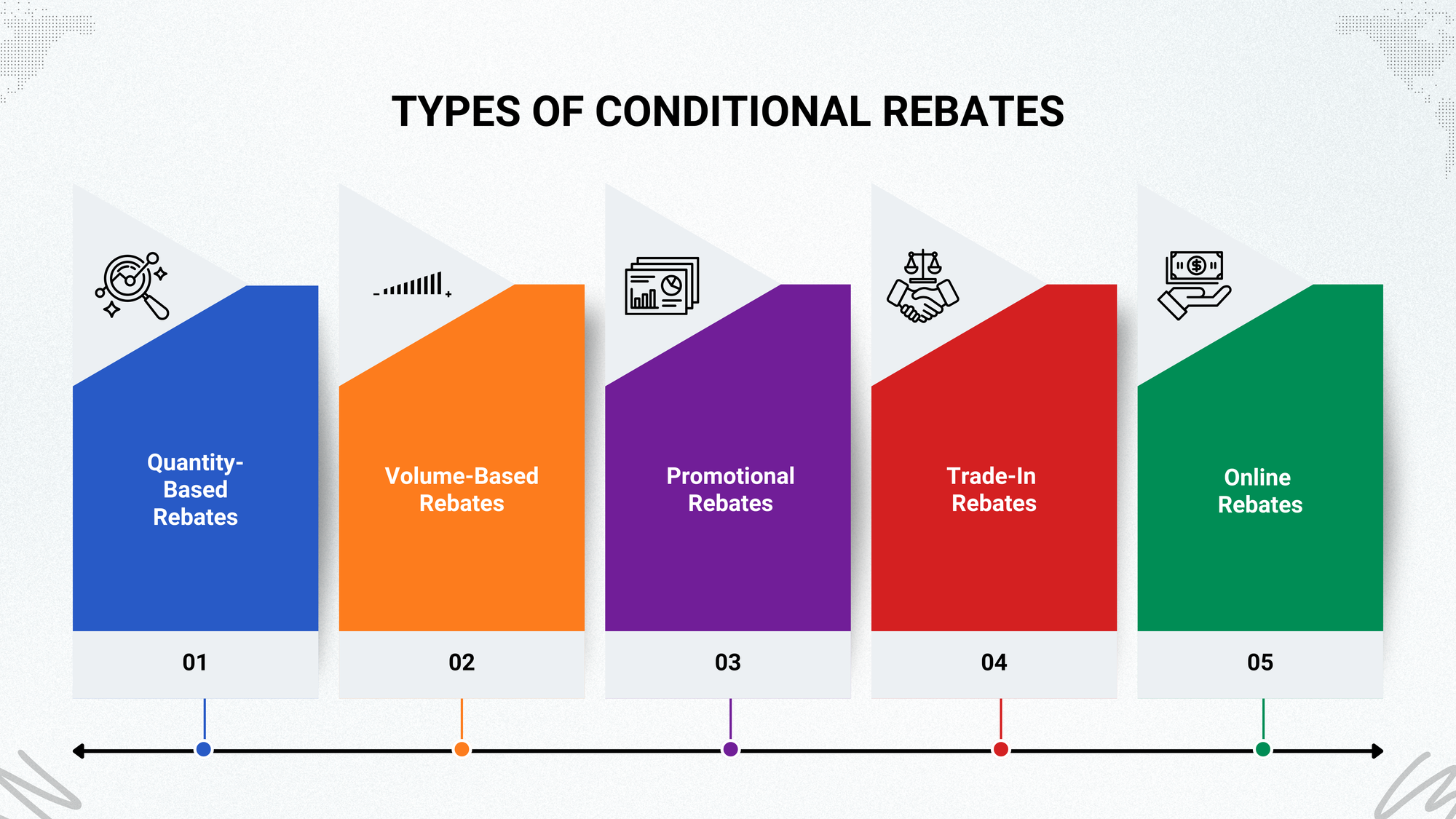

Types of Conditional Rebates

Conditional rebates are designed to incentivize specific behaviors or actions by customers. These rebates only apply when customers meet certain predefined conditions. Below are the key types of conditional rebates.

