The Complete Guide to B2B Rebate Programs

Businesses are constantly looking for innovative ways to drive sales, build loyalty, and build stronger relationships with their partners. One of the most effective strategies to achieve these goals is through a well-structured B2B rebate program.

Unlike traditional discounts, rebates offer a strategic financial incentive that rewards businesses for specific purchasing behaviors, encouraging repeat transactions, larger order volumes, and long-term partnerships. However, designing and managing these programs requires a deep understanding of their mechanics, challenges, and best practices.

In this blog, we’ll explore what B2B rebate programs are, how they differ from B2C rebates, the various types of rebates available, and the key strategies to create the best B2B rebate program.

Table of Contents:

- What is a B2B Rebate Program?

- Differences Between B2B and B2C Rebate Programs

- Types of B2B Rebates

- How B2B Rebate Programs Work?

- Best Practices for Structuring a B2B Rebate Program

- Challenges in B2B Rebate Management

- The Role of Digital Rebate Management Software For B2B Rebate Programs

- Measuring the Success of Your B2B Rebate Program: Key Performance Indicators (KPIs) to Track

Jump to a section that interests you, or keep reading.

What is a B2B Rebate Program?

A B2B rebate program is a structured financial incentive system designed to reward businesses for specific purchasing behaviors. Unlike one-time discounts, rebates are typically issued after the purchase, encouraging repeat transactions, larger order volumes, and long-term partnerships. Manufacturers, distributors, retailers, and resellers use rebate programs to influence purchasing decisions, drive sales growth, and strengthen relationships with channel partners.

Differences Between B2B and B2C Rebate Programs

| Factor | B2B Rebate Programs | B2C Rebate Programs |

|---|---|---|

| Target Audience | Businesses, including manufacturers, distributors, contractors, and resellers | Individual consumers purchasing for personal use |

| Purchase Behavior | Bulk orders, recurring purchases, and long-term supplier agreements | Single transactions or repeat purchases driven by immediate needs |

| Incentive Structure | Complex, often tiered or volume-based, with higher rewards for larger purchases | Simple cashback or discount-based offers on specific products |

| Redemption Process | Requires documentation such as invoices, purchase orders, or contract-based eligibility | Often involves scanning receipts or entering codes online |

| Marketing Channels | Direct sales teams, partner portals, and B2B loyalty programs | Retail stores, e-commerce platforms, social media, and email marketing |

| Rebate Delivery Methods | Direct bank transfers, account credits, or reinvestment in future purchases | Gift cards, cashback, or promotional vouchers |

