How to Use AI for Dispute Resolution & Dispute Management?

Disputes are an unavoidable part of business, especially in industries where high transaction volumes, complex contracts, and multiple stakeholders intersect. From pricing errors and shipment discrepancies to trade promotion claims, unresolved disputes can slow cash flow, strain customer relationships, and erode profitability. Traditionally, dispute management has been a reactive, manual process—one that demands significant time, human effort, and constant coordination across departments. But as transaction complexity grows, traditional methods are no longer sustainable.

This is where Artificial Intelligence (AI) is transforming the game. By integrating automation, predictive analytics, and data-driven intelligence, AI has redefined dispute resolution from an administrative burden into a strategic, insight-led process. It empowers organizations to detect disputes early, resolve them faster, ensure compliance, and even prevent them from occurring altogether.

This blog discusses how AI enables finance and AR teams to manage disputes with precision and speed while maintaining transparency and control through capabilities like machine learning, natural language processing (NLP), automated document analysis, and intelligent workflow orchestration.

Table of Contents:

- How AI is Revolutionizing Dispute Resolution?

- Core Capabilities of AI in Dispute Management

- Implementing AI for Dispute Resolution: Step-by-Step Guide

- Key Applications of AI-Powered Dispute Management Software

- Future of AI in Dispute Resolution

Jump to a section that interests you, or keep reading.

How AI is Revolutionizing Dispute Resolution?

The introduction of Artificial Intelligence (AI) has transformed dispute resolution from a slow, manual, and error-prone process into an intelligent, data-driven system that operates with speed, accuracy, and precision. Traditionally, dispute management relied heavily on manual triage, paperwork, and cross-departmental coordination—processes that consumed time, strained resources, and frequently led to inconsistencies. With AI, this static approach has evolved into a dynamic ecosystem of predictive analytics, automation, and real-time insights, enabling organizations to manage high volumes of disputes efficiently and strategically.

AI does not replace human judgment—it enhances it. By acting as a decision-making partner, AI handles repetitive administrative work, identifies dispute patterns, and presents case managers with accurate insights, allowing teams to focus on negotiation, relationship management, and exception handling. In this new paradigm, human expertise and machine intelligence work together to deliver faster and more reliable outcomes.

AI revolutionizes dispute resolution through intelligent automation and predictive capabilities. Machine learning algorithms analyze historical data—such as invoices, contracts, payment histories, and claim logs—to predict potential disputes before they arise and assess the likelihood of validity once claims are submitted. Advanced risk assessment models then prioritize high-impact or high-risk cases, ensuring resources are deployed effectively. By automating core activities like data extraction, document verification, and case categorization, AI eliminates manual delays and creates a seamless, proactive resolution process.

The transformation is most evident in its measurable outcomes:

- Shorter Resolution Cycles: AI-driven automation drastically reduces processing time by triaging disputes automatically, extracting data from complex documents, and routing cases to the right teams without human intervention. Case managers receive complete, structured data instantly, enabling resolution within hours instead of days.

- Improved Accuracy: Through natural language processing (NLP) and automated document analysis, AI systems interpret unstructured text from emails, PDFs, and call notes with precision. This minimizes human error, ensures all supporting evidence is captured, and standardizes decision-making across cases.

- Enhanced Visibility: AI creates a centralized, data-rich view of every dispute. It breaks down silos by aggregating information from multiple systems—ERP, CRM, and communication logs—so stakeholders can track real-time progress, monitor patterns, and maintain full transparency throughout the dispute lifecycle.

- Consistent Compliance: Every decision made by an AI-enabled system is traceable and auditable. Automated application of policies and regulatory rules minimizes the risk of bias, oversight, or non-compliance, ensuring that every resolution aligns with internal and external governance standards.

- Data-Driven Decisions: With the help of predictive analytics and decision support models, AI offers actionable insights based on patterns from past disputes. It recommends optimal strategies—whether credit adjustments, negotiation approaches, or denials—empowering businesses to make faster, fact-based decisions backed by data rather than intuition.

Core Capabilities of AI in Dispute Management

AI has redefined dispute management by infusing intelligence, automation, and adaptability into every stage of the resolution process. Its true power lies in its ability to process massive volumes of structured and unstructured data, uncover insights, and automate complex tasks—all while continuously improving accuracy and decision quality. Below is a detailed exploration of the core AI capabilities that drive transformation in dispute resolution and management.

