Guide to AI for Deductions Handling

Deductions have long been a hidden drain on profitability — quietly eroding margins, delaying cash flow, and overwhelming finance teams with manual claim validation and documentation chases. Traditional processes built on spreadsheets and emails can’t keep up with today’s deduction volumes, leaving revenue trapped in disputes and valid claims unresolved.

This blog discusses how AI is changing that by combining intelligent automation, machine learning, and real-time analytics.

Table of Contents:

- Traditional vs. AI-Driven Deductions Management

- Core AI Capabilities Transforming Deductions Handling

- Data and Reporting Automation

- Governance, Compliance & Financial Integration

- Impact of AI-Driven Automation

- AI as a Preventative Tool

Jump to a section that interests you, or keep reading.

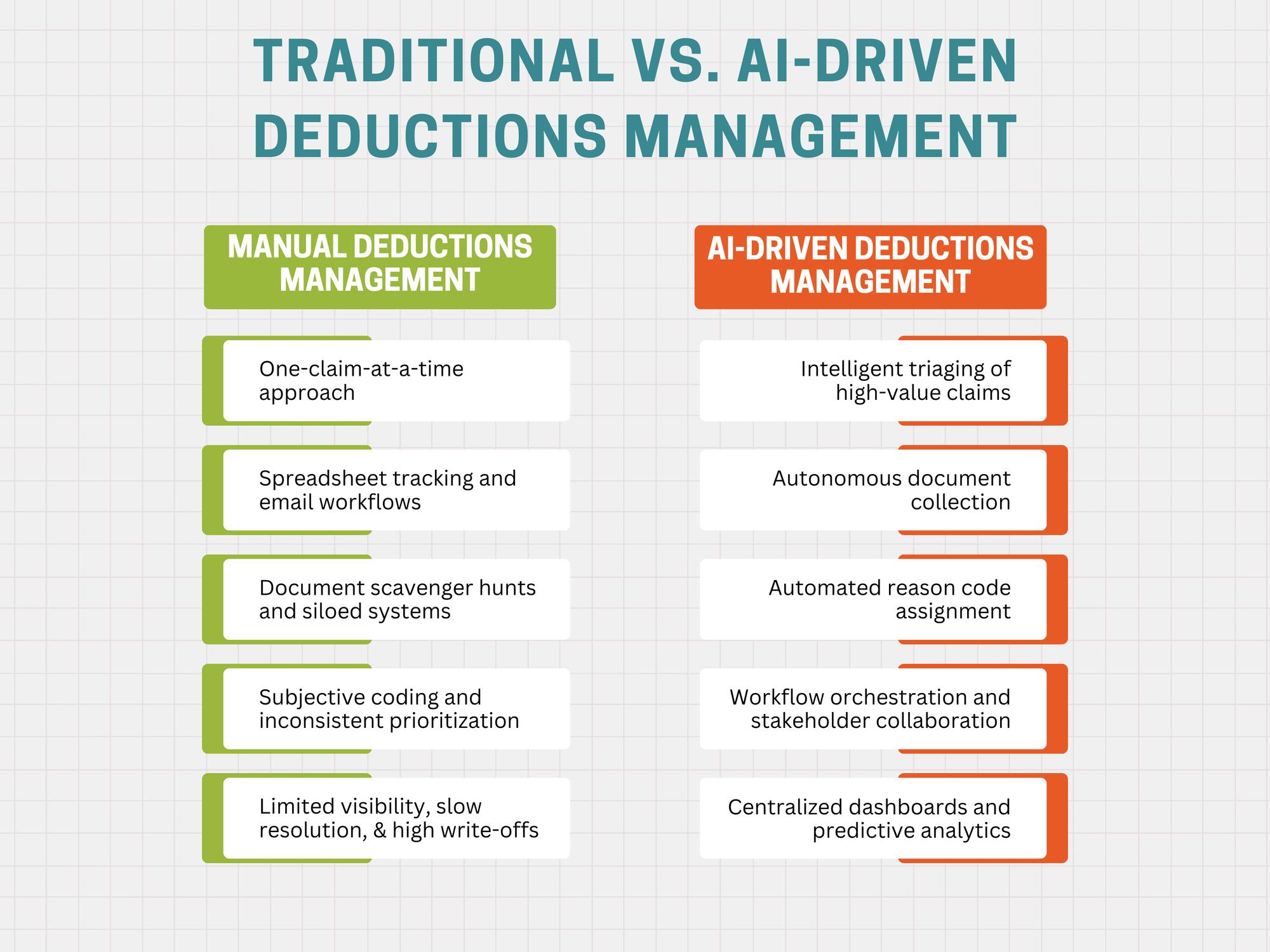

Traditional vs. AI-Driven Deductions Management

1. Manual Deductions Management

Traditional deductions handling has long relied on fragmented, manual workflows that leave finance teams buried under repetitive tasks and inconsistent processes. Analysts typically work claim by claim — each one processed in isolation, with no intelligence guiding prioritization. Every deduction, whether worth $50 or $50,000, receives the same effort and attention. This “one-claim-at-a-time” approach quickly collapses under volume, creating bottlenecks and inefficiencies that ripple across finance, sales, logistics, and customer service.

Documentation retrieval is among the most painful aspects of manual deductions management. Analysts spend up to 40% of their time tracking down proof of delivery, invoices, or claim forms scattered across inboxes, shared folders, and customer portals. Each missing document triggers a cycle of emails and follow-ups that slows resolution and clouds accountability. Without system-to-system connectivity, communication remains fragmented, and data often resides in silos — spreadsheets, disconnected AR tools, or legacy ERPs — making reconciliation tedious and error-prone.

Assigning reason codes is another recurring challenge. Manual coding depends heavily on the analyst’s interpretation of vague remittance data or inconsistent customer terminology. This subjectivity leads to miscoding, routing delays, and unreliable reporting, which in turn distort root-cause analysis and make dispute analytics less actionable. When deductions are tied to trade promotions, analysts are forced to cross-check data manually across multiple systems — verifying agreements, product details, and promotional terms in spreadsheets. The process is slow, error-prone, and unsustainable at scale.

Manual workflows also make it nearly impossible to prioritize effectively. Analysts must decide intuitively which claims to investigate first, often overlooking high-value disputes in favor of those easiest to resolve. With limited visibility into claim aging or recovery potential, time and effort are misallocated. This lack of structured prioritization directly contributes to revenue leakage — particularly when invalid deductions, which account for up to 10% of all claims, remain unchallenged simply because they take too long to investigate.

