What is a Cash Rebate?

Cash rebates have long been a strategic tool for businesses aiming to boost sales and attract customers. By offering consumers a portion of their purchase price back, these incentives not only improve the appeal of products but also build brand loyalty.

Understanding the various types of cash rebates, their advantages, and the challenges they present is important for both consumers and businesses. This comprehensive guide delves into the intricacies of cash rebate programs and provides insights into their benefits, challenges, and more considerations that come with their implementation.

Table of Contents:

- What is a Cash Rebate?

- Types of Cash Rebates

- Advantages of Cash Rebates

- Challenges of Cash Rebates

- Legal and Ethical Considerations in Cash Rebate Programs

- Technological Advancements in Rebate Programs

Jump to a section that interests you, or keep reading.

What is a Cash Rebate?

A cash rebate is a financial incentive where a portion of the purchase price of a product or service is returned to the buyer after the transaction is completed. Unlike immediate discounts that reduce the price at the point of sale, cash rebates require consumers to pay the full price upfront and then follow a specific process to receive a partial refund. This process often involves submitting proof of purchase and adhering to certain terms and conditions.

Cash rebates serve as a marketing strategy employed by manufacturers and retailers to boost sales, clear out inventory, and attract price-sensitive consumers without directly lowering the product's list price. By offering a rebate, companies can make a product more appealing while maintaining its perceived value. For example, an automobile manufacturer might offer a $2,000 cash rebate on a vehicle priced at $25,000, effectively reducing the cost for the buyer after the rebate is processed.