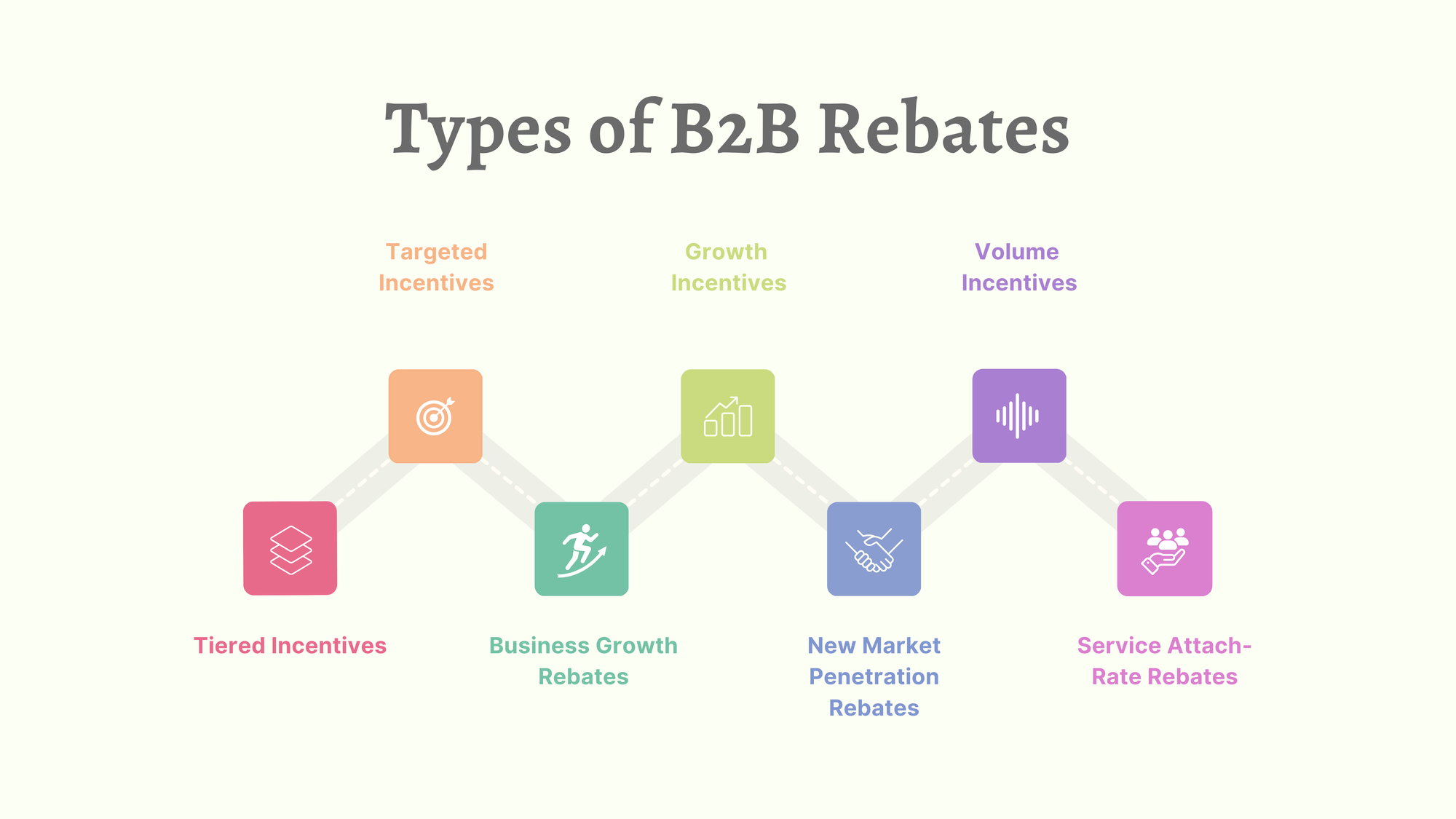

Types of B2B Rebates

B2B rebate programs use structured incentives to encourage specific purchasing behaviors. Different types of rebates are designed to align with various business objectives, from increasing sales volume to expanding into new markets.

Volume Incentives: Discounts Based on Bulk Purchases

Volume incentives reward businesses for purchasing a certain quantity of a product. The more they buy, the higher the rebate. This model encourages larger transactions and helps manufacturers and distributors move inventory more efficiently. Since these rebates are directly tied to order size, they play a critical role in supplier negotiations and inventory management.

Growth Incentives: Rewards for Increasing Purchase Volume Over Time

Growth incentives focus on rewarding businesses for surpassing previous spending levels. If a company spends more in a given period than in a prior timeframe, they qualify for rebates. This structure not only boosts revenue but also strengthens long-term relationships between suppliers and partners by creating a consistent pattern of increasing purchases.

Targeted Incentives: Rebates for Specific Product Categories or Sales Conditions

Targeted incentives drive sales of selected products or encourage purchasing within a specific timeframe. These rebates are used to promote underperforming SKUs, new product launches, or seasonal inventory. Businesses must meet specific conditions—such as buying a designated product line or reaching a sales milestone—to qualify. This type of rebate is highly adaptable and often used to shift demand strategically.

Tiered Incentives: Structured Rebate Programs Based on Spending Levels

Tiered incentives provide escalating rewards based on a partner’s total spending. Businesses progress through different tiers, with each level offering greater rebates. This structure motivates buyers to increase their purchases to reach higher tiers and unlock better financial benefits. By linking rewards to cumulative spending, tiered incentives encourage long-term engagement and larger order volumes.

Business Growth Rebates: Encouraging New Customer Acquisition

Business growth rebates focus on expanding a company's customer base. Vendors offer rebates to distributors, resellers, or affiliates for securing new clients or increasing the number of active accounts. This type of rebate helps businesses extend their market reach and accelerate revenue growth by prioritizing customer acquisition.