The result of these disconnected workflows is predictable: resolution cycles stretch out, valid claims clog the pipeline, and invalid ones are written off. Visibility across teams is minimal — no one knows the current status of a claim, who owns it, or when it will be resolved. Without a centralized audit trail or performance dashboard, metrics like Days Deductions Outstanding (DDO) and recovery rates go untracked in many organizations. The absence of automation also amplifies the cost of dispute handling, diverting skilled employees from value-added tasks to repetitive administrative work. In short, manual deductions management drains efficiency, increases write-offs, and erodes customer satisfaction.

2. AI-Driven Deductions Management

AI-driven deductions management transforms this reactive, fragmented process into a proactive, data-intelligent ecosystem. Using automation, machine learning, and workflow orchestration, finance teams can now manage deductions with unprecedented speed, accuracy, and transparency.

At the core of this transformation is intelligent triaging. As soon as a claim enters the system, AI agents analyze multiple parameters — dollar value, claim type, customer history, and recovery likelihood — to automatically assign priority. High-impact disputes are surfaced instantly, ensuring analysts focus where recovery potential is highest. This dynamic triage replaces guesswork with precision, cutting through backlogs and optimizing analyst time.

Next comes autonomous document collection. Instead of chasing paperwork, AI agents connect directly with customer portals, email inboxes, and internal repositories to retrieve and attach relevant documentation automatically — invoices, proof of delivery, credit memos, and promotional agreements. By eliminating manual searches, this automation accelerates resolution cycles and ensures that every case file is complete before human review even begins.

AI also introduces automated reason code assignment through machine learning models trained on historical data and ERP mappings. These models interpret unstructured remittance information, translate customer-specific language, and accurately map it to standardized internal reason codes. This reduces miscoding errors, enhances reporting reliability, and prevents claims from being misrouted between teams.

Equally transformative is workflow orchestration. Intelligent workflows replace email threads with structured, automated routing. AI systems assign ownership, set deadlines, and trigger reminders and escalations automatically. When a claim touches multiple departments — pricing, logistics, or trade marketing — the workflow ensures that every stakeholder acts in sequence without manual coordination. Collaboration shifts from reactive follow-ups to integrated, visible task execution, supported by built-in communication tools.