1. Quantity-Based Rebates

Quantity-based rebates are offered to customers who purchase a specific quantity of products within a defined period. These rebates encourage customers to buy in bulk.

How It Works:

- The rebate applies only when a customer’s purchase reaches or exceeds the quantity threshold set by the seller.

- Typically, the rebate is calculated as a fixed amount or percentage based on the quantity purchased above the threshold.

Example:

Imagine a company that sells office chairs offers the following quantity-based rebate:

- Condition: "Buy 100 chairs, get a 10% rebate on the total purchase price."

- Price per Chair: $50

- Threshold: 100 chairs

Calculation:

- The customer buys 120 chairs at $50 each.

- The total purchase value is 120 chairs × $50 = $6,000.

- Since the customer bought more than the threshold (100 chairs), they qualify for the rebate.

- Rebate = 10% of $6,000 = $600.

- The customer pays $6,000 - $600 = $5,400.

Purpose:

This type of rebate encourages customers to increase their order quantities, which benefits the seller by moving larger volumes of stock while providing customers with savings for bulk purchasing.

2. Volume-Based Rebates

Volume-based rebates are offered when a customer’s total spending or monetary value of purchases within a specified period reaches a certain level. These rebates are not tied to the number of items purchased but rather the total value of the purchase.

How It Works:

- The rebate is calculated based on the overall monetary value of purchases rather than the number of items.

- Often, volume-based rebates use a tiered structure, where the percentage rebate increases with higher levels of spending.

Example:

A computer hardware distributor offers the following volume-based rebate:

- Condition: "Spend more than $10,000 in a quarter to receive a 5% rebate on the total purchase value."

- Price of Products Purchased: 10 PCs at $1,200 each

Calculation:

- The total purchase value is 10 PCs × $1,200 = $12,000.

- Since the customer’s total spending exceeds the threshold of $10,000, they qualify for a 5% rebate.

- Rebate = 5% of $12,000 = $600.

- The customer pays $12,000 - $600 = $11,400.

Purpose:

Volume-based rebates encourage customers to make higher-value purchases, which benefits the seller by increasing overall revenue and encouraging customer loyalty through larger order values.

3. Promotional Rebates

Promotional rebates are offered during specific promotional periods, typically to encourage customers to purchase products during peak seasons or special sales events. These rebates may apply to a variety of conditions such as specific product categories, time frames, or promotional activities.

How It Works:

- The rebate is available for a limited period, often tied to specific marketing campaigns or events.

- The customer must make a purchase within the promotional period and meet certain criteria to qualify.

Example:

A clothing retailer offers the following promotional rebate:

- Condition: "Get a 20% rebate on all winter clothing purchases made between November 1st and December 15th."

- Price of Winter Jacket: $200

- Quantity Purchased: 2 winter jackets

Calculation:

- Total purchase amount for 2 jackets: 2 × $200 = $400.

- Rebate = 20% of $400 = $80.

- The customer pays $400 - $80 = $320.

Purpose:

Promotional rebates create urgency and excitement during sales events, encouraging customers to buy during specific periods and clearing out seasonal inventory.

4. Trade-In Rebates

Trade-in rebates are offered when customers return old or used products in exchange for a rebate or discount on the purchase of a new product. These rebates are commonly used in industries where customers upgrade to newer models, such as electronics, automobiles, and home appliances.

How It Works:

- The customer exchanges an old product for a rebate, which is then applied to the purchase of a new item.

- The rebate value is often based on the condition and age of the product being traded in.

Example:

A smartphone manufacturer offers the following trade-in rebate:

- Condition: "Trade in an old smartphone to receive a $150 rebate on a new model."

- Price of New Smartphone: $600

Calculation:

- The customer trades in their old smartphone, and the company offers a $150 rebate.

- The price of the new smartphone is $600.

- Rebate = $150.

- The customer pays $600 - $150 = $450.

Purpose:

Trade-in rebates encourage customers to upgrade to newer products and dispose of older models, which can help the seller increase sales and promote new products while simultaneously encouraging recycling and disposal of outdated technology.