New Market Penetration Rebates: Expanding into New Industries or Regions

New market penetration rebates incentivize businesses to enter untapped industries or geographical regions. These rebates offset the risks associated with market expansion by rewarding partners for generating sales in designated areas or industries. This model is particularly useful for companies launching international operations or diversifying their product applications across different sectors.

Service Attach-Rate Rebates: Incentives for Bundling Services with Products

Service attach-rate rebates encourage businesses to bundle services—such as maintenance, training, or extended warranties—alongside product purchases. This strategy enhances customer value while driving higher revenue per transaction. By integrating services with products, companies can improve customer satisfaction, increase retention, and generate recurring revenue streams.

How B2B Rebate Programs Work?

B2B rebate programs function as structured financial incentives designed to influence purchasing decisions, drive sales, and build stronger business relationships. These programs involve multiple stakeholders, follow a structured lifecycle, and use various payout methods to ensure efficiency and engagement.

Key Players Involved

Several entities participate in B2B rebate programs, each playing a distinct role in the rebate process:

- Manufacturers: Design rebate programs to increase sales volume, encourage repeat purchases, and expand market share. They set rebate terms, approve claims, and issue payments.

- Distributors: Act as intermediaries, purchasing in bulk from manufacturers and reselling to retailers or resellers. They qualify for rebates based on their purchasing behavior and influence demand within the supply chain.

- Resellers & Retailers: Buy products from manufacturers or distributors and sell them to end customers. Rebates incentivize them to prioritize specific brands or product lines.

- Affiliates & Contractors: Participate in rebate programs by promoting, installing, or using specific products, often receiving performance-based incentives.

The Rebate Lifecycle

B2B rebate programs follow a structured process, ensuring transparent and accurate incentive distribution:

-

Setting Goals and Targets

- Businesses establish rebate objectives, such as boosting sales, increasing order volume, or promoting new products.

- Targets are defined based on spending thresholds, purchase frequency, or market penetration goals.

- Rebate structures are designed to align with business priorities, ensuring incentives drive desired behaviors.

-

Tracking Partner Performance

- Participants’ sales and purchasing data are continuously monitored to determine rebate eligibility.

- Digital rebate management systems automate data collection, minimizing errors and improving efficiency.

- Key metrics include total purchase volume, revenue growth, and adherence to program conditions.

-

Calculating Rebates

- Rebates are calculated based on predefined criteria such as volume purchased, sales growth, or tier progression.

- Automated systems streamline complex calculations, reducing manual errors and ensuring accurate payout determinations.

- Fraud detection mechanisms validate claims, preventing duplicate submissions or false data entries.

-

Processing and Issuing Payments

- Once validated, rebate payments are processed according to the agreed-upon payout method.

- Digital rebate management platforms enhance transparency, allowing participants to track payment status.

- Timely fulfillment improves partner satisfaction and maintains trust in the program.

Common Rebate Structures and Payout Methods

B2B rebate programs offer diverse payout options to cater to different partner preferences and business models:

- Cash Rebates: Direct payments to participants, often via bank transfers or digital wallets.

- Credits & Discounts: Applied to future purchases, encouraging continued engagement with the brand.

- Non-Cash Incentives: Prepaid gift cards, exclusive services, or product bundles used to drive additional value.

Each rebate program is structured to align with business objectives, ensuring incentives drive measurable results while maintaining operational efficiency.