AI-driven platforms also provide centralized dashboards and predictive analytics that consolidate all claims activity in one place. Finance leaders gain real-time visibility into outstanding deductions, root causes, and performance metrics such as DDO, recovery rate, and invalid claim ratio. Predictive analytics models identify recurring patterns — like specific customers or products driving high deduction volumes — enabling organizations to prevent issues before they occur. These insights support more accurate cashflow forecasting and faster financial close cycles.

The cumulative effect is a smarter, faster, and more scalable deductions process. Routine tasks are handled autonomously, freeing analysts to focus on exception handling and strategic recovery. Resolution times are cut in half, recovery rates rise as invalid deductions are detected earlier, and overall process consistency improves. Most importantly, AI-driven management enhances customer experience by ensuring transparency, faster turnaround, and clear communication — transforming deductions from a cost center into a controlled, insight-driven function that directly contributes to profitability.

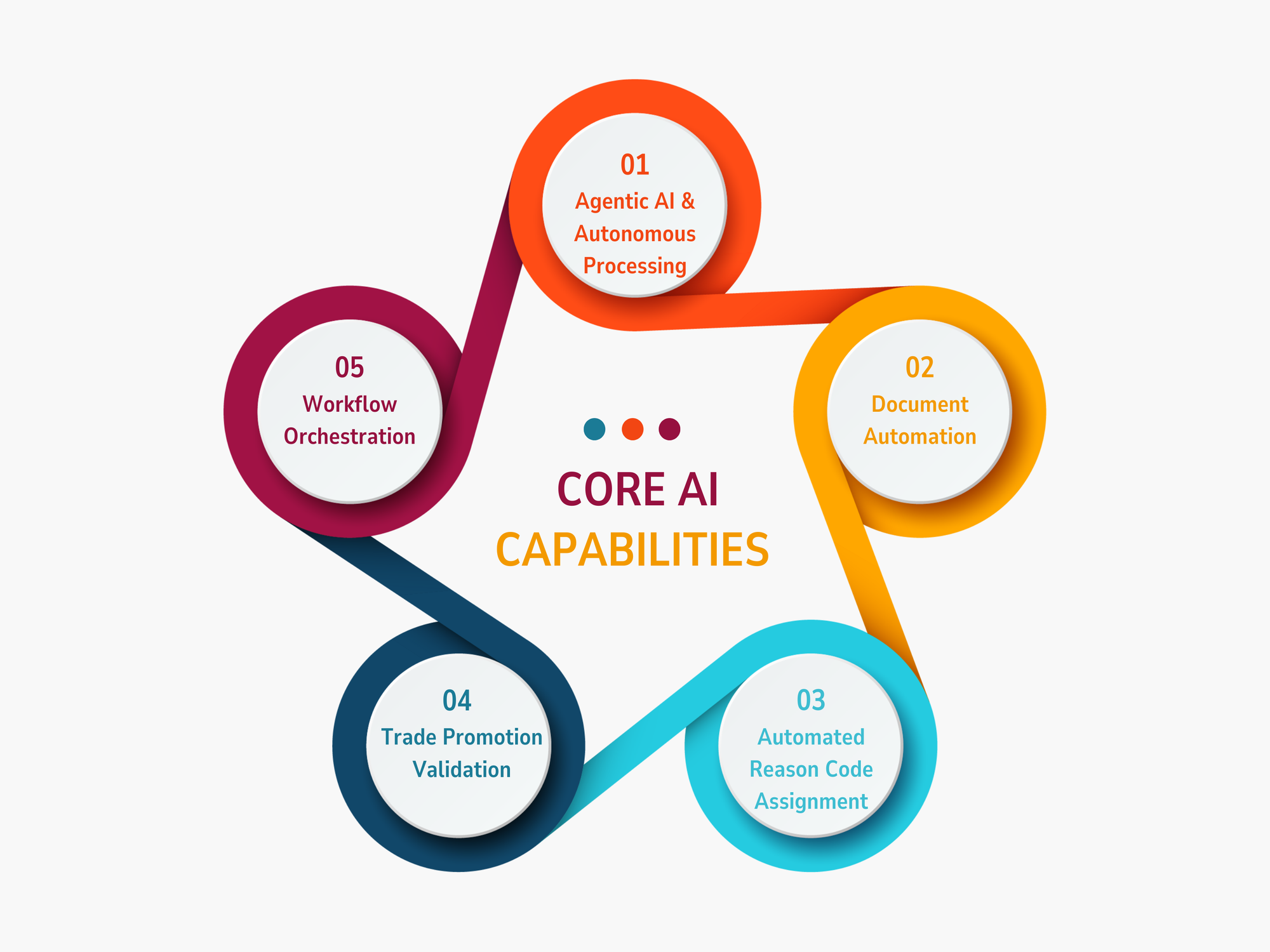

Core AI Capabilities Transforming Deductions Handling

1. Agentic AI and Autonomous Processing

Agentic AI represents the next leap in deductions management — where intelligent agents don’t just automate repetitive tasks, but actively think, decide, and act on behalf of analysts. These autonomous systems validate, classify, and resolve deductions end-to-end, drawing from historical transaction data, claim types, and behavioral patterns to execute informed decisions without waiting for manual intervention.

Unlike static automation, these agents continuously learn from claim outcomes and system feedback to refine their judgment. The moment a deduction enters the workflow, AI evaluates it in real time using weighted parameters such as dollar value, probability of recovery, historical dispute success, and customer patterns. This enables automatic triaging — high-value, recoverable claims are flagged for analyst review, while routine or low-risk claims are processed independently.

Agentic AI systems also orchestrate smart escalation by detecting bottlenecks and routing cases dynamically to relevant stakeholders across departments. With integrated collaboration layers, they eliminate the need for follow-up emails or manual chasers. Reminders, handoffs, and exception handling happen algorithmically, ensuring no claim stalls in the queue. The outcome is a self-governing deduction ecosystem where accuracy scales with volume, freeing analysts to focus on exceptions, strategy, and revenue recovery.

2. Document Automation

One of the most resource-draining aspects of traditional deductions management is document retrieval — and it’s where AI delivers immediate, measurable transformation. Document automation integrates directly with email inboxes, customer portals, ERPs, and shared drives to autonomously fetch, tag, and attach the precise backup materials associated with each claim.