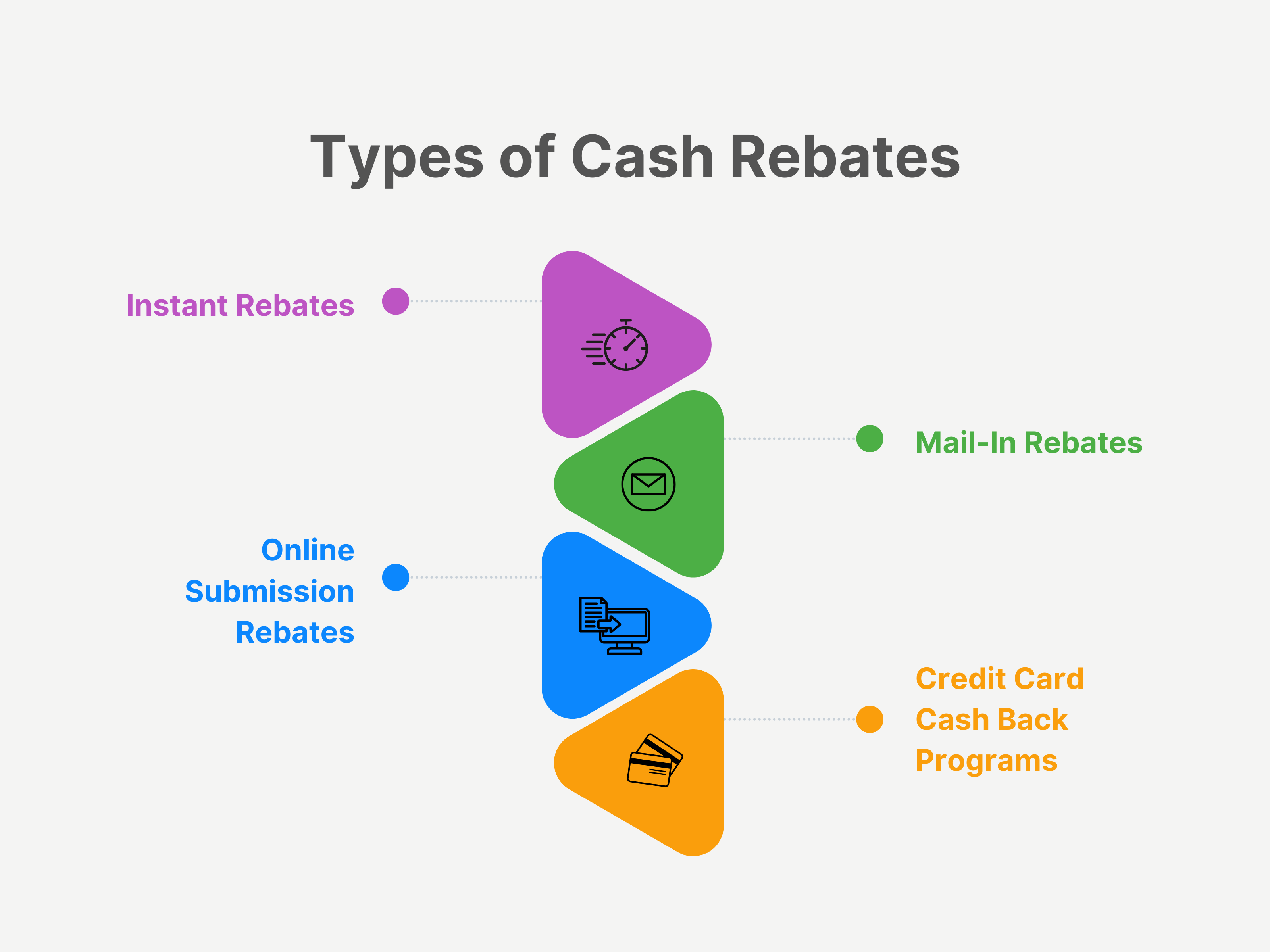

Types of Cash Rebates

Cash rebates are incentives offered by businesses to encourage purchases by providing a return of a portion of the purchase price to the consumer. These rebates come in various forms, each with distinct characteristics and processes. Below are the primary types of cash rebates:

1. Instant Rebates

Description: Instant rebates are discounts applied directly at the point of sale, reducing the purchase price immediately. Unlike other rebate types that require post-purchase actions, instant rebates provide immediate financial relief to the consumer.

Common Usage:

-

Electronics: Retailers often apply instant rebates to gadgets and appliances to make them more affordable and stimulate quick sales.

-

Automotive Industry: Car dealerships may offer instant rebates to incentivize buyers, effectively lowering the vehicle's price at the time of purchase.

Example: A smartphone priced at $500 might have an instant rebate of $50, allowing the customer to pay $450 at checkout.

2. Mail-In Rebates

Description: Mail-in rebates require consumers to pay the full purchase price upfront and then submit proof of purchase, such as receipts and UPC codes, via mail to receive a refund in the form of a check or prepaid card.

Common Usage:

-

Household Appliances: Manufacturers often use mail-in rebates to promote products like refrigerators or washing machines.

-

Consumer Electronics: Items such as cameras or laptops may come with mail-in rebate offers to entice buyers.

Process:

-

Purchase: Buy the product at full price.

-

Documentation: Collect necessary documents, including the sales receipt and original packaging UPC code.

-

Submission: Complete the rebate form and mail it along with the required documents to the specified address.

-

Redemption: Upon approval, receive the rebate as a check or prepaid card after a processing period.

Note: The redemption rate for mail-in rebates is often lower due to the effort required from consumers to complete the process.

3. Online Submission Rebates

Description: Similar to mail-in rebates, online submission rebates allow consumers to submit their proof of purchase and rebate forms through online platforms, streamlining the process and reducing the waiting time for reimbursement.

Advantages:

-

Convenience: Eliminates the need for physical mailing, making the submission process quicker and more user-friendly.

-

Faster Processing: Digital submissions can lead to quicker verification and rebate issuance.

Process:

-

Purchase: Acquire the qualifying product.

-

Documentation: Scan or photograph the sales receipt and any required codes.

-

Submission: Upload the documents via the retailer's or manufacturer's rebate portal.

-

Redemption: Receive the rebate through methods like direct deposit, PayPal, or digital gift cards.

Trend: The popularity of online submission rebates has increased due to the rise of digital technology and consumers' preference for efficient processes.

4. Credit Card Cash Back Programs

Description: These programs offer consumers a percentage of their purchases back as cash rewards when they use specific credit cards. The cash back can be applied as a statement credit, direct deposit, or sometimes as points redeemable for various rewards.

Purpose: To encourage the use of particular credit cards and promote spending in designated categories.

Features:

-

Spending Categories: Some cards offer higher cash back percentages for specific categories such as groceries, dining, or fuel.

-

Tiered Rewards: Certain programs provide different cash back rates based on spending levels or categories.