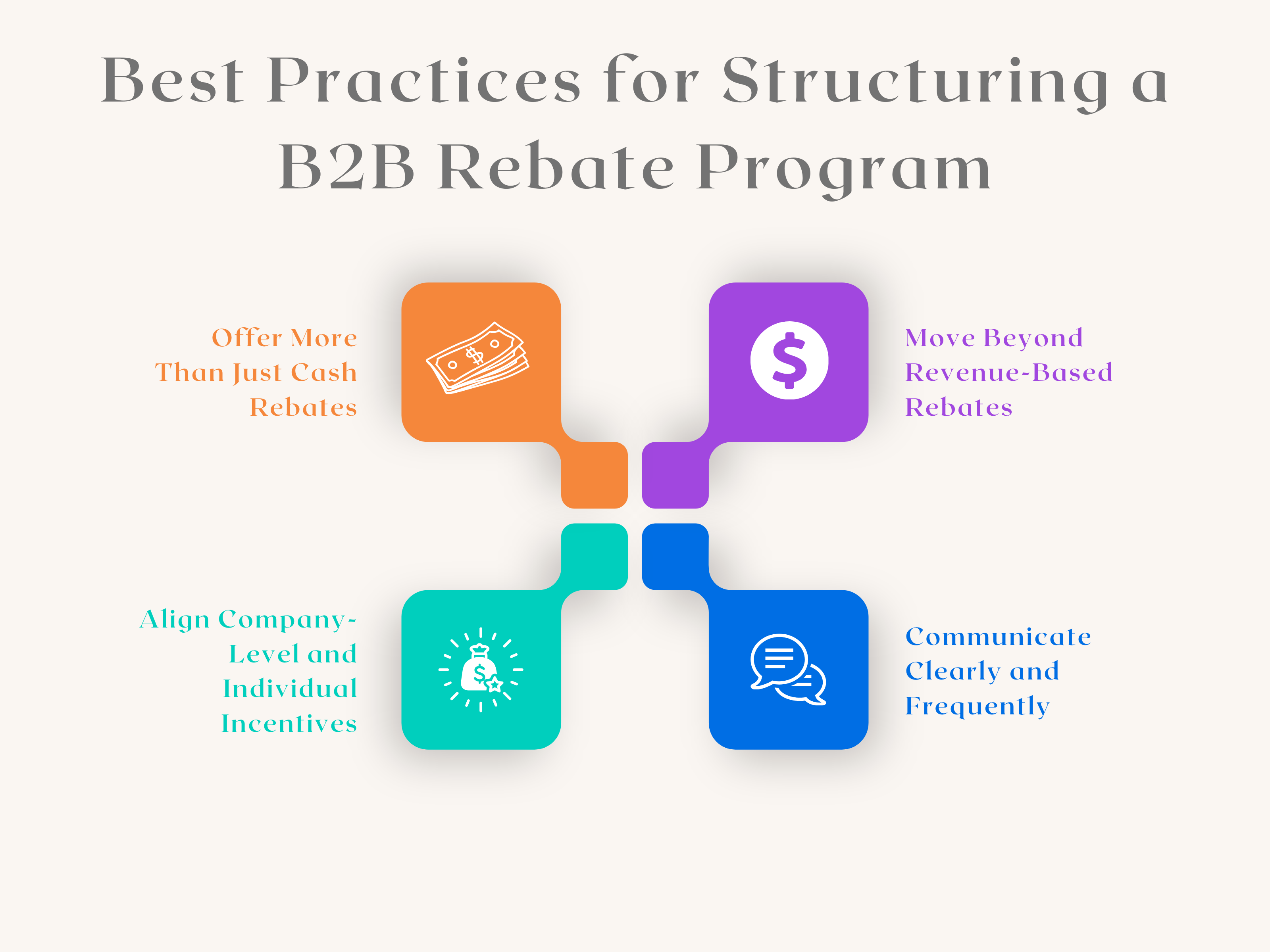

Best Practices for Structuring a B2B Rebate Program

A well-structured B2B rebate program not only drives partner loyalty and sales but also maximizes the value of incentive investments. To ensure that rebate programs yield optimal results, businesses should incorporate best practices that go beyond traditional models and foster stronger relationships with their partners.

Move Beyond Revenue-Based Rebates

Traditional rebate programs focused solely on revenue generation, offering rebates based purely on the amount spent. While these programs were effective in boosting sales, they often lacked nuance and didn't incentivize the behaviors businesses truly wanted to encourage. Focusing only on revenue can overlook crucial aspects such as growth, loyalty, and long-term strategic goals.

Instead of limiting rebates to revenue-based metrics, companies should introduce a variety of incentive layers that address different aspects of business growth. These can include volume incentives, growth incentives, targeted product-specific rebates, and even rewards for market expansion. By diversifying the types of rewards offered, businesses ensure that the rebate program is aligned with both immediate and long-term objectives, fostering a deeper commitment from partners and encouraging sustainable growth across different areas of the business.