As soon as a deduction appears, the AI engine searches all linked data sources, locates supporting files — such as invoices, proof of delivery (POD), credit memos, and trade agreements — and maps them directly to the case record. These systems use advanced pattern recognition and metadata tagging to ensure that every piece of documentation aligns with the correct customer, transaction, and deduction ID.

By replacing manual searches with instantaneous retrieval and auto-matching, document automation shortens cycle times from hours to seconds. The result is clean, complete documentation, improved traceability, and seamless compliance auditability. Analysts are no longer scavenging for evidence; every file they need is automatically attached, categorized, and ready for validation at the moment of review.

3. Automated Reason Code Assignment

Assigning the right deduction reason code has historically been a guessing game riddled with inconsistencies. AI eliminates that ambiguity by using natural language processing (NLP) and supervised machine learning to interpret unstructured customer remittance data, decode ambiguous descriptions, and align them with standardized internal ERP codes.

Trained on historical data and past mappings, the AI engine identifies linguistic patterns and contextual cues to precisely match customer-issued reason codes — which often vary by retailer or distributor — with an organization’s internal taxonomy. This automated translation ensures cross-system consistency, prevents claims from being misrouted, and delivers a single source of truth across finance, sales, and accounting teams.

The impact extends beyond operational accuracy: automated coding produces clean, structured analytics that reveal trends in dispute categories, root causes, and recurring problem areas. It strengthens reporting, enhances decision-making, and enables predictive insights — all while removing the human bias and inconsistency that have long plagued manual coding.

4. Trade Promotion Validation

Trade-related deductions often consume disproportionate analyst time due to their dependency on cross-referencing multiple data points — contracts, product masters, promotional calendars, and invoices. AI-driven validation automates this entire reconciliation process through an intelligent three-way match that instantly compares each deduction against promotional agreements and transaction data.

If a deduction aligns with contractual terms, product eligibility, and pricing thresholds, it’s auto-approved; if discrepancies are detected, the claim is flagged for analyst attention. This precision drastically reduces time spent on manual lookups, eliminates spreadsheet-based verification, and ensures adherence to promotional compliance.

