Accounts Receivable Dispute Resolution

Managing customer payments efficiently is vital to sustaining financial health. Yet, even the most disciplined organizations face one persistent challenge—accounts receivable disputes. These arise when customers question invoices, pricing, delivery quality, or payment terms, interrupting the steady flow of revenue and straining relationships. While occasional disputes are inevitable, how quickly and effectively a business resolves them determines its liquidity, reputation, and operational efficiency.

Accounts Receivable Dispute Resolution is not merely an administrative function—it is a strategic process that safeguards cash flow, ensures billing accuracy, strengthens customer trust, and enhances overall financial control. A well-structured approach minimizes payment delays, reduces bad debt risk, and improves transparency across departments. This complete guide explores every dimension of A/R dispute resolution—from identifying and addressing disputes to implementing preventive measures and leveraging technology for long-term efficiency.

Table of Contents:

- What Is Accounts Receivable Dispute Resolution?

- Why Accounts Receivable Dispute Resolution Matters?

- Common Causes of A/R Disputes

- The Step-by-Step A/R Dispute Resolution Process

- Preventing Future A/R Disputes

- Leveraging Technology for A/R Dispute Management

- Conclusion

Jump to a section that interests you, or keep reading.

What Is Accounts Receivable Dispute Resolution?

Accounts Receivable Dispute Resolution is the structured process of identifying, addressing, and resolving conflicts that arise between a business and its customers regarding unpaid or incorrectly billed invoices. It involves investigating discrepancies in payment amounts, billing accuracy, product quality, or delivery timelines to ensure that the company collects the money it is owed while maintaining transparency and trust with its customers.

Why Accounts Receivable Dispute Resolution Matters?

Accounts receivable dispute resolution is far more than an administrative necessity—it is a financial safeguard that directly influences a company’s liquidity, stability, and customer relationships. When handled effectively, it strengthens the foundation of the entire order-to-cash cycle by ensuring that outstanding payments are collected promptly and accurately. Every unresolved dispute represents potential revenue trapped in limbo; therefore, resolving them efficiently is crucial for maintaining consistent cash flow, minimizing financial risk, and supporting sustainable business growth.

Cash Flow Optimization

Timely dispute resolution plays a critical role in accelerating cash inflows and reducing the impact of delayed or withheld payments. Each unresolved claim stalls the collection process, affecting working capital and liquidity. By identifying and addressing disputes swiftly—through structured documentation, communication, and corrective action—businesses can prevent interruptions in their cash conversion cycle. Effective management ensures that receivables reflect actual collectible revenue, which in turn enhances forecasting accuracy and financial stability.

Customer Retention

Dispute resolution is also integral to maintaining strong, trust-based customer relationships. Customers are more likely to remain loyal when their concerns are acknowledged and resolved promptly and professionally. Transparent communication, empathy, and fairness during the resolution process demonstrate a company’s commitment to service quality and reliability. Rather than being viewed as a conflict, a well-managed dispute can become an opportunity to reinforce credibility and improve customer satisfaction, which drives repeat business and long-term partnerships.

Operational Efficiency

A robust dispute resolution process eliminates repetitive errors and streamlines cross-departmental workflows. By centralizing documentation, automating dispute tracking, and encouraging collaboration among finance, sales, and logistics teams, organizations can reduce manual effort and administrative overhead. The result is faster turnaround times, better data visibility, and improved accountability across the accounts receivable function. Over time, analyzing recurring dispute patterns can help identify systemic process inefficiencies and enable proactive process improvements.

Accurate Financial Reporting

Disputes that remain unresolved or incorrectly recorded distort the accuracy of financial statements. Effective resolution ensures that accounts receivable balances truly represent collectible assets, allowing finance teams to prepare reliable reports and maintain compliance with accounting standards. When disputes are properly documented and closed, companies gain a clearer picture of their financial position, profitability, and credit exposure—critical for decision-making, investor confidence, and audit readiness.