Example: A credit card might offer 2% cash back on grocery purchases and 1% on all other transactions.

Redemption:

-

Automatic: Some programs automatically apply cash back as a statement credit.

-

Manual: Others require cardholders to request the cash back once a certain threshold is reached.

Consideration: It's important for consumers to understand the terms of their credit card's cash back program, including any caps on rewards and expiration policies.

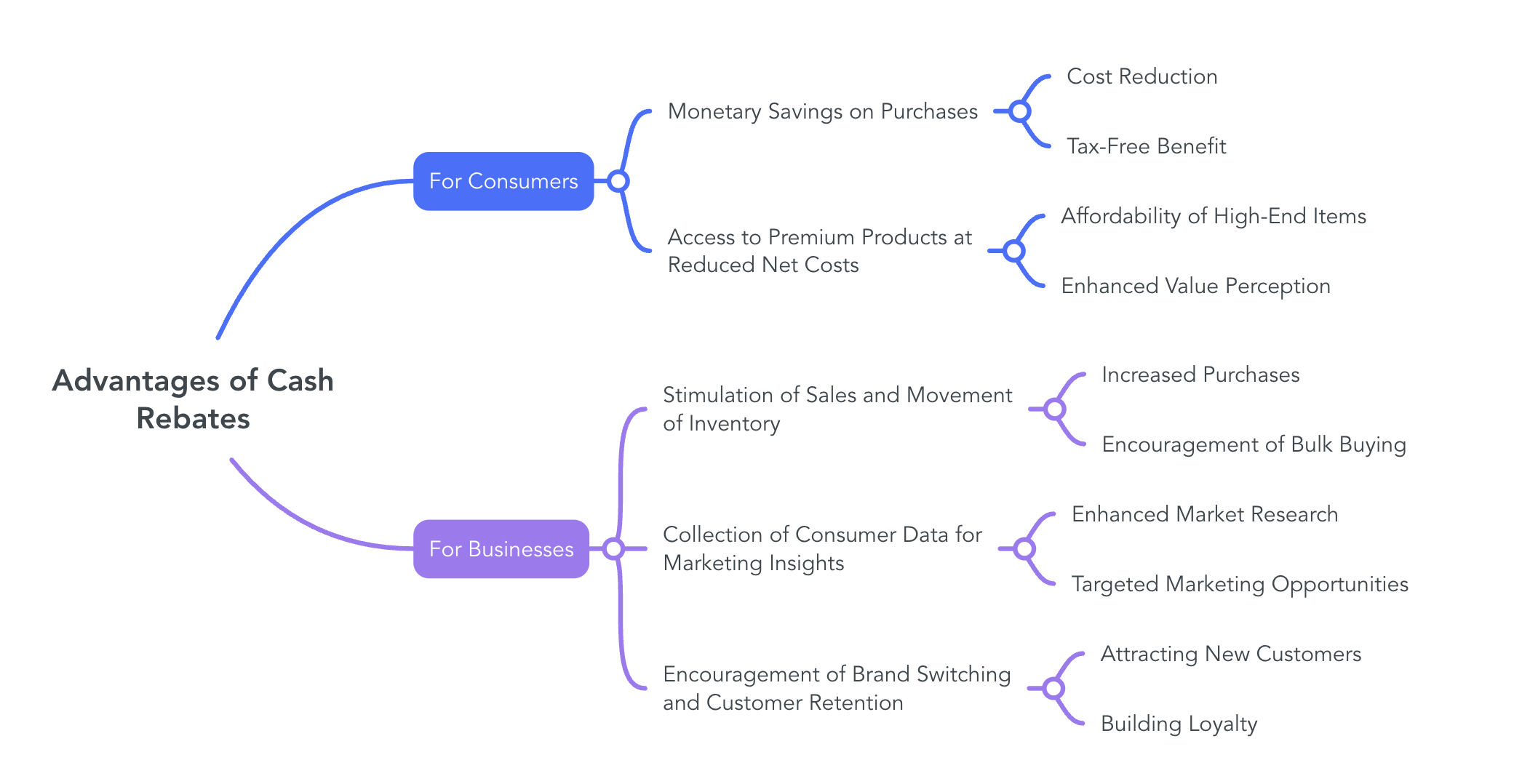

Advantages of Cash Rebates

Cash rebates offer distinct benefits to both consumers and businesses, serving as effective tools in purchasing decisions and marketing strategies.

