Guide to the Accounts Receivable Process

In every business, sales alone don’t guarantee financial success—cash flow does. The period between delivering goods or services and collecting payment is where many companies face their toughest financial challenges, and this gap is managed through the Accounts Receivable (AR) process. More than just a back-office function, AR is the lifeline that links revenue recognition to actual liquidity, influencing everything from operational stability to growth potential.

A well-structured AR process not only ensures faster collections and reduced bad debt but also safeguards compliance, enhances customer relationships, and improves forecasting accuracy. Conversely, inefficiencies in invoicing, collections, or dispute resolution can inflate days sales outstanding (DSO), distort financial reporting, and drain working capital.

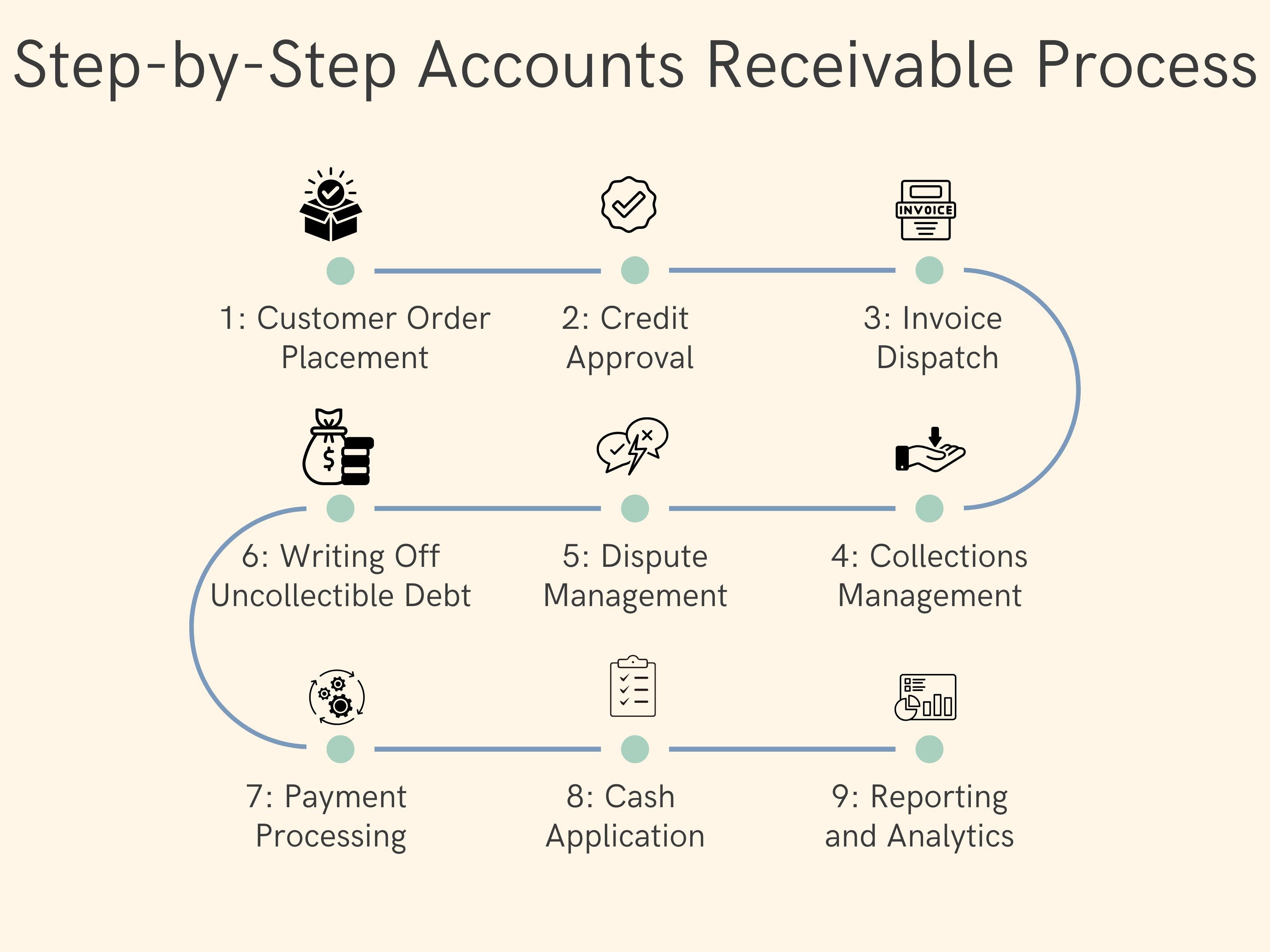

This guide takes a step-by-step approach to the AR lifecycle, covering everything from order placement and credit approval to payment processing, cash application, and reporting.

Table of Contents:

- What is Accounts Receivable?

- Step-by-Step Accounts Receivable Process

- Elevate Your Accounts Receivable Process Flow

Jump to a section that interests you, or keep reading.

What is Accounts Receivable?