Communicate Clearly and Frequently

Clear and frequent communication is key to ensuring that partners understand the terms, benefits, and expectations of the rebate program. Transparency in rebate processing, eligibility criteria, and deadlines prevents confusion, reducing the risk of disputes and dissatisfaction. When partners have a clear understanding of how they can qualify for rebates and how the process works, they are more likely to actively engage and participate.

Complex rebate structures or unclear terms can discourage partner participation and create frustration. To improve engagement, simplify the language and conditions of the program. Use concise, straightforward language and break down complex terms into digestible chunks. This ensures partners can easily understand the program and know what actions to take to earn rebates, reducing administrative burdens and enhancing participation.

Interactive dashboards and automated tracking tools offer real-time insights into a partner’s rebate progress. These digital tools allow partners to track their performance, see how close they are to earning a rebate, and monitor the status of their claims. Providing these tools not only improves transparency but also boosts partner satisfaction by allowing them to have more control over the process. Automation minimizes errors, speeds up processing times, and offers updates at each stage of the rebate lifecycle.

Offer More Than Just Cash Rebates

While cash rebates remain popular, non-cash incentives have been gaining traction in recent years. Non-cash rewards can be more tailored and personalized, offering partners something beyond the typical financial reimbursement. These incentives create more meaningful connections and encourage partners to engage with your brand beyond simple transactions.

Non-cash incentives, such as marketing credits, training programs, and exclusive benefits, provide added value for both the partner and the company. For example, marketing credits allow partners to co-market products, expanding their visibility while reinforcing the brand message. Training opportunities enhance partner expertise and sales capabilities, helping them to better represent the company’s offerings. Exclusive benefits, such as VIP events or early access to new products, also create a sense of loyalty and exclusivity, strengthening long-term partnerships. These types of rewards are not only valued by partners but can also foster more engagement than traditional cash rebates alone.

Align Company-Level and Individual Incentives

For a B2B rebate program to be truly effective, it’s essential to align incentives across all levels of an organization. Company-wide incentives that encourage high-level goals, such as increased sales volume or market share, should complement individual incentives that motivate sales teams, managers, or individual representatives. Combining these different layers of incentives ensures that everyone in the organization, from executives to salespeople, is aligned toward common objectives, which drives overall performance.

When structuring a B2B rebate program, companies must be cautious to avoid conflicts between partner-level incentives and individual sales incentives. If individual incentives for sales teams are too aggressive or misaligned with partner goals, they could create friction, undermining the collaborative nature of the relationship. Ensuring that partner incentives and individual sales goals are complementary—not in competition—helps maintain a cooperative atmosphere and ensures that both sides benefit from the program. A cohesive approach where both partner organizations and salespeople are working toward shared objectives will lead to better outcomes for everyone involved.