Processing time that once stretched into hours is now reduced to minutes, with accuracy rates that minimize both missed recoveries and wrongful approvals. For finance teams, this translates into stronger controls, faster throughput, and consistent application of trade terms across all customers and campaigns.

5. Workflow Orchestration

AI-powered workflow orchestration redefines how deductions move through an organization. Instead of relying on fragmented email chains and manual task delegation, intelligent workflow engines coordinate every step of the process — from claim intake to resolution — across departments such as finance, sales, logistics, and customer service.

Each task is automatically assigned to the right owner based on predefined logic, claim type, or escalation triggers. Deadlines are tracked algorithmically, with real-time reminders and escalation alerts ensuring timely completion. AI agents monitor progress continuously, intervening when bottlenecks arise or SLA thresholds approach.

This orchestration delivers transparent accountability and eliminates friction between teams. Everyone involved has visibility into claim status, dependencies, and responsibilities through centralized dashboards. By embedding automation into every stage, AI converts workflow from reactive coordination to proactive execution — accelerating turnaround and improving both efficiency and cross-functional alignment.

Data and Reporting Automation

Data and reporting automation serve as the analytical backbone of modern deductions management. AI consolidates and analyzes vast datasets — across claims, payments, customers, and disputes — to generate granular insights in real time.Dynamic dashboards track key performance indicators like Days Deductions Outstanding (DDO), recovery rates, dispute resolution times, and invalid claim trends. These dashboards allow drill-down analysis by customer, deduction type, region, or age, revealing the root causes of revenue leakage and enabling rapid corrective action.

Machine learning models extend beyond reporting into prediction: they identify patterns in deduction occurrence, forecast potential dispute spikes, and flag at-risk accounts before claims materialize. This predictive intelligence shifts deductions handling from reactive remediation to proactive prevention.

Cross-functional visibility ensures every stakeholder — from finance to operations — works from the same data source, reducing friction and aligning priorities. By automating data capture, interpretation, and visualization, AI transforms reporting from static postmortems into continuous performance optimization.

Governance, Compliance & Financial Integration

AI-driven deduction systems are not isolated automation layers; they’re deeply embedded within financial governance structures. Seamless integration with general ledger and cash application modules ensures deductions are posted, batched, merged, or offset automatically, maintaining full transactional integrity.

Every adjustment is logged in an immutable audit trail, offering transparency for both internal controls and external audits. This traceability strengthens compliance with corporate accounting standards and regulatory mandates. Real-time reconciliation capabilities synchronize deduction handling with payment settlements, ensuring that receivables and credits balance accurately without manual intervention.

AI governance also supports smarter financial decision-making through continuous monitoring of reserve adequacy, write-off behavior, and recovery performance. Automated write-off thresholds enforce policy discipline — preventing overextensions while ensuring legitimate deductions are expensed promptly.

Impact of AI-Driven Automation

1. Financial Impact

AI-driven deductions automation has a direct and measurable effect on financial performance by accelerating cash realization, reducing revenue leakage, and improving working capital utilization.

Automated validation, classification, and resolution shorten Days Sales Outstanding (DSO) and Days Deductions Outstanding (DDO) by eliminating manual handoffs and document delays. As claims are resolved faster, disputed amounts are either recovered or cleared more quickly, tightening the cash conversion cycle.

With AI managing standard and valid deductions autonomously, analysts can focus on investigating invalid claims — recovering funds that might otherwise be written off. This precision lowers the write-off threshold and increases total cash recovered per reporting period. As a result, organizations see quantifiable improvements in working capital efficiency and more accurate cash flow forecasting, driven by real-time visibility into deduction exposure and recovery potential.

Automation also enhances financial governance: all deductions are properly validated, posted, and reconciled with the general ledger, minimizing balance sheet distortion and improving revenue accuracy. Collectively, these outcomes transform deductions from an uncontrolled expense into a managed asset that actively contributes to financial stability.

2. Operational Efficiency

AI replaces fragmented, manual workflows with streamlined, end-to-end automation, delivering exponential gains in productivity and process velocity. Enterprises that have deployed agentic AI or smart SaaS platforms report deduction resolution cycles reduced by up to 50%, enabling analysts to process twice as many claims within the same timeframe.

Task automation, intelligent triaging, and autonomous document retrieval eliminate redundant communication loops and manual searches, while automated coding and validation remove dependency on individual judgment. Each claim flows through a structured, rule-based process that minimizes rework and error frequency.