5. Online Rebates

Online rebates are offered to customers who make purchases through online platforms. These rebates often require customers to submit claims through online portals and may require proof of purchase, such as receipts or order confirmations.

How It Works:

- Customers need to submit an online claim to receive their rebate. Proof of purchase, such as scanned receipts or order confirmation emails, is typically required.

- The rebate is processed after the claim is verified.

Example:

A retailer offers the following online rebate:

- Condition: "Purchase any laptop from our website and submit a rebate claim for $100."

- Price of Laptop: $1,200

Calculation:

- The customer buys a laptop for $1,200 from the website.

- The customer submits an online rebate form along with the receipt.

- Rebate = $100.

- The customer receives the rebate after their claim is verified, and they pay $1,200 - $100 = $1,100.

Purpose:

Online rebates streamline the rebate process by handling claims digitally and can encourage customers to shop online, increasing e-commerce sales.

How Conditional Rebates Work?

-

Contract Negotiation: Parties agree on clear rebate conditions (e.g. “3% back on volume above 20,000 units/month”). The contract specifies eligible products/services, timeframes, and calculation rules.

-

Tracking Performance: During the rebate period, the supplier (or a rebate-management system) tracks buyer activity against targets. This may involve real-time data feeds from ERP/sales systems. Automated tracking reduces errors and ensures transparency.

-

Verification & Claims: After the period ends, the buyer typically submits documentation (sales reports or claims) showing the conditions were met. The supplier verifies the data against the contract. For example, a distributor files a Ship-&-Debit claim listing the quantity sold below cost.

-

Rebate Calculation: The rebate amount is computed per the agreed formula. Commonly this is a percentage of qualifying spend or a per-unit credit. For instance, if 200 cases were sold at $10 below cost, the rebate = 200 × $10 = $2,000. Complex deals may stack multiple tiers or mix terms (e.g. higher rebates for higher volumes).

-

Payment/Settlement: Once verified, the supplier issues the rebate – often as a credit note or payment against future invoices. Best practice is to base the rebate on the “net” (pocket) price after other discounts. The timing (monthly, quarterly, annually) is defined in the rebate agreement.