For Consumers

-

Monetary Savings on Purchases

-

Cost Reduction: Cash rebates provide consumers with a partial refund after purchasing a product, effectively lowering the overall cost. This is particularly beneficial for high-priced items, where the rebate can represent significant savings.

-

Tax-Free Benefit: In many jurisdictions, rebates are considered a reduction in the purchase price rather than taxable income, allowing consumers to enjoy these savings without additional tax implications.

-

-

Access to Premium Products at Reduced Net Costs

-

Affordability of High-End Items: Rebates can make premium products more accessible by reducing their net cost, enabling consumers to purchase higher-quality items that may have been otherwise unaffordable.

-

Enhanced Value Perception: The opportunity to receive a rebate can enhance the perceived value of a product, as consumers feel they are getting a better deal.

-

For Businesses

-

Stimulation of Sales and Movement of Inventory

-

Increased Purchases: Offering rebates can incentivize consumers to choose a particular product, leading to higher sales volumes. This is especially useful for moving excess or older inventory.

-

Encouragement of Bulk Buying: Rebate programs can be structured to encourage customers to make larger purchases or buy in bundles, further increasing sales and aiding in inventory management.

-

-

Collection of Consumer Data for Marketing Insights

-

Enhanced Market Research: The rebate redemption process often requires consumers to provide personal information, which businesses can use to gain insights into customer demographics and purchasing behaviors.

-

Targeted Marketing Opportunities: With access to consumer data collected through rebate submissions, companies can tailor their marketing strategies to better meet the needs and preferences of their customers.

-

-

Encouragement of Brand Switching and Customer Retention

-

Attracting New Customers: Rebates can entice consumers to switch from a competitor's product by offering a financial incentive, thereby increasing market share.

-

Building Loyalty: Well-structured rebate programs can encourage repeat purchases, as customers may develop a preference for brands that offer financial incentives.

-

Challenges of Cash Rebates

While cash rebates offer benefits to both consumers and businesses, they also present several challenges and criticisms that can impact their effectiveness and perception.

Consumer Challenges

-

Complexity and Time Consumption of the Rebate Submission Process

-

Intricate Requirements: Rebate programs often necessitate consumers to follow detailed procedures, including filling out forms, providing original receipts, and cutting out product barcodes. This complexity can deter participation.

-

Time-Consuming Steps: The process of gathering the necessary documentation, completing forms, and mailing them can be time-intensive, discouraging consumers from pursuing rebates.

-

-

Potential for Missed Deadlines Leading to Forfeited Rebates

-

Strict Submission Windows: Rebates typically have specific time frames within which claims must be submitted. Consumers who miss these deadlines, whether due to oversight or delays, forfeit the rebate.

-

Lack of Awareness: Some consumers may be unaware of the submission deadlines or misinterpret the time frames, leading to unintentional forfeiture of rebates.

-

-

Privacy Concerns Related to Sharing Personal Information

-

Data Collection: Rebate forms often require personal information such as names, addresses, phone numbers, and email addresses. Consumers may be apprehensive about sharing this data due to privacy concerns.

-

Potential for Marketing Use: There is a possibility that the collected information could be used for marketing purposes or shared with third parties, further heightening privacy issues.

-

Business Challenges

-

Administrative Costs and Resource Allocation for Managing Rebate Programs

-

Operational Expenses: Implementing and managing rebate programs involve costs related to processing submissions, verifying claims, and issuing payments. These expenses can accumulate, affecting the overall profitability of the rebate initiative.

-

Resource Allocation: Businesses must dedicate personnel and systems to handle rebate processing, which can divert resources from other critical operations.

-

-

Risk of Consumer Dissatisfaction Due to Processing Delays or Denied Claims

-

Processing Delays: Extended processing times for rebate claims can lead to consumer frustration, especially if there is a lack of communication regarding the status of their submission.

-

Denied Claims: If rebate claims are denied due to technicalities or errors in submission, it can result in negative perceptions of the brand and erode customer trust.