1. Predictive Analytics

AI-powered predictive analytics transforms dispute management from reactive to proactive. By analyzing historical dispute patterns, customer behavior, payment trends, and claim data, AI identifies the likelihood of future disputes and forecasts their potential impact. This predictive insight allows organizations to anticipate issues before they escalate, enabling proactive resolution strategies. Moreover, predictive algorithms assess the probability of dispute validity, empowering teams to prioritize high-impact or high-risk disputes and allocate resources efficiently. The result is a smarter, data-led approach that minimizes revenue leakage and accelerates resolution cycles.

2. Risk Assessment Models

AI introduces data-driven risk evaluation into the dispute workflow. By continuously analyzing transactional histories, customer payment patterns, and behavioral anomalies, AI models detect accounts that pose a higher likelihood of disputes or fraudulent activity. These risk assessment models enable early identification of problem accounts, allowing teams to implement preemptive measures before financial exposure increases. Through intelligent triage, disputes are categorized by urgency and complexity, ensuring critical cases receive immediate attention while routine ones are handled automatically.

3. Root Cause Analysis

Rather than merely resolving symptoms, AI dives deep to uncover the true origins of recurring disputes. It consolidates multi-source data—invoices, contracts, claims, shipment logs, and communication records—to pinpoint patterns and systemic failures causing frequent deductions or disagreements. Whether the issue stems from pricing inconsistencies, delivery discrepancies, or misaligned trade terms, AI-driven root cause analysis enables businesses to eliminate process inefficiencies and prevent future disputes at the source. This continuous feedback loop transforms dispute resolution into a long-term improvement strategy.

4. Natural Language Processing (NLP)

A major advancement in AI dispute management is Natural Language Processing (NLP), which bridges the gap between structured systems and human communication. NLP enables AI to read and interpret unstructured data from emails, PDFs, call transcripts, and customer correspondence—extracting meaningful information instantly. This technology powers intelligent chatbots and digital assistants that engage with users, collect dispute details, and provide real-time guidance. By converting fragmented text into structured data, NLP accelerates information retrieval, enhances context understanding, and ensures quicker, more accurate case handling.

5. Decision Support Systems

AI strengthens human judgment by providing data-backed decision support. Using predictive analytics and historical resolution outcomes, it recommends optimal courses of action—such as issuing credit notes, pursuing negotiation, or denying invalid claims. These systems simulate probable outcomes based on similar past cases, helping analysts make informed, consistent, and timely decisions. By removing subjectivity and bias, AI-powered decision systems ensure accuracy, fairness, and policy alignment across every resolution.

6. Fraud Detection

Fraudulent disputes can severely impact profitability, but AI mitigates this risk through real-time fraud detection models. By scanning large volumes of transactional and behavioral data, AI identifies anomalies—unusual claim patterns, duplicate entries, or irregular refund requests—that signal potential fraud. Advanced algorithms reduce false positives and prioritize legitimate threats for immediate escalation, ensuring analysts focus on high-value investigations. This capability safeguards both the company’s financial assets and its operational integrity.

7. Automated Document Analysis

AI automates one of the most time-consuming aspects of dispute management—document review. Using optical character recognition (OCR) and intelligent data extraction algorithms, it scans and processes supporting documentation such as invoices, contracts, proofs of delivery (PODs), and claim backups. By isolating relevant details and cross-referencing them with system records, AI eliminates manual document handling errors and accelerates verification and validation workflows, ensuring faster and more accurate dispute closure.

8. Dynamic Case Management

Disputes evolve continuously, and AI brings agility to their management. Through dynamic case management, AI monitors case progress, updates priorities in real time, and adjusts workflows based on new data or outcomes. For instance, if a case becomes high-risk due to updated customer information or policy changes, AI can automatically reassign it to specialized teams or trigger escalation protocols. This adaptability ensures every dispute is managed efficiently according to its evolving context and importance.

9. Continuous Learning

AI’s advantage lies in its capacity for continuous improvement through machine learning. Every resolved case contributes to the model’s intelligence, refining its ability to predict dispute outcomes, classify claims, and detect anomalies. Over time, the system becomes more precise, adaptive, and efficient, continually optimizing workflows and decision frameworks. This cycle of learning transforms dispute management into an ever-evolving, self-improving ecosystem, capable of adapting to emerging challenges and changing business dynamics.