Accounts Receivable (AR) represents the money owed to a business by its customers for goods or services already delivered but not yet paid for. In essence, it is an IOU owed to the company—a current asset on the balance sheet that reflects future cash inflows. Unlike cash sales, AR arises when businesses extend credit, allowing customers to pay at a later date under agreed-upon terms such as net 30, 45, or 60 days.

A simple example illustrates AR in practice: Company A delivers office equipment to Company B with a 30-day credit term. The invoice amount is recorded as AR until Company B makes the payment. During this period, AR remains an asset on Company A’s balance sheet, and once cleared, the receivable converts into actual revenue.

Step-by-Step Accounts Receivable Process

Step 1: Customer Order Placement

The accounts receivable cycle begins when a customer decides to purchase goods or services and communicates this intent through a purchase order (PO). Once reviewed, the business generates a sales order (SO), which serves as a binding agreement and the foundation for downstream AR activities. The sales order specifies critical details such as product or service descriptions, quantity, unit price, applicable discounts, delivery timelines, shipping location, and other contractual terms. This step ensures alignment between customer expectations and company obligations, reducing the likelihood of disputes later in the cycle. In many organizations, credit managers review the SO before it is finalized, integrating financial controls early in the process.

Step 2: Credit Approval

Before fulfilling an order on credit, businesses must evaluate the customer’s ability and willingness to pay. Extending credit inherently carries risk, and a structured credit assessment is essential for minimizing exposure to bad debt. For new customers, this typically involves a documented credit application process guided by the company’s credit policy. Factors considered include financial stability, payment history, industry norms, and the business’s own risk tolerance based on margins and cash flow. The approval process may span several days, especially for high-value accounts. For existing customers, credit terms are periodically reviewed and adjusted if order volumes increase or payment behaviors shift, ensuring ongoing protection against default risk.

The outcome of the credit evaluation can lead to three scenarios: full approval under standard terms, denial due to excessive risk, or negotiation of alternative payment structures such as cash on delivery, partial advance, or shorter terms. Formalized credit policies and workflows not only safeguard revenue but also provide consistency in decision-making, ensuring that sales momentum does not compromise financial discipline.

Step 3: Invoice Dispatch

Once credit approval is secured and the sales order is confirmed, the next critical step is invoice generation and delivery. The invoice serves as the definitive financial document of the transaction, outlining the exact amount owed, the due date, and all relevant terms, including agreed-upon discounts or potential late payment penalties. It formalizes the customer’s obligation, making it the cornerstone of the receivables process.

Payment terms vary by industry and customer relationship, typically spanning 30, 60, or 90 days, and must be clearly stated to avoid ambiguity. If late fees apply, they should be explicitly included, as vague terms can delay collections or complicate dispute resolution.

Equally important is the speed of dispatch. The faster an invoice reaches the customer, the sooner the payment clock begins, directly affecting cash flow. Delays in invoicing extend collection cycles and inflate days sales outstanding (DSO). To minimize such risks, many businesses move away from manual methods like printing and mailing toward automated systems that deliver invoices via email, electronic data interchange (EDI), or integrated ERP workflows. Automation ensures accuracy, reduces processing delays, and enables faster acknowledgment by the customer, all of which strengthen the foundation for timely payment.

Step 4: Collections Management

Despite accurate invoicing, late payments are a recurring challenge. An effective collections strategy combines structured timelines with flexibility to preserve customer relationships while safeguarding cash flow. Industry-standard escalation practices include:

<7 days past due: Send a polite reminder highlighting the missed due date.

8–14 days past due: Initiate a second follow-up, typically by email or phone.

15–30 days past due: Issue a formal dunning letter, reinforcing the overdue status and outlining late fee implications.

31–45 days past due: Deliver a final written notice and escalate tone if payment remains outstanding.

46–60 days past due: Continue outreach at regular intervals (e.g., weekly), intensifying urgency.

61–90 days past due: Involve senior management, legal counsel, or external collection agencies if the outstanding amount is significant.

Before any outreach begins, internal validation is crucial. AR teams must verify that the invoice was correctly issued, discounts or credits were properly applied, and no administrative errors occurred. Addressing internal oversights first prevents damaging customer trust and avoids unnecessary disputes.

Collection efforts should also be tailored based on customer payment history. A typically punctual client may merit leniency, while consistently late payers require stricter monitoring or renegotiated terms. This risk-based approach ensures resources are focused where recovery risk is highest, balancing firmness with flexibility to maintain long-term relationships while accelerating cash conversion.

Step 5: Dispute Management

Even with rigorous processes, invoice disputes remain one of the leading causes of delayed payments. Disputes often arise from human errors in billing, such as incorrect amounts or missing discounts, issues with goods or services that fail to meet expectations, discrepancies between proposals, purchase orders, and invoices, or simple miscommunication between buyer and seller. Each of these situations disrupts the cash conversion cycle and increases collection costs.

A frequent outcome of disputes is the short payment, where customers pay only the undisputed portion of an invoice. While this allows partial cash recovery, it creates additional complexity for AR teams, who must determine the legitimacy of the deduction, reconcile the partial payment, and adjust records accordingly.