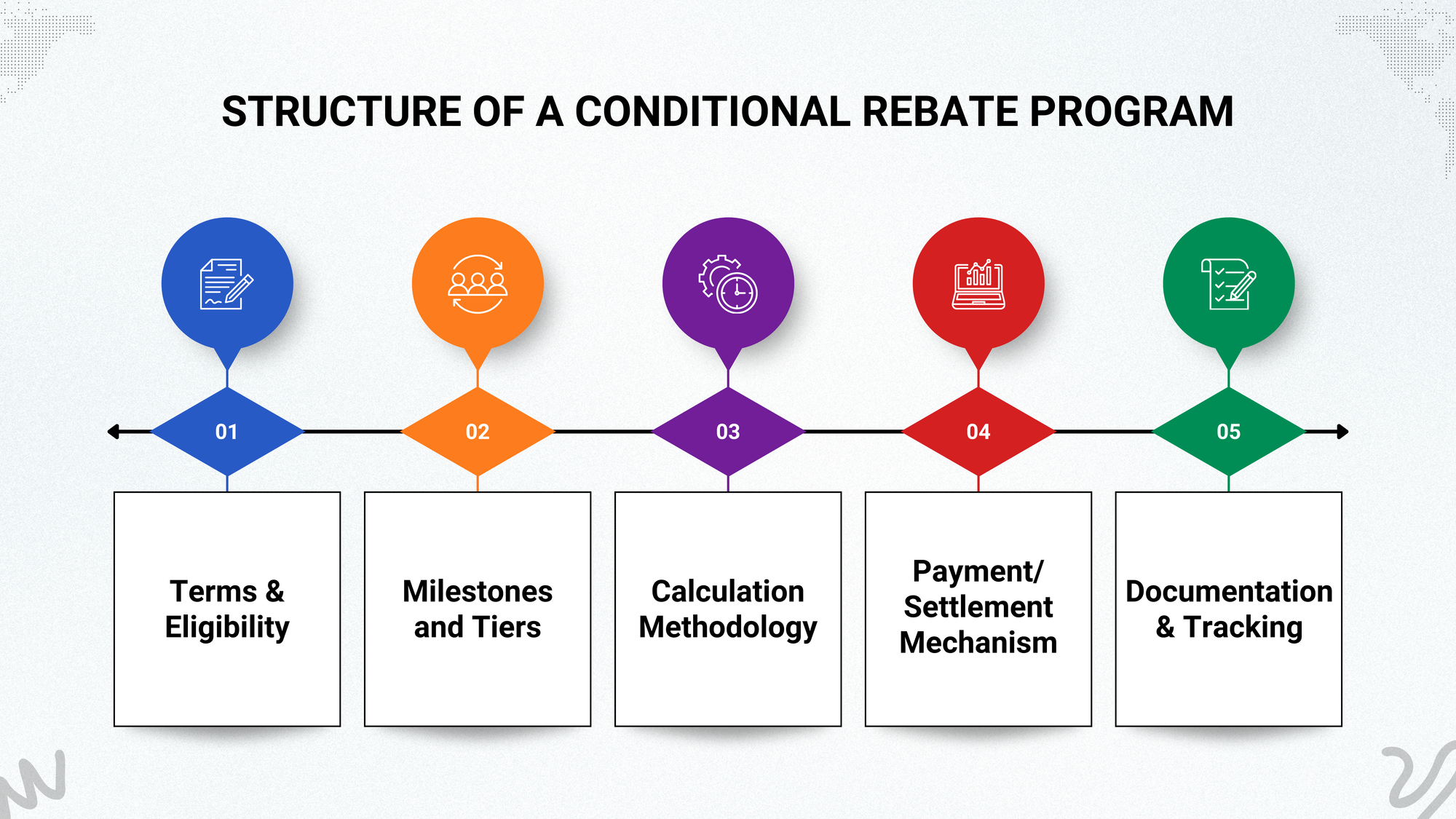

Structure of a Conditional Rebate Program

-

Terms & Eligibility: Clearly define what qualifies: eligible products, channels or regions, customer segments, and time period (quarterly, annual, etc.). Ambiguities cause disputes, so contracts should enumerate conditions and calculation methods in detail.

-

Milestones and Tiers: Specify the targets or events that trigger rebates. This may include volume breakpoints (e.g. 10,000 units = 2%, 20,000 = 3%), sales growth percentages, or mix ratios. Milestones should be challenging yet achievable. Use tiered tables in the agreement to show how rates change with performance.

-

Calculation Methodology: Describe exactly how the rebate is calculated. For example, “Rebate = 5% of qualifying sales value above threshold.” If multiple rebates apply, clarify calculation order and whether rebates apply on invoice price or net price. Best practice is to calculate on the net (pocket) price after other rebates or discounts. For instance, in a ship-and-debit example, the rebate was calculated as 200 cases × ($100 list price – $90 sale price) = $2,000.

-

Payment/Settlement Mechanism: Outline how and when the rebate will be paid or credited. Typically, rebates are settled after the measurement period (e.g. quarterly accrual and annual true-up). The agreement should state whether payment is via credit memo, cash transfer, or offset against future invoices. Specify documentation required (claims, sales reports) and approval processes.

-

Documentation & Tracking: Maintain thorough records of sales, deliveries, and claims. Integrate tracking in ERP or specialized rebate-management tools to automatically record performance against targets. Keep an audit trail of calculations and approvals. Clear internal roles (e.g. sales verifies targets, finance processes payment) prevent errors.

Industries Where Conditional Rebates Are Heavily Used

-

Consumer Packaged Goods (CPG) & Retail: Suppliers of food, beverages, and consumer goods often use volume or growth rebates with distributors/retailers. Example: A beverage manufacturer offered a 3% rebate on any sales beyond 20,000 units per month, incentivizing larger orders and smoother production planning.