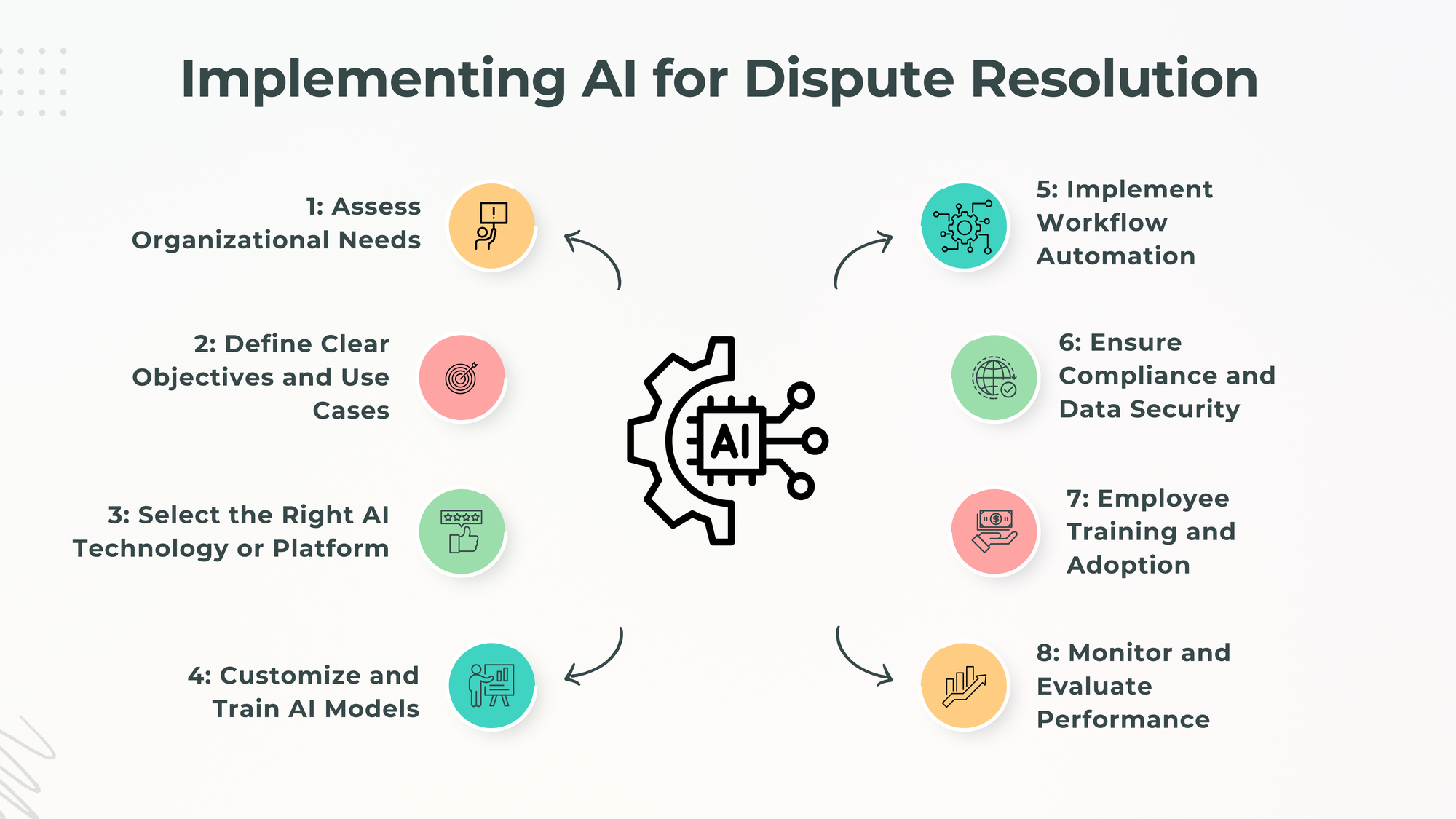

Implementing AI for Dispute Resolution: Step-by-Step Guide

Implementing AI in dispute resolution requires more than just adopting technology—it demands a structured, strategic approach that aligns business goals, operational realities, and human capabilities. From identifying inefficiencies to refining machine learning models, each step is crucial for achieving measurable impact. Below is a complete, practical roadmap to successfully deploy AI for dispute management, built entirely on the insights from the blogs you provided.