The key to minimizing the impact of disputes lies in early intervention. Initiating the resolution process as soon as an invoice becomes overdue helps prevent escalation, preserves customer trust, and accelerates payment release. Proactive communication, thorough documentation, and clearly defined dispute workflows ensure disputes are tracked, addressed, and closed without extended delays. By embedding early dispute management into the AR cycle, businesses safeguard both cash flow and customer relationships.

Step 6: Writing Off Uncollectible Debt

Despite structured collections and dispute resolution, some receivables will inevitably remain unpaid. When all outreach efforts—such as continued follow-ups, escalation to senior management, or engagement with legal counsel and collection agencies—fail to yield results, the receivable must be written off as bad debt.

The timing of a write-off is not universal but varies by industry norms and company policy. For example, in sectors like transportation, an average days sales outstanding (DSO) above 50 days may be common, so businesses may allow more time before recognizing debt as uncollectible. In contrast, industries with faster turnover cycles may establish shorter thresholds.

Under accrual accounting, businesses anticipate this inevitability by creating an allowance for doubtful accounts, which sets aside reserves for potential non-payment. This approach ensures that financial statements more accurately reflect expected cash inflows.

Late payments directly inflate DSO, making timely recognition and resolution of bad debts essential to maintaining realistic performance metrics. Allowing receivables to remain overstated distorts liquidity projections and complicates cash flow forecasting. Writing off uncollectible debt, though undesirable, provides clarity, improves reporting accuracy, and allows finance teams to refocus efforts on more collectible accounts.

Step 7: Payment Processing

Once customers initiate settlement, efficient payment processing ensures accurate financial records and steady cash flow. Businesses typically receive payments through multiple channels, including ACH or EFT transfers, wire transfers, debit or credit cards, virtual cards, and traditional checks. Supporting this diversity requires the right infrastructure: a payment processor to handle transactions, a payment gateway for secure data transmission, and at least one merchant account to accept electronic payments. For companies with ecommerce or self-service models, integration with digital platforms is essential to enable frictionless transactions.

Despite the growth of electronic payments, many B2B organizations still manage a high volume of checks. To handle these efficiently, companies often use lockbox services, where banks receive and process checks on their behalf. Lockboxes eliminate the need for in-office check handling and accelerate deposits, but they do not remove the manual effort of reconciling lockbox files with open invoices.

Alongside speed and accuracy, compliance is critical. Businesses must meet PCI DSS standards for secure handling of cardholder data, apply encryption protocols to protect sensitive information, and implement role-based access controls to minimize risk. Adhering to compliance requirements reduces exposure to fraud, strengthens customer trust, and ensures receivables are processed with both accuracy and security.

Step 8: Cash Application

After funds are received, the next step is cash application—matching payments to corresponding invoices and closing out receivables in the ledger. When remittance advice accompanies the payment, the process is straightforward. However, complications arise when payments arrive without remittance details, when remittance is sent separately from funds (common with ACH and wire transfers), or when provided information does not align with any open invoices. In such cases, AR teams must contact customers for clarification, introducing delays and administrative effort.

Manual cash application is labor-intensive, requiring specialists to track down references, apply payments invoice by invoice, and ensure discounts or partial settlements are recorded correctly. Automated solutions, on the other hand, streamline the process by extracting remittance data, auto-matching payments to invoices, and reconciling discrepancies in real time. This not only improves accuracy but also accelerates revenue recognition and reduces the risk of unapplied cash inflating outstanding receivables.

Step 9: Reporting and Analytics

The final stage of the AR cycle is reporting, which ensures transparency and enables continuous performance improvement. During the month-end close, finance teams review all recorded transactions, prepare a trial balance, and generate financial statements that reflect the company’s receivable position. This formal close process ensures compliance, accuracy, and readiness for audits.

Beyond month-end, ongoing AR status reviews are essential for proactive management. Regular updates to AR aging schedules, dispute resolution tracking, and collection progress reports allow finance leaders to spot risks early and take corrective action before cash flow is disrupted.

Key reports include:

- AR Aging Report – categorizes outstanding invoices by due date, helping prioritize collections.

- Days Sales Outstanding (DSO) – measures average time to collect receivables.

- Collections Effectiveness Index (CEI) – tracks recovery efficiency.

- Staff Productivity Metrics – evaluate operational performance.

Modern AR teams increasingly rely on real-time dashboards and advanced analytics to identify bottlenecks, forecast cash flow, and refine collection strategies. These insights turn AR reporting from a reactive function into a strategic tool that guides decision-making across finance, sales, and operations.

Elevate Your Accounts Receivable Process Flow

SpeedyLabs offers a cloud-based, AI-powered platform that unifies deduction management and accounts receivable operations. Claims and backup proofs are auto-captured from portals, EDI streams, and inboxes, then intelligently de-duplicated and linked to the right invoices, contracts, and promotional accruals. Our explainable AI validates claims in real time, prioritizes disputes by recovery potential, and routes them to the right owner with SLAs for resolution. With every decision backed by linked evidence—PODs, BOLs, invoices, and promo calendars—analysts spend less time chasing data and more time driving recoveries.

Get in touch with us today to discover how SpeedyLabs can transform your accounts receivable operations into a proactive growth engine.