-

Technology & Electronics: Hardware vendors use conditional rebates extensively. Example: A smartphone maker gave a 5% rebate when distributors bundled phones with accessories, driving sales of higher-margin add-ons. Electronics suppliers also give growth/loyalty rebates to channel partners.

-

Industrial & Manufacturing: In sectors like industrial parts or machinery, companies tie rebates to performance. Example: A hardware distributor received a 6% rebate for 20% annual purchase growth, which motivated them to push the manufacturer’s products more aggressively.

-

Construction & Building Materials: Suppliers use ship-and-debit rebates to support competitive bids. Example: A roofing-tile maker reimbursed $10 per case to distributors who had to sell below cost to win a job. This conditional rebate enabled partners to secure large projects without permanent price cuts.

-

Chemicals & Pharmaceuticals: These industries commonly use loyalty and tiered volume rebates with large buyers. Example: A chemical supplier offered a 2% year-end rebate if a customer maintained steady monthly orders, smoothing demand and rewarding commitment.

Benefits of Using Conditional Rebates

-

For Suppliers: Conditional rebates help drive strategic objectives while preserving list prices. Well-structured rebates align supplier goals with partner success and create predictable outcomes. Suppliers enjoy more stable revenues and better demand forecasting. For example, retention rebates deliver predictable revenue streams and improve production planning. They also gain market data and stronger relationships as rebates reward loyal customers and provide insights into purchasing trends.

-

For Buyers: Buyers benefit from performance-based savings without upfront discounts. Achieving targets lowers effective costs (e.g., a distributor earning a volume rebate reduces its average purchase price). This can improve margins and inventory planning. Conditional rebates also foster deeper buyer-supplier collaboration, as customers know exactly what incentives to plan for, promoting transparency and trust. In sum, rebates create a win-win situation: customers succeed (lower net prices) when they meet objectives, just as suppliers benefit from meeting their goals.

-

Shared Advantages: Both sides benefit from clearer alignment. Suppliers only pay out when objectives are met, ensuring ROI on incentives. Buyers receive tangible rewards for agreed behavior. Additionally, because rebates can be structured in tiers, they offer flexibility to reward exceptional performance without permanently lowering base prices.