Step 1 – Assess Organizational Needs

The foundation of a successful AI implementation begins with a comprehensive assessment of your current dispute management process. Identify bottlenecks, inefficiencies, and data silos that slow down resolution cycles or create inconsistencies. Common challenges include manual document handling, fragmented communication between teams, and lack of visibility into case progress. By mapping these gaps, you define specific pain points that AI can address, such as delays in case triage, repetitive data entry, or inconsistent validation of deductions. This clarity ensures that the AI deployment is not a generic upgrade, but a targeted transformation built around real business needs.

Step 2 – Define Clear Objectives and Use Cases

Once problem areas are identified, define clear, measurable objectives for the AI implementation. These goals may include reducing average resolution time, improving case accuracy, minimizing financial leakage, or increasing your Net Recovery Rate by a defined percentage. Establish key performance indicators (KPIs) such as dispute turnaround time, percentage of automated case classification, accuracy of claim validation, and customer satisfaction ratings. Then identify specific use cases where AI can create immediate value—like predictive analytics for dispute prevention, automated claim triage, or fraud detection. Clear objectives create the performance benchmarks that guide both implementation and continuous optimization.

Step 3 – Select the Right AI Technology or Platform

Choosing the right platform is critical to success. Evaluate solutions based on scalability, integration capabilities, and alignment with existing systems such as ERP, CRM, or accounting software. The ideal tool should combine machine learning (ML), natural language processing (NLP), and workflow automation to handle end-to-end dispute resolution—from claim capture to case closure. Ensure the platform supports compliance management, audit trails, and customizable workflows. Leading AI-powered tools such as HighRadius and Kolleno exemplify this model by integrating automation, analytics, and collaboration in one unified system.

Step 4 – Customize and Train AI Models

Generic AI algorithms rarely deliver optimal performance without contextual data. To make the technology business-ready, train and customize AI models using historical dispute records, transaction data, and resolution outcomes. Feed the system examples of valid and invalid disputes, reason codes, and escalation rules so it learns to replicate accurate decision patterns. Tailor features like reason code mapping, prioritization logic, and case routing to your organization’s unique dispute categories. Over time, continually refine these models using real-world performance data to enhance precision, accuracy, and adaptability.

Step 5 – Implement Workflow Automation

Once models are trained, integrate AI into your operational workflows to automate repetitive, manual tasks. Automate case intake from portals or emails, triage disputes based on value or urgency, and route cases automatically to the right department. AI can also extract and verify data from documents, generate claim backups, and send automated notifications to stakeholders. Seamless cross-functional communication between accounts receivable, sales, logistics, and finance ensures that every team operates from the same source of truth. The result is a frictionless process that boosts efficiency, accelerates turnaround, and minimizes manual intervention.

Step 6 – Ensure Compliance and Data Security

AI systems handle sensitive financial and customer data, making compliance and data protection non-negotiable. Ensure the platform adheres to regulations such as GDPR, SOX, and industry-specific standards. Implement strong access controls, encryption protocols, and audit mechanisms to protect confidential information. At the same time, proactively mitigate algorithmic bias by maintaining transparency in model training and ensuring fair, explainable outcomes. Ethical AI deployment not only builds regulatory trust but also safeguards the organization’s financial and reputational integrity.

Step 7 – Employee Training and Adoption

Technology alone cannot transform dispute resolution—people must evolve with it. Conduct comprehensive training programs for accounts receivable analysts, dispute managers, and IT teams to help them understand AI workflows and interpret AI-generated insights effectively. Encourage collaboration between human expertise and machine intelligence, positioning AI as a strategic assistant rather than a replacement. Cultivate a culture of innovation and continuous learning, motivating teams to embrace automation as a tool for empowerment, efficiency, and smarter decision-making.

Step 8 – Monitor and Evaluate Performance

Implementation does not end with deployment; it requires continuous measurement and optimization. Monitor key metrics such as dispute resolution time, accuracy rate, percentage of automated workflows, recovery improvement, and customer feedback. Use AI-driven analytics to identify trends, performance gaps, and process improvements. Regularly refine both your AI models and operational workflows to adapt to new data, changing customer behaviors, or updated compliance frameworks. This iterative feedback loop ensures the AI solution evolves alongside the business, continually driving performance gains and efficiency.

Key Applications of AI-Powered Dispute Management Software

AI-powered dispute management software has evolved into a comprehensive, end-to-end ecosystem that automates every stage of dispute resolution — from identifying valid deductions to delivering full transparency across teams.