-

-

Potential for Fraudulent Submissions Impacting Profitability

-

Fraud Risk: Businesses face the risk of fraudulent rebate claims, where individuals submit false information or counterfeit documents to obtain rebates illegitimately.

-

Financial Impact: Fraudulent activities can lead to significant financial losses and may necessitate the implementation of stringent verification processes, further increasing administrative burdens.

-

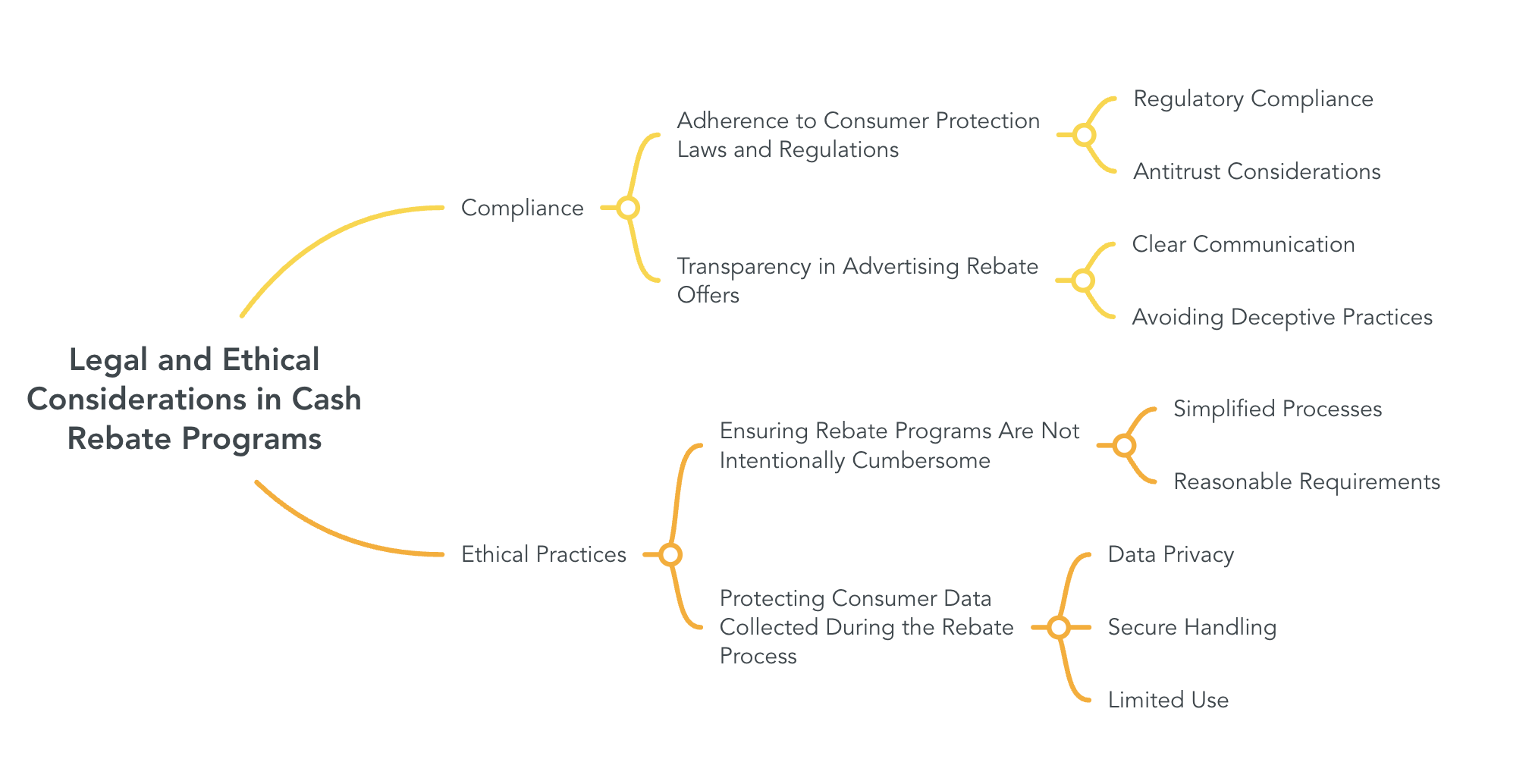

Legal and Ethical Considerations in Cash Rebate Programs

Cash rebate programs, while beneficial for both consumers and businesses, must be designed and implemented with careful attention to legal compliance and ethical standards to maintain trust and avoid potential pitfalls.