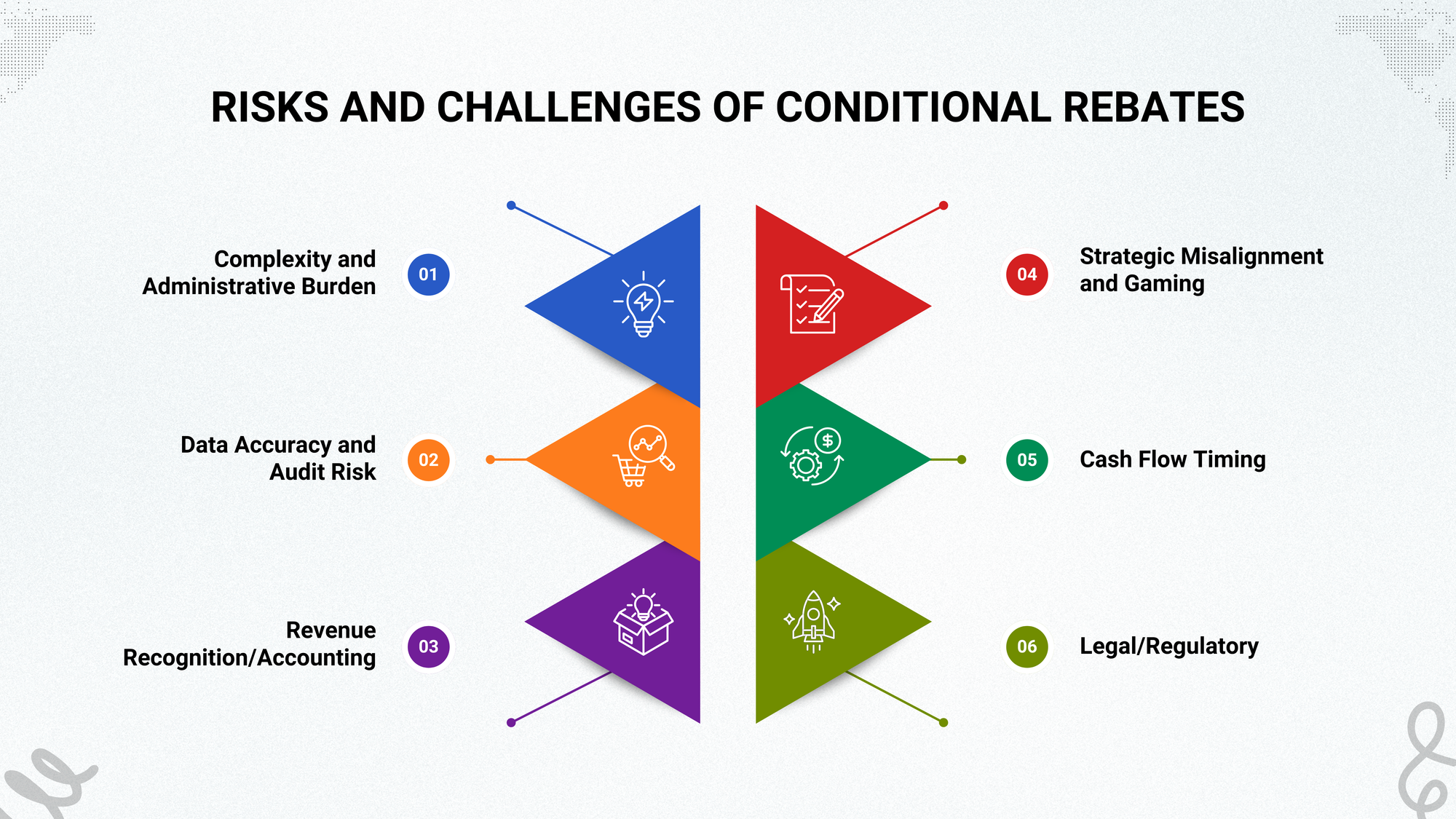

Risks and Challenges of Conditional Rebates

-

Complexity and Administrative Burden: Conditional rebates often involve detailed tracking of transactions, which can overwhelm standard ERP systems. Without proper tools, companies struggle to capture deals correctly, leading to miscalculations and disputes. The more complex the rebate (multiple tiers, overlapping deals), the higher the chance of errors or misunderstandings.

-

Data Accuracy and Audit Risk: Inadequate record-keeping can cause inaccurate payouts. Organizations must maintain robust audit trails of all rebate transactions. Failing to do so invites compliance issues and financial restatements. Complex accruals (e.g. tiered incentives) are prone to mis-estimation, undermining confidence in financial reports.

-

Revenue Recognition/Accounting: From a finance perspective, conditional rebates are variable consideration under revenue recognition rules. Misclassifying rebates can distort net revenue figures. Companies must carefully estimate liabilities and follow accounting standards (e.g. IFRS 15/ASC 606) to avoid compliance fines.

-

Strategic Misalignment and Gaming: Poorly designed conditions may lead to unintended behavior (order gaming, returns, or “pull-forward” of demand). If targets are unrealistic or loopholes exist, customers might manipulate orders to earn rebates. Setting inappropriate goals can also frustrate partners or erode margins (e.g. if rebate percentages become expectations rather than incentives).

-

Cash Flow Timing: For suppliers, rebates are liabilities until earned, potentially straining cash if many conditions are met at period-end. For buyers, delaying rebates until after purchase ties up capital. Both sides must manage these timing effects.

-

Legal/Regulatory: Conditional rebates must avoid violating pricing or competition laws (e.g. not disadvantaging certain customers illegally). Complex incentive programs may raise scrutiny under rebate-related tax or trade regulations if not well-documented.

Best Practices for Setting Up, Tracking, and Managing Conditional Rebates

-

Strategic Planning: Align the rebate program with business goals. Segment customers and set clear, measurable objectives (volume, growth, mix) that fit each segment. Negotiate terms that balance ambition with achievability, reducing later disputes.