Legal Compliance

Finally, well-structured dispute resolution supports legal and regulatory compliance. Failure to address disputes in a timely or transparent manner can lead to escalations, damaged reputations, or even litigation. By maintaining complete documentation of communications, actions taken, and final resolutions, businesses can demonstrate due diligence and protect themselves from potential legal claims. This documentation also ensures that the company meets internal policy standards and external audit requirements.

Common Causes of A/R Disputes

Accounts receivable disputes typically arise from inconsistencies between what a customer expects and what is reflected in an invoice, delivery, or payment record. These disputes, while common, can significantly delay collections, impact cash flow, and strain customer relationships if not identified and managed promptly. Understanding the root causes is essential for businesses to build preventive strategies and strengthen their order-to-cash process.

Incorrect or Duplicate Invoices

One of the most frequent triggers of disputes is invoicing errors, including incorrect amounts, duplicate billing, or missing credits. Even a small discrepancy between the agreed-upon pricing and the amount billed can prompt a customer to challenge an invoice. Inaccurate invoice generation often stems from manual entry errors, outdated data synchronization, or weak integration between sales, order management, and accounting systems.

Pricing Discrepancies or Contract Mismatches

Disputes frequently occur when the invoiced price does not align with the contractual agreement or quoted terms. These mismatches can result from pricing updates not reflected in the billing system, misinterpretation of contract clauses, or unapproved discounts and promotions. Failure to verify price lists or contractual details before invoicing can create immediate tension and delay payments as customers seek clarification or adjustments.

Damaged, Incomplete, or Non-Delivered Goods/Services

When the goods or services received by a customer differ in quantity, quality, or delivery timing from what was promised, disputes are inevitable. Issues such as damaged shipments, missing items, or partial service delivery lead customers to question the validity of the invoice. In many cases, logistics or fulfillment breakdowns are the underlying cause, emphasizing the need for accurate delivery documentation and strong cross-functional coordination between operations and finance.

Misapplied Payments or Credit Notes

Payment posting errors, such as applying funds to the wrong customer account or invoice, can create artificial outstanding balances that customers will contest. Similarly, failure to properly record credit notes, refunds, or previous adjustments can make an account appear overdue when it is not. These administrative mistakes highlight the importance of maintaining precise transaction records and reconciling accounts regularly.

Miscommunication Between Departments or With Customers

Internal silos and poor information sharing between sales, billing, and collections teams often result in inconsistent communication with customers. For instance, sales may agree to a credit adjustment that finance is unaware of, or a billing issue may go unresolved due to delayed internal responses. Likewise, unclear or delayed communication with customers regarding payment expectations can quickly escalate minor issues into formal disputes.

Lack of Clarity in Payment Terms

When payment deadlines, discount structures, or penalties are not explicitly stated in contracts or invoices, misunderstandings are inevitable. Ambiguous terms can lead customers to interpret due dates differently or contest additional fees. Clearly documented payment conditions—outlined before transactions occur—help establish mutual expectations and reduce the likelihood of confusion or conflict.

Errors in Taxes, Discounts, or Delivery Charges:

Incorrect tax calculations, unapproved discounts, or inconsistencies in freight and delivery charges often contribute to billing disputes. These errors may arise from using outdated tax codes, overlooking promotional discounts, or applying incorrect shipping rates. Inaccurate cost allocation not only creates distrust but also leads to time-consuming reconciliation efforts between both parties.

The Step-by-Step A/R Dispute Resolution Process

An effective Accounts Receivable (A/R) dispute resolution process is not a single action—it’s a structured, multi-step framework designed to ensure disputes are identified, investigated, and resolved efficiently while preserving customer relationships and financial accuracy. The following stages combine operational precision with best practices drawn from comprehensive dispute management methodologies.