Compliance

-

Adherence to Consumer Protection Laws and Regulations

-

Regulatory Compliance: Businesses must ensure that their rebate programs comply with all applicable consumer protection laws and regulations. This includes honoring advertised rebate offers and fulfilling them as promised.

-

Antitrust Considerations: Companies should be cautious of rebate structures that could be perceived as anti-competitive, such as exclusive or loyalty-inducing rebates that may violate antitrust laws.

-

-

Transparency in Advertising Rebate Offers

-

Clear Communication: All terms and conditions of rebate offers should be clearly and conspicuously disclosed to consumers. This includes information on eligibility, submission procedures, deadlines, and any other pertinent details to prevent misleading consumers.

-

Avoiding Deceptive Practices: Advertisements should not exaggerate the benefits of rebates or obscure important conditions that could affect a consumer's ability to redeem the rebate.

-

Ethical Practices

-

Ensuring Rebate Programs Are Not Intentionally Cumbersome

-

Simplified Processes: Rebate programs should be designed to be user-friendly, avoiding unnecessary complexity that could discourage consumers from redeeming them.

-

Reasonable Requirements: Submission requirements should be straightforward, and deadlines should provide ample time for consumers to complete the process.

-

-

Protecting Consumer Data Collected During the Rebate Process

-

Data Privacy: Businesses must handle personal information collected during the rebate process responsibly, ensuring compliance with data protection laws and regulations.

-

Secure Handling: Implementing robust data security measures is essential to protect consumer information from unauthorized access or breaches.

-

Limited Use: Personal data collected should be used solely for the purpose of processing the rebate, unless explicit consent is obtained from consumers for other uses.

-

Technological Advancements in Rebate Programs

The evolution of technology has significantly reshaped rebate programs, enhancing their efficiency and user experience. Key developments include the adoption of digital platforms and automation tools.

Digital Rebates

-

Use of Mobile Apps and Online Platforms for Rebate Submissions

-

Enhanced Accessibility: Consumers can now submit rebate claims through user-friendly mobile applications and online portals, eliminating the need for traditional mail-in processes. This shift not only simplifies the submission procedure but also accelerates the overall rebate cycle.

-

Real-Time Tracking: Digital platforms often provide features that allow consumers to monitor the status of their rebate submissions in real-time, increasing transparency and trust in the process.

-

-

Integration with Digital Wallets for Seamless Rebate Redemption

-

Immediate Fund Access: By linking rebate programs with digital wallets, consumers can receive their rebate funds directly into their preferred digital payment methods, facilitating quicker and more convenient access to their money.

-

Reduced Processing Costs: For businesses, digital disbursements minimize the expenses associated with issuing physical checks or prepaid cards, leading to cost savings and operational efficiency.

-

Automation

-

Utilization of Rebate Management Software to Streamline Processing

-

Centralized Data Management: Advanced rebate management solutions offer centralized platforms where all rebate-related data is stored and managed, ensuring consistency and ease of access.

-

Automated Calculations: These systems can automatically calculate rebate amounts based on predefined criteria, reducing the manual effort required and ensuring accuracy.

-

-

Reduction of Manual Errors and Faster Fulfillment

-

Error Minimization: Automation significantly decreases the likelihood of human errors in data entry and processing, leading to more accurate rebate disbursements.

-

Accelerated Processing Times: With automated workflows, the time taken to process and fulfill rebate claims is substantially reduced, enhancing customer satisfaction and operational efficiency.

-

Conclusion

Cash rebate programs serve as a powerful marketing tool, offering tangible benefits to both consumers and businesses. For consumers, they present an opportunity to save money and access premium products at reduced costs. For businesses, these programs can stimulate sales, gather valuable consumer data, and encourage brand loyalty. However, it's essential to navigate the complexities and challenges associated with rebates, such as ensuring transparency, protecting consumer data, and managing administrative costs. By addressing these challenges and embracing technological advancements, businesses can design effective rebate programs that not only attract customers but also build lasting relationships, ultimately contributing to sustained success in the marketplace.