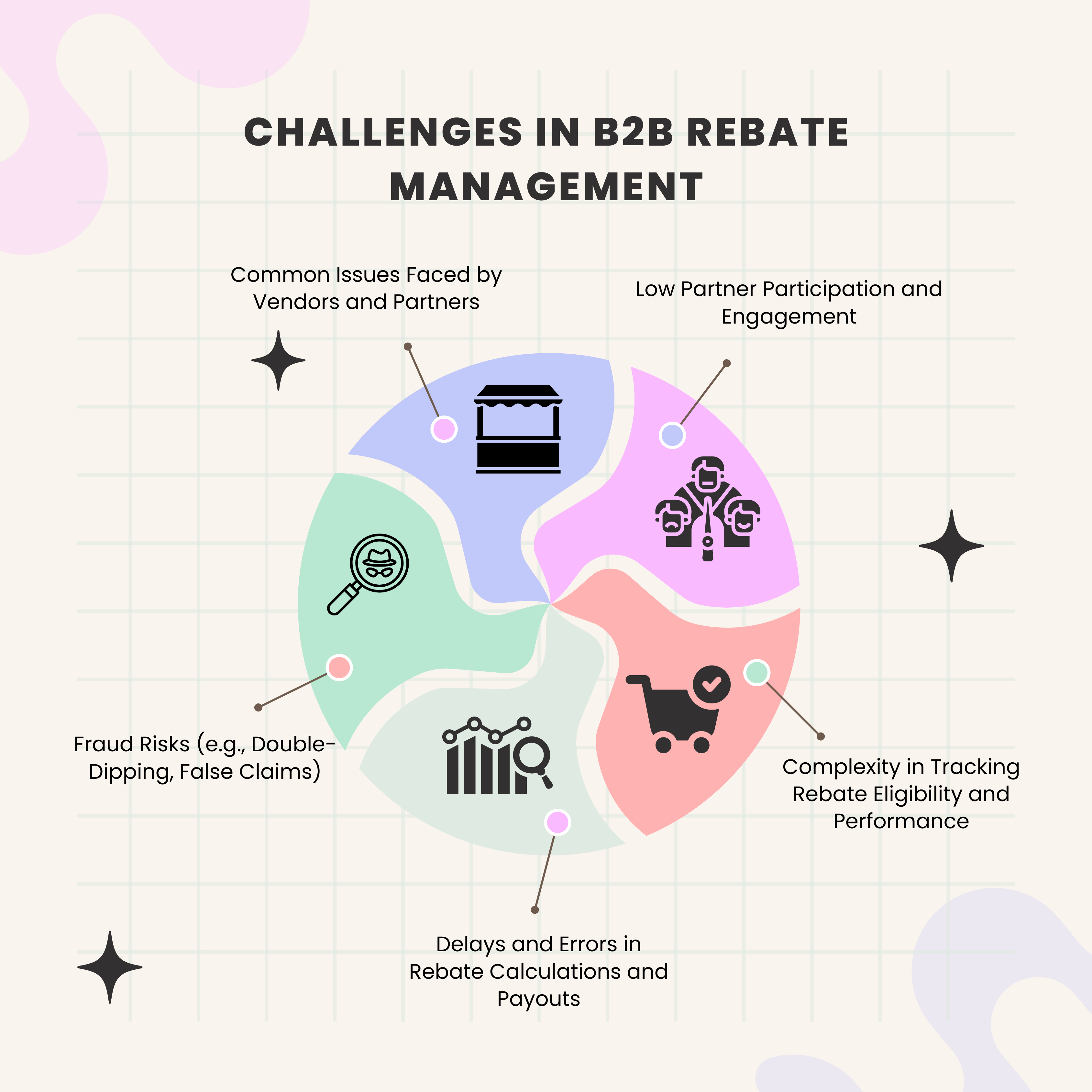

Challenges in B2B Rebate Management

B2B rebate programs offer significant value when managed effectively. However, businesses often face a range of challenges that can hinder the success of their rebate initiatives. Understanding these challenges is essential to refining the process, improving partner relationships, and ultimately boosting program effectiveness.

Common Issues Faced by Vendors and Partners

Both vendors and partners experience difficulties in rebate management, which can lead to frustration and reduced program participation. Vendors often struggle with balancing the administrative burden of managing rebates while ensuring compliance with various program rules. On the other hand, partners can face confusion around rebate terms and complicated procedures, resulting in a lack of engagement. These issues can create a cycle of inefficiency that affects the overall performance of the program.

Low Partner Participation and Engagement

Low participation from partners is one of the most common challenges faced in B2B rebate management. Many rebate programs fail to capture the attention of potential participants due to unclear terms, complicated processes, or perceived low value in the rewards offered. When partners do not clearly understand the benefits or the steps involved, they are less likely to take full advantage of the program. This disengagement is often further compounded by inefficient communication, where partners are not provided with timely updates on their progress or the status of their claims. To drive better engagement, it is essential to design a user-friendly program with clear instructions, easy claim submission processes, and regular updates that highlight the value of participation.

Complexity in Tracking Rebate Eligibility and Performance

Rebate programs often involve multiple layers of complexity, especially when various incentives are applied at different stages or tied to different conditions (e.g., volume, growth, or targeted product purchases). For both vendors and partners, tracking rebate eligibility and performance can become overwhelming. Multiple partners with varying purchase behaviors, unique rebate conditions, and differing qualification criteria make it difficult to keep accurate records. Without a centralized system to manage this complexity, vendors risk errors in tracking, and partners risk confusion or missing out on rewards they qualify for. Automated, real-time tracking solutions integrated with rebate management systems are essential for simplifying this process, providing transparency, and ensuring that all participants are evaluated correctly.