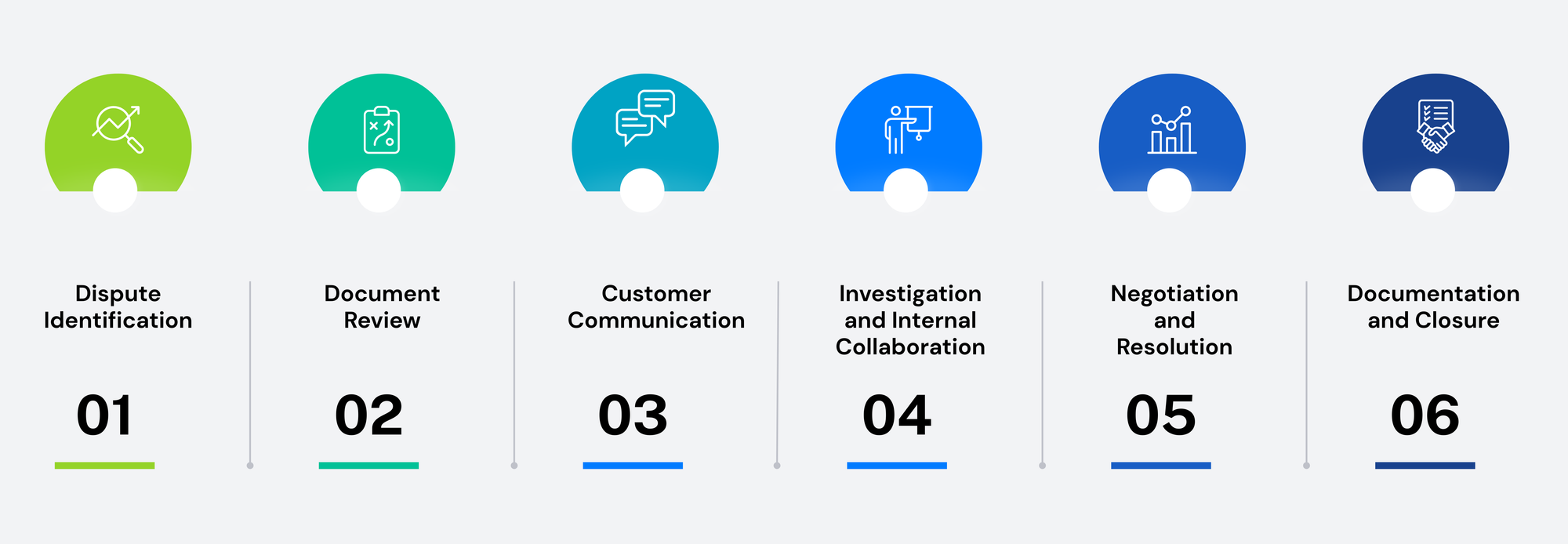

Dispute Identification

The first step in resolving any dispute is accurate identification. This involves promptly recognizing when a customer has raised a concern—whether through direct communication, a returned invoice, or a flagged payment discrepancy. Once a dispute is reported, it must be logged systematically into the company’s A/R management or case tracking system to ensure proper documentation and accountability. Each dispute should be categorized based on its nature—such as pricing errors, product quality issues, missing or damaged goods, or administrative inconsistencies like double billing. Categorization helps determine priority levels and enables assignment to the appropriate team member or department for investigation. A structured intake process ensures no claim goes unrecorded or unresolved.

Document Review

After identifying the dispute, the next step is gathering and reviewing all supporting documentation to understand the issue’s scope and legitimacy. This includes collecting invoices, sales orders, proof of delivery, shipping documents, contracts, prior communications, and customer correspondence. Complete and accurate documentation forms the foundation for a fair assessment of the situation. In a manual environment, this step can be time-consuming and prone to oversight; however, businesses with automated A/R systems integrated with Customer Relationship Management (CRM) or Enterprise Resource Planning (ERP) platforms can retrieve relevant documents instantly. Automation not only reduces administrative burden but also enhances traceability and transparency throughout the dispute resolution lifecycle.