These operational efficiencies compound: fewer human interventions mean less time spent chasing documentation, escalating disputes, or correcting misclassifications. In aggregate, productivity per analyst rises by 20% or more, administrative overhead decreases, and process scalability increases — allowing AR teams to manage growing deduction volumes without expanding headcount.

3. Customer Experience (CX) Impact

AI-driven deductions management directly improves customer satisfaction by making dispute resolution faster, transparent, and easier to navigate. Automated workflows ensure customers receive quicker responses and consistent resolution timelines, replacing opaque processes with predictable outcomes.

Integrated customer portals and self-service dashboards allow buyers to track claim status in real time — a significant improvement over legacy systems that forced customers to call or email for updates. This visibility builds confidence and reduces friction in B2B relationships.

Moreover, by improving accuracy in billing, shipment validation, and trade promotion matching, AI reduces the frequency of erroneous deductions altogether. Retailers and distributors experience fewer invoice disputes, better compliance alignment, and faster closure on trade claims. These efficiencies reinforce trust between vendors and customers, positioning suppliers as reliable, technology-forward partners that are easy to do business with.

4. Employee Experience

The impact of AI on the workforce is equally transformative. Automation relieves analysts from repetitive, low-value tasks such as manual data entry, document retrieval, or claim sorting — allowing them to focus on strategic work like resolving complex exceptions, investigating root causes, and identifying process improvements.

Cross-departmental collaboration improves as workflows and dashboards make ownership transparent and tasks automatically visible to all stakeholders. Instead of chasing updates through fragmented communication, teams engage in structured, data-driven cooperation supported by system-triggered notifications and reminders.

As workload pressure decreases and accountability increases, job satisfaction improves. Analysts evolve from processors to decision-makers, applying analytical and financial expertise rather than administrative effort. This elevation of roles not only enhances productivity but also drives retention in AR teams traditionally bogged down by repetitive work.

AI as a Preventative Tool

The true strength of AI in deductions management extends beyond automation — it lies in its capacity to prevent disputes before they occur. Machine learning models trained on historical deduction data can identify predictive patterns across customers, SKUs, and transaction behaviors to forecast where and why future deductions may arise.

By continuously analyzing root causes — such as pricing errors, shipment inaccuracies, late deliveries, or inconsistent trade promotion terms — AI surfaces systemic vulnerabilities within the order-to-cash process. These insights enable organizations to correct upstream issues in pricing, logistics, or billing before they trigger new claims.

Predictive analytics further empower finance leaders to model deduction risk by customer or channel, helping prioritize high-risk accounts and establish preventive controls. When combined with automated dashboards and closed-loop feedback systems, these insights transform deductions handling into a continuous improvement engine.

Closed-loop feedback ensures that once a deduction is resolved, its cause and resolution path feed back into the system to refine both the AI model and internal processes. Over time, this creates a self-learning ecosystem where errors are not just corrected — they are systematically eliminated.

The result is a proactive, intelligent deductions function that continuously strengthens itself, reducing disputes, improving compliance, and creating a virtuous cycle of efficiency and accuracy across the order-to-cash chain.

Conclusion

For decades, deductions were seen as an unavoidable cost of doing business — a slow, opaque, and often frustrating process that drained both cash and confidence. But the rise of AI and intelligent automation has rewritten that narrative. What was once a reactive, people-heavy task is now becoming a proactive, data-driven discipline where speed, precision, and transparency are the norm.

Organizations embracing AI for deductions management are not just accelerating recovery or reducing write-offs — they’re fundamentally transforming the economics of their order-to-cash cycle. Automated validation and triaging shorten DSO, predictive analytics prevent future claims, and centralized dashboards deliver real-time financial clarity. Beyond the numbers, these systems rebuild trust: customers experience faster, transparent resolutions, while analysts engage in higher-value, strategic work.

The message is clear: automation is no longer a technological upgrade — it’s a financial imperative. Companies that harness AI to manage and prevent deductions gain a compounding advantage — stronger liquidity, smarter governance, and more resilient customer relationships. Those that delay risk falling behind in an ecosystem where speed, accuracy, and insight define competitiveness.

In an era where every dollar of working capital matters, AI gives finance teams what they’ve always needed but never had — the ability to see, decide, and act before revenue slips away. The future of deductions management isn’t reactive recovery; it’s intelligent prevention. And that future is already here.