Delays and Errors in Rebate Calculations and Payouts

One of the most frustrating aspects of rebate management is dealing with delays and errors in rebate calculations and payouts. Rebate programs often involve complex calculations based on sales volume, product categories, and performance metrics. Manually processing these calculations is prone to errors, which can result in underpayment, overpayment, or incorrect rebate amounts. Such mistakes not only damage the relationship between the vendor and the partner but also lead to delays in rebate payouts, undermining trust in the program. To combat this issue, implementing rebate management software with automated calculations can streamline the process, minimize human error, and ensure that payments are made promptly. Automation also provides real-time status updates for partners, so they can track their rebates and see when payments are due.

Fraud Risks (e.g., Double-Dipping, False Claims)

Fraud poses a significant threat to the integrity of B2B rebate programs. Common fraud risks include double-dipping, where a partner attempts to claim a rebate multiple times for the same transaction, and the submission of false claims, such as altering invoices or misreporting sales volumes. Such fraudulent activities can lead to significant financial losses and disrupt the smooth functioning of the rebate program. Rebate management systems with built-in fraud prevention tools can identify discrepancies in submitted claims, such as duplicate claims or invalid data, and flag them for review. Additionally, using unique transaction identifiers (like digital footprints or IP addresses) can make it easier to track and trace fraudulent activity. By adopting stronger verification mechanisms, vendors can maintain the credibility of their programs and ensure that rebates are issued only to eligible participants.

The Role of Digital Rebate Management Software For B2B Rebate Programs

Digital rebate management software plays a pivotal role in streamlining B2B rebate programs. With the complexities and volume of rebates often involved, automation and digital tools have become essential for efficient management, error reduction, and enhanced partner satisfaction.

How Automation Improves Rebate Processing

Automation is a game-changer in rebate processing. It allows businesses to minimize manual labor, reducing the risk of human errors in tasks such as calculating rebate amounts, validating claims, and issuing payments. Automated systems handle various stages of the rebate lifecycle—from claim submission to payout—quickly and accurately. By automating the entire process, companies can eliminate bottlenecks, enhance the efficiency of rebate fulfillment, and provide partners with faster, more reliable service. This not only saves time but also ensures that the rebate program operates smoothly, meeting deadlines and maintaining trust with partners.

Benefits of Cloud-Based Rebate Management

Cloud-based rebate management solutions offer several advantages, particularly in scalability, accessibility, and integration. By storing data in the cloud, businesses can access real-time insights from anywhere and at any time, making it easier to monitor and adjust rebate programs as needed. Cloud systems are more adaptable to growth, allowing companies to scale their rebate programs as they expand their customer base or enter new markets. Furthermore, cloud-based solutions often come with built-in updates and security features, ensuring that the system remains up to date and protected against potential risks.

Real-Time Data & Visibility: Dashboards, Tracking, and Notifications

One of the key benefits of digital rebate management software is real-time data access. Dashboards provide a clear, visual overview of rebate performance, including tracking of rebate claims, partner performance, and redemption rates. These dashboards also allow vendors and partners to monitor the status of rebates at every stage, from submission to approval and payout. Notifications keep both parties informed with updates on claim statuses, ensuring that no step in the process is overlooked. This transparency not only strengthens relationships but also helps vendors identify and address any issues or delays immediately.

Fraud Prevention: Built-in Verification Tools

Fraud is a major concern in rebate programs, with issues like double-dipping and false claims potentially undermining the program’s integrity. Digital rebate management software incorporates built-in fraud prevention mechanisms that can automatically detect and flag suspicious activity. Verification tools check for discrepancies such as duplicate claims or false data by using unique identifiers, such as IP addresses or transaction numbers, to trace and cross-check the legitimacy of submissions. These systems also offer the ability to create digital footprints for each claim, adding another layer of security to ensure that fraud is minimized. By proactively identifying and preventing fraudulent activity, companies can protect their program's financial health and preserve trust with partners.

Error-Free Calculations: Automated Validation and Fulfillment

Rebate programs often involve complex calculations, including multiple criteria such as spend thresholds, product categories, or sales volumes. Manual calculations are prone to errors that can lead to incorrect rebate payouts, which can damage vendor-partner relationships. Digital rebate management software automates the validation and fulfillment process, ensuring that calculations are accurate and consistent. Automated systems instantly validate submitted claims against pre-defined criteria, such as purchase volumes or product categories, and calculate the appropriate rebate amounts. This ensures that partners receive accurate payouts and that vendors avoid costly mistakes.