Customer Communication

Once documentation is consolidated, proactive and professional communication with the customer becomes essential. The A/R or customer service representative should reach out through the preferred communication channel—whether by phone, email, or formal correspondence—to acknowledge the dispute and express a willingness to resolve it collaboratively. During this stage, active listening is crucial. Understanding the customer’s perspective allows the business to uncover the root cause rather than treating symptoms. The tone should remain courteous, respectful, and solution-oriented to maintain the customer’s confidence. If necessary, request additional evidence or clarifications to support their claim. Clear communication not only accelerates resolution but also reinforces the organization’s commitment to fairness and accountability.

Investigation and Internal Collaboration

After initial communication, the dispute enters the investigative phase, where internal collaboration becomes vital. The A/R team works closely with departments such as sales, logistics, operations, and finance to verify the facts and reconcile any inconsistencies. For example, the logistics team may confirm delivery records, sales may review contractual pricing, and finance may validate billing accuracy. This cross-functional evaluation determines whether the dispute is valid or the result of a misunderstanding. Effective internal collaboration ensures all sides of the transaction are examined, minimizing guesswork and improving decision accuracy. The ultimate goal is to establish a factual basis for resolution while maintaining procedural fairness and operational efficiency.

Negotiation and Resolution

Once the investigation concludes, the next phase focuses on negotiation and implementing an appropriate resolution. If the business identifies an error on its part—such as an overcharge, missing credit, or incorrect delivery—it should adjust the invoice, issue a credit note, or provide a partial refund as necessary. In cases where the invoice is accurate, the company must communicate its findings clearly, backed by documentation, to help the customer understand the validity of the charge. This stage often requires balancing financial prudence with relationship management. The A/R team, guided by company policy, decides whether to proceed with collection, offer a compromise, or write off the disputed amount. The emphasis should always be on reaching a mutually agreeable outcome that preserves goodwill while maintaining financial discipline.

Documentation and Closure

Once the dispute has been resolved, thorough documentation and formal closure are critical. All communications, investigative findings, decisions, and resolution details should be recorded within the company’s dispute management system. The dispute status must be updated to reflect its closure, ensuring visibility for future reference and internal reporting. A final confirmation with the customer helps verify that the issue has been resolved to their satisfaction. This step not only concludes the current case but also provides valuable insights for identifying recurring issues and refining internal processes. Properly archived dispute records create an auditable trail that supports compliance, facilitates management reviews, and contributes to continuous process improvement.

Preventing Future A/R Disputes

Preventing disputes is far cheaper and faster than resolving them. The approach combines contractual clarity, proactive outreach, accurate billing, customer-focused service, automation, and regular account hygiene. Below are concrete, non-overlapping strategies you can implement immediately.Establish Clear Payment Terms

Embed explicit payment conditions into every sales agreement and invoice: due date, accepted payment methods, early-payment discounts, late-payment penalties, and penalties’ calculation method. Make terms prominent and consistent across channels (contracts, purchase orders, electronic invoices) so there’s no ambiguity about expectations or consequences.

Communicate Early and Often

Proactively notify customers before and after invoicing—issue pre-invoice alerts, delivery confirmations, and scheduled reminders. Use multiple channels (email, portal notices, SMS where appropriate) to ensure receipt and to surface disputes while they are small and easy to fix.

Verify Invoice Accuracy

Institute a checklist and approval gate before invoices leave your system: confirm pricing against the contract, reconcile quantities with delivery records, and validate tax and discount calculations. Standardize invoice templates and require supporting references (order numbers, shipment IDs) to make validation straightforward for both parties.

Provide Excellent Customer Service

Train client-facing and billing staff to respond promptly, document interactions, and adopt a solutions-first mindset. Create a single point of contact or a dedicated dispute inbox so customers know exactly where to raise issues. Simplify the dispute submission process with clear forms or portal workflows to capture necessary evidence up front.

Use Digital Billing and Automation

Replace manual steps with an integrated A/R platform or ERP/CRM workflows that auto-populate invoices from confirmed orders, validate calculations, and flag anomalies. Automation reduces human error, accelerates dispute triage, enforces approval rules, and provides a centralized audit trail for faster resolution.