1. AI Deductions Validity Predictor

The AI Deductions Validity Predictor uses advanced machine learning algorithms that analyze 20+ variables across historical and transactional data to determine whether a deduction is valid or invalid. By leveraging up to 12 months of historical dispute patterns, it calculates the probability of claim validity with exceptional accuracy. This allows analysts to prioritize legitimate claims and focus investigative efforts on those most likely to be valid while automatically flagging and rejecting invalid deductions, ensuring faster dispute closure and improved recovery rates.

2. Claim Backup Automation

Manual document gathering is one of the biggest bottlenecks in dispute resolution. AI-powered claim backup automation eliminates this challenge by aggregating deduction-related documents from customer portals, carrier sites, and emails automatically. The system retrieves proofs, contracts, invoices, and claim details without analyst intervention, removing the delays and errors associated with manual retrieval. This not only saves time but also provides immediate access to all supporting evidence, accelerating case validation and audit readiness.

3. Deductions Auto-Coding

Accurate coding of disputes is essential for efficient routing and resolution. The deductions auto-coding feature uses machine learning algorithms and an extensive library of reason code identification models to determine the cause behind each deduction automatically. The AI then routes each case to the appropriate department—pricing, logistics, or trade promotions—ensuring faster categorization, minimal manual input, and high coding accuracy. This intelligent classification drives operational speed and consistency across teams.

4. Pricing Deductions Research Automation

Price discrepancies are among the most frequent causes of trade deductions. AI solves this through pricing deductions research automation, which automatically compares invoice prices with claim data to identify mismatches. The system highlights discrepancies instantly, helping teams verify pricing disputes in seconds rather than hours. This precision-based automation reduces resolution time while minimizing revenue leakage caused by undetected pricing errors.

5. Trade Promotion Auto-Matching

Trade promotions often lead to complex deductions that require cross-referencing multiple data sources. The trade promotion auto-matching capability connects directly with Trade Promotion Management (TPM) systems, allowing AI to automatically match customer claims to corresponding promotional activities. By verifying claim accuracy and promotional eligibility, this functionality ensures complete transparency and eliminates manual validation errors, safeguarding margins and enhancing efficiency in trade deduction handling.

6. Shortage & Returns Deduction Research Automation

AI automates one of the most tedious aspects of dispute resolution—verifying shortages and returns. The software aggregates Proof of Delivery (POD) documents, shipment details, and return-related files from carrier portals and emails, linking them directly to the dispute record. This automation validates quantity mismatches, missing shipments, and returned goods claims with unmatched accuracy. As a result, disputes related to logistics or returns are resolved rapidly, ensuring both customer satisfaction and operational accuracy.

7. Dispute Denial Automation

For invalid claims, dispute denial automation accelerates the process of rejecting and communicating denials to customers. The AI system automatically generates denial notifications and posts them directly to customer portals or emails, eliminating manual processing delays. This immediate feedback mechanism reduces bottom-line erosion, ensures timely communication, and maintains compliance by providing traceable denial documentation within the system.

8. Workflow Automation & Collaboration Tools

AI-driven workflow automation centralizes all dispute-related tasks within a unified platform. Features like automated task assignment, smart escalation routing, and collaborative dashboards ensure that every stakeholder—from finance to logistics—has real-time access to case progress. These collaboration tools foster transparency, accountability, and speed, enabling teams to communicate seamlessly, reduce follow-ups, and maintain a continuous resolution flow. The centralized environment ensures no dispute is lost, delayed, or mismanaged.

9. Real-Time Alerts & Case Tracking

The real-time alerts and case tracking capability enables organizations to stay ahead of every dispute as it arises. The system sends instant notifications for new disputes, chargebacks, or deductions, keeping AR and collection teams informed at all times. Each case is tagged with a reason code and priority level, enabling easy tracking, trend identification, and performance analysis. This visibility allows for proactive management, ensuring that time-sensitive or high-value cases are addressed immediately to prevent escalation.

10. Data Integration & System Connectivity

Modern dispute resolution depends on seamless data flow across multiple business systems. AI-powered platforms like HighRadius and Kolleno are designed with end-to-end integration capabilities, connecting directly with ERP, CRM, and accounting systems. This unified data ecosystem removes redundancies, maintains a single source of truth, and ensures all teams work with synchronized, accurate information. Integrated reporting and analytics tools further allow management to derive real-time insights and compliance-ready documentation from a centralized dashboard.