Integration with Other Systems: Streamlining Supply Chains and Financial Tracking

Modern digital rebate management software integrates seamlessly with other business systems, such as Enterprise Resource Planning (ERP) software, Customer Relationship Management (CRM) systems, and financial tracking tools. This integration is crucial for streamlining rebate processes across different departments, reducing errors, and ensuring that all aspects of the rebate program are aligned. For example, integration with ERP systems allows businesses to track inventory and predict demand more effectively, while integration with CRM systems ensures that partners are tracked consistently across all stages of the rebate program. Financial tracking systems also benefit from integration, making it easier to reconcile payments, manage budgets, and monitor overall program profitability.

How Digital Solutions Enhance Partner Experience

The transition to digital rebate management enhances the partner experience by offering convenience, speed, and transparency. Partners can submit rebate claims and track their progress in real-time through intuitive online portals, apps, or through automated email and SMS notifications. This eliminates the delays and frustrations associated with manual claims processing and paper-based systems. Furthermore, digital tools simplify the rebate process by automating tasks like claim validation, submission, and payout, allowing partners to focus on their core business activities instead of rebate-related administration. With clear, real-time tracking and communication, partners feel more engaged and satisfied with the rebate program, resulting in stronger, long-lasting relationships.

Measuring the Success of Your B2B Rebate Program: Key Performance Indicators (KPIs) to Track

Measuring the success of a B2B rebate program is essential for understanding its effectiveness and optimizing its impact. By tracking key performance indicators (KPIs), businesses can evaluate how well the rebate program is driving desired outcomes such as increased sales, partner engagement, and ROI. Leveraging analytics and dashboards further refines strategies, ensuring that rebates are delivering value to both the company and its partners.

- Rebate Redemption Rates

Rebate redemption rates are one of the most direct indicators of a program’s success. This metric tracks the percentage of eligible partners who actually redeem their rebates. A low redemption rate could indicate that the rebate offer is not appealing, that partners are unaware of the rebates, or that the process is too complicated. On the other hand, a high redemption rate suggests that the incentive is enticing and that partners are actively engaging with the program. Regularly tracking redemption rates helps identify patterns, allowing businesses to adjust their rebate offers or communication strategies for improved performance.

- Sales Growth Due to Rebates

Sales growth driven by rebates is another critical KPI to measure. The primary purpose of a rebate program is to drive increased sales, whether through higher purchase volumes, new customers, or expanded market reach. By comparing sales data before and after the introduction of a rebate program, businesses can assess how effective the rebates are in stimulating demand. This metric also helps businesses determine which rebate types (e.g., volume or growth incentives) are most successful in encouraging larger purchases or long-term relationships with partners.

- Partner Engagement Levels

Partner engagement levels reflect the extent to which channel partners are interacting with the rebate program. High engagement indicates that partners see value in the program and are motivated to participate. Engagement can be measured through several touchpoints, such as how frequently partners access the rebate portal, how often they check their rebate status, or the number of rebate claims submitted. Low engagement, on the other hand, might signal issues with the rebate structure, partner communication, or the simplicity of the program. Tracking engagement allows businesses to make informed adjustments to keep partners motivated and committed.

- ROI of Rebate Programs

The ROI (Return on Investment) of rebate programs measures the financial return relative to the costs incurred in running the program. It compares the revenue generated from increased sales or partner activity to the rebate payouts issued. A positive ROI indicates that the program is financially beneficial, while a negative ROI suggests that the costs of administering the rebates are outweighing the gains. To calculate ROI, businesses should factor in both direct and indirect benefits, such as customer retention, brand loyalty, and long-term sales growth, in addition to immediate revenue increases. Monitoring ROI helps determine whether the rebate program is a worthwhile investment.

Conclusion

A well-optimized B2B rebate program not only boosts immediate sales but also helps to strengthen relationships with partners, build loyalty, and improve overall brand visibility. As competition intensifies, companies that use the full potential of digital rebate management and continually improve their strategies will be best positioned to thrive in the years to come.