Regularly Reconcile Accounts

Schedule periodic reconciliations between customer ledgers, bank postings, and internal billing records to surface misapplied payments, missing credit notes, or duplicate invoices early. Use aging reports and exception dashboards to prioritize follow-ups and prevent small mismatches from becoming formal disputes.

Leveraging Technology for A/R Dispute Management

Technology has transformed accounts receivable dispute management from a manual, reactive process into a data-driven, automated system that enhances speed, accuracy, and collaboration. By integrating automation, centralized documentation, and predictive analytics, businesses can eliminate inefficiencies, minimize errors, and resolve disputes before they disrupt cash flow or customer relationships.

Benefits of Automation: Faster Identification, Centralized Documentation, and Streamlined Workflows

Automation brings structure, speed, and precision to dispute resolution. Modern A/R systems automatically capture and categorize disputes as soon as they arise, linking them directly to the related invoice, customer account, and supporting documents. This immediate identification prevents delays caused by lost or untracked claims.

Centralized digital repositories consolidate every piece of information—purchase orders, contracts, proof of delivery, and customer communication—into one accessible platform. This eliminates the need for manual searches and ensures that all stakeholders have real-time visibility into case status. Automated workflows route disputes to the right team members, set priority levels, and trigger reminders for pending actions, ensuring consistent follow-up and timely closure. By reducing manual handling and repetitive administrative work, automation minimizes human error, improves accuracy, and frees up finance staff to focus on higher-value tasks such as analysis and prevention.

How Integrated A/R Platforms and CRMs Improve Collaboration and Resolution Accuracy

Integrated systems bridge the communication gap between departments and streamline the end-to-end dispute process. When A/R platforms are connected to Customer Relationship Management (CRM) tools, all customer interactions—from order creation to payment collection—exist within a unified ecosystem. This transparency ensures that sales, finance, and customer service teams can view the same information, verify claims instantly, and coordinate responses without duplication of effort.

Real-time data sharing across these systems enhances collaboration and reduces miscommunication. For instance, if a customer disputes an invoice due to a pricing error, the sales and billing teams can simultaneously validate contract details, update records, and provide the customer with a quick, accurate resolution. Integration also enables performance tracking, letting managers monitor dispute trends, resolution times, and recurring issues to refine internal policies and strengthen overall A/R governance.

Using AI and Analytics to Predict Disputes Before They Occur

Artificial intelligence and analytics add a predictive layer to dispute management by identifying patterns and early warning signals that may lead to future disputes. Machine learning models analyze historical transactions, payment behaviors, and dispute records to flag anomalies such as frequent billing corrections, chronic late payments, or inconsistencies in order data. These insights enable businesses to take preventive action—verifying invoices, confirming deliveries, or reaching out to customers proactively—before disputes escalate.

AI-driven dashboards also help finance leaders understand root causes at scale, providing data-backed recommendations for process improvement. For example, analytics can reveal that most disputes stem from a specific product line, salesperson, or delivery location, allowing targeted intervention. Over time, predictive intelligence transforms dispute management from a reactive cost center into a strategic tool for continuous improvement, reduced DSO (Days Sales Outstanding), and enhanced customer experience.

Conclusion

Effective Accounts Receivable Dispute Resolution is more than resolving short-term billing disagreements—it’s about building a foundation of trust, accuracy, and financial resilience. By implementing structured processes, maintaining open communication, and leveraging automation and analytics, businesses can transform disputes from operational roadblocks into opportunities for improvement. Clear documentation, transparent communication, and proactive prevention ensure that disputes are handled swiftly and fairly, keeping customer relationships intact and cash flow uninterrupted.

In an era where speed and precision define business success, companies that invest in robust dispute management systems not only reduce revenue leakage but also gain a competitive advantage through stronger customer loyalty and sharper financial visibility. Ultimately, the goal isn’t just to settle disputes—it’s to prevent them altogether through clarity, collaboration, and intelligent technology. A well-executed dispute resolution strategy empowers organizations to protect their bottom line while delivering the seamless, trustworthy financial experiences their customers expect.