-

Clear Contracts: Use unambiguous language in agreements. Include examples or formulas to illustrate calculations. Store rebate deals in a centralized system so all stakeholders see the same rules.

-

Automation & Integration: Automate rebate tracking using specialized software integrated with your ERP. This ensures real-time data on sales vs. targets and accuracy in calculations. Automation reduces manual efforts and handles complexity, freeing teams to focus on strategy.

-

Transparent Communication: Keep both internal teams and customers informed. Regularly update buyers on their rebate progress, and have internal governance (e.g. joint sales-finance reviews) to resolve issues early.

-

Continuous Monitoring: Analyze redemption rates and financial impact frequently. Use data to adjust thresholds or incentives if needed. For example, if few customers reach a tier, lower the bar; if almost all do easily, consider a higher target.

-

Documentation & Audit: Maintain a rigorous audit trail from deal creation through payment. Reconcile every rebate payment to underlying transactions. Regularly review claims against contract rules to catch errors.

-

Cross-Functional Coordination: Involve sales, finance, legal, and IT teams in program design and execution. Joint ownership ensures that commercial intent, accounting requirements, and system capabilities align.

Role of Technology in Managing Conditional Rebates

-

Rebate Management Software: Modern platforms allow the creation of complex conditional rebate schemes, automatically calculate payouts, and track fulfillment. They reduce spreadsheet errors and can handle multiple overlapping deals.

-

ERP/CRM Integration: Linking rebate tools with core enterprise systems provides seamless data flow. ERP integration is crucial for seamless data flow and real-time rebate metrics. This ensures that sales orders instantly update rebate progress, improving accuracy and timeliness.

-

Advanced Analytics & Dashboards: Technology can analyze customer buying patterns and forecast rebate liability. Graphical dashboards help managers see who’s close to earning rebates and predict financial impact. This data-driven insight aids both planning and negotiations.

-

Automated Alerts and Workflows: Systems can flag when a customer is nearing a rebate tier or if a claim is overdue. Automated notifications and approval workflows (e.g., for a Ship-&-Debit claim) accelerate the process and reduce missed opportunities.

-

Audit Trail & Security: Digital systems record every change in rebate deals and all payout calculations. This auditability is essential for compliance, as all rebate transactions are logged and easily reviewable.

Legal, Accounting, and Compliance Aspects Unique to Conditional Rebates

-

Revenue Recognition: Under IFRS 15/ASC 606, conditional rebates are treated as variable consideration. Suppliers must estimate expected rebates and recognize revenue net of those estimates. Incorrect estimates or late adjustments can distort reported sales. Properly classifying rebates in contracts (as post-sale discounts rather than expenses) is critical to compliance.

-

Accounting Records: Companies must accrue rebate liabilities when obligations are probable. This requires linking the rebate program to financial processes. Inadequate ERP capability means many firms struggle to show rebates on income statements correctly. Strong controls ensure rebates are recorded in the correct period.

-

Tax and Audit: Rebates may affect taxable income, so maintaining documentation for tax audits is crucial. An effective audit trail is vital—document all transactions related to rebates, including agreements, calculations, and payments. Detailed record-keeping protects against compliance audits and ensures accuracy in financial reporting.

-

Regulatory Compliance: Large conditional rebates (especially in regulated industries like pharmaceuticals or defense) might be scrutinized under anti-kickback or fair trade laws. It is essential to ensure your rebate structures comply with industry-specific regulations and avoid anti-competitive practices.

-

Legal Documentation: Rebate agreements should be formalized as part of contracts or amendments. Legal review ensures terms (such as termination or dispute clauses) are enforceable. Clarity in legal language prevents future litigation over interpretation.

Conclusion

Conditional rebates provide a powerful tool for both suppliers and buyers, driving sales while maintaining pricing integrity and strengthening business relationships. However, their success hinges on well-defined strategies, clear communication, and robust systems for tracking and managing rebates. By leveraging technology, automating processes, and ensuring compliance with legal and financial standards, companies can maximize the benefits of conditional rebates while mitigating risks. When done right, conditional rebates not only incentivize desired behaviors but also foster long-term partnerships built on trust and shared success.