Future of AI in Dispute Resolution

The future of dispute resolution is being reshaped by the rapid evolution of AI—from predictive automation to intelligent collaboration. What began as a tool for speeding up manual tasks is now becoming a strategic ecosystem that anticipates disputes, engages directly with customers, and enables seamless cooperation between humans and machines. The next phase of AI in dispute management will be defined by predictive prevention, generative intelligence, real-time collaboration, and customer self-service, creating a dispute process that is faster, fairer, and virtually frictionless.

Integration with Generative AI for Conversational Case Management

The next leap in dispute management lies in the integration of generative AI, which brings human-like communication and contextual understanding into dispute handling. Unlike traditional automation that executes predefined tasks, generative AI models can comprehend case narratives, draft contextual responses, summarize complex documentation, and assist analysts through conversational interfaces. This enables dispute teams to interact with AI as a co-worker—asking for case summaries, root cause explanations, or recommended actions in natural language.

AI-powered virtual assistants, enhanced by natural language generation (NLG), will manage case conversations, interpret tone and intent in customer communication, and compose professional, compliant responses automatically. This conversational capability transforms dispute management from static workflows into interactive, dialogue-driven case resolution, significantly improving communication accuracy and reducing turnaround time.

Predictive Prevention of Disputes Before They Occur

AI’s predictive capabilities are evolving from forecasting outcomes to preventing disputes entirely. By analyzing large volumes of transaction, invoice, and claim data in real time, future systems will identify patterns, anomalies, and behaviors that typically precede disputes—such as pricing mismatches, shipment inconsistencies, or recurring claim errors.

This shift from reactive dispute management to preventive intelligence means that businesses will be able to address potential conflicts before customers even raise them. AI will automatically trigger alerts for at-risk transactions, correct pricing or policy errors preemptively, and notify teams of early warning signals. This proactive approach not only minimizes financial exposure and operational rework but also fosters stronger customer trust and smoother relationships.

Real-Time Collaboration Between AI Agents and Human Analysts

The dispute resolution of the future will thrive on symbiotic collaboration between AI and humans. AI agents will continuously monitor case flows, extract and update data, and present analysts with intelligent insights, freeing them to focus on complex negotiation and decision-making tasks. Instead of replacing human input, these AI agents will enhance human expertise with real-time recommendations, automated document validation, and data-backed confidence scores for proposed actions.

As AI becomes embedded in enterprise ecosystems, real-time collaboration will extend beyond individual users to entire teams. Analysts, AR specialists, and compliance officers will operate in shared, AI-assisted workspaces where case updates, escalations, and audit trails are synchronized instantly. This model will ensure consistent accuracy, continuous visibility, and cross-functional alignment, making dispute resolution not only faster but also strategically coordinated across the organization.

AI-Enabled Self-Service Dispute Portals for Customers

Future-ready dispute management will also be customer-centric, with AI-enabled self-service portals revolutionizing how disputes are raised, tracked, and resolved. Instead of relying on back-and-forth emails or long waiting cycles, customers will be able to log disputes directly into intelligent portals, guided step-by-step by AI assistants that validate claim data, request supporting documents, and provide real-time status updates.

These self-service platforms will integrate seamlessly with back-end AI systems to auto-triage disputes, verify claims instantly, and provide transparent resolution timelines. Generative AI will further personalize the customer experience by delivering contextual explanations and tailored responses, ensuring that communication remains clear and consistent throughout the process. By giving customers autonomy and visibility, these portals will reduce friction, enhance satisfaction, and lighten the operational load on dispute teams.

Conclusion

AI has shifted dispute management from a fragmented, manual process to a connected, intelligent, and predictive ecosystem. By leveraging automation, analytics, and continuous learning, organizations can now resolve disputes faster, enhance accuracy, and strengthen compliance—all while creating a more transparent and customer-centric experience.

The adoption of AI-powered platforms enables finance teams to go beyond surface-level resolution and tackle the root causes of recurring disputes, improving not just process efficiency but overall business resilience. As generative AI, real-time collaboration, and predictive prevention become integral to dispute management, businesses will gain the power to anticipate issues before they occur and maintain seamless cash flow across their operations.

Ultimately, AI is not replacing human decision-making—it’s elevating it. It brings the scale, speed, and insight required to manage the increasing complexity of modern financial ecosystems. Companies that invest in AI-driven dispute management today are not just optimizing their present—they’re building the foundation for a future of smarter, faster, and more proactive financial operations where disputes no longer disrupt progress but instead drive continuous improvement and innovation.